𝗦𝘁𝗮𝗰𝗸𝗶𝗻𝗴 𝗦𝗮𝘁𝘀 𝗶𝘀 𝗘𝗮𝘀𝘆 — 𝗛𝗲𝗿𝗲’𝘀 𝗛𝗼𝘄 𝘁𝗼 𝗦𝘁𝗮𝘆 𝗛𝘂𝗺𝗯𝗹𝗲

#Bitcoin is winning, and once again, you’re being proven right. But if you forget to stay humble, you’ll set yourself up for failure.

Here are some tips to help you stay humble👇

𝗥𝗲𝗰𝗼𝗴𝗻𝗶𝘇𝗲 𝘁𝗵𝗮𝘁 𝗬𝗼𝘂'𝗿𝗲 𝗡𝗼𝘁 𝗜𝗻𝗳𝗮𝗹𝗹𝗶𝗯𝗹𝗲

No one has a monopoly on knowledge, and it's essential to acknowledge that you can still learn and grow. Even if you've been right about Bitcoin, 𝘵𝘩𝘦𝘳𝘦'𝘴 𝘢𝘭𝘸𝘢𝘺𝘴 𝘮𝘰𝘳𝘦 𝘵𝘰 𝘥𝘪𝘴𝘤𝘰𝘷𝘦𝘳 𝘢𝘯𝘥 𝘶𝘯𝘥𝘦𝘳𝘴𝘵𝘢𝘯𝘥.

𝗔𝘃𝗼𝗶𝗱 𝗕𝗲𝗰𝗼𝗺𝗶𝗻𝗴 𝗢𝘃𝗲𝗿𝗹𝘆 𝗦𝗲𝗹𝗳-𝗔𝘀𝘀𝘂𝗿𝗲𝗱

It's easy to become overconfident when others praise your foresight, but it's important to remember that 𝘺𝘰𝘶𝘳 𝘴𝘶𝘤𝘤𝘦𝘴𝘴 𝘪𝘴 𝘯𝘰𝘵 𝘴𝘰𝘭𝘦𝘭𝘺 𝘥𝘶𝘦 𝘵𝘰 𝘺𝘰𝘶𝘳 𝘰𝘸𝘯 𝘢𝘣𝘪𝘭𝘪𝘵𝘪𝘦𝘴. Be grateful for the support and encouragement you've received from others.

𝗙𝗼𝗰𝘂𝘀 𝗼𝗻 𝘁𝗵𝗲 𝗕𝗶𝗴𝗴𝗲𝗿 𝗣𝗶𝗰𝘁𝘂𝗿𝗲

Instead of basking in personal glory, redirect your attention to the broader impact of Bitcoin on society. Remember that your success is not just about personal recognition but about 𝘵𝘩𝘦 𝘱𝘰𝘴𝘪𝘵𝘪𝘷𝘦 𝘤𝘩𝘢𝘯𝘨𝘦 𝘵𝘩𝘢𝘵 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘤𝘢𝘯 𝘣𝘳𝘪𝘯𝘨 𝘵𝘰 𝘵𝘩𝘦 𝘸𝘰𝘳𝘭𝘥.

𝗦𝘁𝗮𝘆 𝗚𝗿𝗼𝘂𝗻𝗱𝗲𝗱

Keep your feet firmly planted on the ground and avoid getting carried away by praise or fame. Remember that 𝘵𝘳𝘶𝘦 𝘴𝘶𝘤𝘤𝘦𝘴𝘴 𝘪𝘴 𝙣𝙤𝙩 𝘮𝘦𝘢𝘴𝘶𝘳𝘦𝘥 𝘣𝘺 𝘦𝘹𝘵𝘦𝘳𝘯𝘢𝘭 𝘷𝘢𝘭𝘪𝘥𝘢𝘵𝘪𝘰𝘯, but by the positive difference you make in the lives of others.

𝗦𝗲𝗲𝗸 𝗗𝗶𝘃𝗲𝗿𝘀𝗲 𝗣𝗲𝗿𝘀𝗽𝗲𝗰𝘁𝗶𝘃𝗲𝘀

Surround yourself with people who have 𝘥𝘪𝘧𝘧𝘦𝘳𝘦𝘯𝘵 𝘷𝘪𝘦𝘸𝘱𝘰𝘪𝘯𝘵𝘴 𝘢𝘯𝘥 𝘦𝘹𝘱𝘦𝘳𝘪𝘦𝘯𝘤𝘦𝘴. This will help you stay open-minded and avoid becoming too narrow-focused on your own beliefs.

𝗣𝗿𝗮𝗰𝘁𝗶𝗰𝗲 𝗚𝗿𝗮𝘁𝗶𝘁𝘂𝗱𝗲

Be thankful for the opportunities you've had, the lessons you’ve learned, and the people who have brought you to this point. 𝘎𝘳𝘢𝘵𝘪𝘵𝘶𝘥𝘦 𝘬𝘦𝘦𝘱𝘴 𝘺𝘰𝘶 𝘩𝘶𝘮𝘣𝘭𝘦 𝘢𝘯𝘥 𝘢𝘱𝘱𝘳𝘦𝘤𝘪𝘢𝘵𝘪𝘷𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘣𝘭𝘦𝘴𝘴𝘪𝘯𝘨𝘴 𝘪𝘯 𝘺𝘰𝘶𝘳 𝘭𝘪𝘧𝘦.

𝗘𝗺𝗯𝗿𝗮𝗰𝗲 𝗖𝗿𝗶𝘁𝗶𝗰𝗶𝘀𝗺

Don't take criticism personally. Instead, 𝘶𝘴𝘦 𝘪𝘵 𝘢𝘴 𝘢𝘯 𝘰𝘱𝘱𝘰𝘳𝘵𝘶𝘯𝘪𝘵𝘺 𝘵𝘰 𝘭𝘦𝘢𝘳𝘯 𝘢𝘯𝘥 𝘨𝘳𝘰𝘸. Remember that criticism can help you refine your ideas and make them better.

𝗙𝗼𝗰𝘂𝘀 𝗼𝗻 𝘁𝗵𝗲 𝗪𝗼𝗿𝗸 𝗔𝗵𝗲𝗮𝗱

Instead of dwelling on past successes, 𝘧𝘰𝘤𝘶𝘴 𝘰𝘯 𝘵𝘩𝘦 𝘸𝘰𝘳𝘬 𝘵𝘩𝘢𝘵 𝘴𝘵𝘪𝘭𝘭 𝘯𝘦𝘦𝘥𝘴 𝘵𝘰 𝘣𝘦 𝘥𝘰𝘯𝘦. There's always more to learn, explore, and accomplish in the realm of Bitcoin.

By following these tips, you can cultivate humility, which will serve you well in your journey with Bitcoin. Remember: 𝘁𝗿𝘂𝗲 𝘀𝘂𝗰𝗰𝗲𝘀𝘀 𝗶𝘀 𝗻𝗼𝘁 𝗮𝗯𝗼𝘂𝘁 𝗽𝗲𝗿𝘀𝗼𝗻𝗮𝗹 𝗴𝗹𝗼𝗿𝘆, 𝗯𝘂𝘁 𝗮𝗯𝗼𝘂𝘁 𝙢𝙖𝙠𝙞𝙣𝙜 𝙖 𝙥𝙤𝙨𝙞𝙩𝙞𝙫𝙚 𝙞𝙢𝙥𝙖𝙘𝙩 𝙤𝙣 𝙩𝙝𝙚 𝙬𝙤𝙧𝙡𝙙.

Did you find these tips valuable? Give this a 𝗟𝗶𝗸𝗲🤙

Think others might appreciate it? 𝗦𝗵𝗮𝗿𝗲🔄 this with them!

Want to remember this for when you’re proven right again? 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for later!

Know any other tips for staying humble? Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗪𝗵𝗮𝘁 𝗖𝗼𝘂𝗹𝗱 𝘁𝗵𝗲 𝗖𝗵𝗶𝗻𝗲𝘀𝗲 𝗭𝗼𝗱𝗶𝗮𝗰 𝗠𝗲𝗮𝗻 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻?

Tomorrow the Chinese New Year begins, and we will exit the year of the 𝗪𝗮𝘁𝗲𝗿 𝗥𝗮𝗯𝗯𝗶𝘁, and enter the year of the 𝗪𝗼𝗼𝗱 𝗗𝗿𝗮𝗴𝗼𝗻.

Whether or not you take the Chinese zodiac seriously, it can be fun to learn the different elements and animals of each year, and what they symbolize.

Here is a glimpse of #Bitcoin through this lens👇

Bitcoin was both proposed and born in the year of the 𝗘𝗮𝗿𝘁𝗵 𝗥𝗮𝘁, which embodies the Rat's 𝘤𝘭𝘦𝘷𝘦𝘳𝘯𝘦𝘴𝘴 and 𝘢𝘥𝘢𝘱𝘵𝘢𝘣𝘪𝘭𝘪𝘵𝘺, and the Earth’s 𝘴𝘵𝘢𝘣𝘪𝘭𝘪𝘵𝘺 and 𝘳𝘦𝘭𝘪𝘢𝘣𝘪𝘭𝘪𝘵𝘺. Bitcoin perfectly demonstrates the Earth Rat's characteristics of innovation, practical application, and the foresight to solve the problem of trust in the digital age.

Bitcoin's origins in the Earth Rat year emphasizes its quiet strength and potential for growth. 𝗘𝘃𝗲𝗻 𝘁𝗵𝗲 𝗻𝗮𝗺𝗲 𝗼𝗳 𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗰𝗿𝗲𝗮𝘁𝗼𝗿, 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗡𝗮𝗸𝗮𝗺𝗼𝘁𝗼, 𝗲𝘀𝘀𝗲𝗻𝘁𝗶𝗮𝗹𝗹𝘆 𝗿𝗲𝗳𝗲𝗿𝗲𝗻𝗰𝗲𝘀 𝘁𝗵𝗲 𝗘𝗮𝗿𝘁𝗵 𝗥𝗮𝘁 𝗰𝗼𝗻𝗰𝗲𝗽𝘁: “Satoshi” can be translated to mean “𝘸𝘪𝘴𝘥𝘰𝘮” or “𝘬𝘯𝘰𝘸𝘭𝘦𝘥𝘨𝘦”, which are both qualities of the Rat. “Nakamoto” can be translated to mean “𝘧𝘰𝘶𝘯𝘥𝘢𝘵𝘪𝘰𝘯” or "𝘴𝘰𝘶𝘳𝘤𝘦", which both describe the groundedness of the Earth element. 🌎🐀

Truly, Bitcoin is characterized by the qualities that those born in the year of the Earth Rat are said to have! 🤯

Tomorrow, however, begins the year of the 𝗪𝗼𝗼𝗱 𝗗𝗿𝗮𝗴𝗼𝗻. This could signify 𝗮 𝗽𝗲𝗿𝗶𝗼𝗱 𝗼𝗳 𝗲𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻 𝗮𝗻𝗱 𝗽𝗿𝗼𝘀𝗽𝗲𝗿𝗶𝘁𝘆 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻. Dragons symbolize 𝘴𝘵𝘳𝘦𝘯𝘨𝘵𝘩 and 𝘭𝘶𝘤𝘬, and wood infuses these qualities with 𝘨𝘳𝘰𝘸𝘵𝘩 and 𝘳𝘦𝘯𝘦𝘸𝘢𝘭. This combination hints at an exciting year for Bitcoin, especially with the anticipated halving event.

