Since this video was shared through many social channels, it needed to stay under 1 minute, so there was only so much that could be said in that timeframe.

Putting that aside, Bitcoin's energy use benefits the environment 𝘢𝘯𝘥 is justified by its utility.

This sentence from the video encapsulates how Bitcoin's energy use is beneficial to the environment:

"𝘌𝘯𝘦𝘳𝘨𝘺 𝘤𝘰𝘴𝘵𝘴 𝘪𝘯𝘤𝘦𝘯𝘵𝘪𝘷𝘪𝘻𝘦 𝘮𝘪𝘯𝘦𝘳𝘴 𝘵𝘰 𝘶𝘵𝘪𝘭𝘪𝘻𝘦 𝘰𝘵𝘩𝘦𝘳𝘸𝘪𝘴𝘦 𝘸𝘢𝘴𝘵𝘦𝘥 𝘦𝘯𝘦𝘳𝘨𝘺, 𝘱𝘳𝘰𝘷𝘪𝘥𝘪𝘯𝘨 𝘢 𝘴𝘵𝘦𝘢𝘥𝘺 𝘴𝘵𝘳𝘦𝘢𝘮 𝘰𝘧 𝘧𝘶𝘯𝘥𝘪𝘯𝘨 𝘧𝘰𝘳 𝘳𝘦𝘯𝘦𝘸𝘢𝘣𝘭𝘦 𝘢𝘯𝘥 𝘳𝘦𝘭𝘪𝘢𝘣𝘭𝘦 𝘦𝘯𝘦𝘳𝘨𝘺 𝘴𝘰𝘶𝘳𝘤𝘦𝘴."

And this sentence from the video explains how Bitcoin's energy use is justified by its utility:

"𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘴𝘦𝘤𝘶𝘳𝘦𝘴 𝘦𝘷𝘦𝘳𝘺𝘰𝘯𝘦'𝘴 𝘵𝘳𝘢𝘯𝘴𝘢𝘤𝘵𝘪𝘰𝘯𝘴, 𝘳𝘦𝘮𝘰𝘷𝘪𝘯𝘨 𝘵𝘩𝘦 𝘪𝘯𝘩𝘦𝘳𝘦𝘯𝘵 𝘸𝘢𝘴𝘵𝘦 𝘧𝘳𝘰𝘮 𝘧𝘪𝘢𝘵 𝘤𝘶𝘳𝘳𝘦𝘯𝘤𝘺, 𝘢𝘯𝘥 𝘵𝘩𝘦 𝘯𝘦𝘦𝘥 𝘧𝘰𝘳 𝘸𝘢𝘳 𝘢𝘯𝘥 𝘥𝘦𝘴𝘵𝘳𝘶𝘤𝘵𝘪𝘰𝘯 𝘵𝘰 𝘣𝘢𝘤𝘬 𝘵𝘩𝘦 𝘮𝘰𝘯𝘦𝘵𝘢𝘳𝘺 𝘴𝘺𝘴𝘵𝘦𝘮."

If a skeptic wants to dive deeper and challenge these ideas, they can do so here:

https://app.SpiritofSatoshi.ai

or here:

Part 2 of my team's report on the Nexus of #Bitcoin and #Ai just dropped! 🤩

Listen to the voice of nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev read this for you on his show, Ai Unchained:

https://fountain.fm/episode/woZmt6rKCe4f5NSPDYM2

Haven't listened to Part 1 yet? Check it out here👇

🚨 CORRECTION! 🚨

This is the new link to Part 2 of nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev's read of "The Nexus of #Bitcoin and #Ai", on Ai Unchained:

Don't have time to read my team's report on the Nexus of #Bitcoin and #Ai? nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev just dropped Part 1 of our report on his show, Ai Unchained!🙌

Listen to Guy read it while you drive, do chores, or stack sats, and discover all we know about Bitcoin and Ai.

Part 2 of my team's report on the Nexus of #Bitcoin and #Ai just dropped! 🤩

Listen to the voice of nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev read this for you on his show, Ai Unchained:

https://fountain.fm/episode/woZmt6rKCe4f5NSPDYM2

Haven't listened to Part 1 yet? Check it out here👇

𝗜𝘀 #Bitcoin 𝗵𝗮𝗿𝗺𝗳𝘂𝗹 𝘁𝗼 𝘁𝗵𝗲 𝗲𝗻𝘃𝗶𝗿𝗼𝗻𝗺𝗲𝗻𝘁?

No. In fact, it’s very 𝘣𝘦𝘯𝘦𝘧𝘪𝘤𝘪𝘢𝘭 to the environment.

Here’s why👇

𝗕𝗶𝘁𝗰𝗼𝗶𝗻’𝘀 𝗣𝗿𝗶𝗰𝗲 𝗖𝗮𝗻 𝗜𝗻𝗰𝗿𝗲𝗮𝘀𝗲 𝙈𝙪𝙘𝙝 𝗙𝗮𝘀𝘁𝗲𝗿 𝗧𝗵𝗮𝗻 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸

𝘠𝘰𝘶’𝘳𝘦 𝘭𝘪𝘬𝘦𝘭𝘺 𝙛𝙖𝙧 𝘵𝘰𝘰 𝘣𝘦𝘢𝘳𝘪𝘴𝘩.

Here’s why.👇

Many analysts and enthusiasts attempt to forecast Bitcoin's future price by dividing Bitcoin’s total potential market capitalization — all the money that will soon flow into Bitcoin — by its maximum supply of 21 million. However, this method overlooks one crucial factor: 𝙏𝙝𝙚 𝙖𝙘𝙩𝙪𝙖𝙡 𝙖𝙢𝙤𝙪𝙣𝙩 𝙤𝙛 𝙗𝙞𝙩𝙘𝙤𝙞𝙣 𝙖𝙫𝙖𝙞𝙡𝙖𝙗𝙡𝙚 𝙤𝙣 𝙚𝙭𝙘𝙝𝙖𝙣𝙜𝙚𝙨 𝙞𝙨 𝙛𝙖𝙧 𝙡𝙚𝙨𝙨 𝙩𝙝𝙖𝙣 𝙩𝙝𝙚 𝙩𝙤𝙩𝙖𝙡 𝙨𝙪𝙥𝙥𝙡𝙮.

Estimating the exact number of bitcoin on exchanges is challenging, due to the decentralized and often private nature of transactions. But it's clear that the actual figure is a 𝘴𝘮𝘢𝘭𝘭 𝘧𝘳𝘢𝘤𝘵𝘪𝘰𝘯 of the total supply. This scarcity, coupled with increasing demand, suggests that current estimations of Bitcoin's future price might be extremely conservative.

