Bitcoin Accelerationism.

Bicoin Accelerationism embodies all that Effective Accelerationism (e/acc) represents, yet it posits that Bitcoin is crucial in ushering in this future. Let’s explore:

First, let’s break down what e/acc stands for, and why bitcoin is inevitably intertwined in this technological movement.

Effective Accelerationism posits that the universe inherently aims to optimize itself, constantly expanding and evolving. This expansion is seen as an unstoppable force, with the future always building upon and surpassing the present, and the main driver of this is ‘techno-capital’. Said more simply, ‘techno-capital’ is the force which will change/fix the world.

Now, let’s turn to bitcoin:

Similar to AI, bitcoin mining faces never ending scrutiny regarding its “energy use”. In reality, mining serves as a pivotal tool for energy grid load-balancing and waste energy mitigation. It's one of the only consumers of energy that can power off on a moments notice entirely subject to market demand.

By empowering location agnostic energy monetization while enforcing ever increasing efficiency through the difficulty adjustment, bitcoin mining doesn't waste energy, but rather consumes energy waste. With the brutal reality of continuously rising network hash rate subsequently increasing mining difficulty, inefficient operators are driven out via market forces, while the increased difficulty simultaneously reinforces the asset’s supply inelasticity and programmatically increasing marginal cost of production.

The significance? There is now a global opportunity cost for energy waste that exists anywhere found by satellite signal, thereby directly incentivizing and quantifying the chase of Moore's Law AND the ascent of the Kardashev scale.

Bitcoin adheres to e/acc principles, and metaphorically aligns with the natural order and thermodynamic laws, by adeptly transforming forms of energy into an immutable ledger of subjective value.

Its 21,000,000 capped supply mirrors the finite energy in closed systems, a nod to the conservation law. Bitcoin mining, which channels raw energy into computation, goes to securing and extending property rights to $800b of pseudonymous global wealth. The process of elegantly converting energy in any form into an immutable ledger of absolute monetary scarcity brings about order from entropy.

Do not shy away from energy production nor energy consumption. Bitcoin's Proof of Work is not a weakness, but an absolute source of strength. Lean in.

As a store of value, bitcoin epitomizes a free market for capital, underpinned by the energy securing it, SHA-256 cryptography, and a global consensus of distributed nodes, each user acting in their own self-interest. The key principle is that value is not derived by decree, but rather subjectively by self preserving individuals through economic incentives.

As a unit of account, bitcoin is the ruler against which the vast technological gains of past and future decades will be quantified and measured against most accurately, given its attributes and free market emergence.