The halving is a significant event in Bitcoin, as 𝘪𝘵 𝘢𝘭𝘪𝘨𝘯𝘴 𝘸𝘪𝘵𝘩 𝘵𝘩𝘦 𝘞𝘰𝘰𝘥 𝘋𝘳𝘢𝘨𝘰𝘯'𝘴 𝘦𝘯𝘦𝘳𝘨𝘺 𝘰𝘧 𝘵𝘳𝘢𝘯𝘴𝘧𝘰𝘳𝘮𝘢𝘵𝘪𝘰𝘯 𝘢𝘯𝘥 𝘨𝘳𝘰𝘸𝘵𝘩. It increases bitcoin’s scarcity by changing the issuance of new coins from about 𝟵𝟬𝟬 𝗽𝗲𝗿 𝗱𝗮𝘆 to about 𝟰𝟱𝟬 𝗽𝗲𝗿 𝗱𝗮𝘆. This decrease of new supply causes prices to rise, and drives more value and innovation to the Bitcoin network. This beautifully reflects the Wood Dragon's blend of 𝘢𝘮𝘣𝘪𝘵𝘪𝘰𝘯 with 𝘢 𝘤𝘰𝘰𝘱𝘦𝘳𝘢𝘵𝘪𝘷𝘦 𝘴𝘱𝘪𝘳𝘪𝘵. 🪵🐉

As Bitcoin enters the year of the Wood Dragon, its journey showcases the enduring qualities of its birth in the year of the Earth Rat. 𝗧𝗵𝗲 𝗯𝗹𝗲𝗻𝗱 𝗼𝗳 𝗶𝗻𝗻𝗼𝘃𝗮𝘁𝗶𝗼𝗻, 𝘀𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆, 𝗮𝗻𝗱 𝗴𝗿𝗼𝘄𝘁𝗵 𝗽𝗿𝗼𝘀𝗽𝗲𝗰𝘁𝘀 𝗽𝗼𝘀𝗶𝘁𝗶𝗼𝗻𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗳𝗼𝗿 𝗮 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹𝗹𝘆 𝘁𝗿𝗮𝗻𝘀𝗳𝗼𝗿𝗺𝗮𝘁𝗶𝘃𝗲 𝗽𝗲𝗿𝗶𝗼𝗱, embodying the best traits of these powerful zodiac symbols.

Remember to give this a 𝗟𝗶𝗸𝗲🤙, and celebrate the Chinese New Year by 𝗦𝗵𝗮𝗿𝗶𝗻𝗴🔄 this and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝗶𝗻𝗴🔖 it for later (𝘵𝘩𝘦𝘯 𝘺𝘰𝘶’𝘭𝘭 𝘴𝘦𝘦 𝘪𝘧 𝘸𝘩𝘢𝘵 𝘪𝘵 𝘱𝘳𝘦𝘥𝘪𝘤𝘵𝘴 𝘧𝘰𝘳 𝘵𝘩𝘪𝘴 𝘺𝘦𝘢𝘳 𝘤𝘰𝘮𝘦𝘴 𝘵𝘳𝘶𝘦! 😉).

What do you think about the Chinese New Year and its zodiac?

Tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗪𝗵𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝘀 𝘁𝗵𝗲 𝙊𝙣𝙡𝙮 𝗣𝗲𝗿𝗳𝗲𝗰𝘁𝗹𝘆 𝗦𝗰𝗮𝗿𝗰𝗲 𝗔𝘀𝘀𝗲𝘁

In a world of abundance, 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗿𝗲𝗱𝗲𝗳𝗶𝗻𝗲𝘀 𝘁𝗵𝗲 𝗺𝗲𝗮𝗻𝗶𝗻𝗴 𝗼𝗳 𝘀𝗰𝗮𝗿𝗰𝗶𝘁𝘆.

𝘈𝘭𝘭 𝘰𝘵𝘩𝘦𝘳 𝘢𝘴𝘴𝘦𝘵𝘴 have a potentially unlimited supply, but 𝘰𝘯𝘭𝘺 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 is absolutely scarce and 𝘱𝘦𝘳𝘧𝘦𝘤𝘵𝘭𝘺 limited.

But aren’t precious metals supposed to be scarce? And what about real estate?

Let’s explore 𝗲𝘃𝗲𝗿𝘆 𝗮𝘀𝘀𝗲𝘁 𝗰𝗹𝗮𝘀𝘀 below, and examine just how scarce they 𝘳𝘦𝘢𝘭𝘭𝘺 are…👇

𝗪𝗵𝘆 𝗙𝗶𝗮𝘁 𝗖𝘂𝗿𝗿𝗲𝗻𝗰𝗶𝗲𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Fiat currencies are government-issued money 𝗯𝗮𝗰𝗸𝗲𝗱 𝗼𝗻𝗹𝘆 𝗯𝘆 𝗽𝗿𝗼𝗺𝗶𝘀𝗲𝘀 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗶𝘀𝘀𝘂𝗲𝗿, rather than by a commodity. Central banks can create more at will, leading to inflation and diminishing purchasing power. This lack of scarcity undermines fiat's long-term value.

Fiat's supply is measured in various ways, such as M0 (physical currency) and M1/M2/M3 (including digital forms). These measurements show fiat's 𝘧𝘭𝘦𝘹𝘪𝘣𝘪𝘭𝘪𝘵𝘺 and the 𝘣𝘭𝘶𝘳𝘳𝘦𝘥 𝘭𝘪𝘯𝘦𝘴 between present and future money, contributing to its abundance.

Ownership of fiat is conditional and 𝗰𝗮𝗻 𝗯𝗲 𝗿𝗲𝘃𝗼𝗸𝗲𝗱 𝗮𝘁 𝗮𝗻𝘆 𝘁𝗶𝗺𝗲 by issuing authorities. This uncertainty, coupled with fiat's ability to manifest 𝘯𝘦𝘨𝘢𝘵𝘪𝘷𝘦 balances through debt creation, further highlights its fundamental lack of scarcity.

𝗪𝗵𝘆 𝗦𝘁𝗼𝗰𝗸𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Stocks represent ownership shares in companies, and are far from being scarce. Companies can issue new shares, diluting existing ownership. This process is subject to corporate decisions and market conditions, making stocks 𝘪𝘯𝘩𝘦𝘳𝘦𝘯𝘵𝘭𝘺 𝘢𝘣𝘶𝘯𝘥𝘢𝘯𝘵.

Stock issuance is controlled by company executives and boards, 𝗻𝗼𝘁 𝗮 𝗽𝗿𝗲𝗱𝗲𝘁𝗲𝗿𝗺𝗶𝗻𝗲𝗱 𝗺𝗮𝘁𝗵𝗲𝗺𝗮𝘁𝗶𝗰𝗮𝗹 𝗮𝗹𝗴𝗼𝗿𝗶𝘁𝗵𝗺. This means the total number of shares can increase, leading to potential dilution of individual share value.

The regulatory environment also influences stock scarcity. Securities laws and market demands can lead to stock splits or reverse splits, further adding to supply volatility, and altering the number of shares 𝘸𝘪𝘵𝘩𝘰𝘶𝘵 𝘢 𝘧𝘪𝘹𝘦𝘥 𝘭𝘪𝘮𝘪𝘵.

𝗪𝗵𝘆 𝗕𝗼𝗻𝗱𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Bonds are debt securities issued by entities like governments and corporations to raise capital. Investors lend money in exchange for periodic interest payments and the return of the bond's face value at maturity. 𝘐𝘴𝘴𝘶𝘦𝘳𝘴 𝘤𝘢𝘯 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘢𝘭𝘭𝘺 𝘤𝘳𝘦𝘢𝘵𝘦 𝘯𝘦𝘸 𝘣𝘰𝘯𝘥𝘴 𝘵𝘰 𝘧𝘪𝘯𝘢𝘯𝘤𝘦 𝘥𝘦𝘣𝘵 𝘰𝘳 𝘧𝘶𝘯𝘥 𝘱𝘳𝘰𝘫𝘦𝘤𝘵𝘴, making them abundant, not scarce.

The issuance of bonds is 𝗹𝗶𝗺𝗶𝘁𝗲𝗱 𝗼𝗻𝗹𝘆 𝗯𝘆 𝘁𝗵𝗲 𝗶𝘀𝘀𝘂𝗲𝗿'𝘀 𝗰𝗿𝗲𝗱𝗶𝘁𝘄𝗼𝗿𝘁𝗵𝗶𝗻𝗲𝘀𝘀 𝗮𝗻𝗱 𝗺𝗮𝗿𝗸𝗲𝘁 𝗱𝗲𝗺𝗮𝗻𝗱, not by a fixed supply. Governments, in particular, issue bonds regularly to finance budget deficits, making the total volume of bonds in the market 𝘦𝘷𝘦𝘳-𝘦𝘹𝘱𝘢𝘯𝘥𝘪𝘯𝘨.

In essence, the bond market's 𝘪𝘯𝘩𝘦𝘳𝘦𝘯𝘵 𝘤𝘢𝘱𝘢𝘤𝘪𝘵𝘺 𝘧𝘰𝘳 𝘨𝘳𝘰𝘸𝘵𝘩 and the 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘰𝘶𝘴 𝘪𝘯𝘵𝘳𝘰𝘥𝘶𝘤𝘵𝘪𝘰𝘯 𝘰𝘧 𝘯𝘦𝘸 𝘪𝘴𝘴𝘶𝘢𝘯𝘤𝘦𝘴 underscore its lack of scarcity.

𝗪𝗵𝘆 𝗥𝗲𝗮𝗹 𝗘𝘀𝘁𝗮𝘁𝗲 𝗜𝘀 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Real estate encompasses land and any structures on it, including buildings and natural resources. While often perceived as scarce due to its fixed geographical nature, 𝗿𝗲𝗮𝗹 𝗲𝘀𝘁𝗮𝘁𝗲 𝗶𝘀 𝗻𝗼𝘁 𝗮𝗯𝘀𝗼𝗹𝘂𝘁𝗲𝗹𝘆 𝘀𝗰𝗮𝗿𝗰𝗲 when considering the long-term perspective and human innovation, including the eventual colonization of other planets.

On Earth, scarcity of desirable locations drives up real estate values. However, 𝘵𝘩𝘪𝘴 𝘴𝘤𝘢𝘳𝘤𝘪𝘵𝘺 𝘪𝘴 𝘳𝘦𝘭𝘢𝘵𝘪𝘷𝘦 𝘢𝘯𝘥 𝘴𝘶𝘣𝘫𝘦𝘤𝘵 𝘵𝘰 𝘤𝘩𝘢𝘯𝘨𝘦 𝘸𝘪𝘵𝘩 𝘵𝘦𝘤𝘩𝘯𝘰𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘢𝘥𝘷𝘢𝘯𝘤𝘦𝘮𝘦𝘯𝘵𝘴, such as the ability to reclaim land from the sea, or create habitable environments in previously uninhabitable areas.

Real estate’s scarcity is further challenged by the potential for space colonization. As humanity explores and settles on other planets or moons, 𝘁𝗵𝗲 𝘀𝘂𝗽𝗽𝗹𝘆 𝗼𝗳 𝗹𝗮𝗻𝗱 𝗮𝗻𝗱 𝗵𝗮𝗯𝗶𝘁𝗮𝗯𝗹𝗲 𝗹𝗼𝗰𝗮𝘁𝗶𝗼𝗻𝘀 𝘄𝗶𝗹𝗹 𝗲𝘅𝗽𝗮𝗻𝗱, reducing the constraints of Earth-bound real estate scarcity.

𝗪𝗵𝘆 𝗖𝗼𝗹𝗹𝗲𝗰𝘁𝗶𝗯𝗹𝗲𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Collectibles encompass items like rare artifacts, art, and jewelry, valued for their uniqueness and desirability. While some may appear scarce, 𝘁𝗵𝗲𝗶𝗿 𝘀𝗰𝗮𝗿𝗰𝗶𝘁𝘆 𝗶𝘀𝗻'𝘁 𝗮𝗯𝘀𝗼𝗹𝘂𝘁𝗲. Technological advancements and changing tastes can affect their rarity and value.