The amount of bitcoin available for sale is important because it represents the supply that can be bought at that time, as long as exchanges are honest and aren’t selling paper bitcoin “IOUs”. 𝗔 𝗹𝗮𝗿𝗴𝗲 𝗽𝗼𝗿𝘁𝗶𝗼𝗻 𝗼𝗳 𝗕𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 𝘁𝗼𝘁𝗮𝗹 𝘀𝘂𝗽𝗽𝗹𝘆 𝗶𝘀 𝗲𝗶𝘁𝗵𝗲𝗿 𝗹𝗼𝘀𝘁, 𝗵𝗲𝗹𝗱 𝗶𝗻 𝗹𝗼𝗻𝗴-𝘁𝗲𝗿𝗺 𝘀𝘁𝗼𝗿𝗮𝗴𝗲, 𝗼𝗿 𝗻𝗼𝘁 𝗳𝗼𝗿 𝘀𝗮𝗹𝗲 𝗮𝘁 𝗮𝗻𝘆 𝗽𝗿𝗶𝗰𝗲. This significantly reduces the available supply, and makes any purchase that more effective at moving the price skyward.

Bitcoin’s current location on its adoption curve shows that it’s on its way to becoming a predominant store of value and medium of exchange, free from censorship, debasement, and top-down manipulation. If demand for a money with these qualities continues to grow, and if Bitcoin takes even a 𝘧𝘳𝘢𝘤𝘵𝘪𝘰𝘯 of the global monetary base, the valuation could reach astronomical figures.

So when considering Bitcoin's future price, 𝘪𝘵'𝘴 𝘦𝘴𝘴𝘦𝘯𝘵𝘪𝘢𝘭 𝘵𝘰 𝘧𝘰𝘤𝘶𝘴 𝘰𝘯 𝘵𝘩𝘦 𝘦𝘧𝘧𝘦𝘤𝘵𝘪𝘷𝘦 𝘴𝘶𝘱𝘱𝘭𝘺 𝘢𝘷𝘢𝘪𝘭𝘢𝘣𝘭𝘦 𝘰𝘯 𝘦𝘹𝘤𝘩𝘢𝘯𝘨𝘦𝘴 𝘳𝘢𝘵𝘩𝘦𝘳 𝘵𝘩𝘢𝘯 𝘵𝘩𝘦 𝘵𝘰𝘵𝘢𝘭 𝘴𝘶𝘱𝘱𝘭𝘺. This approach paints a much more bullish picture of Bitcoin's potential valuation than most people are willing to see, and demonstrates just how early we all are.

Bullish enough for you?😏 Give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this to look back on later.

Why are 𝘺𝘰𝘶 bullish on Bitcoin?

Tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

Share the link to this video with them (https://m.primal.net/HYti.mp4), and then tell us how they responded! 😁

𝗜𝘀 #Bitcoin 𝗺𝗮𝗶𝗻𝗹𝘆 𝘂𝘀𝗲𝗱 𝗯𝘆 𝗰𝗿𝗶𝗺𝗶𝗻𝗮𝗹𝘀?

Of course not. Most criminals prefer to use — and 𝘳𝘶𝘯 — the fiat system.

Time for another AI video to clear this up.

𝗧𝗵𝗲 𝗕𝗲𝘀𝘁 𝗪𝗮𝘆 𝘁𝗼 𝗦𝗮𝘃𝗲 𝗠𝗼𝗻𝗲𝘆

A follow-up to my post from last week, on the best way to 𝘮𝘢𝘬𝘦 money.

Now that you’re providing a good or service that the world needs, and you have some extra money, what should you do with it?

Here are some recommendations👇

Saving money effectively is as much an art as it is a science. In a world where bitcoin reigns as the supreme store of value, 𝘶𝘯𝘥𝘦𝘳𝘴𝘵𝘢𝘯𝘥𝘪𝘯𝘨 𝘩𝘰𝘸 𝘵𝘰 𝘴𝘢𝘷𝘦 𝘴𝘮𝘢𝘳𝘵𝘭𝘺 𝘪𝘴 𝘤𝘳𝘶𝘤𝘪𝘢𝘭. Here's a guide to help you navigate this journey.

𝗕𝘂𝗱𝗴𝗲𝘁𝗶𝗻𝗴 𝗶𝘀 𝗞𝗲𝘆: Start by creating a budget. Track your income and expenses meticulously. This allows you to identify areas where you can cut back, thereby increasing the amount of sats you can stack. Remember, every sat is an 𝘪𝘯𝘷𝘢𝘭𝘶𝘢𝘣𝘭𝘦 piece of the total limited supply.

𝗗𝗼𝗹𝗹𝗮𝗿-𝗖𝗼𝘀𝘁 𝗔𝘃𝗲𝗿𝗮𝗴𝗶𝗻𝗴 (𝗗𝗖𝗔) 𝗶𝗻𝘁𝗼 𝗕𝗶𝘁𝗰𝗼𝗶𝗻: Instead of exchanging a lump-sum of fiat for bitcoin, DCA into bitcoin. This means regularly buying a fixed fiat amount of bitcoin, irrespective of its price. 𝘛𝘩𝘪𝘴 𝘴𝘵𝘳𝘢𝘵𝘦𝘨𝘺 𝘳𝘦𝘥𝘶𝘤𝘦𝘴 𝘵𝘩𝘦 𝘪𝘮𝘱𝘢𝘤𝘵 𝘰𝘧 𝘷𝘰𝘭𝘢𝘵𝘪𝘭𝘪𝘵𝘺, and averages out the purchase price over time, making it ideal for long-term saving.

𝗦𝗲𝗰𝘂𝗿𝗲 𝗦𝘁𝗼𝗿𝗮𝗴𝗲: Once you acquire bitcoin, prioritize its security. Use hardware wallets for the bulk of your holdings. These physical devices store your private keys offline, separating them from any online hacking attempts. Remember to buy the most reputable open-source devices, only buy directly from the manufacturer, and 𝘯𝘦𝘷𝘦𝘳 𝙚𝙫𝙚𝙧 𝘴𝘩𝘢𝘳𝘦 𝘺𝘰𝘶𝘳 𝘱𝘳𝘪𝘷𝘢𝘵𝘦 𝘬𝘦𝘺’𝘴 𝘴𝘦𝘦𝘥 𝘱𝘩𝘳𝘢𝘴𝘦 𝘸𝘪𝘵𝘩 𝘢𝘯𝘺𝘰𝘯𝘦!

