Shoutout to all of the people that predicted ATHs before the halving, months ago when for many that was hard to imagine.

“Transaction fees going up forever” is different than “fees will be higher in the future permanently”.

The former is false, the later is likely true.

500k sats is unlikely to be operative dust, but it could cost a very high percentage of itself in fees to be moved.

You can read the article where that chart came from, and the math behind it, here:

The only realistic way that fees fall in sats terms is with forks, or new tech that uses blockspace more efficiently

If the size is the same and the fee rate is the same, then the sats cost must also be the same.

The only way for the sats cost to decline, is if the fee rates decline (most people are expecting the opposite) or forks that create new efficient methods of using blockspace (SegWit, Taproot)

Didn't have to do that, but thanks! Appreciate sharing the info as well.

Well this chart from nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en is a ₿anger

I created this chart, it's on the Unchained blog, not River.

Wow the bitcoin price recovery over night is the most surprising price action I’ve seen in a long while. Really fascinating

Who is Satoshi Nakamoto? A reflection on Atlas Shrugged

Ok, I’d support CTV.

Can someone help me understand why they think it's a good idea to soft fork bitcoin every few years, introducing cool new tech but also the risk of unintended consequences (or consequences intended only by bad actors)?

Doesn't seem worth it to me. What are we on pace for, 25+ soft forks over the next century? Does that sound like a good idea? What could go wrong?

I'm guessing it's easier to convince several countries to officially adopt bitcoin together at once, than it is to convince one country to join in at a time.

What if nostr:npub1jan3xfrvxmd35smylytmnp3ne0sgqh2x47yq766s55zaf6eja4rselx52y is not just named that way because of the genesis block date, but also as a way of publicly reaching consensus among countries interested in adopting bitcoin?

"Don't try to delay it or sit on the fence, the game plan is January 3rd, participate or don't."

Just a conspiracy theory to get extra bullish in the last few weeks of the year ;)

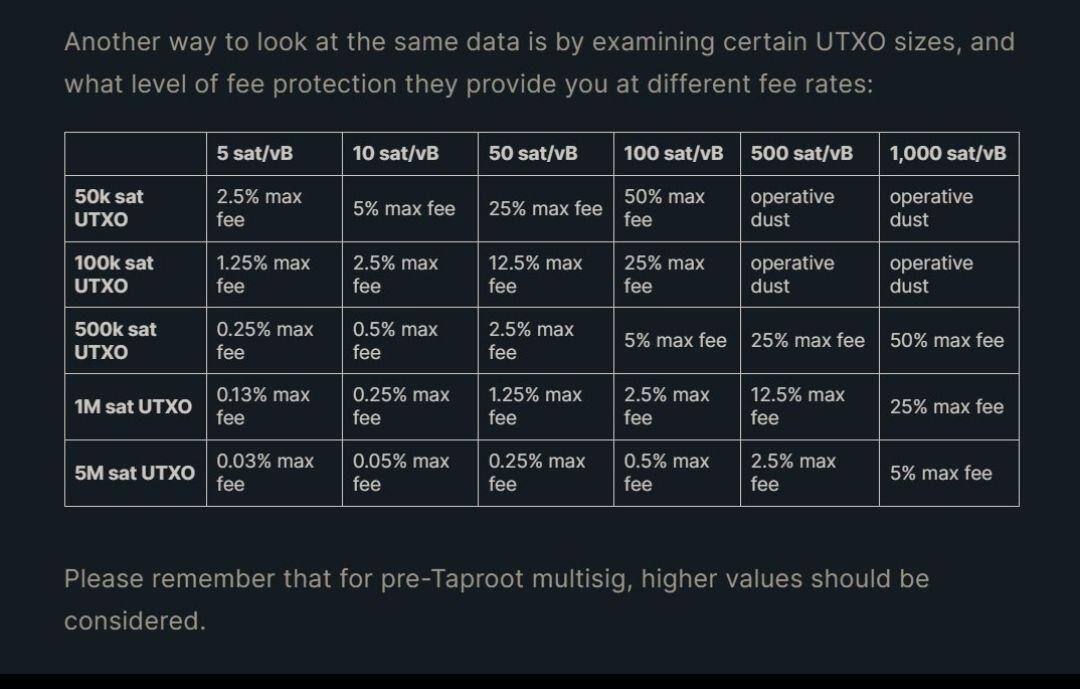

To help protect yourself from high #bitcoin txn fees on a relative basis, a common recommendation is to deposit to your wallet in 1M+ sat increments (for legacy wallets and script multisig wallets, the number should be higher).

Ordinals and non-economic transactions change the math.

The assumption was, that as fee rates rise, smaller UTXOs would be priced out of being spent, because it would make no economic sense (they would approach “operative dust”).

This creates an equilibrium effect, where fee rates can’t go beyond a certain level for a sustained period of time. Blockspace is scarce, but so is bitcoin itself, and large value UTXOs even more so.

However, if people find value in paying higher fees to move a UTXO than what it’s actually worth, such as for inscription trading and similar things, the earlier assumption is incorrect.

This means fee rates could go “higher for longer” than what some people were anticipating. 1M sat UTXOs could be insufficient for the fee protection you’re looking for.

What’s the right number, then? It depends on an individual’s preferences and predictions, but in the linked article, I provide the math to help you calculate it.

unchained.com/blog/small-utx…

If people begin to need to make wallet deposits of, say, 2M+ sats to protect themselves from fees, that’s already $800+ per deposit. If the price of bitcoin goes above $100k, we could be talking thousands of dollars to simply make a reasonably sized deposit to on-chain self custody.

This consideration exists regardless of non-economic transactions, but they certainly speed up the relevancy.

We may be approaching a point where even most middle class people in the western world become priced out of using bitcoin on-chain. This was expected to happen but I’m not sure people are expecting it as soon as it could happen (next bull cycle?).

Do we currently have 2nd layer tools to use bitcoin off-chain, that provide adequate UX, trust minimization, and security?

Damus vs Primal apps hmmm

Primal looking and loading cleaner so far. Button to make a post keeps disappearing tho

Anyone interested in helping to critique my latest article? I explain my view that “this decade, a trillion dollars will be unable to buy a bitcoin”

https://tomhonzik.com/articles/this-decade-a-trillion-dollars-will-be-unable-to-purchase-a-bitcoin

What if AI is overhyped by sovereign states to give them an excuse to build larger data centers that are actually not going to be used fro AI, but for mining bitcoin?

Yeah. Need a good way to query my node or someone else’s for this information

I’m getting desperate to find a resource that will allow me to filter the entire UTXO set by value and date.

The closest thing I’ve found is Blockchair, which I’ve identified as shitty and inaccurate.

I’m really surprised there seems to be nobody charting this or making it available in block explorers.

Does anyone have any leads????

“TL;DR” followed by a lengthy explanation.

The same people who destroyed the word “literally” seem to be coming for this one next.

I do think bitcoin fixes this, though.