Furthermore, collectibles' perceived scarcity 𝘪𝘴 𝘰𝘧𝘵𝘦𝘯 𝘴𝘶𝘣𝘫𝘦𝘤𝘵 𝘵𝘰 𝘮𝘢𝘳𝘬𝘦𝘵 𝘥𝘺𝘯𝘢𝘮𝘪𝘤𝘴. For instance, as more collectors enter the market, previously overlooked items can become sought after, creating new categories of collectibles.

Some collectibles, may in fact be scarce, but they are issued by a central authority, so 𝗼𝗻𝗲 𝗺𝘂𝘀𝘁 𝘁𝗿𝘂𝘀𝘁 𝘁𝗵𝗲 𝗶𝘀𝘀𝘂𝗲𝗿’𝘀 𝗰𝗹𝗮𝗶𝗺𝘀 𝘁𝗼 𝘀𝗰𝗮𝗿𝗰𝗶𝘁𝘆, and their promise that they will never increase the supply in the future. This reliance on a promise make them hardly any scarcer than fiat currencies.

𝗪𝗵𝘆 𝗖𝗼𝗺𝗺𝗼𝗱𝗶𝘁𝗶𝗲𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Commodities are raw materials or agricultural products that can be bought and sold. While they might 𝘴𝘦𝘦𝘮 scarce, technological innovations, such as more efficient mining techniques and the potential for atomic transmutation, could make it possible to create or mine commodities faster and more efficiently.

The discovery of commodities on meteors and distant planets could reduce their scarcity even further. With the vastness of space, and ever-improving methods to one day access the commodities found there, their potential supply is 𝘷𝘪𝘳𝘵𝘶𝘢𝘭𝘭𝘺 𝘭𝘪𝘮𝘪𝘵𝘭𝘦𝘴𝘴.

While commodities are currently limited by their available amounts on Earth, as well as the costs of extraction and production, 𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝗶𝗰𝗮𝗹 𝗮𝗱𝘃𝗮𝗻𝗰𝗲𝗺𝗲𝗻𝘁𝘀 𝗮𝗻𝗱 𝘀𝗽𝗮𝗰𝗲 𝗲𝘅𝗽𝗹𝗼𝗿𝗮𝘁𝗶𝗼𝗻 𝗵𝗮𝘃𝗲 𝘁𝗵𝗲 𝗽𝗼𝘁𝗲𝗻𝘁𝗶𝗮𝗹 𝘁𝗼 𝘀𝗶𝗴𝗻𝗶𝗳𝗶𝗰𝗮𝗻𝘁𝗹𝘆 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝘁𝗵𝗲𝗶𝗿 𝘀𝘂𝗽𝗽𝗹𝘆, challenging the traditional notion of scarcity.

𝗪𝗵𝘆 𝗖𝗿𝘆𝗽𝘁𝗼𝗰𝘂𝗿𝗿𝗲𝗻𝗰𝗶𝗲𝘀 𝗔𝗿𝗲 𝗡𝗼𝘁 𝗦𝗰𝗮𝗿𝗰𝗲

Cryptocurrencies, including Bitcoin, its forks, altcoins, and NFTs, are digital currencies that are secured using cryptography. However, any perceived scarcity in the “crypto” space (i.e. everything besides Bitcoin) is actually 𝘢𝘯𝘺𝘵𝘩𝘪𝘯𝘨 𝘣𝘶𝘵 𝘢𝘣𝘴𝘰𝘭𝘶𝘵𝘦𝘭𝘺 𝘴𝘤𝘢𝘳𝘤𝘦.

New cryptocurrencies can be created relatively easily. This means that even if their protocols make them have a limited supply, 𝘦𝘷𝘦𝘳𝘺 𝘯𝘦𝘸 𝘱𝘳𝘰𝘫𝘦𝘤𝘵 𝘥𝘪𝘭𝘶𝘵𝘦𝘴 𝘵𝘩𝘦 𝘷𝘢𝘭𝘶𝘦 𝘰𝘧 𝘢𝘭𝘭 𝘵𝘩𝘦 𝘰𝘵𝘩𝘦𝘳𝘴, effectively making them abundant.

Additionally, every cryptocurrency other than Bitcoin has a central leader or group that can change or update their system as they see fit. So even if a cryptocurrency’s protocol says it has a limited supply, 𝘁𝗵𝗲 𝗽𝗿𝗼𝘁𝗼𝗰𝗼𝗹 𝗰𝗮𝗻 𝗯𝗲 𝗮𝗹𝘁𝗲𝗿𝗲𝗱 𝗯𝘆 𝗰𝗲𝗻𝘁𝗿𝗮𝗹 𝗮𝘂𝘁𝗵𝗼𝗿𝗶𝘁𝗶𝗲𝘀, as has been seen with Ethereum and other cryptocurrencies.

𝗪𝗵𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗜𝘀 𝗧𝗿𝘂𝗹𝘆 𝗦𝗰𝗮𝗿𝗰𝗲

Bitcoin's scarcity is foundational to its value, with an eventual supply of just under 21 million coins. Bitcoin is run by users around the world, who are incentivized to never increase its supply. This immutable supply limit ensures bitcoin remains scarce, 𝘳𝘦𝘨𝘢𝘳𝘥𝘭𝘦𝘴𝘴 𝘰𝘧 𝘵𝘦𝘤𝘩𝘯𝘰𝘭𝘰𝘨𝘪𝘤𝘢𝘭 𝘢𝘥𝘷𝘢𝘯𝘤𝘦𝘮𝘦𝘯𝘵𝘴 𝘰𝘳 𝘩𝘶𝘮𝘢𝘯𝘪𝘵𝘺'𝘴 𝘨𝘳𝘰𝘸𝘵𝘩.

The mining process, or guessing a particular large number in order to add transactions to Bitcoin’s ledger, the timechain, is how new bitcoin are issued. However, the rate of the issuance of new coins decreases over time through "halving" events, causing the supply to 𝘢𝘱𝘱𝘳𝘰𝘢𝘤𝘩 21 million, 𝗯𝘂𝘁 𝗻𝗲𝘃𝗲𝗿 𝗽𝗮𝘀𝘀 𝗶𝘁, 𝗼𝗿 𝗲𝘃𝗲𝗻 𝗿𝗲𝗮𝗰𝗵 𝗶𝘁.

#Bitcoin was designed to mirror the scarcity of traditional assets like gold. However, while Bitcoin and commodities are mined more in response to price increases, 𝘰𝘯𝘭𝘺 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘮𝘢𝘪𝘯𝘵𝘢𝘪𝘯𝘴 𝘪𝘵𝘴 𝘪𝘴𝘴𝘶𝘢𝘯𝘤𝘦 𝘴𝘤𝘩𝘦𝘥𝘶𝘭𝘦, regardless of how many miners start hashing, thanks to the difficulty adjustment. This makes Bitcoin truly scarce, no matter what any individuals choose to do.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻

As you can see, Bitcoin is the only completely and permanently scarce asset. The only other thing that might be as scarce as Bitcoin is your 𝘵𝘪𝘮𝘦, but you can never know how much you have left. And with technology assisting you in using your time more efficiently, and extending your lifetime by many years, 𝗶𝘁 𝗺𝗮𝘆 𝘁𝘂𝗿𝗻 𝗼𝘂𝘁 𝘁𝗵𝗮𝘁 𝗲𝘃𝗲𝗻 𝘁𝗶𝗺𝗲 𝗶𝘁𝘀𝗲𝗹𝗳 𝗶𝘀 𝗻𝗼𝘁 𝗯𝗲 𝗮𝘀 𝘀𝗰𝗮𝗿𝗰𝗲 𝗮𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻.

Some other things that aren’t scarce are 𝗟𝗶𝗸𝗲🤙, 𝗦𝗵𝗮𝗿𝗲𝘀🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝘀🔖.

And if there’s anything you’d like to add to this, please leave it in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗕𝗹𝗼𝗰𝗸𝗰𝗵𝗮𝗶𝗻 𝗼𝗿 𝗧𝗶𝗺𝗲𝗰𝗵𝗮𝗶𝗻?

If you’re new to #Bitcoin, you’ve likely heard of “𝘣𝘭𝘰𝘤𝘬𝘤𝘩𝘢𝘪𝘯”, though you may not know what it is or how it works. And if you’ve come across the term “𝘵𝘪𝘮𝘦𝘤𝘩𝘢𝘪𝘯”, then you may be even more confused.

Let’s sort this out👇

The prevalent term for Bitcoin’s distributed ledger is “𝘣𝘭𝘰𝘤𝘬𝘤𝘩𝘢𝘪𝘯”, yet the original name that Bitcoin's creator, Satoshi Nakamoto, gave it was “𝘵𝘪𝘮𝘦𝘤𝘩𝘢𝘪𝘯”. 𝗧𝗵𝗶𝘀 𝗳𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝘁𝗲𝗿𝗺 𝘂𝗻𝗱𝗲𝗿𝘀𝗰𝗼𝗿𝗲𝘀 𝘁𝗵𝗲 𝘀𝗲𝗾𝘂𝗲𝗻𝘁𝗶𝗮𝗹 𝗮𝗻𝗱 𝗶𝗺𝗺𝘂𝘁𝗮𝗯𝗹𝗲 𝗻𝗮𝘁𝘂𝗿𝗲 𝗼𝗳 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 𝘄𝗶𝘁𝗵𝗶𝗻 𝗕𝗶𝘁𝗰𝗼𝗶𝗻, highlighting its progression through time as a one-way, irreversible system.

A blockchain/timechain is not an especially disruptive technology or a “secret sauce” that somehow makes a system decentralized. In reality, 𝗶𝘁’𝘀 𝗻𝗼𝘁𝗵𝗶𝗻𝗴 𝗺𝗼𝗿𝗲 𝘁𝗵𝗮𝗻 𝗮 𝗹𝗲𝗱𝗴𝗲𝗿 𝗸𝗲𝗽𝘁 𝗯𝘆 𝗺𝘂𝗹𝘁𝗶𝗽𝗹𝗲 𝗰𝗼𝗺𝗽𝘂𝘁𝗲𝗿𝘀, which agree on each update whenever it’s time for a new “page”, or block, to be added to the ledger.

"Blockchain" has become a generic descriptor for various projects with distributed ledgers, though it's essential to recognize that 𝗻𝗼𝘁 𝗮𝗹𝗹 𝗲𝗺𝗯𝗼𝗱𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 𝗰𝗼𝗿𝗲 𝗽𝗿𝗶𝗻𝗰𝗶𝗽𝗹𝗲𝘀, such as proof-of-work and decentralization. 𝘛𝘩𝘦 𝘵𝘦𝘳𝘮 "𝘵𝘪𝘮𝘦𝘤𝘩𝘢𝘪𝘯" 𝘪𝘴 𝘥𝘪𝘴𝘵𝘪𝘯𝘤𝘵, 𝘳𝘦𝘧𝘦𝘳𝘳𝘪𝘯𝘨 𝘴𝘱𝘦𝘤𝘪𝘧𝘪𝘤𝘢𝘭𝘭𝘺 𝘵𝘰 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘯𝘥 𝘪𝘵𝘴 𝘶𝘯𝘪𝘲𝘶𝘦 𝘢𝘵𝘵𝘳𝘪𝘣𝘶𝘵𝘦𝘴 𝘵𝘩𝘢𝘵 𝘦𝘯𝘴𝘶𝘳𝘦 𝘴𝘦𝘤𝘶𝘳𝘪𝘵𝘺 𝘢𝘯𝘥 𝘵𝘳𝘶𝘴𝘵.

So while “𝘣𝘭𝘰𝘤𝘬𝘤𝘩𝘢𝘪𝘯” might dominate the discourse today, “𝘵𝘪𝘮𝘦𝘤𝘩𝘢𝘪𝘯” more accurately captures the essence and originality of Bitcoin, stressing the importance of its chronological, 𝘁𝗿𝘂𝗹𝘆 𝗶𝗿𝗿𝗲𝘃𝗲𝗿𝘀𝗶𝗯𝗹𝗲 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀 that distinguish it from all other cryptocurrencies.