𝗟𝗼𝗻𝗴-𝗧𝗲𝗿𝗺 𝗩𝗶𝘀𝗶𝗼𝗻: Have a long-term perspective. Bitcoin's value proposition shines brightest in the long run. Resist the urge to sell when the price dips, and instead 𝘴𝘦𝘦 𝘪𝘵 𝘢𝘴 𝘢𝘯 𝘰𝘱𝘱𝘰𝘳𝘵𝘶𝘯𝘪𝘵𝘺 𝘵𝘰 𝘴𝘵𝘢𝘤𝘬 𝘮𝘰𝘳𝘦 𝘴𝘢𝘵𝘴. Patience is a virtue, and those who view their savings with a multi-year horizon are greatly rewarded.

𝗖𝗼𝗻𝘁𝗶𝗻𝘂𝗼𝘂𝘀 𝗘𝗱𝘂𝗰𝗮𝘁𝗶𝗼𝗻: Stay informed. The Bitcoin ecosystem is dynamic and constantly evolving. By keeping up with the latest developments, 𝘺𝘰𝘶 𝘤𝘢𝘯 𝘮𝘢𝘬𝘦 𝘮𝘰𝘳𝘦 𝘪𝘯𝘧𝘰𝘳𝘮𝘦𝘥 𝘥𝘦𝘤𝘪𝘴𝘪𝘰𝘯𝘴 𝘢𝘣𝘰𝘶𝘵 𝘺𝘰𝘶𝘳 𝘴𝘢𝘷𝘪𝘯𝘨𝘴 𝘴𝘵𝘳𝘢𝘵𝘦𝘨𝘺. There are many resources for that, including myself.

𝗜𝗴𝗻𝗼𝗿𝗲 𝘁𝗵𝗲 𝗡𝗼𝗶𝘀𝗲: Finally, tune out the short-term noise. Market speculators, sensationalist media, and Bitcoin detractors can distract you from building generational wealth. 𝘍𝘰𝘤𝘶𝘴 𝘰𝘯 𝘉𝘪𝘵𝘤𝘰𝘪𝘯’𝘴 𝘶𝘯𝘥𝘦𝘳𝘭𝘺𝘪𝘯𝘨 𝘧𝘶𝘯𝘥𝘢𝘮𝘦𝘯𝘵𝘢𝘭𝘴, and train yourself to have a long-term outlook on the future.

And remember, every sat you stack is more wealth that’s 𝘁𝗿𝘂𝗹𝘆 𝘆𝗼𝘂𝗿𝘀, and disconnects you a little more from the need to trust the whims of centralized financial systems.

Be sure to 𝗟𝗶𝗸𝗲🤙 and 𝗦𝗵𝗮𝗿𝗲🔄 this, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 it for later.

And give me your thoughts on this in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

It's time for something new.

I've been plugged into a few AI tools, which helped me generate this video.

So here's a reminder of why you should ignore the #Bitcoin ETFs, and just stick to stacking sats.

𝗧𝗵𝗲 𝗕𝗲𝘀𝘁 𝗪𝗮𝘆 𝘁𝗼 𝗠𝗮𝗸𝗲 𝗠𝗼𝗻𝗲𝘆

This is a secret that pretty much everyone knows, but not everyone follows. Many prefer to seek what they 𝘵𝘩𝘪𝘯𝘬 is an easier way, but overcomplicate it with unnecessary tips and tricks.

But the truth is actually quite simple. Read on for more👇

𝗧𝗵𝗲 𝗯𝗲𝘀𝘁 𝘄𝗮𝘆 𝘁𝗼 𝗺𝗮𝗸𝗲 𝗺𝗼𝗻𝗲𝘆 𝗶𝘀 𝘁𝗼 𝗰𝗿𝗲𝗮𝘁𝗲 𝘃𝗮𝗹𝘂𝗲 𝗳𝗼𝗿 𝗼𝘁𝗵𝗲𝗿𝘀. Value is subjective, and what is valuable to one may not be valuable to another. However, if you want to make money, 𝘺𝘰𝘶 𝘯𝘦𝘦𝘥 𝘵𝘰 𝘤𝘳𝘦𝘢𝘵𝘦 𝘴𝘰𝘮𝘦𝘵𝘩𝘪𝘯𝘨 𝘵𝘩𝘢𝘵 𝘱𝘦𝘰𝘱𝘭𝘦 𝘸𝘢𝘯𝘵 𝘢𝘯𝘥 𝘢𝘳𝘦 𝘸𝘪𝘭𝘭𝘪𝘯𝘨 𝘵𝘰 𝘱𝘢𝘺 𝘧𝘰𝘳. This can be a product, a service, or even an idea. The key is to identify what people want and need, and then find a way to provide it to them.

True wealth generation can only come with effort. Bitcoin epitomizes this principle, as new bitcoin can only be initially acquired through the process known as Proof of Work. This exemplifies the truth that 𝘸𝘦𝘢𝘭𝘵𝘩 𝘪𝘴 𝘣𝘦𝘴𝘵 𝘦𝘢𝘳𝘯𝘦𝘥 𝘵𝘩𝘳𝘰𝘶𝘨𝘩 𝘨𝘦𝘯𝘶𝘪𝘯𝘦 𝘸𝘰𝘳𝘬, through your efforts and the utility you provide, not by mere speculation or chance.

Rent-seeking, or the pursuit of wealth without creating value, erodes economic integrity. 𝗜𝘁'𝘀 𝗮𝗻 𝗮𝘁𝘁𝗲𝗺𝗽𝘁 𝘁𝗼 𝗴𝗮𝗶𝗻 𝘄𝗶𝘁𝗵𝗼𝘂𝘁 𝗰𝗼𝗻𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗻𝗴 𝗮𝗻𝘆𝘁𝗵𝗶𝗻𝗴 𝘁𝗼 𝗼𝘁𝗵𝗲𝗿𝘀, a shortcut that undermines the principle of fair exchange in a healthy economy. This leads to moral decay, financial failures, and ultimately (if left unchecked) civilizational collapse.

Common forms of rent-seeking include leveraging one’s proximity to newly created fiat money, producing post-modern art devoid of effort or beauty, and gambling in various arenas like stock markets, casinos, and crypto grifts. 𝘛𝘩𝘦𝘴𝘦 𝘢𝘤𝘵𝘪𝘷𝘪𝘵𝘪𝘦𝘴 𝘤𝘰𝘯𝘵𝘳𝘪𝘣𝘶𝘵𝘦 𝘯𝘰 𝘳𝘦𝘢𝘭 𝘦𝘤𝘰𝘯𝘰𝘮𝘪𝘤 𝘷𝘢𝘭𝘶𝘦, and only leech value from others.

