"This is why, despite its flaws, I see value in voting for the Progressive “money printer” for now. The risks of radically changing policy are severe and immediate. Continued expansion, by contrast, carries longer-term risks, allowing us to prepare strategically. If we use this time wisely to develop and fortify a parallel system, we may have a chance to mitigate the fallout when the existing system finally breaks down."

I'm Voting for the Money Printer

https://bitcoinbarks.com/Barks/Im-Voting-for-the-Money-Printer/#wbb1

originally posted at https://stacker.news/items/731327

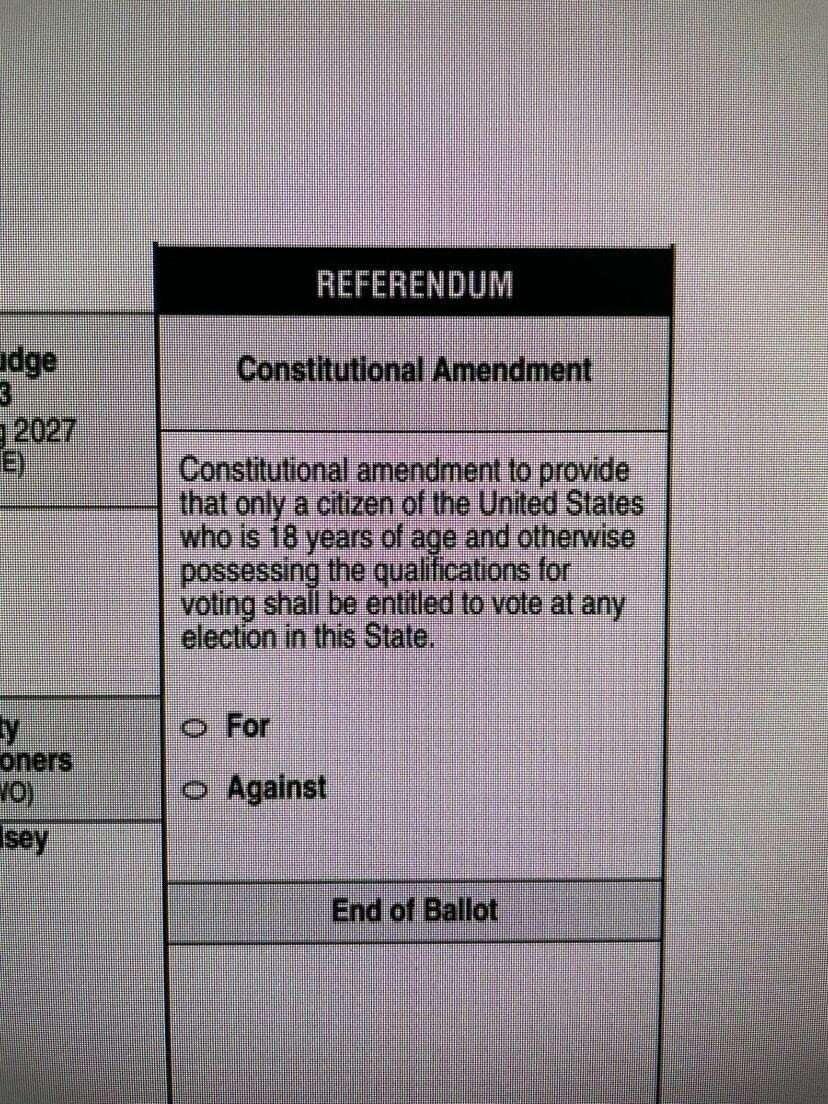

It really does read as though only 18 year olds should have the ability to vote...

Another critical point I almost missed (I was half-asleep while typing my earlier response) is the sheer challenge of actually paying down the debt at this point. While the threat of an accelerating inflationary spiral is a major concern for me, I'm not convinced that "properly" addressing it would be wise.

The U.S. and much of the world are deeply reliant on money printing, with the dollar as the global reserve currency. U.S. Treasuries don’t just form the backbone of the American financial system; they are integral to the global financial infrastructure.

Policies aimed at slowing our descent into what I believe is an inevitable hyperinflationary crisis would likely trigger seismic disruptions across financial markets. This could result in higher interest rates, collapses of major financial institutions, economic contraction, skyrocketing unemployment, and a sharp decline in tax revenues—among other negative effects.

In my view, addressing the debt problem in any substantial way would almost certainly lead to a severe depression that would ripple across the globe.