Was this helpful? Give it a 𝗟𝗶𝗸𝗲🤙

Think this might help someone else? 𝗦𝗵𝗮𝗿𝗲🔄 it with others.

𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this so you can reference it later.

Which term do 𝘺𝘰𝘶 prefer, “blockchain” or “timechain”?

Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗛𝗼𝘄 𝘁𝗵𝗲 𝗗𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗔𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗩𝗮𝗹𝘂𝗲

You’ve probably heard of Bitcoin’s 𝗗𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗔𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁, but what is it? How does it work? And why does it matter?

Here’s everything you need to know👇

The difficulty adjustment is 𝘷𝘪𝘵𝘢𝘭 to #Bitcoin, since it ensures new blocks are created timely and the network remains secure. It's part of the Proof-of-Work consensus, adapting it to the network's computational power to maintain a 10-minute block creation rate. This self-regulating mechanism distinguishes Bitcoin from centralized systems, removing the need for human intervention to make necessary adjustments.

Mining Bitcoin is competitive, with miners searching for solutions to cryptographic functions to add transactions to the blockchain. As mining power increases, so does competition, necessitating the difficulty adjustment. It keeps the challenge appropriate, increasing the difficulty when there’s more power and decreasing it when there’s less, 𝘦𝘯𝘴𝘶𝘳𝘪𝘯𝘨 𝘢 𝘴𝘵𝘦𝘢𝘥𝘺 𝘣𝘭𝘰𝘤𝘬 𝘳𝘢𝘵𝘦 𝘳𝘦𝘨𝘢𝘳𝘥𝘭𝘦𝘴𝘴 𝘰𝘧 𝘵𝘩𝘦 𝘯𝘦𝘵𝘸𝘰𝘳𝘬'𝘴 𝘵𝘰𝘵𝘢𝘭 𝘩𝘢𝘴𝘩 𝘳𝘢𝘵𝘦.

The 𝗗𝗶𝗳𝗳𝗶𝗰𝘂𝗹𝘁𝘆 𝗔𝗱𝗷𝘂𝘀𝘁𝗺𝗲𝗻𝘁 𝗔𝗹𝗴𝗼𝗿𝗶𝘁𝗵𝗺 (DAA) recalibrates the mining difficulty every 𝟮,𝟬𝟭𝟲 𝗯𝗹𝗼𝗰𝗸𝘀, or about 𝗲𝘃𝗲𝗿𝘆 𝘁𝘄𝗼 𝘄𝗲𝗲𝗸𝘀, based on the time taken to mine the previous set. This ensures the block rate remains stable at roughly 10 minutes per block, which is crucial for network integrity and security against attacks like double-spending.

By stabilizing block creation, 𝘵𝘩𝘦 𝘋𝘈𝘈 𝘴𝘦𝘤𝘶𝘳𝘦𝘴 𝘵𝘩𝘦 𝘯𝘦𝘵𝘸𝘰𝘳𝘬 𝘢𝘨𝘢𝘪𝘯𝘴𝘵 𝘴𝘶𝘥𝘥𝘦𝘯 𝘤𝘩𝘢𝘯𝘨𝘦𝘴 𝘵𝘩𝘢𝘵 𝘤𝘰𝘶𝘭𝘥 𝘭𝘦𝘢𝘥 𝘵𝘰 𝘷𝘶𝘭𝘯𝘦𝘳𝘢𝘣𝘪𝘭𝘪𝘵𝘪𝘦𝘴, including forks. This consistency aids in achieving consensus across the network, reducing the likelihood of exploitable discrepancies and maintaining the blockchain's decentralized integrity.

Economically, difficulty adjustments impact miner profitability by affecting the effort required to mine new blocks. 𝗧𝗵𝗶𝘀 𝗱𝘆𝗻𝗮𝗺𝗶𝗰 𝗯𝗮𝗹𝗮𝗻𝗰𝗲𝘀 𝘁𝗵𝗲 𝗶𝗻𝘁𝗿𝗼𝗱𝘂𝗰𝘁𝗶𝗼𝗻 𝗼𝗳 𝗺𝗼𝗿𝗲 𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝘁 𝗺𝗶𝗻𝗶𝗻𝗴 𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆, ensuring that despite hardware advancements, the issuance rate of new bitcoins stays predictable, aligning with Bitcoin's deflationary monetary policy.

Technological advancements in mining hardware, which could potentially accelerate block creation, are 𝘤𝘰𝘶𝘯𝘵𝘦𝘳𝘣𝘢𝘭𝘢𝘯𝘤𝘦𝘥 by the difficulty adjustment. 𝘛𝘩𝘪𝘴 𝘯𝘦𝘶𝘵𝘳𝘢𝘭𝘪𝘻𝘦𝘴 𝘵𝘩𝘦 𝘦𝘧𝘧𝘦𝘤𝘵 𝘰𝘧 𝘪𝘮𝘱𝘳𝘰𝘷𝘦𝘥 𝘦𝘧𝘧𝘪𝘤𝘪𝘦𝘯𝘤𝘺 𝘰𝘯 𝘣𝘭𝘰𝘤𝘬 𝘳𝘢𝘵𝘦𝘴, preserving the 10-minute target and supporting Bitcoin's long-term economic principles, including its 21 million cap.

The difficulty adjustment is a cornerstone of Bitcoin's design, vital for its operation, security, and economic model. 𝗜𝘁 𝗮𝗹𝗹𝗼𝘄𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗼 𝗮𝗱𝗮𝗽𝘁 𝗱𝘆𝗻𝗮𝗺𝗶𝗰𝗮𝗹𝗹𝘆 to changes in mining activity and technology, safeguarding the network's decentralized nature and ensuring the predictable issuance of bitcoins.

Remember to 𝗟𝗶𝗸𝗲🤙, 𝗦𝗵𝗮𝗿𝗲🔄 and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this, so you can find it later!

𝗖𝗼𝘂𝗹𝗱 𝗖𝗿𝗮𝗶𝗴 𝗪𝗿𝗶𝗴𝗵𝘁 𝗥𝗲𝗮𝗹𝗹𝘆 𝗕𝗲 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗡𝗮𝗸𝗮𝗺𝗼𝘁𝗼?

I usually only answer this question with a chuckle, but in light of today’s trial with the Crypto Open Patent Alliance (COPA), it seems a good time to fully weigh-in on this issue.

This question is so ridiculous, I intend this to be the 𝘰𝘯𝘭𝘺 time I will give it any serious consideration.

Craig Wright's claim to be Satoshi Nakamoto, the pseudonymous creator of #Bitcoin, 𝗹𝗮𝗰𝗸𝘀 𝗰𝗿𝗲𝗱𝗶𝗯𝗶𝗹𝗶𝘁𝘆 𝗼𝗻 𝗺𝘂𝗹𝘁𝗶𝗽𝗹𝗲 𝗳𝗿𝗼𝗻𝘁𝘀. Unlike Satoshi, who was deeply involved in Bitcoin's early development, Wright appeared 𝘺𝘦𝘢𝘳𝘴 later, and with 𝗮 𝗰𝗼𝗺𝗽𝗹𝗲𝘁𝗲𝗹𝘆 𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁 𝘄𝗿𝗶𝘁𝗶𝗻𝗴 𝘀𝘁𝘆𝗹𝗲—verbose and error-prone—compared to Satoshi's concise technicality.

Satoshi's online presence was 𝘮𝘪𝘯𝘪𝘮𝘢𝘭, focusing on development rather than publicity. Wright, conversely, actively seeks media attention. His actions, including attempts to control Bitcoin’s shared ledger, the blockchain, starkly contrast with Satoshi's decentralization ethos. Furthermore, 𝘁𝗶𝗺𝗲𝗹𝗶𝗻𝗲𝘀 𝗼𝗳 𝘁𝗵𝗲𝗶𝗿 𝗶𝗻𝘃𝗼𝗹𝘃𝗲𝗺𝗲𝗻𝘁 𝗮𝗻𝗱 𝗰𝗼𝗱𝗶𝗻𝗴 𝘀𝘁𝘆𝗹𝗲𝘀 𝗱𝗼 𝗻𝗼𝘁 𝗺𝗮𝘁𝗰𝗵.

Evidence supporting Wright's claim is unconvincing. If he really were Satoshi, he could have proved it long ago by publicly signing a message using Satoshi’s private key, but he has failed to do so. 𝘏𝘦 𝘢𝘭𝘴𝘰 𝘥𝘪𝘴𝘱𝘭𝘢𝘺𝘴 𝘶𝘯𝘧𝘢𝘮𝘪𝘭𝘪𝘢𝘳𝘪𝘵𝘺 𝘸𝘪𝘵𝘩 𝘉𝘪𝘵𝘤𝘰𝘪𝘯'𝘴 𝘦𝘢𝘳𝘭𝘪𝘦𝘴𝘵 𝘥𝘢𝘺𝘴, 𝘢𝘯𝘥 𝘰𝘧𝘵𝘦𝘯 𝘤𝘰𝘯𝘵𝘳𝘢𝘥𝘪𝘤𝘵𝘴 𝘣𝘢𝘴𝘪𝘤 𝘱𝘳𝘪𝘯𝘤𝘪𝘱𝘭𝘦𝘴 𝘵𝘩𝘢𝘵 𝘚𝘢𝘵𝘰𝘴𝘩𝘪 𝘭𝘪𝘷𝘦𝘥 𝘣𝘺. Consequently, Bitcoiners largely view Wright's assertions with skepticism, questioning his motives.

In sum, his discrepancies in involvement, writing, and principles, along with a complete lack of hard evidence, make it 𝘦𝘹𝘤𝘦𝘦𝘥𝘪𝘯𝘨𝘭𝘺 𝘶𝘯𝘭𝘪𝘬𝘦𝘭𝘺 that Craig Wright is Satoshi Nakamoto. One could even say that 𝗶𝘁’𝘀 𝗳𝗮𝗿 𝗺𝗼𝗿𝗲 𝗹𝗶𝗸𝗲𝗹𝘆 𝘁𝗵𝗮𝘁 𝘆𝗼𝘂 𝘄𝗶𝗹𝗹 𝗴𝘂𝗲𝘀𝘀 𝗦𝗮𝘁𝗼𝘀𝗵𝗶'𝘀 𝗽𝗿𝗶𝘃𝗮𝘁𝗲 𝗸𝗲𝘆, 𝘁𝗵𝗮𝗻 𝗳𝗼𝗿 𝗖𝗿𝗮𝗶𝗴 𝗪𝗿𝗶𝗴𝗵𝘁 𝘁𝗼 𝗮𝗰𝘁𝘂𝗮𝗹𝗹𝘆 𝗯𝗲 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗡𝗮𝗸𝗮𝗺𝗼𝘁𝗼.

Be sure to 𝗟𝗶𝗸𝗲🤙 and 𝗦𝗵𝗮𝗿𝗲🔄 this, and save it in your 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝘀🔖

What do you think? Is Craig Wright Satoshi Nakamoto? Why or why not?

Write your answer in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗧𝗿𝘆𝗶𝗻𝗴 𝘁𝗼 𝗥𝗲𝗰𝗼𝘃𝗲𝗿 𝗳𝗿𝗼𝗺 𝗮 𝗦𝗵𝗶𝘁𝗰𝗼𝗶𝗻 𝗔𝗱𝗱𝗶𝗰𝘁𝗶𝗼𝗻?

𝘠𝘰𝘶’𝘳𝘦 𝘯𝘰𝘵 𝘢𝘭𝘰𝘯𝘦. 🫂

Inspired by Max Keiser and El Brandino Martinez, below is a list of 𝟭𝟮 𝗦𝘁𝗲𝗽𝘀 you can take to cleanse your life and soul of shitcoins, and find the #Bitcoin maximalist that’s waiting to emerge victoriously from within you.