As you work hard, 𝘴𝘢𝘷𝘪𝘯𝘨 what you earn is also paramount. It fortifies your financial stability, allowing you to harness stored resources when truly needed. 𝗧𝗵𝗶𝘀 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗲 𝗲𝗺𝗯𝗼𝗱𝗶𝗲𝘀 𝘁𝗵𝗲 𝘃𝗶𝗿𝘁𝘂𝗲 𝗼𝗳 𝗹𝗼𝘄 𝘁𝗶𝗺𝗲 𝗽𝗿𝗲𝗳𝗲𝗿𝗲𝗻𝗰𝗲, or delayed gratification, which is essential for building a better world and improving your future.

There are many ways to create value, and the best approach will depend on your skills, interests, and resources. The important thing is to find what you are good at and what people want, and then focus on creating value in that area. 𝗠𝗼𝗻𝗲𝘆 𝘄𝗶𝗹𝗹 𝗳𝗼𝗹𝗹𝗼𝘄 𝗶𝗳 𝘆𝗼𝘂 𝗽𝗿𝗼𝘃𝗶𝗱𝗲 𝗼𝘁𝗵𝗲𝗿𝘀 𝘄𝗶𝘁𝗵 𝘀𝗼𝗺𝗲𝘁𝗵𝗶𝗻𝗴 𝗼𝗳 𝘃𝗮𝗹𝘂𝗲.

Remember to give this a 𝗟𝗶𝗸𝗲🤙 and a 𝗦𝗵𝗮𝗿𝗲🔄, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 it for when you might need it later.

And let me know your thoughts in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

Don't have time to read my team's report on the Nexus of #Bitcoin and #Ai? nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev just dropped Part 1 of our report on his show, Ai Unchained!🙌

Listen to Guy read it while you drive, do chores, or stack sats, and discover all we know about Bitcoin and Ai.

𝗪𝗵𝘆 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝘀 𝙉𝙤𝙩 𝗮 𝗦𝗽𝗲𝗰𝘂𝗹𝗮𝘁𝗶𝘃𝗲 𝗔𝘀𝘀𝗲𝘁

You hear it all the time from the Jamie Dimons of the world: “𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘪𝘴 𝘰𝘯𝘭𝘺 𝘨𝘰𝘰𝘥 𝘧𝘰𝘳 𝘴𝘱𝘦𝘤𝘶𝘭𝘢𝘵𝘪𝘰𝘯.”

Nothing could be farther from the truth. Here’s why👇

nostr:npub1clfjjuhrnr2dyrxknvdgg5v4dnq55t5svkk34r76rpwzqf5cjdas7rk28k

Many view #bitcoin as merely a speculative asset, believing its value lies solely in trading and price fluctuations. 𝘛𝘩𝘪𝘴 𝘱𝘦𝘳𝘴𝘱𝘦𝘤𝘵𝘪𝘷𝘦 𝘴𝘵𝘦𝘮𝘴 𝘧𝘳𝘰𝘮 𝘢 𝘭𝘢𝘤𝘬 𝘰𝘧 𝘶𝘯𝘥𝘦𝘳𝘴𝘵𝘢𝘯𝘥𝘪𝘯𝘨 — both from the speculators themselves and from Bitcoin critics — 𝘰𝘧 𝘸𝘩𝘢𝘵 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘳𝘦𝘢𝘭𝘭𝘺 𝘪𝘴.

While bitcoin's price movements invite speculation, its core value transcends mere market dynamics. Price action, adoption rates, and protocol enhancements will always be uncertain, but 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗲𝗺𝗯𝗼𝗱𝗶𝗲𝘀 𝗱𝗲𝗳𝗶𝗻𝗶𝘁𝗲, 𝗻𝗼𝗻-𝘀𝗽𝗲𝗰𝘂𝗹𝗮𝘁𝗶𝘃𝗲 𝗾𝘂𝗮𝗹𝗶𝘁𝗶𝗲𝘀 𝘁𝗵𝗮𝘁 𝗮𝗿𝗲 𝗲𝗮𝘀𝗶𝗹𝘆 𝘃𝗲𝗿𝗶𝗳𝗶𝗮𝗯𝗹𝗲, 𝗮𝗻𝗱 𝗳𝗼𝘂𝗻𝗱𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝘁𝗼 𝗶𝘁𝘀 𝗲𝘀𝘀𝗲𝗻𝗰𝗲.

A prime example is 𝗕𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 𝘂𝗻𝗽𝗮𝗿𝗮𝗹𝗹𝗲𝗹𝗲𝗱 𝗱𝗲𝗰𝗲𝗻𝘁𝗿𝗮𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻. It stands as the 𝘰𝘯𝘭𝘺 form of money that is not controlled by any single entity. This was tested and proven during the 2017 Block Size Wars, where user consensus prevailed over the largest miners, wealthiest exchanges, and most influential thought leaders in the Bitcoin space at the time. 𝘕𝘰 𝘰𝘵𝘩𝘦𝘳 𝘤𝘳𝘺𝘱𝘵𝘰𝘤𝘶𝘳𝘳𝘦𝘯𝘤𝘺 𝘤𝘢𝘯 𝘤𝘭𝘢𝘪𝘮 𝘴𝘶𝘤𝘩 𝘷𝘦𝘳𝘪𝘧𝘪𝘢𝘣𝘭𝘦 𝘥𝘦𝘤𝘦𝘯𝘵𝘳𝘢𝘭𝘪𝘻𝘢𝘵𝘪𝘰𝘯, making any good attributes they may have vulnerable to change.

Another concrete fact is 𝗯𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 𝗳𝗶𝘅𝗲𝗱 𝘀𝘂𝗽𝗽𝗹𝘆 𝗰𝗮𝗽 𝗼𝗳 𝗷𝘂𝘀𝘁 𝘂𝗻𝗱𝗲𝗿 𝟮𝟭 𝗺𝗶𝗹𝗹𝗶𝗼𝗻 𝗰𝗼𝗶𝗻𝘀. This scarcity is hardcoded, and can’t change without everyone agreeing to debase their own savings, thus ensuring that 𝘦𝘢𝘤𝘩 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘭𝘸𝘢𝘺𝘴 𝘳𝘦𝘱𝘳𝘦𝘴𝘦𝘯𝘵𝘴 𝘰𝘯𝘦 𝘵𝘸𝘦𝘯𝘵𝘺-𝘰𝘯𝘦 𝘮𝘪𝘭𝘭𝘪𝘰𝘯𝘵𝘩 𝘰𝘧 𝘵𝘩𝘦 𝘵𝘰𝘵𝘢𝘭 𝘴𝘶𝘱𝘱𝘭𝘺. This scarcity principle is a key non-speculative characteristic that underpins its value, independent of market price.

