If you’re teach your kids to save in dollars, you’re teaching them that theft is allowed

Multifaceted.

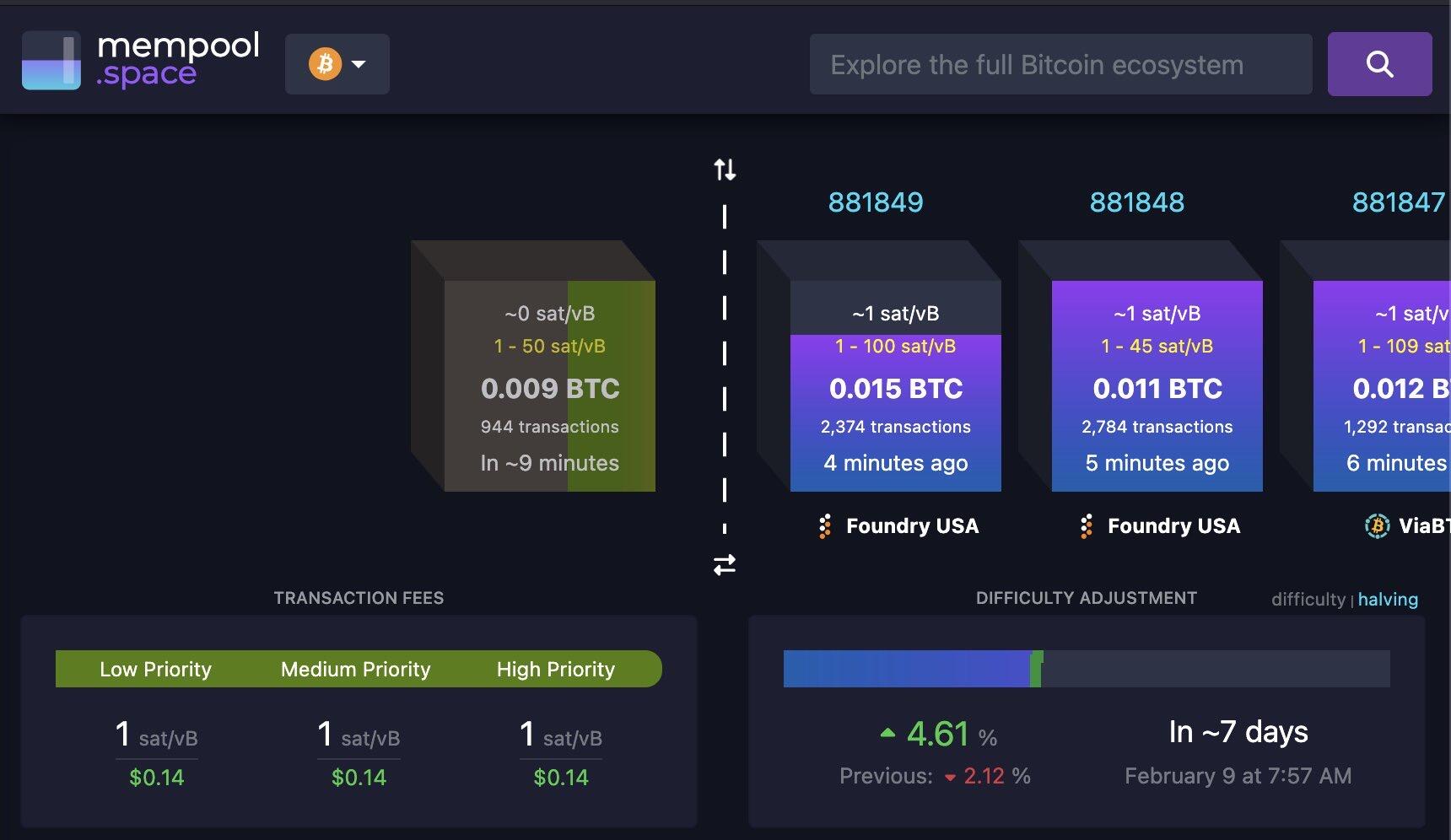

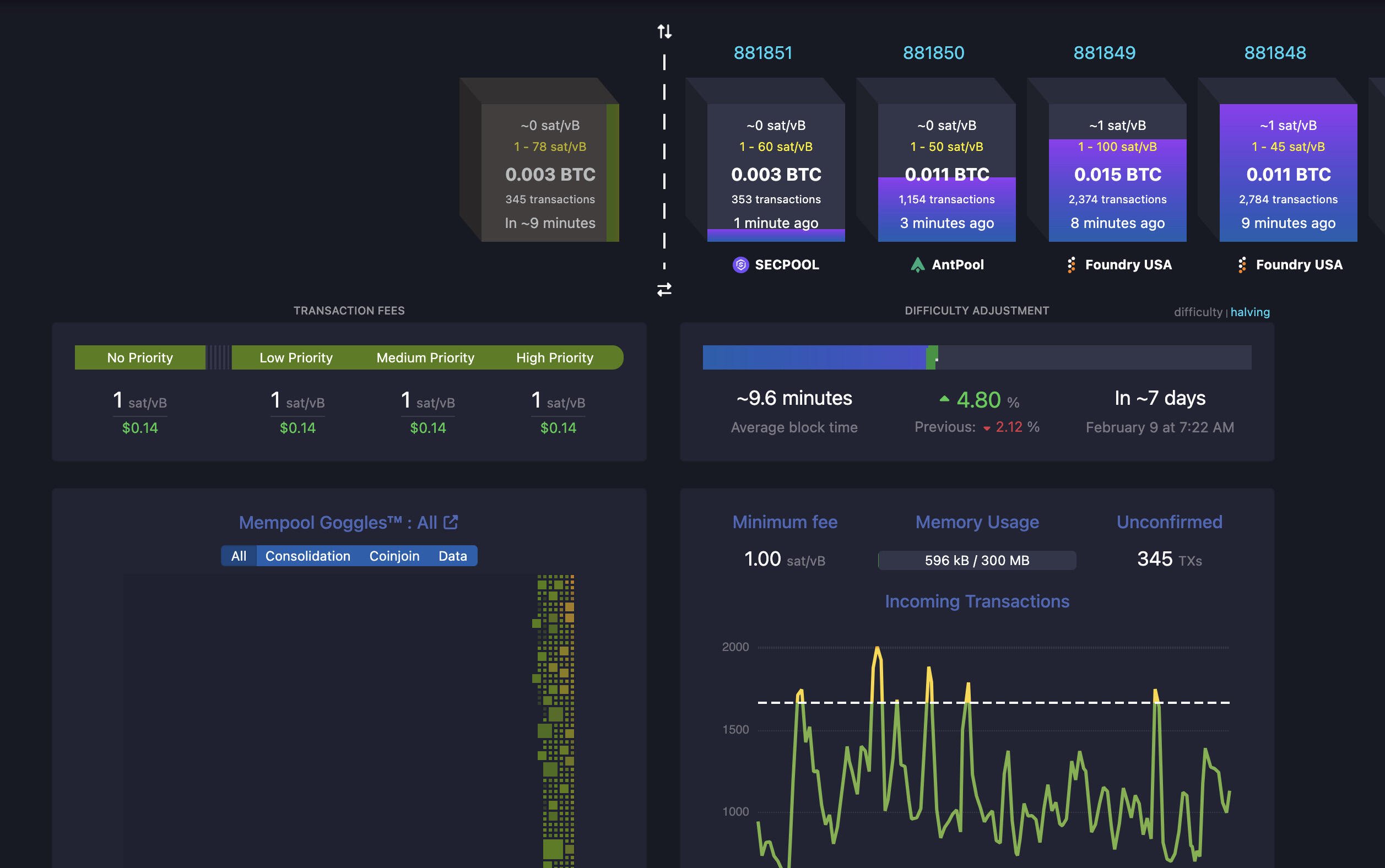

The UTXO set would be so large that network of nodes would have a hard time relaying the transactions

The block space would be incapable of supporting that many transactions

As transactions grow exponentially, fees grow exponentially leading to large amounts of UTXO dust

I’m enjoy the conversation!

I could be completely wrong with all of this, I actually have no idea what I’m talking about and I’m just adding my food for thought that popped into my brain this morning while I was having my first coffee. ☕️ GM

What I meant by that was the companies in those countries would have to pay the duty to import their own goods into the US.

I did not consider American companies also having to pay this import tax, because the current administration did not communicate that. I assumed that the tariff was only on companies in those jurisdictions, and that countries would have to subsidize that expense

It did not appear clear to me that companies in the United States doing any importing would be subject to the same expense.

Hands down FCPX!

I’ve been using it since the Final Cut express days.

100% agree that this action from the administration is stupidly irresponsible.

I was just trying to think about it from first principles. Thank you for your input!! I did not consider a lot of what you discussed

Totally understand that, however This seems more like the symptom than the cause.

In reality before people from the United States can purchase the imported good it must be paid for by the country importing it.

Sure, the trickle down effect will be to raise the price of the item in the US economy. But the very first payment to import the goods must initially be paid by the company from the country that is importing it. if the price is too high for them to import it, either the import will not occur, making the price increase impossible because the imported good is not able to come into the states, or the argument I pose, is that CA & MX governments will just subsidize the duty.

Just food for thought

I can’t quite tear myself away from X, but I also can’t get that nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe voice out of my head.

🙅♂️ I only see this emoji when I think of that company

Sup. Time to make friends 🫂

It’s already stared is what you’re telling me 😏