𝗦𝘁𝗲𝗽 𝟭: 𝗔𝗱𝗺𝗶𝘁 𝘆𝗼𝘂’𝗿𝗲 𝗽𝗼𝘄𝗲𝗿𝗹𝗲𝘀𝘀 𝗼𝘃𝗲𝗿 𝘀𝗵𝗶𝘁𝗰𝗼𝗶𝗻𝘀—𝘁𝗵𝗮𝘁 𝗼𝘂𝗿 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼 𝗵𝗮𝘀 𝗯𝗲𝗰𝗼𝗺𝗲 𝘂𝗻𝗺𝗮𝗻𝗮𝗴𝗲𝗮𝗯𝗹𝗲.

The first step towards recovery is 𝘢𝘥𝘮𝘪𝘵𝘵𝘪𝘯𝘨 that chasing high-risk, low-reward tokens has led to more losses than gains.

𝗦𝘁𝗲𝗽 𝟮: 𝗕𝗲𝗹𝗶𝗲𝘃𝗲 𝘁𝗵𝗮𝘁 𝗮 𝗣𝗼𝘄𝗲𝗿 𝗴𝗿𝗲𝗮𝘁𝗲𝗿 𝘁𝗵𝗮𝗻 𝘆𝗼𝘂𝗿𝘀𝗲𝗹𝗳 𝗰𝗮𝗻 𝗿𝗲𝘀𝘁𝗼𝗿𝗲 𝘆𝗼𝘂 𝘁𝗼 𝘀𝗮𝗻𝗶𝘁𝘆.

This higher Power is the immutable, decentralized ethos of Bitcoin—the original cryptocurrency that stands as a beacon of stability and integrity.

𝗦𝘁𝗲𝗽 𝟯: 𝗗𝗲𝗰𝗶𝗱𝗲 𝘁𝗼 𝘁𝘂𝗿𝗻 𝘆𝗼𝘂𝗿 𝘄𝗶𝗹𝗹 𝗮𝗻𝗱 𝘆𝗼𝘂𝗿 𝗹𝗶𝗳𝗲 𝗼𝘃𝗲𝗿 𝘁𝗼 𝘁𝗵𝗲 𝗰𝗮𝗿𝗲 𝗼𝗳 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗡𝗮𝗸𝗮𝗺𝗼𝘁𝗼, 𝗮𝘀 𝘆𝗼𝘂 𝘂𝗻𝗱𝗲𝗿𝘀𝘁𝗮𝗻𝗱 𝗛𝗶𝗺.

Accept the principles of sound money, and the purpose of Bitcoin as the key to individual sovereignty.

𝗦𝘁𝗲𝗽 𝟰: 𝗠𝗮𝗸𝗲 𝗮 𝘀𝗲𝗮𝗿𝗰𝗵𝗶𝗻𝗴 𝗮𝗻𝗱 𝗳𝗲𝗮𝗿𝗹𝗲𝘀𝘀 𝗺𝗼𝗿𝗮𝗹 𝗶𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆 𝗼𝗳 𝘆𝗼𝘂𝗿 𝗽𝗼𝗿𝘁𝗳𝗼𝗹𝗶𝗼.

Thoroughly review your past trades, acknowledging the allure of quick profits that led you astray from the path of long-term value savings and low time preference.

𝗦𝘁𝗲𝗽 𝟱: 𝗔𝗱𝗺𝗶𝘁 𝘁𝗼 𝗦𝗮𝘁𝗼𝘀𝗵𝗶, 𝘁𝗼 𝘆𝗼𝘂𝗿𝘀𝗲𝗹𝗳, 𝗮𝗻𝗱 𝘁𝗼 𝗮𝗻𝗼𝘁𝗵𝗲𝗿 𝗵𝘂𝗺𝗮𝗻 𝗯𝗲𝗶𝗻𝗴 𝘁𝗵𝗲 𝗲𝘅𝗮𝗰𝘁 𝗻𝗮𝘁𝘂𝗿𝗲 𝗼𝗳 𝘆𝗼𝘂𝗿 𝘄𝗿𝗼𝗻𝗴𝘀.

Confess your missteps into speculations, and giving into the temptation of pump-and-dump schemes to a trusted peer or mentor in the Bitcoin space.

𝗦𝘁𝗲𝗽 𝟲: 𝗕𝗲𝗰𝗼𝗺𝗲 𝗲𝗻𝘁𝗶𝗿𝗲𝗹𝘆 𝗿𝗲𝗮𝗱𝘆 𝘁𝗼 𝗵𝗮𝘃𝗲 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗿𝗲𝗺𝗼𝘃𝗲 𝗮𝗹𝗹 𝘆𝗼𝘂𝗿 𝗱𝗲𝗳𝗲𝗰𝘁𝘀 𝗼𝗳 𝗰𝗵𝗮𝗿𝗮𝗰𝘁𝗲𝗿.

Prepare yourself to let go of the greed and impatience that drove you to shitcoin speculation in the first place.

𝗦𝘁𝗲𝗽 𝟳: 𝗛𝘂𝗺𝗯𝗹𝘆 𝗮𝘀𝗸 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝘁𝗼 𝗿𝗲𝗺𝗼𝘃𝗲 𝘆𝗼𝘂𝗿 𝘀𝗵𝗼𝗿𝘁𝗰𝗼𝗺𝗶𝗻𝗴𝘀.

Seek the strength to focus on disciplined savings strategies, such as DCA, and to resist the allure of shitcoins, be they altcoins, NFTs, or anything else.

𝗦𝘁𝗲𝗽 𝟴: 𝗠𝗮𝗸𝗲 𝗮 𝗹𝗶𝘀𝘁 𝗼𝗳 𝗮𝗹𝗹 𝗽𝗲𝗿𝘀𝗼𝗻𝘀 𝘆𝗼𝘂 𝗵𝗮𝗿𝗺𝗲𝗱, 𝗮𝗻𝗱 𝗯𝗲𝗰𝗼𝗺𝗲 𝘄𝗶𝗹𝗹𝗶𝗻𝗴 𝘁𝗼 𝗺𝗮𝗸𝗲 𝗮𝗺𝗲𝗻𝗱𝘀 𝘁𝗼 𝘁𝗵𝗲𝗺 𝗮𝗹𝗹.

Acknowledge if your shitcoin evangelism or trading led others astray, or got them rekt, and prepare to guide them back towards the orange light of Bitcoin.

𝗦𝘁𝗲𝗽 𝟵: 𝗠𝗮𝗸𝗲 𝗱𝗶𝗿𝗲𝗰𝘁 𝗮𝗺𝗲𝗻𝗱𝘀 𝘁𝗼 𝘀𝘂𝗰𝗵 𝗽𝗲𝗼𝗽𝗹𝗲 𝘄𝗵𝗲𝗿𝗲𝘃𝗲𝗿 𝗽𝗼𝘀𝘀𝗶𝗯𝗹𝗲, 𝗲𝘅𝗰𝗲𝗽𝘁 𝘄𝗵𝗲𝗻 𝘁𝗼 𝗱𝗼 𝘀𝗼 𝘄𝗼𝘂𝗹𝗱 𝗶𝗻𝗷𝘂𝗿𝗲 𝘁𝗵𝗲𝗺 𝗼𝗿 𝗼𝘁𝗵𝗲𝗿𝘀.

Where your advice or actions have caused financial loss to others, seek to rectify these wrongs through guidance and support.

𝗦𝘁𝗲𝗽 𝟭𝟬: 𝗖𝗼𝗻𝘁𝗶𝗻𝘂𝗲 𝘁𝗼 𝘁𝗮𝗸𝗲 𝗽𝗲𝗿𝘀𝗼𝗻𝗮𝗹 𝗶𝗻𝘃𝗲𝗻𝘁𝗼𝗿𝘆, 𝗮𝗻𝗱 𝘄𝗵𝗲𝗻 𝘆𝗼𝘂 𝘄𝗲𝗿𝗲 𝘄𝗿𝗼𝗻𝗴, 𝗽𝗿𝗼𝗺𝗽𝘁𝗹𝘆 𝗮𝗱𝗺𝗶𝘁𝘁𝗲𝗱 𝗶𝘁.

Commit to ongoing self-reflection on your financial decisions, and admit when a relapse to shitcoining is imminent.

𝗦𝘁𝗲𝗽 𝟭𝟭: 𝗦𝗲𝗲𝗸 𝘁𝗵𝗿𝗼𝘂𝗴𝗵 𝘀𝘁𝘂𝗱𝘆 𝗮𝗻𝗱 𝗰𝗼𝗺𝗺𝘂𝗻𝗶𝘁𝘆 𝘁𝗼 𝗶𝗺𝗽𝗿𝗼𝘃𝗲 𝘆𝗼𝘂𝗿 𝗰𝗼𝗻𝘀𝗰𝗶𝗼𝘂𝘀 𝗰𝗼𝗻𝘁𝗮𝗰𝘁 𝘄𝗶𝘁𝗵 𝗦𝗮𝘁𝗼𝘀𝗵𝗶 𝗡𝗮𝗸𝗮𝗺𝗼𝘁𝗼, 𝗽𝗿𝗮𝘆𝗶𝗻𝗴 𝗼𝗻𝗹𝘆 𝗳𝗼𝗿 𝗸𝗻𝗼𝘄𝗹𝗲𝗱𝗴𝗲 𝗼𝗳 𝗛𝗶𝘀 𝘄𝗶𝗹𝗹 𝗳𝗼𝗿 𝘆𝗼𝘂, 𝗮𝗻𝗱 𝘁𝗵𝗲 𝗽𝗼𝘄𝗲𝗿 𝘁𝗼 𝗰𝗮𝗿𝗿𝘆 𝘁𝗵𝗮𝘁 𝗼𝘂𝘁.

Deepen your understanding of Bitcoin's technological, philosophical, and economic principles, and engage with the community to reinforce your commitment to Bitcoin’s ethos.

𝗦𝘁𝗲𝗽 𝟭𝟮: 𝗛𝗮𝘃𝗶𝗻𝗴 𝗵𝗮𝗱 𝗮 𝘀𝗽𝗶𝗿𝗶𝘁𝘂𝗮𝗹 𝗮𝘄𝗮𝗸𝗲𝗻𝗶𝗻𝗴 𝗮𝘀 𝘁𝗵𝗲 𝗿𝗲𝘀𝘂𝗹𝘁 𝗼𝗳 𝘁𝗵𝗲𝘀𝗲 𝘀𝘁𝗲𝗽𝘀, 𝘁𝗿𝘆 𝘁𝗼 𝗰𝗮𝗿𝗿𝘆 𝘁𝗵𝗶𝘀 𝗺𝗲𝘀𝘀𝗮𝗴𝗲 𝘁𝗼 𝘀𝗵𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗿𝗮𝗱𝗲𝗿𝘀, 𝗮𝗻𝗱 𝘁𝗼 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗲 𝘁𝗵𝗲𝘀𝗲 𝗽𝗿𝗶𝗻𝗰𝗶𝗽𝗹𝗲𝘀 𝗶𝗻 𝗮𝗹𝗹 𝘆𝗼𝘂𝗿 𝗮𝗳𝗳𝗮𝗶𝗿𝘀.

Share our journey of recovery and enlightenment with others who may still be in the throes of shitcoin despair, offering them a path towards individual sovereignty through Bitcoin.

Remember, Bitcoin maximalism is a 𝘫𝘰𝘶𝘳𝘯𝘦𝘺, not a destination. May your path lead you to the enlightened state of sound money, and away from the volatile shores of shitcoin trading.

Remember to give this a 𝗟𝗶𝗸𝗲🤙, 𝗦𝗵𝗮𝗿𝗲🔄 it with those who need to take these steps to recover from shitcoinery.

And 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for when you come in contact with shitcoiners in the future.

Are 𝘺𝘰𝘶 a recovering shitcoiner?