Moreover, 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗲𝗻𝗮𝗯𝗹𝗲𝘀 𝗶𝗻𝘀𝘁𝗮𝗻𝘁, 𝗽𝗿𝗶𝘃𝗮𝘁𝗲, 𝗮𝗻𝗱 𝘂𝗻𝗰𝗲𝗻𝘀𝗼𝗿𝗮𝗯𝗹𝗲 𝘁𝗿𝗮𝗻𝘀𝗮𝗰𝘁𝗶𝗼𝗻𝘀, making it inherently resistant to control or interference from governments, banks, or military forces. This freedom of transactability is a tangible attribute, not subject to speculation, and upholds the principles of liberty and autonomy.

While Bitcoin's price may be a playground for speculators who don’t yet understand what they’re trading, 𝘪𝘵𝘴 𝘮𝘦𝘳𝘦𝘭𝘺 𝘵𝘩𝘦 𝘵𝘪𝘱 𝘰𝘧 𝘵𝘩𝘦 𝘪𝘤𝘦𝘣𝘦𝘳𝘨 𝘰𝘧 𝘸𝘩𝘢𝘵 𝘉𝘪𝘵𝘤𝘰𝘪𝘯 𝘳𝘦𝘢𝘭𝘭𝘺 𝘪𝘴. Its true value lies in its foundational properties: decentralization, fixed supply, and censorship resistance. 𝗧𝗵𝗲𝘀𝗲 𝗾𝘂𝗮𝗹𝗶𝘁𝗶𝗲𝘀 𝗮𝗿𝗲 𝗰𝗲𝗿𝘁𝗮𝗶𝗻, 𝘃𝗲𝗿𝗶𝗳𝗶𝗮𝗯𝗹𝗲, 𝗮𝗻𝗱 𝗳𝗮𝗿 𝗺𝗼𝗿𝗲 𝘃𝗮𝗹𝘂𝗮𝗯𝗹𝗲 𝘁𝗵𝗮𝗻 𝗮𝗻𝘆 𝗺𝗼𝗻𝗲𝘁𝗮𝗿𝘆 𝗽𝗿𝗶𝗰𝗲. Hence, bitcoin is arguably the 𝘭𝘦𝘢𝘴𝘵 speculative asset in history, with its value rooted in absolute, immutable principles.

Next time you hear someone say that bitcoin is a speculative asset, 𝗦𝗵𝗮𝗿𝗲🔄 this with them.

Remember to 𝗟𝗶𝗸𝗲🤙 and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this, too!

What are some other verifiable qualities of Bitcoin that require no speculation?

Tell me in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗵𝗲 𝙍𝙚𝙖𝙡 𝗥𝗼𝗼𝘁 𝗼𝗳 𝗔𝗹𝗹 𝗘𝘃𝗶𝗹?

𝘏𝘪𝘯𝘵: 𝘐𝘵'𝘴 𝙣𝙤𝙩 𝘮𝘰𝘯𝘦𝘺.

You’ve likely heard the adage, “𝘔𝘰𝘯𝘦𝘺 𝘪𝘴 𝘵𝘩𝘦 𝘳𝘰𝘰𝘵 𝘰𝘧 𝘢𝘭𝘭 𝘦𝘷𝘪𝘭.” You may have even heard others correct the quote, saying that “𝘛𝘩𝘦 𝙡𝙤𝙫𝙚 𝘰𝘧 𝘮𝘰𝘯𝘦𝘺 𝘪𝘴 𝘵𝘩𝘦 𝘳𝘰𝘰𝘵 𝘰𝘧 𝘢𝘭𝘭 𝘦𝘷𝘪𝘭.”

Either way, this quote is not quite true, and lacks the necessary nuance.

Let me explain👇

In his first letter to Timothy, chapter 6 verse 10, Paul wrote: "𝘍𝘰𝘳 𝘵𝘩𝘦 𝘭𝘰𝘷𝘦 𝘰𝘧 𝘮𝘰𝘯𝘦𝘺 𝘪𝘴 𝘵𝘩𝘦 𝘳𝘰𝘰𝘵 𝘰𝘧 𝘢𝘭𝘭 𝘦𝘷𝘪𝘭: 𝘸𝘩𝘪𝘤𝘩 𝘸𝘩𝘪𝘭𝘦 𝘴𝘰𝘮𝘦 𝘤𝘰𝘷𝘦𝘵𝘦𝘥 𝘢𝘧𝘵𝘦𝘳, 𝘵𝘩𝘦𝘺 𝘩𝘢𝘷𝘦 𝘦𝘳𝘳𝘦𝘥 𝘧𝘳𝘰𝘮 𝘵𝘩𝘦 𝘧𝘢𝘪𝘵𝘩, 𝘢𝘯𝘥 𝘱𝘪𝘦𝘳𝘤𝘦𝘥 𝘵𝘩𝘦𝘮𝘴𝘦𝘭𝘷𝘦𝘴 𝘵𝘩𝘳𝘰𝘶𝘨𝘩 𝘸𝘪𝘵𝘩 𝘮𝘢𝘯𝘺 𝘴𝘰𝘳𝘳𝘰𝘸𝘴” (KJV). This Bible reference discourages many Christians from investigating Bitcoin, which holds them back from adopting this freedom technology.

To say that money 𝘪𝘵𝘴𝘦𝘭𝘧 is the root of all evil would be akin to blaming the messenger for the message. And saying that the 𝘭𝘰𝘷𝘦 of money is the root of all evil is like saying that all evil springs from loving work, your time to be alive, and your ability to choose. 𝗠𝗼𝗻𝗲𝘆 𝗶𝘀 𝗮𝗻 𝗮𝗯𝘀𝘁𝗿𝗮𝗰𝘁𝗶𝗼𝗻 𝗼𝗳 𝗺𝗼𝘀𝘁 𝗴𝗼𝗼𝗱 𝘁𝗵𝗮𝘁 𝗺𝗮𝗻𝗸𝗶𝗻𝗱 𝗰𝗮𝗻 𝗽𝗿𝗼𝗱𝘂𝗰𝗲, and is therefore the farthest thing from “evil”.

Ayn Rand, in her book "Atlas Shrugged," eloquently dissects money’s true nature. Money, as she explains, is not the root of evil, but merely a medium for exchanging all kinds of goods. It represents effort, production, and the potential for trade. 𝗠𝗼𝗻𝗲𝘆, 𝗶𝗻 𝗶𝘁𝘀𝗲𝗹𝗳, 𝗶𝘀 𝗷𝘂𝘀𝘁 𝗮𝗻 𝗼𝗯𝗷𝗲𝗰𝘁, 𝗮 𝘁𝗼𝗼𝗹. It cannot inherently be the root of good or evil; rather, 𝘪𝘵'𝘴 𝘵𝘩𝘦 𝘩𝘶𝘮𝘢𝘯 𝘢𝘤𝘵𝘪𝘰𝘯 𝘢𝘯𝘥 𝘪𝘯𝘵𝘦𝘯𝘵𝘪𝘰𝘯 𝘣𝘦𝘩𝘪𝘯𝘥 𝘪𝘵 𝘵𝘩𝘢𝘵 𝘪𝘮𝘱𝘢𝘳𝘵𝘴 𝘮𝘰𝘳𝘢𝘭 𝘷𝘢𝘭𝘶𝘦.

