In time you will.

Between years 2100 and 2140, 40 years, there will be only 1.24 BTC mined. That's how early we are.

Sometimes I forget o refresh the site since its always open and I never turn my computer off. So you are correct as that was a NAV from the 16th. Anyhow, right now at this red hot moment its at 1.865 after all the FUD from yesterdays FOMC announcement. It's wild to watch in real time how these markets (all the markets) are so entrenched in what the Fed's say and not so much in what they do. In the end, its what they do and not what they say of course. On the tracker site, its interesting that if you only look at the top headlines you see the NAV at 2.140x. If you look deeper in to the actual charts they provide by scrolling down, the NAV is always different than the red hot minute NAV on the charts. I forget to look at the charts sometimes as well.

“I’m going to try much harder to get back to water”

I go off of the URL for the site I gave you yesterday in regards to the “official” NAV number.

Is ₿itcoin the only money and everything else is currency?

nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk OMG!!! ₿TC @ 101k!!! We need a groovy chilly Daily Dose to get back on track so here it is.

https://open.spotify.com/track/1FRdE8y4itKKjScYYXh4s7?si=CQYdRMf6RFu_llVyhoim3g

I see what graph you are talking about now. That was from the other day. My post from this morning is the new NAV. It’s moving up. Just like clock work. I add to my positions when the NAV gets down to 2 or lower and then ride it back up to 3 to 4, then take some profits. Wash, rinse repeat.

NAV Premium against Diluted Share: 2.541x with stock price at $379 this morning

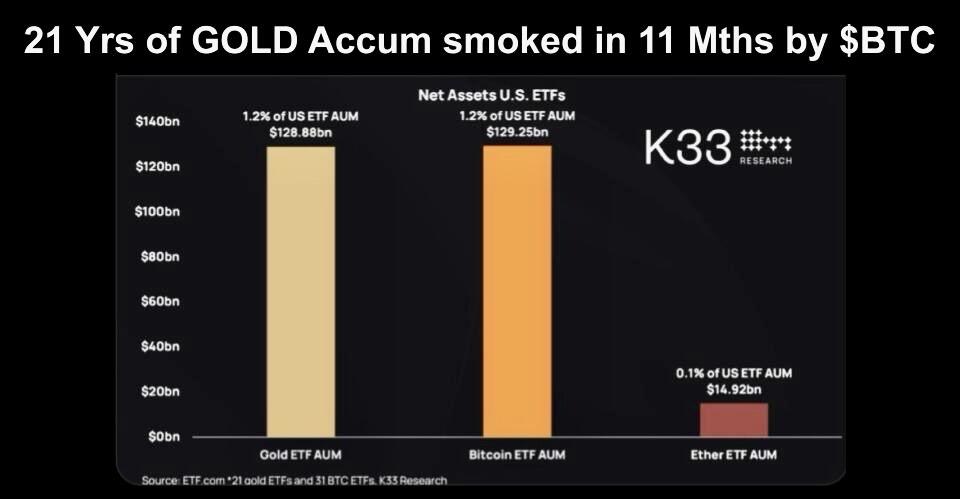

Gold ETFs have been around since 2003 - and BTC ETFs beat them in 11 months.

21 years of GOLD ETF investing beat by BTC in 11 months.

nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk A Two for Tuesday Daily Dose with similar vibe from one of the best in the biz. Enjoy 🌹

https://open.spotify.com/track/7zKZna0gKON11cZmxAyb5a?si=28A0vPQLRRuJwcTTHyK7kA

7 straight weeks of ₿TC pride going up! Oh my ✨

Its at 2.072x right now. Its been there since around 12-10-24. Lowest year to date. I use this site to keep tabs. https://www.mstr-tracker.com/

Its the opposite of what you feel. I am glad to have this conversation. I appreciate your experience and I like to step back from my own personnel analysis and get other opinions. One thing that I know is that you don't know what you don't know. Or said another way, I know that I do not know. I think that looking at the past to predict the future of this asset is not a good approach this time around. Literally, everything except the protocol itself is different this cycle and in a major bullish way. FASB really only matters to me in regards to MSTR in this next (Q1) earnings report. After that, you are right on point. Making a bet on this means that if I am wrong, I loose twice, and if I am right, the money I would make on the bet from being right is fractions of a penny compared to my profit (unrealized profit until it is actually realized).

I will not be selling any of my MSTR position in the middle of an amazing bull market. I have been building this this position since 08-2020. On Friday when the QQQ news was announced MSTR was $389. Right now on Tuesday morning in pre market its at $415. So no, I did not sell, and on paper, I am up so much that any pull backs are insignificant. FASB rules went into effect on Sunday and that is another major tailwind come Q1 earnings reporting. A possible S&P inclusion before this market turns into a bear market and ETF's creating a perpetual bid for BTC, a possible reserve asset allocation coming, ect... I have diamond hands with anything BTC related for at least another 6 to 12 months.

A Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk I think the ultimate compliment is for a musician to cover their musical inspirations songs and do it great.

https://open.spotify.com/track/0gqp35lTH7mS2B6JDjYAdo?si=Bv1J3HP9TLS7Gw9G1cousw

Bullish ₿TC events: FASB accounting rules now live, Trump Pump inauguration day, the FTX redistribution, and maybe the most significant is Senator French Hill to lead the House on Financial Services Committee. He is a super bullish on crypto.

What is your number one take away from the video. I listened last night but will need to listen while more focused again today.