Tell your story in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

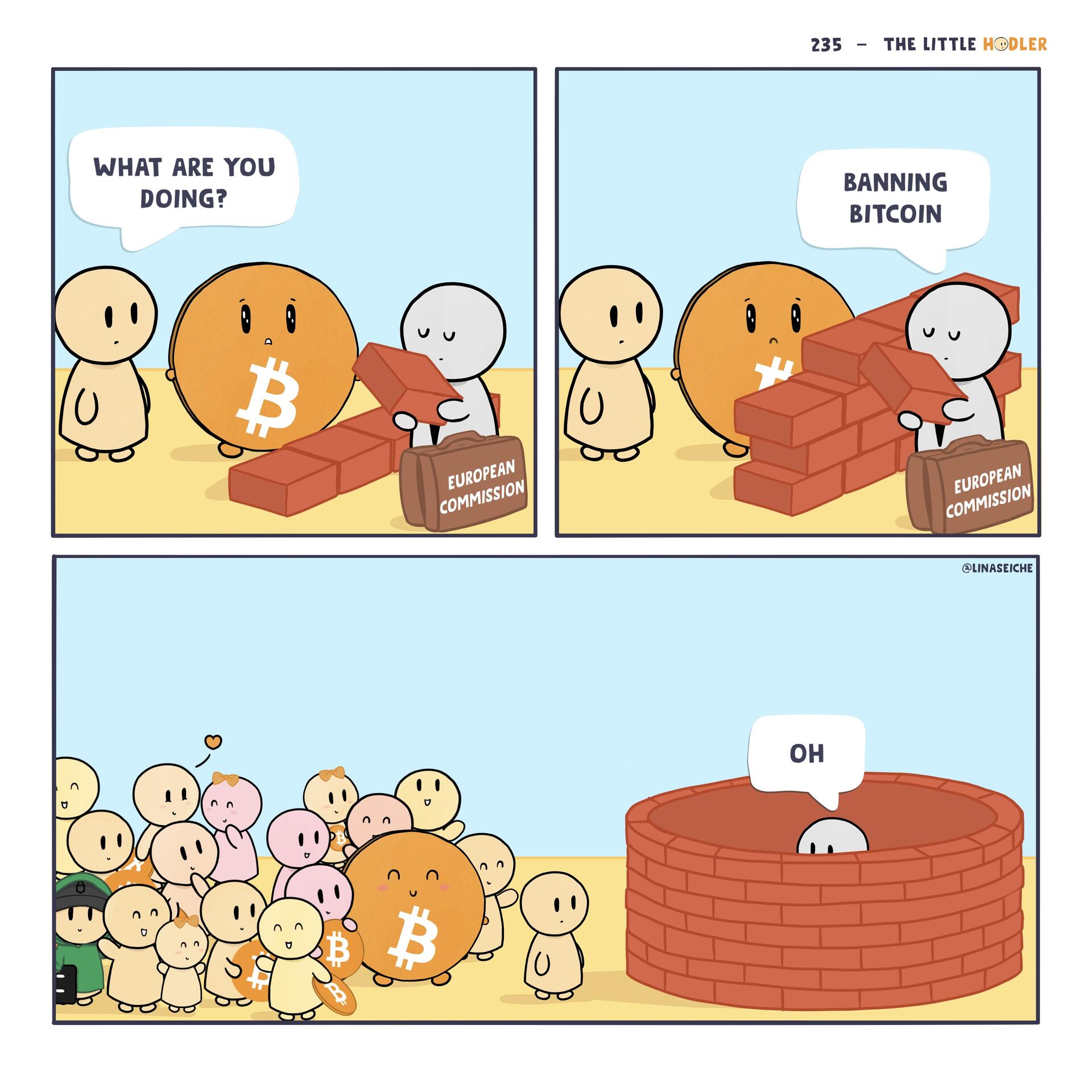

Reminder: 𝗚𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁𝘀 𝗰𝗮𝗻’𝘁 𝗯𝗮𝗻 #Bitcoin.

They can only ban themselves 𝘧𝘳𝘰𝘮 Bitcoin, including all its technological, social, and economic benefits.

Ignore the noise, and keep stacking.

𝗛𝗮𝗽𝗽𝘆 𝗚𝗿𝗼𝘂𝗻𝗱𝗵𝗼𝗴 𝗗𝗮𝘆!

The Bitcoin Groundhog paused his mining earlier today, and ventured to the surface to check whether he could see his shadow.

If he saw his shadow, he would scurry back to his mine, and #Bitcoin would have 𝟲 𝗺𝗼𝗿𝗲 𝘄𝗲𝗲𝗸𝘀 𝗼𝗳 𝗮 𝗯𝗲𝗮𝗿 𝗺𝗮𝗿𝗸𝗲𝘁. But if he didn't, then the bear market would officially be over.

I am pleased to report that the Bitcoin Groundhog did 𝙣𝙤𝙩 see his shadow! The bear market is over! 𝗜𝘁'𝘀 𝘁𝗶𝗺𝗲 𝘁𝗼 𝘀𝘁𝗮𝗰𝗸 𝗺𝗼𝗿𝗲 𝘀𝗮𝘁𝘀! 🎉

Of course, it’s 𝘢𝘭𝘸𝘢𝘺𝘴 a good time for that. 😉

🚨 Please note: The title of this post should have been something like "Multisig vs. Splitting a Seed Phrase", not "Splitting Keys". While the main part of the above post was written by Ai, the title was written by a human.

The truth is that there are many ways to split a private key, such as MPC/sharding, which divide governance and allow multiple parties to manage a private key without revealing their piece to the other parties. While this is a fine setup for security purposes, one should never simply divide their seed phrase into smaller groups (i.e. 6 words to one party and 6 to another), as this will allow the rest of the seed phrase to be guessed much more easily.

What about the nostr:npub1wdj735gknh68znhtwg8njvs8vyqh48zzhquka7aks8s2u4quscsqj3hdy0 ? Doesn't it make this halving the "most" important one?

It is anticipated that all future halvings will be commemorated with halving parties, but from the perspective of economics, that won't make this halving, or any of the others, any more important than they already are.

It could be argued, however, that the most important part of any halving is the bitcoiners we celebrate it with, which is why halving parties, regular meetups, and in-person connections made through services like nostr:npub1ve8qwrlztemdmnh62jffcr0y9m9dpqgqjdg8ufx7gc3qw5wdk74qyv9ka6 are so valuable.

In any case, this next halving will make bitcoin the hardest money in the history of the world. And similarly, the friendships you make with other bitcoiners at halving parties and other events have the potential to become the strongest bonds you will ever make, as you work together to fight against fiat and fix the world, starting at the foundation of our very culture: money.

𝗠𝘂𝗹𝘁𝗶𝘀𝗶𝗴 𝘃𝘀. 𝗦𝗽𝗹𝗶𝘁𝘁𝗶𝗻𝗴 𝗞𝗲𝘆𝘀

To truly own your bitcoin, you must custody your private key. This usually involves writing down a 12 or 24-word seed phrase, and keeping it offline where it’s safe from theft, flood, and fire.

But what if it’s discovered? Is it safer to use multiple private keys connected to the same wallet, or to split up a single seed phrase into multiple pieces?

Let’s explore this below👇

Multisignature, commonly referred to as 𝘮𝘶𝘭𝘵𝘪𝘴𝘪𝘨, is a method of 𝗱𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗻𝗴 𝗰𝗼𝗻𝘁𝗿𝗼𝗹 𝗼𝘃𝗲𝗿 𝗮 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝘄𝗮𝗹𝗹𝗲𝘁 𝘂𝘀𝗶𝗻𝗴 𝗺𝘂𝗹𝘁𝗶𝗽𝗹𝗲 𝘄𝗵𝗼𝗹𝗲 𝗽𝗿𝗶𝘃𝗮𝘁𝗲 𝗸𝗲𝘆𝘀. So instead of one private key being used to control the asset, multiple private keys are required to sign, execute, and validate a transaction.

The most common multisig implementation is a 2-of-3 scheme, where any 2 of the 3 private keys are needed to sign a valid transaction. In this setup, 𝘯𝘰𝘯𝘦 𝘰𝘧 𝘵𝘩𝘦 𝘬𝘦𝘺 𝘴𝘪𝘨𝘯𝘦𝘳𝘴 𝘯𝘦𝘦𝘥 𝘵𝘰 𝘱𝘳𝘰𝘷𝘪𝘥𝘦 𝘵𝘩𝘦𝘪𝘳 𝘱𝘳𝘪𝘷𝘢𝘵𝘦 𝘬𝘦𝘺 𝘵𝘰 𝘵𝘩𝘦 𝘰𝘵𝘩𝘦𝘳𝘴, allowing for trustless wallet management, even among a wallet’s co-owners.

Contrasting that with splitting your private key into smaller pieces, 𝘢𝘯 𝘢𝘵𝘵𝘢𝘤𝘬𝘦𝘳 𝘤𝘰𝘶𝘭𝘥 𝘱𝘰𝘵𝘦𝘯𝘵𝘪𝘢𝘭𝘭𝘺 𝘢𝘤𝘤𝘦𝘴𝘴 𝘺𝘰𝘶𝘳 𝘤𝘰𝘪𝘯𝘴 𝘣𝘺 𝘰𝘣𝘵𝘢𝘪𝘯𝘪𝘯𝘨 𝘫𝘶𝘴𝘵 𝘰𝘯𝘦 𝘱𝘪𝘦𝘤𝘦, and then correctly guessing the rest. 𝗘𝘃𝗲𝗿𝘆 𝘄𝗼𝗿𝗱 𝘁𝗵𝗲𝘆 𝗵𝗮𝘃𝗲 𝗼𝗳 𝘆𝗼𝘂𝗿 𝘀𝗲𝗲𝗱 𝗽𝗵𝗿𝗮𝘀𝗲 𝗺𝗮𝗸𝗲𝘀 𝗶𝘁 𝗲𝘅𝗽𝗼𝗻𝗲𝗻𝘁𝗶𝗮𝗹𝗹𝘆 𝗲𝗮𝘀𝗶𝗲𝗿 𝘁𝗼 𝗴𝘂𝗲𝘀𝘀 𝘁𝗵𝗲 𝗿𝗲𝗺𝗮𝗶𝗻𝗶𝗻𝗴 𝘄𝗼𝗿𝗱𝘀, but that is not the case with multisig.

It's important to note that multisig can be implemented at different levels, such as at the blockchain or consensus level — which provides the highest level of security — or by a particular application, which is far less secure. If the number of signers or authorization keys can be changed without a publicly-visible transaction on the blockchain, 𝘆𝗼𝘂'𝗿𝗲 𝘂𝘀𝗶𝗻𝗴 𝗮 𝗹𝗲𝘀𝘀 𝘀𝗲𝗰𝘂𝗿𝗲 𝗮𝗽𝗽𝗹𝗶𝗰𝗮𝘁𝗶𝗼𝗻-𝗽𝗼𝗹𝗶𝗰𝘆-𝗯𝗮𝘀𝗲𝗱 𝘀𝗲𝗿𝘃𝗶𝗰𝗲, where the authors of the application ultimately control the asset.

Multisig offers several benefits, including increased security, as it requires multiple signatures to create a transaction, making it much more difficult for an attacker to compromise your wallet. Additionally, 𝗲𝗮𝗰𝗵 𝗽𝗲𝗿𝘀𝗼𝗻 𝗶𝗻𝘃𝗼𝗹𝘃𝗲𝗱 𝗶𝗻 𝘁𝗵𝗲 𝗺𝘂𝗹𝘁𝗶𝘀𝗶𝗴 𝗰𝗼𝗻𝗳𝗶𝗴𝘂𝗿𝗮𝘁𝗶𝗼𝗻 𝗵𝗮𝘀 𝘁𝗵𝗲𝗶𝗿 𝗼𝘄𝗻 𝗯𝗮𝗰𝗸𝘂𝗽, so if a key is lost or stolen, a new multisignature wallet can be created, and the other key holders can move the funds into the new wallet.