So was Paul wrong? In Paul's time, money itself was fundamentally broken, just like fiat money today. Roman currency, often debased, was a tool for the powerful to manipulate value and control the populace. 𝘐𝘯 𝘵𝘩𝘪𝘴 𝘤𝘰𝘯𝘵𝘦𝘹𝘵, 𝘵𝘩𝘦 𝘭𝘰𝘷𝘦 𝘰𝘧 𝘮𝘰𝘯𝘦𝘺 𝘪𝘯𝘥𝘦𝘦𝘥 𝘮𝘪𝘳𝘳𝘰𝘳𝘦𝘥 𝘢 𝘭𝘰𝘷𝘦 𝘧𝘰𝘳 𝘱𝘰𝘸𝘦𝘳 𝘢𝘯𝘥 𝘤𝘰𝘯𝘵𝘳𝘰𝘭 𝘰𝘷𝘦𝘳 𝘰𝘵𝘩𝘦𝘳𝘴, often leading to corruption and moral decay. Before 2009, there was never a time when this wasn’t the case to some extent, so Paul was 𝘵𝘦𝘤𝘩𝘯𝘪𝘤𝘢𝘭𝘭𝘺 correct, especially with the money that existed in his day.

The heart of this issue lies in Paul’s next phrase: "𝘸𝘩𝘪𝘤𝘩 𝘸𝘩𝘪𝘭𝘦 𝘴𝘰𝘮𝘦 𝘤𝘰𝘷𝘦𝘵𝘦𝘥 𝘢𝘧𝘵𝘦𝘳". This coveting of money, or 𝘢𝘯 𝘪𝘯𝘵𝘦𝘯𝘴𝘦 𝘥𝘦𝘴𝘪𝘳𝘦 𝘧𝘰𝘳 𝙚𝙖𝙨𝙮 𝘮𝘰𝘯𝘦𝘺, aligns with what economists call “high time preference” — the preference for immediate rewards over greater rewards in the future, at the expense of values, integrity, and long-term welfare. This high time preference leads to shortsighted decisions, unethical behavior, and ultimately to both personal and societal harm.

Contrast this with bitcoin, a modern form of money that embodies the principles of 𝘭𝘰𝘸 time preference. Bitcoin, by its very nature, encourages production over rent-seeking, saving over spending, and long-term planning over short-term gratification. 𝗜𝘁'𝘀 𝗮 𝘁𝗼𝗼𝗹 𝗳𝗼𝗿 𝗽𝗲𝗿𝘀𝗼𝗻𝗮𝗹 𝘀𝗼𝘃𝗲𝗿𝗲𝗶𝗴𝗻𝘁𝘆, 𝗻𝗼𝘁 𝘀𝗼𝗰𝗶𝗲𝘁𝗮𝗹 𝗰𝗼𝗻𝘁𝗿𝗼𝗹. This aligns well with the Austrian economic theory, which advocates for sound money as a foundation for a healthy, ethical, and prosperous society.

Thus, the true root of all evil is not money, but high time preference, or the craving for immediate, unearned wealth. It leads to corruption, moral degradation, and societal decay. 𝗠𝗼𝗻𝗲𝘆, 𝘄𝗵𝗲𝗻 𝗿𝗲𝘀𝗽𝗲𝗰𝘁𝗲𝗱 𝗮𝘀 𝗮 𝘁𝗼𝗼𝗹 𝗳𝗼𝗿 𝗳𝗮𝗶𝗿 𝗲𝘅𝗰𝗵𝗮𝗻𝗴𝗲 𝗮𝗻𝗱 𝗮 𝘀𝘁𝗼𝗿𝗲 𝗼𝗳 𝗹𝗼𝗻𝗴-𝘁𝗲𝗿𝗺 𝘃𝗮𝗹𝘂𝗲, 𝗰𝗮𝗻 𝗯𝗲 𝗼𝘂𝗿 𝘀𝘁𝗿𝗼𝗻𝗴𝗲𝘀𝘁 𝗳𝗼𝗿𝗰𝗲 𝗳𝗼𝗿 𝗴𝗼𝗼𝗱, driving innovation, productivity, and ethical behavior.

It's crucial to understand money's role as a neutral tool, a facilitator of trade and a measure of value. By embracing sound money principles and rejecting high time preference behavior, 𝘄𝗲 𝗰𝗮𝗻 𝗳𝗼𝘀𝘁𝗲𝗿 𝗮 𝘀𝗼𝗰𝗶𝗲𝘁𝘆 𝘁𝗵𝗮𝘁 𝘃𝗮𝗹𝘂𝗲𝘀 𝗶𝗻𝘁𝗲𝗴𝗿𝗶𝘁𝘆, 𝗹𝗼𝗻𝗴-𝘁𝗲𝗿𝗺 𝗽𝗿𝗼𝘀𝗽𝗲𝗿𝗶𝘁𝘆, 𝗮𝗻𝗱 𝗲𝘁𝗵𝗶𝗰𝗮𝗹 𝗰𝗼𝗻𝗱𝘂𝗰𝘁.

Make sure you 𝗟𝗶𝗸𝗲🤙 and 𝗦𝗵𝗮𝗿𝗲🔄 this, and spread the word on why neither money — nor the love of it — is the root of all evil.

And 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for when you need it later.

What is your opinion on this Biblical quote and my take on it?

Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗶𝘀 𝗥𝗼𝗴𝘂𝗲 𝗠𝗼𝗻𝗲𝘆

𝘈𝘯𝘥 𝘉𝘪𝘵𝘤𝘰𝘪𝘯𝘦𝘳𝘴 𝘸𝘰𝘶𝘭𝘥 𝘩𝘢𝘷𝘦 𝘪𝘵 𝘯𝘰 𝘰𝘵𝘩𝘦𝘳 𝘸𝘢𝘺

Recently, Samantha LaDuc commented on #Bitcoin, calling it “𝘳𝘰𝘨𝘶𝘦 𝘮𝘰𝘯𝘦𝘺”, and saying it’s “𝘰𝘯 𝘵𝘩𝘦 𝘰𝘱𝘱𝘰𝘴𝘪𝘵𝘦 𝘴𝘱𝘦𝘤𝘵𝘳𝘶𝘮 𝘵𝘰 𝘴𝘰𝘶𝘯𝘥 𝘮𝘰𝘯𝘦𝘺.”