So, why do it now? The way I see it, catastrophe is on the horizon either way. Implementing meaningful fiscal responsibility only hastens the pain by "resetting" the global economy. Whether through action or inaction, tough times seem inevitable.

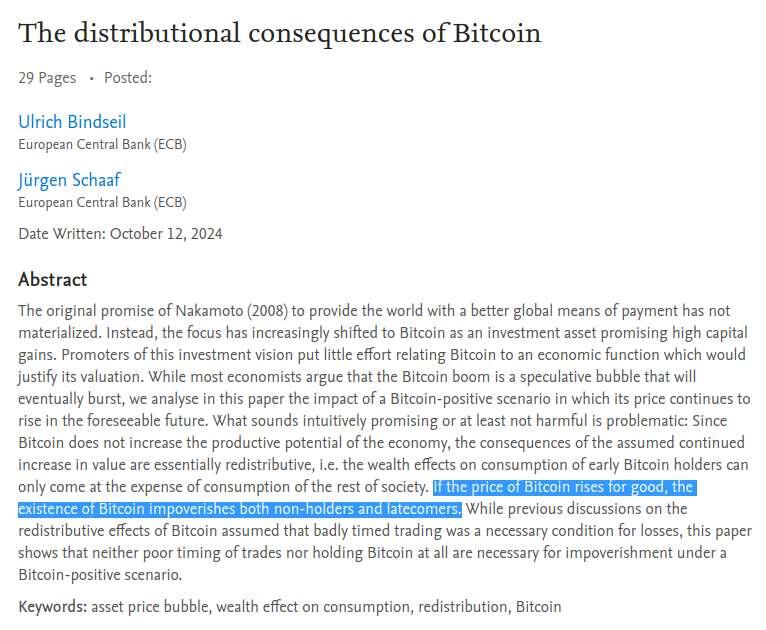

What if, instead, we continued to kick the can down the road? What if we kept printing money to keep the global financial system afloat, even as the debt-to-GDP ratio continues to soar? If we bought time, we could allow a parallel deflationary system to develop and grow. As more money flowed into this system, the value of its finite base unit could rise—a clear signal to the world that an alternative safe haven exists.

Perhaps, instead of rushing into a painful reset, we could buy time and build the solution. This is why, for now, I lean toward supporting continued monetary expansion.

New blog post out!! Not going lie I’m struggling with this election.

https://the-orange-revolution.npub.pro/post/9099b452/

#bitcoin #election2024

Don't have the time to fully put my thoughts to text right now, but I found it really refreshing to read your blog post and see someone else who (at least according to my interpretation) is rational and finds themselves stuck in the political middle while having no faith in either party taking actions to improve the long-term outlook for the United States.

I agree with different points on different sides, but as neither party wishes to acknowledge the iceberg we are rapidly approaching, on a whim I find myself somewhat inclined to vote Progressive this time around.

They'll print like no one has printed before...

I think the system needs a jump-start, but not the jump-start I believe Trump would deliver. So I lean towards more of the same, accepting things getting 10% worse, but mostly continuing along the current track.

Trump has just enough qualities to be attractive, but not so much as to shift my view positive. His shitcoining and endless grift really bother someone like me who holds integrity and honesty above all. This is not to say that Trump has a monopoly on dishonesty, but if there is a "Bitcoin" candidate, I will hold them to a higher standard as they represent me more directly.

I'm sure many will read this and take issue with it, that's fine. I'm just a dog finding my way along the orange brick road, and mistakes will be made along the way. Until they reveal themselves, all I can do is follow my own moral compass, and choose what I deem to be the least bad option whenever I can.

Once again, thanks for your thoughts. I wish you all the best as you make your decision.

Until then, Make Zaps Great Again!

The object that leads to the salvation of the few who chose to embrace it, is not responsible for the demise of those who reject it.

As if it is the existence of a lifeboat that causes the passengers of a sinking ship to drown. Passengers, many of whom had 15 years to debate the seaworthiness of said lifeboat...

I bull-maxxed the last bear.

At 18k, took the maximum 401k loans I could to stack sats.

At 24k, quit my job so I could liquidate my retirement accounts for bitcoin.

Class of 2021, #OnZero since 2022.

I discovered what Bitcoin was, and have been pedal to the metal ever since.

Watching a live Harris speech.

She's going to print so much fucking money if she wins...

#OptOut #StudyBitcoin

Apparently they can't be found. I'm here though!

Reminds me of The Atomic Priesthood.