Who is going to jail for this ?

Chemonics is the largest recipient.

Visit the US goverment website usaspending.gov. In the Agency - Funding Agency filter, enter USAID.

I have seen the same. I suspect it is related to which specific relay(s) your Nostr client is synchronizing with at that moment.

Bitcoin Way. Just went thru their available guides. Some great best practices mentioned there.

GM.

This is my first paid bitcoin workshop. It's scheduled 3 days after a cete (where I'll go over Bisq trade stats) and will focus on Bisq's background and the best way to buy KYC-free sats.

https://blog.sdbitcoiners.com/59088/special-ticketed-event-bisq-primer-and-workshop

Excellent ! Hopefully one of many paid workshops.

Joplin has been my note keeping solution on mobile and desktop, synchronized over Dropbox (encrypted, of course).

You can also look into nostr:nprofile1qqsza56ed667de7q6mu6uxspetg7gzadqtkeug3plserzcj2nz6vc7qpzdmhxue69uhhwmm59e6hg7r09ehkuef0l6dq7f. It also has Direct Deposit with slider ratio, but the BTC goes to your self custody wallet. To make payments, you send BTC to an address dedicated to each payee. There is no ACH option, which can be an issue for certain mortgage and loan payments.

Keepass, sync to my other devices via Dropbox.

Thanks for the very detailed explanation ! I really meant to avoid exchanges reporting a cost basis conflicting with my own calculations. Regardless, i better start considering HIFO. I guess 2025 is the last year where HIFO will be allowed.

Curious if you came up with some scheme for the future cost basis reporting. My scheme is to transfer all BTC to a single self custody wallet. Purchases from 1 source, and any sale thru a different broker / exchange. My goals are 1) be the sole provider of cost basis to IRS 2) ensure all sales are considered long term capital gains.

IRS still pending to define any rules specific to self custody wallets.

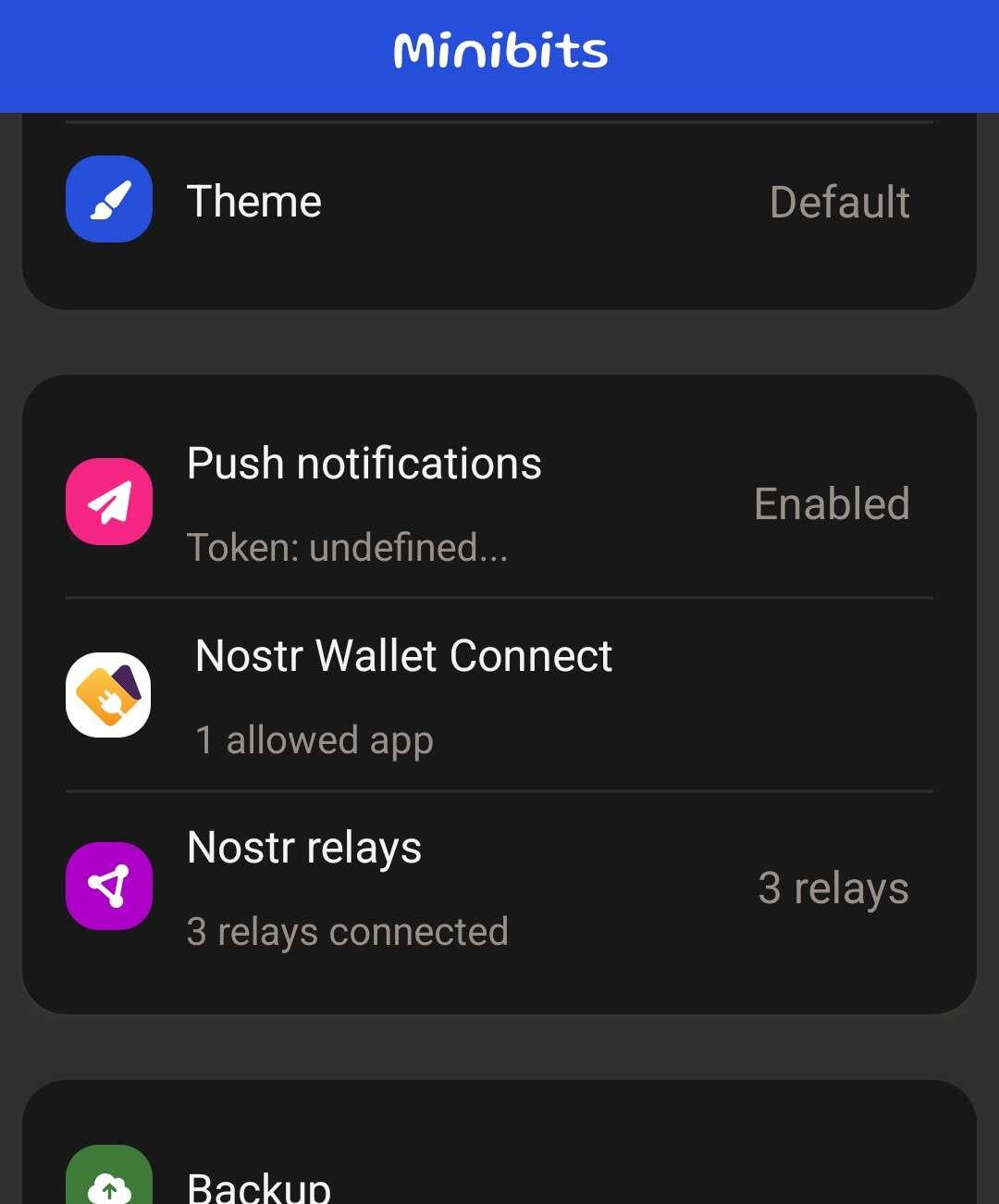

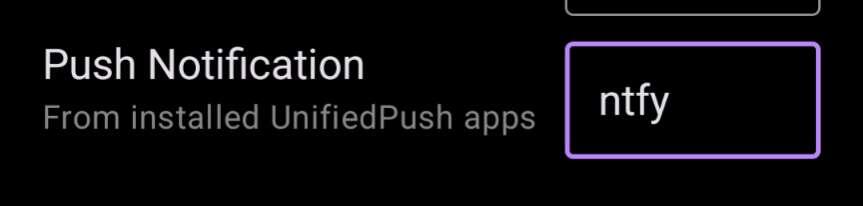

Nothing yet. But this may help. I installed nfty and added it to Amethyst long ago.

I have it running on GrapheneOS. Push notifications are enabled as per the Settings.

Whers's the nostr:nprofile1qqs2c0m2lct4j0mpsyz38kkf58j5f6rmnn53kf7n0wywck8m42gpf2spr9mhxue69uhhyetvv9ujuumwdae8gtnnda3kjctv9uvqdxna guy? He's got a lot to say about this.