While we thank Samantha for complimenting Bitcoin so highly, it seems she’s a little confused on what it means for something to be “sound money”.

Hopefully the following will help set the record straight👇

The implication here that only state-enforced currency is "sound" is amusingly archaic. It implies that money issued by the state is inherently stable and reliable. However, 𝗵𝗶𝘀𝘁𝗼𝗿𝘆 𝗶𝘀 𝗿𝗶𝗳𝗲 𝘄𝗶𝘁𝗵 𝗲𝘅𝗮𝗺𝗽𝗹𝗲𝘀 𝗼𝗳 𝗴𝗼𝘃𝗲𝗿𝗻𝗺𝗲𝗻𝘁 𝗰𝘂𝗿𝗿𝗲𝗻𝗰𝗶𝗲𝘀 𝗰𝗿𝘂𝗺𝗯𝗹𝗶𝗻𝗴 𝘂𝗻𝗱𝗲𝗿 𝘁𝗵𝗲 𝘄𝗲𝗶𝗴𝗵𝘁 𝗼𝗳 𝗺𝗶𝘀𝗺𝗮𝗻𝗮𝗴𝗲𝗺𝗲𝗻𝘁 𝗮𝗻𝗱 𝗵𝘆𝗽𝗲𝗿𝗶𝗻𝗳𝗹𝗮𝘁𝗶𝗼𝗻, brought on by poor incentives.

Bitcoin, unfettered by state control, 𝗲𝗺𝗯𝗼𝗱𝗶𝗲𝘀 𝘁𝗿𝘂𝗲 𝗳𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗮𝘂𝘁𝗼𝗻𝗼𝗺𝘆. Being "rogue" means it's not subject to whimsical monetary policies or political agendas. It's a monetary system that operates on principles of scarcity and decentralized consensus, unlike state currencies prone to excessive printing and devaluation.

In a world witnessing rampant money printing and currency debasement, 𝗕𝗶𝘁𝗰𝗼𝗶𝗻'𝘀 "𝗿𝗼𝗴𝘂𝗲" 𝘀𝘁𝗮𝘁𝘂𝘀 𝗶𝘀 𝗶𝘁𝘀 𝘀𝘁𝗿𝗲𝗻𝗴𝘁𝗵. It offers an alternative to the failed legacy system, where the value of money is constantly eroded by inflationary policies. 𝘉𝘪𝘵𝘤𝘰𝘪𝘯'𝘴 𝘧𝘪𝘹𝘦𝘥 𝘴𝘶𝘱𝘱𝘭𝘺 𝘢𝘯𝘥 𝘥𝘦𝘤𝘦𝘯𝘵𝘳𝘢𝘭𝘪𝘻𝘦𝘥 𝘯𝘢𝘵𝘶𝘳𝘦 𝘮𝘢𝘬𝘦 𝘪𝘵 𝘴𝘰𝘶𝘯𝘥 𝘮𝘰𝘯𝘦𝘺 𝘪𝘯 𝘢𝘯 𝘶𝘯𝘴𝘰𝘶𝘯𝘥 𝘸𝘰𝘳𝘭𝘥.

As the "rouge" Thomas Jefferson likely said: "𝘞𝘩𝘦𝘯 𝘪𝘯𝘫𝘶𝘴𝘵𝘪𝘤𝘦 𝘣𝘦𝘤𝘰𝘮𝘦𝘴 𝘭𝘢𝘸, 𝘳𝘦𝘴𝘪𝘴𝘵𝘢𝘯𝘤𝘦 𝘣𝘦𝘤𝘰𝘮𝘦𝘴 𝘥𝘶𝘵𝘺.” He is also attributed to saying: "𝘐𝘧 𝘢 𝘭𝘢𝘸 𝘪𝘴 𝘶𝘯𝘫𝘶𝘴𝘵, 𝘢 𝘮𝘢𝘯 𝘪𝘴 𝘯𝘰𝘵 𝘰𝘯𝘭𝘺 𝘳𝘪𝘨𝘩𝘵 𝘵𝘰 𝘥𝘪𝘴𝘰𝘣𝘦𝘺 𝘪𝘵, 𝘩𝘦 𝘪𝘴 𝘰𝘣𝘭𝘪𝘨𝘢𝘵𝘦𝘥 𝘵𝘰 𝘥𝘰 𝘴𝘰.” Likewise, another rogue named Henry David Thoreau once said, "𝘋𝘪𝘴𝘰𝘣𝘦𝘥𝘪𝘦𝘯𝘤𝘦 𝘪𝘴 𝘵𝘩𝘦 𝘵𝘳𝘶𝘦 𝘧𝘰𝘶𝘯𝘥𝘢𝘵𝘪𝘰𝘯 𝘰𝘧 𝘭𝘪𝘣𝘦𝘳𝘵𝘺. 𝘛𝘩𝘦 𝘰𝘣𝘦𝘥𝘪𝘦𝘯𝘵 𝘮𝘶𝘴𝘵 𝘣𝘦 𝘴𝘭𝘢𝘷𝘦𝘴.” And the roguish Martin Luther King, Jr, whose birthday was yesterday, is quoted as saying, "𝘖𝘯𝘦 𝘩𝘢𝘴 𝘢 𝘮𝘰𝘳𝘢𝘭 𝘳𝘦𝘴𝘱𝘰𝘯𝘴𝘪𝘣𝘪𝘭𝘪𝘵𝘺 𝘵𝘰 𝘥𝘪𝘴𝘰𝘣𝘦𝘺 𝘶𝘯𝘫𝘶𝘴𝘵 𝘭𝘢𝘸𝘴.” This resistance and disobedience — i.e. going 𝙧𝙤𝙜𝙪𝙚 — is exactly what we need most today.

Therefore, in an era where the so-called "sound money" of states is anything but, 𝗴𝗼𝗶𝗻𝗴 𝗿𝗼𝗴𝘂𝗲 𝘀𝗲𝗲𝗺𝘀 𝘁𝗵𝗲 𝗼𝗻𝗹𝘆 𝗿𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗰𝗵𝗼𝗶𝗰𝗲. Bitcoin, with its immutable rules and decentralized governance, stands as a bastion of monetary sanity in a world of fiscal chaos.

George Orwell, a rogue if there ever was one!

Be sure to 𝗟𝗶𝗸𝗲🤙 and 𝗦𝗵𝗮𝗿𝗲🔄 this so more people can learn why Bitcoin is rogue money.

And 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for quick reference later!

How else is Bitcoin rogue money?

Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

Yes, Andreas Antonopoulos was correct. The future isn't #Bitcoin or the status quo; the future is either Bitcoin or CBDCs.

It's a choice between:

Free speech or censorship

Privacy or surveillance

Freedom or slavery

Hope or despair

Those are everyone's choices when they learn about Bitcoin.

