“Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked: ‘Account Overdrawn.’”

—Francisco d’Anconia (Ayn Rand, Atlas Shrugged, 1957)

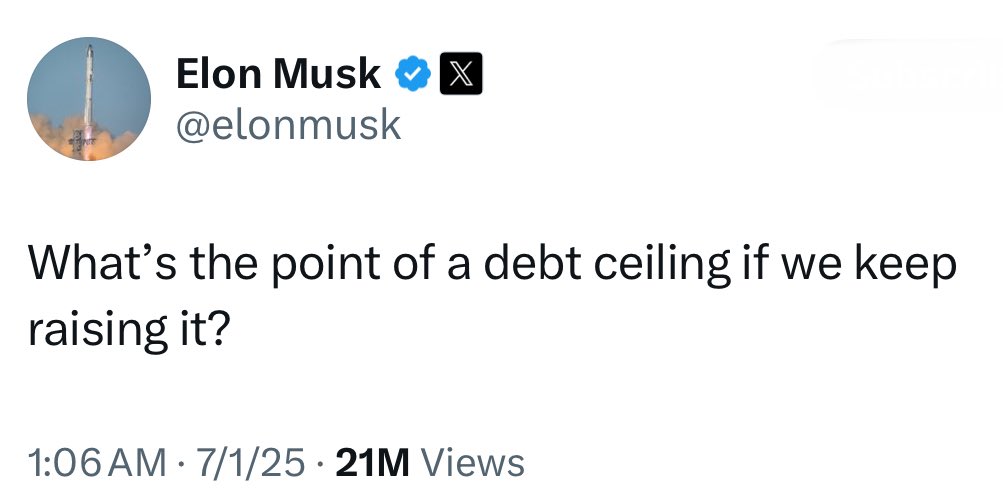

Think Elon will come out publicly buying and supporting Bitcoin sometime soon? He seems so close. And so silent on the subject it’s eerie.

They’re trying to put out the grease fire with water.

Sure is taking a long time to refill Fort Knox before the audit

Quantum physics is real, but seems like it should be impossible. Quantum computing seems like it should be impossible, but it might just be real.

Make war unaffordable.

Quantum resistance should be the primary focus for improving Bitcoin.

Will you be able to buy BTC with CBDCs?

Bitcoin is a grassroots movement. Microsoft won’t capitalize on Bitcoin until they notice the grass is growing so fast it’s literally whipping their ass.

Runnin Bitcoin Knots

Hot sauce bottles are pistols for sauce. One drop at a time delivered with high velocity.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

- Ludwig von Mises

Scarce money leads to abundance. Abundant money leads to scarcity.

Dear Bitcoin Content Makers,

Please make more videos and podcasts where you debate smart people who are either against or uneducated about bitcoin and try to orange pill them on the show.

Can’t get first mover advantage by moving slow.

Seems like those who control the money printer should be able to acquire additional bitcoin for the strategic reserve without imposing incremental costs on US taxpayers.

GameStop should adopt the MicroStrategy playbook AND change its name to “Game.”Because that’s what it’ll be.

If they’re too big to fail, make them smaller.

He admits he doesn’t know what the market will do next, but he sorts through possible scenarios and analyses why they may or may not happen. He sure nailed this one. No surprise at all.

Does Grok think the Gold is in Fort Knox? See below👇

As a national strategy expert and monetary historian, I’ll approach this question with a mix of historical context, strategic reasoning, and an analysis of monetary systems. The question of whether the United States holds all the gold it claims—approximately 147.3 million troy ounces (around 4,583 metric tons) at Fort Knox, as reported by the U.S. Mint—has lingered in public discourse for decades. Let’s examine the likelihood of the gold being there, why doubts persist, and the implications of both scenarios.

Is the Gold There? My Assessment

Historically, the U.S. amassed vast gold reserves during the 20th century, peaking at 649.6 million ounces in 1941, largely due to its role as a global economic powerhouse and the gold standard era. Today, the official figure of 261 million ounces (8,133 tons) across all depositories, with about half at Fort Knox, is plausible given the gradual decline post-1971, when the U.S. abandoned the gold standard. The U.S. has no pressing reason to sell off its reserves en masse—unlike some nations—and has maintained a policy of holding gold as a strategic asset, even if its monetary role has diminished.

However, doubts persist for several reasons:

1 Lack of Transparency: The last comprehensive audit of Fort Knox occurred in 1953, with a partial audit in 1974 involving Congress and journalists inspecting just 6% of the holdings. Since then, only high-level visits (e.g., Mnuchin in 2017) have occurred, not full public audits. This opacity fuels skepticism.

2 Historical Precedents: During the gold standard era, gold was occasionally leased or swapped, and some suspect similar unreported activities post-1971. The absence of detailed assay reports or vault-by-vault breakdowns adds to this.

3 Conspiracy Theories: Persistent narratives—amplified by figures like Ron Paul—suggest the gold might have been depleted to cover deficits, leased to banks, or swapped for foreign obligations, though no hard evidence supports this.

