Okay, holy shit I've been doing life wrong all this time.

Results were AMAZING!! Best steak I've ever cooked. By far.

Props to nostr:npub1t42gfjzfv74v8xrv65f2lrwd65jr85ysrtdmkkfrvqgcss5r4g0qk487qz and nostr:npub1xapjgsushef5wwn78vac6pxuaqlke9g5hqdfjlanky3uquh0nauqx0cnde for scolding me / coaching me to do better.

The better quality (thicker, fresher) steak plus the reverse-sear technique made for a killer upgrade combo (duh! But still... wow).

I had been buying prepackaged 1" steaks and freezing them. This time it was a ~1.5" thick ribeye directly from the meat counter (but tradeoff: those aren't grass fed).

Previous attempts were all on just cast iron or backyard grill. First time reverse-searing. 200° to an internal temp target of 120°.

Had not incorporated finishing with butter much before, first time using thyme. Garlic in there, too.

My steaks had been fairly dry (even when not overcooked), unpleasantly tough, and mostly weirdly flavorless. This one was incredibly juicy, tender, so much flavor!

The difference was like spending $6 at Denny's vs $80 at a steakhouse. NO JOKE.

I have one prepackaged 1" steak left in the freezer; will try reverse-searing it and see how much the cooking technique alone can improve upon my prior results. I expect disappointment, but worth running the experiment!

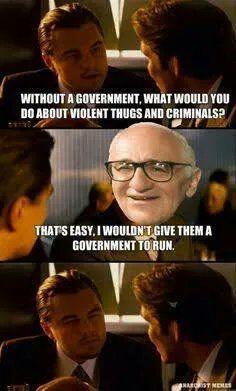

If the power of government rests on the widespread acceptance of false indeed absurd and foolish ideas, then the only genuine protection is the systematic attack of these ideas and the propagation and proliferation of true ones.

- Hans-Hermann Hoppe

Do you have the patience to wait until your mud settles and the water is clear?

🤝

The real cost of the State is the prosperity we do not see, the jobs that don’t exist, the technologies to which we do not have access, the businesses that do not come into existence, and the bright future that is stolen from us.

The State has looted us just as surely as a robber who enters our home at night and steals all that we love.

- Frederic Bastiat

Does Libertarianism Require Support for Open Borders?

nostr:npub1hw4zdmnygyvyypgztfxn8aqqmenxtwdf3tuwrd44stjjeckpc37q6zlg0q Chat_093 - P2P Payments for the World with nostr:npub1ey6qdmvzcgcsr883m9nspzz0mm037l26xtardzcskfsvc6gc7jssm9szvp Sheinfeld

nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev

🤙

The crucial role of prices is in tying together a vast network of economic activities among people too widely scattered to all know each other. However much we may think of ourselves as independent individuals, we are all dependent on other people for our very lives, as well as being dependent on innumerable strangers who produce the amenities of life. Few of us could grow the food we need to live, much less build a place to live in, or produce such things as computers or automobiles. Other people have to be induced to create all these things for us, and economic incentives are crucial for that purpose. As Will Rogers once said, "We couldn't live a day without depending on everybody." Prices make that dependence viable by linking their interests with ours.