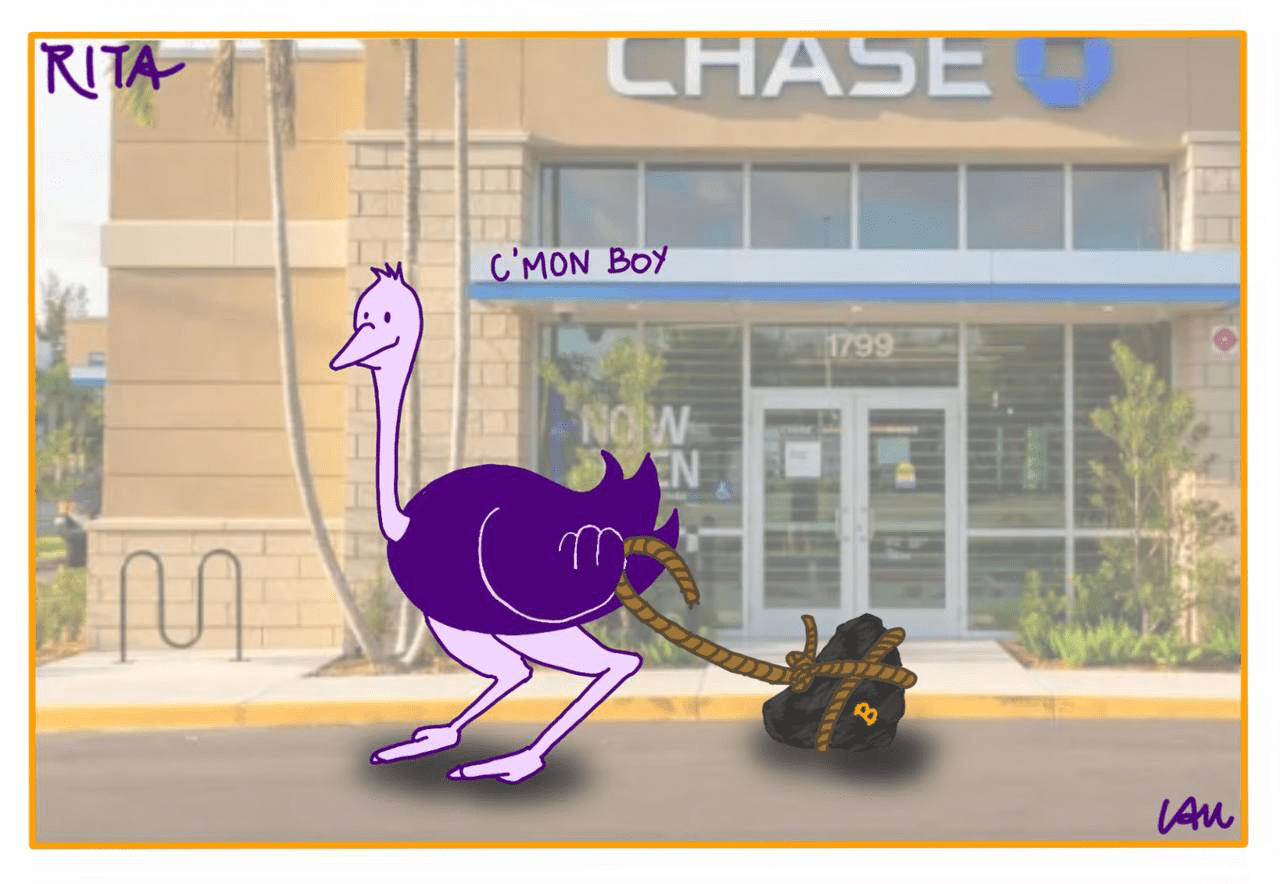

In contrast, political currency, issued by increasingly corrupted institutions, will continue to devalue against everything we hold dear; fundamentally incompatible with a future where AI brings about abundance through the reduction in the cost of everyday services.

This contrast between two opposing forces has never been more evident, with tech advances accelerating by day while the issuance of additional political currency aims to offset said deflationary gains to keep an evermore fragile and faltering system of debt and IOUs from collapsing under its own weight.

As censorship-resistant money, bitcoin is pivotal for a future where censorship and surveillance by the state and/or techno-monopolies are more powerful and potentially oppressive than ever.

As a bearer asset, bitcoin stands out as one of the few possessions that can be truly owned in a digital native world riddled with third party custodians and counterparties. Possession can be custodied literally in one's mind, not as the liability of a captured and corrupted institution operating under the long-reach of the state.

Lastly, it is an inevitable reality that all monetary mediums compete in perpetuity, and the Darwinian process of a free market monetary medium monetizing from scratch, not by decree but by free market forces, has only occurred successfully a rare few times in human history, and never with the speed or global scale currently underway.

Bitcoin Accelerationism is an acknowledgment of this all; the growing surveillance apparatus of the state, the attempt to restrict and reduce global energy production/consumption, and the precarious position of the global political currency experiment that threatens to undermine the past and present gains brought about by technological innovation. In e/acc terms, bitcoin is THE capital in ‘techno-capital’.

In a world where the very medium in which we store our time, labor, and value is led by individuals more interested in looting the coffers than in the long-term health or vitality of our society, it’s time to lean in.

Bitcoin Accelerationism is about embracing this reality. No force on earth can stop an idea whose time has come.

We will not apologize, reconsider, slow down, or reverse course. Instead,

ACCELERATE.