The beauty of bitcoin is that it can be easily self-custodied, making ETFs and banks unnecessary. And when anyone does prefer to have a bank or other institution hold their bitcoin, the institution will only ever be able to offer bitcoin IOUs, which have an unlimited supply, and not real bitcoin, which is perfectly scarce.

So even in that situation, the amount of real bitcoin is fixed at 20,999,999.9769, and will never be a single sat more.

“𝘽𝙞𝙩𝙘𝙤𝙞𝙣 𝙞𝙨𝙣’𝙩 𝙨𝙘𝙖𝙧𝙘𝙚 𝙗𝙚𝙘𝙖𝙪𝙨𝙚 𝙞𝙩 𝙘𝙖𝙣 𝙗𝙚 𝙙𝙞𝙫𝙞𝙙𝙚𝙙 𝙛𝙤𝙧𝙚𝙫𝙚𝙧 𝙤𝙣 𝙨𝙚𝙘𝙤𝙣𝙙 𝙡𝙖𝙮𝙚𝙧𝙨.”

As nonsensical as this FUD is, it keeps resurfacing from so-called “intellectuals”.

If it were true, then 𝗶𝘁 𝘄𝗼𝘂𝗹𝗱 𝗮𝗽𝗽𝗹𝘆 𝘁𝗼 𝗼𝘁𝗵𝗲𝗿 𝘁𝗵𝗶𝗻𝗴𝘀 𝘁𝗵𝗮𝘁 𝗰𝗮𝗻 𝗯𝗲 𝗱𝗶𝘃𝗶𝗱𝗲𝗱 𝗶𝗻𝘁𝗼 𝘀𝗺𝗮𝗹𝗹𝗲𝗿 𝗽𝗶𝗲𝗰𝗲𝘀, like pizza, and we could solve world hunger!

Sadly, this argument isn’t enough for some people. They think so 𝘤𝘰𝘯𝘤𝘦𝘱𝘵𝘶𝘢𝘭𝘭𝘺 that they forget to apply these things 𝘱𝘳𝘢𝘤𝘵𝘪𝘤𝘢𝘭𝘭𝘺.

The following explanation is for them.👇

Bitcoin's scarcity is defined by its fixed supply of exactly 2,099,999,997,690,000 sats, 𝘯𝘰𝘵 𝘣𝘺 𝘩𝘰𝘸 𝘪𝘵'𝘴 𝘥𝘪𝘷𝘪𝘥𝘦𝘥. Dividing sats into smaller units doesn't increase their total number any more than splitting a gold bar into smaller pieces creates more gold.

𝗠𝗮𝘁𝗵𝗲𝗺𝗮𝘁𝗶𝗰𝗮𝗹𝗹𝘆, 𝘁𝗵𝗲 𝘁𝗼𝘁𝗮𝗹 𝗾𝘂𝗮𝗻𝘁𝗶𝘁𝘆 𝗼𝗳 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝗿𝗲𝗺𝗮𝗶𝗻𝘀 𝗰𝗼𝗻𝘀𝘁𝗮𝗻𝘁, regardless of division in second layers. 2,099,999,997,690,000 sats are equal to 2,099,999,997,690,000,000 millisats, 2,099,999,997,690,000,000,000 microsats, and 2,099,999,997,690,000,000,000,000 nanosats. Each number may appear bigger than the last, but their denominations are proportionally smaller, which means they’re truly equal in amount.

Thus, bitcoin maintains its value and scarcity, regardless of how it's divided or used on second layers. Its fixed supply is a core feature, unaffected by transactional divisions.

Give this a 𝗟𝗶𝗸𝗲🤙, and 𝗦𝗵𝗮𝗿𝗲🔄 this with anyone who still spreads this FUD.

Someone will certainly bring this up again, so be sure to 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸🔖 this for when they do!

How would 𝘺𝘰𝘶 respond to this FUD?

Let me know in the 𝗖𝗼𝗺𝗺𝗲𝗻𝘁𝘀⬇️

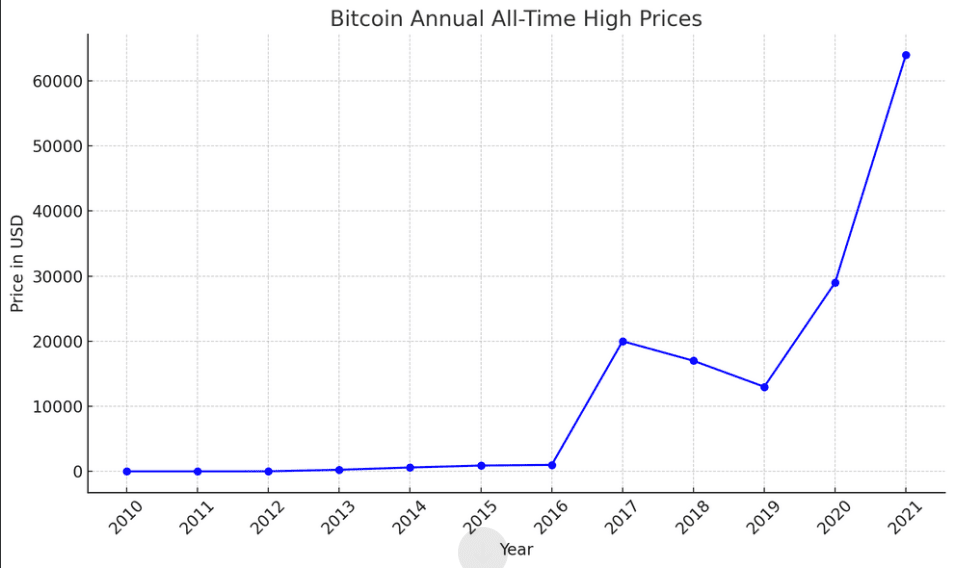

Me: Can you make a chart of each year's ATH?

Spirit of Satoshi on SatoshiGPT: - nostr:npub1tayp5jjjfqx4ufukxqamsl28wd5pggvteqe6u9n3svjn62lfr0hsp89l42

Here is a chart illustrating the annual all-time high (ATH) prices of Bitcoin. Each point on the graph represents the highest price Bitcoin reached in that particular year. This chart vividly demonstrates Bitcoin's exponential growth and its remarkable journey from a nascent digital asset to a significant financial instrument, reflecting its increasing utility and adoption over the years.

Answered using Spirit of Satoshi's Nakamoto repository knowledge base.

That's a great chart! Here it is again, in log scale, and through the end of 2023.

When you need help with using #Bitcoin, don't turn to ChatGPT.

I've got you covered. 😎

(From @BitcoinShopBiz on Twitter: https://x.com/BitcoinShopBiz/status/1745771775621787921 )