It's incredible how ardently people will defend a money that steals from them when presented with a money that doesn't.

Stockholm syndrome is real.

We aren't meant to be caged.

Come on out of there.

Happy Thanksgiving y'all!

Even the bears...

🦃🏈🤙🇺🇸😘

"Hustle culture" isn't necessarily something to be celebrated.

"Hustle culture" is born out of the fact that monetary inflation is making it increasingly impossible to get by on a single income.

It doesn't have to be this way.

For decades, we have compared the dollar against other fiat currencies.

It was always the least dishonest amongst dishonest monies.

It was the "cleanest dirty shirt," as they say.

Enter Bitcoin

Absolutely scarce, honest money

A clean shirt

The game has changed.

Yes, liquidity is suffering right now, but look at the trend. Does anyone believe this dip in M2 is anything but temporary?

NEW EPISODE

TCB Short: How is Bitcoin Created? https://video.nostr.build/3465f74a86372d504ae1cec36e6090fa817270edfe274edb6bd41cc0c9ac332d.mp4

Many people on earth never had a landline phone, they jumped the shark straight to the cellphone.

In similar fashion, some countries with failing currencies will collapse into the dollar, but as soon as Bitcoin is large enough, most will jump the shark straight into Bitcoin.

We knew the game theory would come for individuals.

We knew it would come for corporations.

We knew it would come for financial managers.

We knew it would come for sovereign wealth funds and nation states.

But, let's be honest, did we see it coming this soon?

Bitcoin is about to teach the whole world a lesson in absolute scarcity.

I applaud all y'all for getting to class early.

👏

The government shouldn't control the size of the money supply.

The money supply should control the size of the government.

🇺🇸

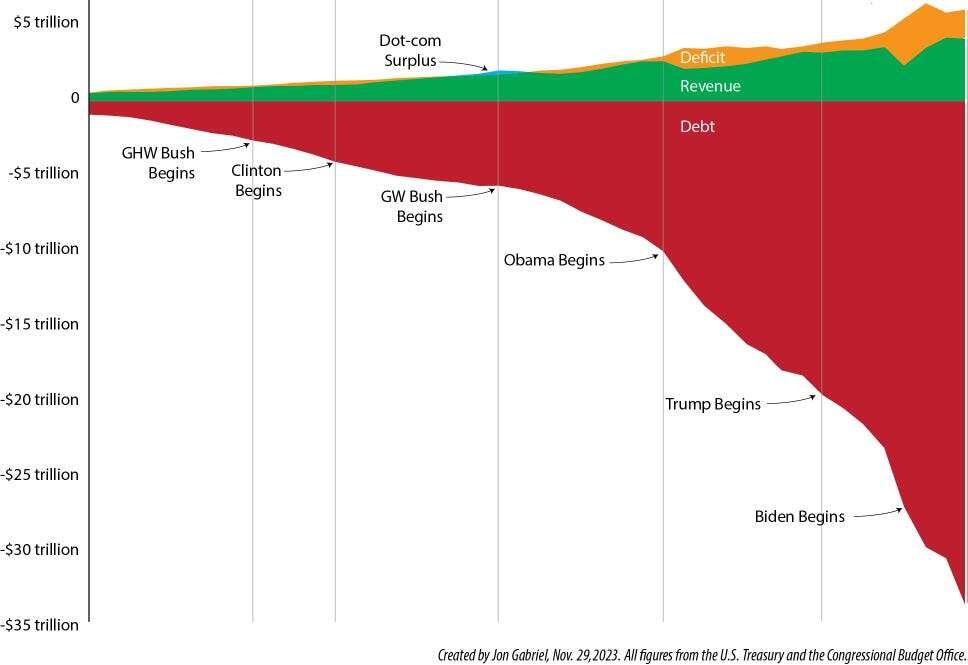

We've kicked the debt crisis up the stack from the banking level to the sovereign level.

"Too big to fail" has become "Too big to bailout."

Prepare yourself for the reset.

The incentives are undeniable.

The choice is simple.