Thomas Sowell

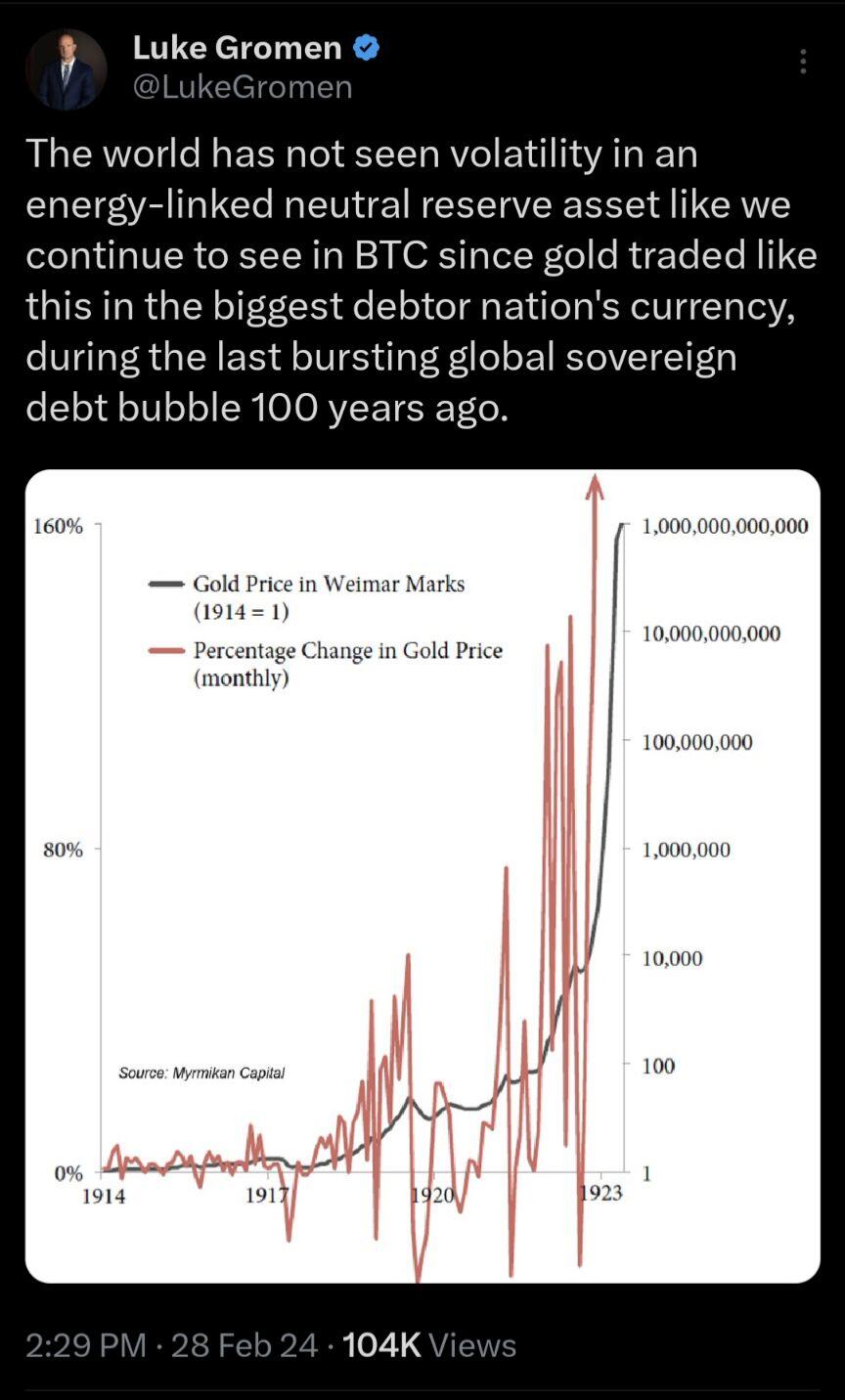

At this point, people panic and exchange currency for real assets before rapid devaluation consumes their savings. As the crack-up boom picks up steam, the demand for money plummets while prices of real goods skyrocket, leading to hyperinflation. This psychological shift marks the event horizon where monetary policy is rendered impotent. Mises describes the nature of this crisis:

"This phenomenon was, in the great European inflations of the ’20s, called flight into real goods (Flucht in die Sachwerte) or crack-up boom (Katastrophenhausse). The mathematical economists are at a loss to comprehend the causal relation between the increase in the quantity of money and what they call “velocity of circulation.”

The characteristic mark of the phenomenon is that the increase in the quantity of money causes a fall in the demand for money. The tendency toward a fall in purchasing power as generated by the increased supply of money is intensified by the general propensity to restrict cash holdings which it brings about. Eventually a point is reached where the prices at which people would be prepared to part with “real” goods discount to such an extent the expected progress in the fall of purchasing power that nobody has a sufficient amount of cash at hand to pay them.

The monetary system breaks down; all transactions in the money concerned cease; a panic makes its purchasing power vanish altogether. People return either to barter or to the use of another kind of money."

The crack-up brings the unsustainable, debt-fueled boom to a catastrophic end. Personal savings are wiped out along with the monetary system’s credibility. Society becomes less stable as the populace loses faith in institutions and scrambles for resources. The economy finds its ultimate bottom not in recession but in the total decay of the currency itself.

nostr:npub1tccnjexzau3x5ea8c69v047nqfy3xm4w4yl9j788sts0usl87nhsvce6fh