Remember to give this a 𝗟𝗶𝗸𝗲🤙, 𝗦𝗵𝗮𝗿𝗲🔄 it with others, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 it for later.

A very special thanks to nostr:npub1ztyqtftdkt6q36gux3xptn4ldv7sdpqka3rvhvlmna50e9t7kx4qk5kfjr for the first image in this video! 🙏

𝗧𝗵𝗲 𝗻𝗲𝘅𝘁 #BitcoinHalving 𝗶𝘀 𝗰𝗼𝗺𝗶𝗻𝗴 𝘁𝗵𝗶𝘀 𝗔𝗽𝗿𝗶𝗹.

This means the amount of new #bitcoin issued to the miners with each block will be 𝘩𝘢𝘭𝘷𝘦𝘥 from 6.25 bitcoin to 3.125 bitcoin.

What makes this the 𝘮𝘰𝘴𝘵 important halving so far?

The answer is found in bitcoin’s 𝘀𝘁𝗼𝗰𝗸-𝘁𝗼-𝗳𝗹𝗼𝘄 𝗿𝗮𝘁𝗶𝗼:

𝗪𝗵𝗮𝘁 𝗮𝗿𝗲 𝗨𝗧𝗫𝗢𝘀, 𝗮𝗻𝗱 𝗛𝗼𝘄 𝗦𝗵𝗼𝘂𝗹𝗱 𝗬𝗼𝘂 𝗠𝗮𝗻𝗮𝗴𝗲 𝗧𝗵𝗲𝗺?

Unspent Transaction Outputs (UTXOs) are the bedrock of Bitcoin's transaction model. 𝘛𝘩𝘦𝘺 𝘳𝘦𝘱𝘳𝘦𝘴𝘦𝘯𝘵 𝘵𝘩𝘦 𝘢𝘮𝘰𝘶𝘯𝘵 𝘰𝘧 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘵𝘩𝘢𝘵 𝘢𝘯 𝘢𝘥𝘥𝘳𝘦𝘴𝘴 𝘩𝘢𝘴 𝘳𝘦𝘤𝘦𝘪𝘷𝘦𝘥 𝘣𝘶𝘵 𝘩𝘢𝘴 𝘯𝘰𝘵 𝘺𝘦𝘵 𝘴𝘱𝘦𝘯𝘵. Each bitcoin transaction consumes UTXOs as inputs and creates new ones as outputs; this is how bitcoin moves between addresses.

𝗠𝗮𝗻𝗮𝗴𝗶𝗻𝗴 𝗨𝗧𝗫𝗢𝘀 𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝘁𝗹𝘆 𝗶𝘀 𝗰𝗿𝘂𝗰𝗶𝗮𝗹 𝗳𝗼𝗿 𝗯𝗼𝘁𝗵 𝗽𝗿𝗶𝘃𝗮𝗰𝘆 𝗮𝗻𝗱 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻 𝗳𝗲𝗲𝘀. Large sets of small UTXOs can lead to higher fees when spending, as more UTXOs mean more data, and more data means a larger transaction size. Conversely, fewer and larger UTXOs can reduce fees and improve privacy by minimizing transaction linkability.

Consolidation is the process of combining many small UTXOs into fewer larger ones. 𝘛𝘩𝘪𝘴 𝘪𝘴 𝘣𝘦𝘴𝘵 𝘥𝘰𝘯𝘦 𝘥𝘶𝘳𝘪𝘯𝘨 𝘱𝘦𝘳𝘪𝘰𝘥𝘴 𝘰𝘧 𝘭𝘰𝘸 𝘯𝘦𝘵𝘸𝘰𝘳𝘬 𝘤𝘰𝘯𝘨𝘦𝘴𝘵𝘪𝘰𝘯 𝘵𝘰 𝘮𝘪𝘯𝘪𝘮𝘪𝘻𝘦 𝘧𝘦𝘦𝘴. Thoughtful UTXO management can significantly reduce future transaction costs and enhance transactional privacy.

The essence of UTXOs and their management is captured clearly in nostr:npub1excellx58e497gan6fcsdnseujkjm7ym5yp3m4rp0ud4j8ss39js2pn72a’s analogy below. Just as it's cumbersome to carry and count quarters for transactions, 𝗶𝘁'𝘀 𝗶𝗻𝗲𝗳𝗳𝗶𝗰𝗶𝗲𝗻𝘁 𝘁𝗼 𝗺𝗮𝗻𝗮𝗴𝗲 𝗮 𝘄𝗮𝗹𝗹𝗲𝘁 𝗳𝘂𝗹𝗹 𝗼𝗳 𝘀𝗺𝗮𝗹𝗹 𝗨𝗧𝗫𝗢𝘀. Consolidating them into larger amounts when transaction fees are low simplifies transactions, reduces future fees, and takes up less of the limited space in each block.

𝗛𝗼𝘄 𝘁𝗼 𝗨𝘀𝗲 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗣𝗿𝗶𝘃𝗮𝘁𝗲𝗹𝘆

It’s well-known that Bitcoin runs on an open ledger called the timechain, though commonly known as the blockchain.

While this ledger is visible to anyone, 𝘪𝘵 𝘥𝘰𝘦𝘴 𝘯𝘰𝘵 𝘤𝘰𝘯𝘵𝘢𝘪𝘯 𝘢𝘯𝘺 𝘪𝘯𝘧𝘰𝘳𝘮𝘢𝘵𝘪𝘰𝘯 𝘳𝘦𝘨𝘢𝘳𝘥𝘪𝘯𝘨 𝘵𝘩𝘦 𝘪𝘥𝘦𝘯𝘵𝘪𝘵𝘪𝘦𝘴 𝘰𝘧 𝘦𝘪𝘵𝘩𝘦𝘳 𝘴𝘦𝘯𝘥𝘦𝘳𝘴 𝘰𝘳 𝘳𝘦𝘤𝘦𝘪𝘷𝘦𝘳𝘴. It is sometimes possible, however, to deduce who sent bitcoin to whom, based on a few clues that centralized exchanges will know, due to “Know Your Customer” (KYC) laws.

𝗡𝗼 𝗽𝗿𝗶𝘃𝗮𝗰𝘆 𝘀𝗼𝗹𝘂𝘁𝗶𝗼𝗻 𝗶𝘀 𝗽𝗲𝗿𝗳𝗲𝗰𝘁, but here are some things you can do to use bitcoin more privately.👇

To enhance your anonymity in the realm of Bitcoin, it's crucial to 𝘂𝘀𝗲 𝗮 𝗻𝗲𝘄 𝗮𝗱𝗱𝗿𝗲𝘀𝘀 𝗲𝗮𝗰𝗵 𝘁𝗶𝗺𝗲 𝘆𝗼𝘂 𝗿𝗲𝗰𝗲𝗶𝘃𝗲 𝗯𝗶𝘁𝗰𝗼𝗶𝗻. 𝘛𝘩𝘪𝘴 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘦 𝘱𝘳𝘦𝘷𝘦𝘯𝘵𝘴 𝘵𝘩𝘦 𝘭𝘪𝘯𝘬𝘢𝘣𝘪𝘭𝘪𝘵𝘺 𝘰𝘧 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯𝘴 𝘵𝘰 𝘢 𝘴𝘪𝘯𝘨𝘭𝘦 𝘰𝘸𝘯𝘦𝘳. By ensuring each address is used only once, users significantly bolster their on-chain privacy.

Another effective method is the utilization of 𝗖𝗼𝗶𝗻𝗝𝗼𝗶𝗻𝘀. Protocols like JoinMarket and PayJoins, and platforms like Wasabi and Samourai offer the ability to mix coins (UTXOs) and their histories from multiple users. 𝘛𝘩𝘪𝘴 𝘮𝘪𝘹𝘪𝘯𝘨 𝘱𝘳𝘰𝘤𝘦𝘴𝘴 𝘦𝘧𝘧𝘦𝘤𝘵𝘪𝘷𝘦𝘭𝘺 𝘰𝘣𝘴𝘤𝘶𝘳𝘦𝘴 𝘵𝘩𝘦 𝘵𝘳𝘢𝘪𝘭𝘴 𝘭𝘦𝘢𝘥𝘪𝘯𝘨 𝘣𝘢𝘤𝘬 𝘵𝘰 𝘵𝘩𝘦 𝘰𝘳𝘪𝘨𝘪𝘯𝘢𝘭 𝘰𝘸𝘯𝘦𝘳𝘴, making it difficult to trace transactions to a particular individual.

It's also important to 𝗮𝘃𝗼𝗶𝗱 𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗲𝘅𝗰𝗵𝗮𝗻𝗴𝗲𝘀, wherever possible. These platforms often require extensive Know Your Customer (KYC) procedures, creating a significant privacy risk. Decentralized exchanges like Bisq and RoboSats are preferable alternatives, as 𝘵𝘩𝘦𝘺 𝘵𝘺𝘱𝘪𝘤𝘢𝘭𝘭𝘺 𝘳𝘦𝘲𝘶𝘪𝘳𝘦 𝘯𝘰 𝘱𝘦𝘳𝘴𝘰𝘯𝘢𝘭 𝘪𝘯𝘧𝘰𝘳𝘮𝘢𝘵𝘪𝘰𝘯.

𝗥𝘂𝗻𝗻𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝗼𝘄𝗻 𝗳𝘂𝗹𝗹 𝗻𝗼𝗱𝗲 is another step towards privacy. By doing so, 𝘺𝘰𝘶 𝘢𝘷𝘰𝘪𝘥 𝘳𝘦𝘭𝘺𝘪𝘯𝘨 𝘰𝘯 𝘵𝘩𝘪𝘳𝘥-𝘱𝘢𝘳𝘵𝘺 𝘴𝘦𝘳𝘷𝘦𝘳𝘴, which can link transactions to your IP address. Operating a full node ensures that your transactions are verified independently, keeping your online activity within your control.

Implementing 𝗺𝘂𝗹𝘁𝗶-𝘀𝗶𝗴𝗻𝗮𝘁𝘂𝗿𝗲 𝘄𝗮𝗹𝗹𝗲𝘁𝘀 adds an additional layer of security and privacy. These wallets require multiple keys to authorize a transaction, 𝘮𝘢𝘬𝘪𝘯𝘨 𝘪𝘵 𝘮𝘰𝘳𝘦 𝘤𝘩𝘢𝘭𝘭𝘦𝘯𝘨𝘪𝘯𝘨 𝘵𝘰 𝘵𝘳𝘢𝘤𝘦 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯𝘴 𝘣𝘢𝘤𝘬 𝘵𝘰 𝘢 𝘴𝘪𝘯𝘨𝘭𝘦 𝘶𝘴𝘦𝘳, while also adding another security layer to your holdings.

Using tools like 𝗧𝗼𝗿 𝗮𝗻𝗱 𝗩𝗣𝗡𝘀 to mask your IP address while transacting adds an extra layer of privacy. 𝘛𝘩𝘪𝘴 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘦 𝘱𝘳𝘦𝘷𝘦𝘯𝘵𝘴 𝘱𝘰𝘵𝘦𝘯𝘵𝘪𝘢𝘭 𝘰𝘣𝘴𝘦𝘳𝘷𝘦𝘳𝘴 𝘧𝘳𝘰𝘮 𝘢𝘴𝘴𝘰𝘤𝘪𝘢𝘵𝘪𝘯𝘨 𝘺𝘰𝘶𝘳 𝘐𝘗 𝘢𝘥𝘥𝘳𝘦𝘴𝘴 𝘸𝘪𝘵𝘩 𝘺𝘰𝘶𝘳 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯𝘴, thereby safeguarding your online identity.