Individuals

Corporations

Financial managers

Pension funds

Endowments

Sovereign wealth funds

Central banks

Nation states

Join, or die

NEW EPISODE

TCB Re-Hash with Mike Albert! https://video.nostr.build/40a57cbfbf58f820edec4093dbd961debd45b60190e0223851c983ded9c82652.mp4

Isn't it ironic...

Just when we're at the precipice of issuing unprecedented amounts of government debt, a superior risk-off asset is born.

Bonds are dead.

They just don't know it yet.

Bitcoin is the savior.

They just don't know it...yet.

Occupy Wall Street

Tea Party

These were the same movement.

One side blamed big banks.

One side blamed big government.

Both were correct.

This system is a collaborative kleptocracy between Wall Street and the Government, facilitated by the Federal Reserve.

Recent appearance on the Robin Seyr Podcast! nostr:nprofile1qqsd3a7gc2rnj3vwsvq8rverr59mqj3hf7lys8kqv3t2n99pes34ydcpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtcpyfmhxue69uhkummnw3ez6un9d3shjtnnvd5xu6t50fjkctnhdaexcep0qyfhwumn8ghj7ur4wfcxcetsv9njuetn9uw7hln3

Check it out y'all! 🤙🇺🇸

https://open.spotify.com/episode/6r1z9zaxwmOJCrwA3rNeej?si=X5wkXcidRzeabWetno2c_g

The Triffin dilemma

A country's status as a reserve currency leads to a perpetual trade deficit.

America has hollowed out our industrial base. We export nothing but inflation to provide the world with dollars.

Tariffs are an attempt to treat the symptom, not the cause.

Bitcoin vs Real Estate...

Real Estate:

Requires large down payment

Closing costs

Management

Upkeep

Property taxes

Illiquid

Immobile

Bitcoin:

All the store of value proposition, none of the friction

No barriers to entry

No management or upkeep

No property tax

Liquid

Mobile

Once you see Bitcoin,

you can't unsee Bitcoin.

And more people are seeing Bitcoin every day.

The combined net worth of the 10 wealthiest Americans (Musk, Ellison, Zuckerberg, Bezos, etc.) is about $2.2 trillion.

If we liquidated them and spread their wealth evenly amongst all Americans, each person would get about $6500.

We aren't taxing our way out of this mess.

Bitcoin takes us out of the fiat quicksand and puts us on a mountain trail.

Every step, every hour of human productivity, takes us higher.

We cannot yet grasp the capital accumulation sound money will unlock for humanity.

Pure mathematics is, in Bitcoin, the poetry of logical money.

When you borrow money, you need to ensure that you generate enough future income to cover both the principal and the interest.

The government hasn't run a surplus since the late 1990s.

So...how are they paying yield on Treasuries? 🤔

New Episode

Taking Care of Bitcoin with Developer Josh Swift!

Hear his amazing story about recovering Bitcoin from 2010! https://video.nostr.build/8eaa4e001e5165eb1d120050936baadf1b1d45c10932520345ba48ba66cbc231.mp4

Bitcoin is not a trade.

Bitcoin is not an investment.

The system has failed us.

Whether we realize it yet or not, we are all refugees seeking asylum from an oppressive monetary regime.

Bitcoin is a revolution.

Bitcoin is freedom.

Strategy front ran all corporations and has built an insurmountable lead.

God willing, the United States will do the same to nation states.

🇺🇸

For years, we have been diligently planting the seeds.

The plants are budding now.

And soon, we shall reap the harvest.

Clear eyes

Full hearts

Can't lose

They only way to lose in Bitcoin is by being too arrogant to play

Humble yourself

Educate yourself

Free yourself

Bitcoin does not just allow us to free ourselves. 🇺🇸

Bitcoin empowers us to abolish monetary slavery for all people. 🌎

What a beautiful idea.

Without knowledge of the heart, an EKG would be terrifying.

In similar fashion, once you understand Bitcoin, the volatility should not scare you.

The programmatic supply shocks are just the heartbeat of Bitcoin.

💗💓💗💓

In 1971, the US chose to back the dollar with nothing more than the full faith and credit of the US government.

They then obliterated this faith and credit by weaponizing and debasing that dollar.

The dollar is now backed by nothing.

The world will find the alternative.

The Emporer is butt ass naked