March 1st. Yaeh!!!

"The market can remain irrational longer than you can remain solvent."—John Maynard Keynes

H. Con Res 14.

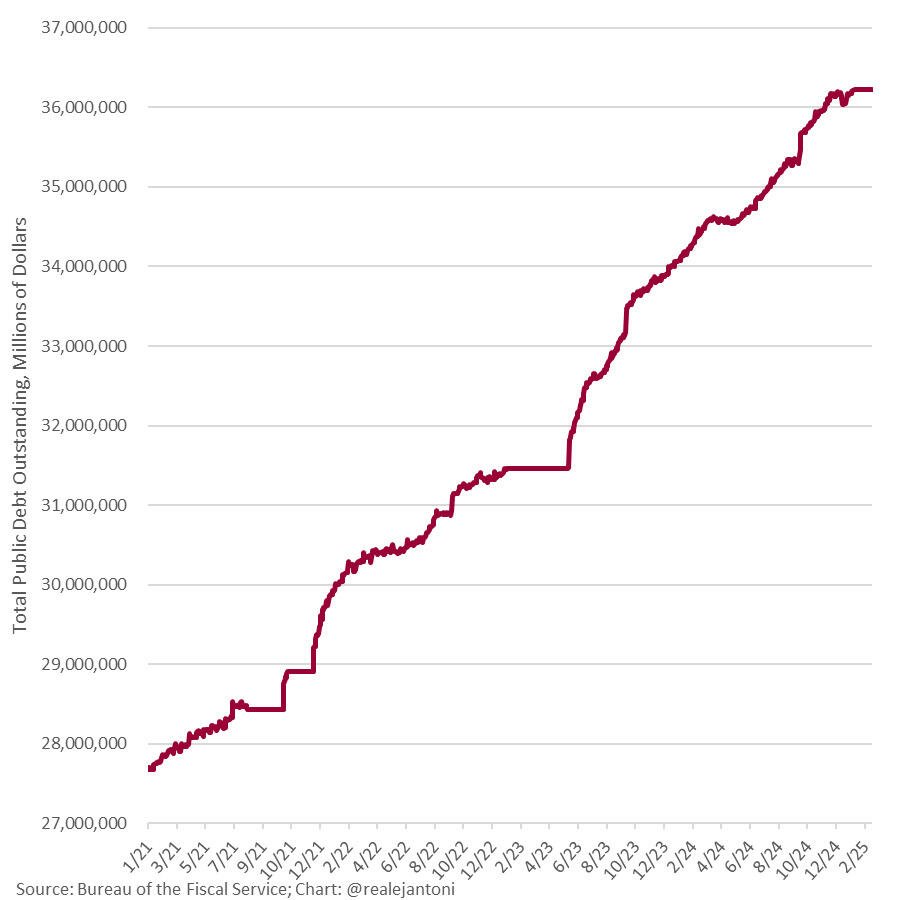

Do the Republicans in Congress have any sense of shame at all? The House of Representatives passed a resolution yesterday that guarantees annual deficits of $2 trillion every year between now and 2034 (technically, the House predicts deficits of $1.9 trillion in 2027 and 2029, but all up, that’s $20.2 trillion in NEW deficits, along with increasing the debt ceiling by $4 trillion.)

Without any debt reduction, total US government debt will be over $56 trillion by 2034. Republicans voted for this, even though the text of the CR itself acknowledges that this year’s $1.9 trillion deficit will be 6.2% of GDP and that $952 billion in net interest expense is 3.2$ of GDP. The text also acknowledges that 70% of the budget is made up of ‘mandatory spending’ for Social Security and Medicare and that ‘mandatory spending’ is up 59% since 2019.

It’s possible there are trillions of dollars worth of fraud in Social Security and Medicare that DOGE will uncover (and save). But it’s also possible that the bill for the Welfare/Warfare State is coming due over the next ten years and that there's no way we can pay it. We can’t grow fast enough to increase tax revenues. We can’t (or won’t) cut the programs that most contribute to the deficit (including and especially the firepower industry). And our Congress, even when led by nominal Republicans, kicks the can down the road yet again. As a reminder, you probably don’t own enough Bitcoin, gold or silver.

Source: Dan Denning

Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk It’s been a long week so right now we are going to sit back, relax and start picking up those pieces 😎

https://open.spotify.com/track/3NTwkFnd4dPcvpg43O3XW3?si=57ibnvDBQAyniyCKUaYU-Q

Incoming recession? The Atlanta Fed’s GDP Now tracker indicates the US economy will contract in the first quarter of this year. It will shrink by 1.5% instead of growing by 2.3% as previously expected.

If you feel any sympathy for fired federal workers, check the chart above. Massively bloated government payrolls were used to disguise weak private sector employment over the last five years. The chart above shows a sharp increase in total government employees (local, state, federal) from May of 2020 to January of 2025.

The private sector got punished with lockdowns and mask/vax mandates. The public sector worked from home and became even more bloated. Our country has $36 trillion in debt and our elected politicians are committed to adding $20 trillion more. This is no time for tears. Cut deeper and fire more. Dan Denning

Source: Bonner Research

36+ trillion. Ouch.

After 8 days of outflows, the ETF’s are back and IBIT has yet to report. AND they are now auto allocating 1% to 2% to their model portfolio.

That's the ultimate for of being humble :-)

Bitcoin at $80K cuckbucks.

DCA scooping me more sats.

Chilling in the nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8 studio narrating “The Big Print” by nostr:npub1d3f4m9dgvkdjxn26pqzsxn6lpfn78sxwllxyt8mp76q0a9zyyjlswhr4xv

Wife and son asleep after quality time spent with both.

Nice little evening.

Are you making the audio book version for release?

Stacking below 80K always feels great. GM to you too.

THE FRESH, NEW, AND REVITALIZED!!!

Who would ever want to be stuck in that metaverse! OMG, that sounds like hell on steroids.

The most successful logos are with the most successful companies (obviously) and they are the simplest logs imaginable and have 2 colors.

Global liquidity has surged considerably since the start of 2025. Patience is all that is required. This ₿ull market will resume as liquidity floods back in.

A GM Daily Dose for nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk More satisfied and cool customers at Red Rocks Amphitheater in CO