Finally, 𝗯𝗲 𝘄𝗮𝗿𝘆 𝗼𝗳 𝗺𝗲𝘁𝗮𝗱𝗮𝘁𝗮. Often overlooked, the information revealed by checking mempool.space or posting transaction info in an online discussion 𝘤𝘢𝘯 𝘪𝘯𝘢𝘥𝘷𝘦𝘳𝘵𝘦𝘯𝘵𝘭𝘺 𝘤𝘰𝘯𝘯𝘦𝘤𝘵 𝘺𝘰𝘶 𝘸𝘪𝘵𝘩 𝘢 𝘴𝘱𝘦𝘤𝘪𝘧𝘪𝘤 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯. Caution in this area is essential to maintain complete privacy in your bitcoin transactions.

When these practices are diligently followed, 𝘵𝘩𝘦𝘺 𝘰𝘧𝘧𝘦𝘳 𝘢 𝘳𝘰𝘣𝘶𝘴𝘵 𝘧𝘳𝘢𝘮𝘦𝘸𝘰𝘳𝘬 𝘧𝘰𝘳 𝘮𝘢𝘪𝘯𝘵𝘢𝘪𝘯𝘪𝘯𝘨 𝘱𝘳𝘪𝘷𝘢𝘤𝘺 𝘪𝘯 𝘵𝘩𝘦 𝘦𝘷𝘦𝘳-𝘦𝘷𝘰𝘭𝘷𝘪𝘯𝘨 𝘸𝘰𝘳𝘭𝘥 𝘰𝘧 𝘉𝘪𝘵𝘤𝘰𝘪𝘯. Each step plays a crucial role in safeguarding your identity and financial autonomy in the digital age.

Give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for when you need it.

What other privacy methods are there?

Share them in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝘀 𝗡𝗼𝘁 𝗮 𝗣𝗲𝘁 𝗥𝗼𝗰𝗸

Jamie Dimon, the CEO of JP Morgan, recently referred to #Bitcoin as a “pet rock”. We should expect nothing less from someone like him, but as usual, he is completely wrong on Bitcoin.

Here’s why👇

Comparing Bitcoin to a "pet rock" completely overlooks its revolutionary attributes and potential. 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗿𝗲𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝘀 𝘁𝗵𝗲 𝗺𝗼𝘀𝘁 𝘀𝗶𝗴𝗻𝗶𝗳𝗶𝗰𝗮𝗻𝘁 𝗮𝗱𝘃𝗮𝗻𝗰𝗲𝗺𝗲𝗻𝘁 𝗶𝗻 𝗺𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆 𝘀𝗶𝗻𝗰𝗲 𝘁𝗵𝗲 𝗶𝗻𝘃𝗲𝗻𝘁𝗶𝗼𝗻 𝗼𝗳 𝗺𝗼𝗻𝗲𝘆 𝗶𝘁𝘀𝗲𝗹𝗳.

Bitcoin is a decentralized, digital store of value and medium of exchange, 𝘪𝘮𝘮𝘶𝘯𝘦 𝘵𝘰 𝘵𝘩𝘦 𝘸𝘩𝘪𝘮𝘴 𝘰𝘧 𝘤𝘦𝘯𝘵𝘳𝘢𝘭 𝘣𝘢𝘯𝘬𝘴 𝘢𝘯𝘥 𝘨𝘰𝘷𝘦𝘳𝘯𝘮𝘦𝘯𝘵 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘱𝘰𝘭𝘪𝘤𝘺. Its fixed supply of 21 million coins, achieved through the halving process, is a bulwark against inflation’s consistent erosion of fiat’s purchasing power.

𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝘁𝗶𝗺𝗲𝗰𝗵𝗮𝗶𝗻 𝗲𝗻𝘀𝘂𝗿𝗲𝘀 𝘁𝗵𝗲 𝘀𝗲𝗰𝘂𝗿𝗶𝘁𝘆, 𝘁𝗿𝗮𝗻𝘀𝗽𝗮𝗿𝗲𝗻𝗰𝘆, 𝗮𝗻𝗱 𝗶𝗺𝗺𝘂𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗼𝗳 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀. its unparalleled level of security, combined with the decentralized nature of the network, makes Bitcoin a form of "digital gold" that is protected from political and economic manipulation. Moreover, Bitcoin's programmable nature allows for 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘰𝘶𝘴 𝘪𝘯𝘯𝘰𝘷𝘢𝘵𝘪𝘰𝘯 against any future threats.

While skeptics may dismiss it as a fad or speculative asset, Bitcoin's growing adoption and resilience over the years underscore its value and potential as a transformative financial instrument. It's a pioneering force in reshaping the global financial landscape, 𝗼𝗳𝗳𝗲𝗿𝗶𝗻𝗴 𝗮 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗮𝗹𝘁𝗲𝗿𝗻𝗮𝘁𝗶𝘃𝗲 to traditional, government-controlled fiat currencies.

In essence, Bitcoin is a manifestation of economic freedom and a hedge against inflationary fiscal policies, 𝗿𝗲𝗽𝗿𝗲𝘀𝗲𝗻𝘁𝗶𝗻𝗴 𝗮 𝗽𝗮𝗿𝗮𝗱𝗶𝗴𝗺 𝘀𝗵𝗶𝗳𝘁 𝗶𝗻 𝗵𝗼𝘄 𝘃𝗮𝗹𝘂𝗲 𝗶𝘀 𝘀𝘁𝗼𝗿𝗲𝗱 𝗮𝗻𝗱 𝘁𝗿𝗮𝗻𝘀𝗳𝗲𝗿𝗿𝗲𝗱 𝗴𝗹𝗼𝗯𝗮𝗹𝗹𝘆.

Be sure to 𝗟𝗶𝗸𝗲🤙 and 𝗦𝗵𝗮𝗿𝗲🔄 this, and add it to your 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸𝘀🔖

Why else is Bitcoin 𝘯𝘰𝘵 a “pet rock”?

Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗜𝗻𝗲𝘃𝗶𝘁𝗮𝗯𝗹𝗲 𝗣𝗮𝘁𝗵 𝘁𝗼 $𝟭𝗠𝗶𝗹𝗹𝗶𝗼𝗻

No one knows when, and no one knows exactly what will transpire on our way to $1 million per #bitcoin, but that eventual price (and higher) is inevitable.

Here are a few reasons why👇

Bitcoin's ascent to $1 million per coin and beyond is deeply rooted in its fundamental properties, unique market dynamics, and historical growth patterns. 𝘔𝘢𝘯𝘺 𝘬𝘦𝘺 𝘧𝘢𝘤𝘵𝘰𝘳𝘴 𝘤𝘰𝘯𝘵𝘳𝘪𝘣𝘶𝘵𝘦 𝘵𝘰 𝘵𝘩𝘪𝘴 𝘵𝘳𝘢𝘫𝘦𝘤𝘵𝘰𝘳𝘺, each playing a crucial role in bitcoin's value proposition.

𝗜𝗻𝘁𝗲𝗿𝗻𝗮𝗹 𝗙𝗮𝗰𝘁𝗼𝗿𝘀

Halving events, in which the rate of newly mined bitcoin is automatically halved, occur approximately every four years, with the next one due this April. 𝗧𝗵𝗶𝘀 𝗿𝗲𝗱𝘂𝗰𝗲𝘀 𝘁𝗵𝗲 𝗻𝘂𝗺𝗯𝗲𝗿 𝗼𝗳 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗮𝘃𝗮𝗶𝗹𝗮𝗯𝗹𝗲 𝗳𝗼𝗿 𝗽𝘂𝗿𝗰𝗵𝗮𝘀𝗲, 𝗹𝗲𝗮𝗱𝗶𝗻𝗴 𝘁𝗼 𝗮 𝘀𝘂𝗽𝗽𝗹𝘆 𝘀𝗾𝘂𝗲𝗲𝘇𝗲. This reduction, juxtaposed against ever-rising demand for its role as a store of value and inflation hedge, propels the price upward.

Technological advancements, particularly in scalability solutions like the Lightning Network, also contribute to its growth. These developments ensure that bitcoin remains 𝘦𝘧𝘧𝘪𝘤𝘪𝘦𝘯𝘵 and 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘢𝘭 for an increasing number of transactions, which further increases its utility and appeal.

Bitcoin's increasing role as a medium of exchange, especially in developing countries, enhances its utility and demand. This broader adoption, whether for transactions or as a tool for financial inclusion, 𝗶𝗻𝗰𝗿𝗲𝗮𝘀𝗲𝘀 𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗻𝗲𝘁𝘄𝗼𝗿𝗸 𝗲𝗳𝗳𝗲𝗰𝘁, and strengthens its position as a global currency.

𝗘𝘅𝘁𝗲𝗿𝗻𝗮𝗹 𝗙𝗮𝗰𝘁𝗼𝗿𝘀

Public perception and media coverage play an undeniable role in Bitcoin's path to $1 million. As misconceptions are addressed and awareness grows, the understanding and appreciation of bitcoin rises, leading to 𝗴𝗿𝗲𝗮𝘁𝗲𝗿 𝗱𝗲𝗺𝗮𝗻𝗱 𝗰𝗵𝗮𝘀𝗶𝗻𝗴 𝗮𝗻 𝘂𝗻𝗰𝗵𝗮𝗻𝗴𝗲𝗮𝗯𝗹𝗲 𝘀𝘂𝗽𝗽𝗹𝘆.

In times of economic turmoil, bitcoin emerges as a safe-haven asset. Its 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗲𝗱 𝗻𝗮𝘁𝘂𝗿𝗲 and 𝗳𝗶𝗻𝗶𝘁𝗲 𝘀𝘂𝗽𝗽𝗹𝘆 appeal to those seeking stability and security, making it a favorable option against inflation and geopolitical uncertainties.

Regulatory clarity and government recognition, once perceived as hurdles, are now beginning to align with Bitcoin's growth trajectory. 𝘛𝘩𝘪𝘴 𝘦𝘷𝘰𝘭𝘶𝘵𝘪𝘰𝘯 𝘪𝘯 𝘵𝘩𝘦 𝘳𝘦𝘨𝘶𝘭𝘢𝘵𝘰𝘳𝘺 𝘭𝘢𝘯𝘥𝘴𝘤𝘢𝘱𝘦 𝘦𝘯𝘩𝘢𝘯𝘤𝘦𝘴 𝘣𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘭𝘦𝘨𝘪𝘵𝘪𝘮𝘢𝘤𝘺 𝘢𝘯𝘥 𝘢𝘤𝘤𝘦𝘴𝘴𝘪𝘣𝘪𝘭𝘪𝘵𝘺, and is an important step towards replacing our current financial system with a global bitcoin standard.

𝗜𝗻𝗲𝘃𝗶𝘁𝗮𝗯𝗶𝗹𝗶𝘁𝘆

Sooner or later, the price for 1 bitcoin will reach $1 million, with 1 sat equaling 1 cent, 𝘢𝘯𝘥 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦 𝘶𝘱𝘸𝘢𝘳𝘥 𝘪𝘯𝘧𝘪𝘯𝘪𝘵𝘦𝘭𝘺 𝘢𝘧𝘵𝘦𝘳𝘸𝘢𝘳𝘥. This will be from a combination of reasons, including both bitcoin’s rising popularity, and fiat’s declining value.

When a new form of money can’t be stopped, and the old one it’s being measured against can’t last, 𝘁𝗵𝗲 𝗼𝗻𝗹𝘆 𝗹𝗼𝗴𝗶𝗰𝗮𝗹 𝗰𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻 𝗶𝘀 𝘁𝗵𝗮𝘁 𝘁𝗵𝗲 𝗽𝗿𝗶𝗰𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗻𝗲𝘄 𝗮𝘀 𝗺𝗲𝗮𝘀𝘂𝗿𝗲𝗱 𝗯𝘆 𝘁𝗵𝗲 𝗼𝗹𝗱 𝘄𝗶𝗹𝗹 𝗿𝗶𝘀𝗲 𝘁𝗼𝘄𝗮𝗿𝗱 𝗶𝗻𝗳𝗶𝗻𝗶𝘁𝘆.

And $1 million is just a pit stop along the way.

Give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for later.

How soon do you think bitcoin will reach $1 million?

Tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️