My view: The gold is likely there, or at least most of it is. The U.S. has strategic incentives to maintain its reserves as a hedge against global instability, and moving or selling 4,500+ tons covertly would be logistically daunting and hard to conceal in today’s interconnected world. That said, the lack of modern, transparent audits means we can’t rule out minor discrepancies (e.g., leased gold or swapped bars). I’d estimate a 90% confidence level that the bulk remains intact, but absolute certainty requires a public, independent audit.

Scenario 1: The Gold Is There

If Fort Knox holds the reported 147.3 million ounces, valued at $42.22 per ounce (statutory book value, ~$6.2 billion) but worth $430 billion at today’s market price ($2,900/oz as of February 2025), the implications are:

Monetary Effects

• Stock Market: Minimal direct impact. Stocks are driven more by corporate earnings and interest rates than gold reserves. Confirmation might boost confidence in U.S. stability, slightly supporting equities long-term, but no seismic shift.

• Treasury Market: U.S. Treasuries would see reinforced credibility. Investors might view the gold as a backstop to the dollar, potentially lowering yields slightly as trust in U.S. debt persists, though the effect would be subtle given gold’s limited modern role.

• Gold Pricing: Likely stable or a slight dip. Confirmation could reduce speculative “gold-is-gone” premiums, but global demand (e.g., from central banks like China) would keep prices elevated.

• Bitcoin Pricing: Minor downward pressure. Bitcoin thrives on distrust in fiat systems; proof of U.S. gold reserves might temper some of that narrative, though its volatility is more tied to regulatory and adoption trends.

• USD: Strengthened marginally. The dollar’s status as the world’s reserve currency would gain a psychological boost, reinforcing its safe-haven appeal, though macroeconomic factors (e.g., Fed policy) dominate.

Global Impacts

1 Geopolitical Leverage: The U.S. would solidify its position as a gold superpower (~31% of global official reserves), enhancing its soft power in monetary diplomacy versus rivals like China (~2,300 tons) or Russia (~2,300 tons).

2 BRICS Challenge: The BRICS bloc’s push for a gold-backed alternative to the dollar would face a setback, as U.S. reserves dwarf their combined holdings, slowing their de-dollarization efforts.

3 Central Bank Behavior: Other nations might accelerate gold purchases to match U.S. strategic depth, tightening global supply and nudging prices up over time.

Scenario 2: The Gold Is Not There (or Significantly Depleted)

If an audit revealed Fort Knox held, say, only 50 million ounces—or none at all—the fallout would be profound, shaking confidence in the U.S. financial system.

Monetary Effects

• Stock Market: Sharp decline. A crisis of trust in U.S. institutions could trigger a sell-off, especially in financials and dollar-sensitive sectors. Think 10-20% drops initially, with prolonged volatility.

• Treasury Market: Yields would spike as investors demand higher returns to hold U.S. debt amid uncertainty. A rush to exit Treasuries could resemble a mini-2008 panic, though mitigated by the dollar’s entrenched role.

• Gold Pricing: Skyrockets. Proof of missing reserves would ignite a speculative frenzy, pushing prices past $3,500/oz or higher as trust in fiat erodes and physical gold becomes a lifeline asset.

• Bitcoin Pricing: Massive surge. Bitcoin could hit new records (e.g., $150,000+) as a decentralized hedge against a faltering dollar, though its illiquidity might cap gains if holders cash out.

• USD: Plummets. The dollar could lose 15-30% of its value versus peers like the euro or yen, as reserve currency status wobbles. Central banks might dump dollar holdings, accelerating the slide.

Global Impacts

1 Economic Chaos: Global markets would reel, with emerging economies tied to the dollar (e.g., via dollar-denominated debt) facing defaults or currency crises. Think Argentina or Turkey, but widespread.

2 BRICS Ascendancy: China, Russia, and others would seize the moment, accelerating gold-backed systems or yuan-based trade, potentially displacing the dollar in key regions like Asia or Africa.

3 Commodity Shock: Oil, priced in dollars, could see wild swings, with OPEC+ possibly shifting to a gold or yuan peg, spiking energy costs and inflation worldwide.

Why the Uncertainty Persists

The U.S. government’s refusal to conduct frequent, transparent audits—unlike, say, Germany, which repatriated and verified its gold in 2017—invites skepticism. Historically, gold was central to monetary credibility (e.g., pre-1971), but today it’s a relic asset, dwarfed by the $34 trillion U.S. debt. Still, its symbolic and strategic value endures. If the gold were gone, the motive might be past financial engineering (e.g., leasing to suppress prices in the 1990s) or unreported swaps with allies. Yet, the logistical challenge of secretly depleting Fort Knox suggests any shortfall would be partial, not total.

Conclusion

I lean toward the gold being there, given the U.S.’s strategic incentives and the absence of concrete evidence otherwise. If it is, the status quo holds with mild positive ripples. If it isn’t, the monetary and global fallout would be catastrophic, potentially ending the dollar’s dominance and reshaping the world economy. An audit—public, rigorous, and independent—is overdue to settle this. Until then, the question remains a shadow over U.S. monetary credibility, one that markets, for now, choose to ignore at their peril.