Rules are meant to be broken.

Except rules that relate to #money.

#Bitcoin.

#Money is a tool meant to facilitate exchange, serving as the measuring stick for valuing the time and energy we spend (i.e. our labor).

Why should anybody, especially a group of privileged individuals, be able to manipulate it?

Having money with a fixed supply would enhance efficiencies and level the playing field.

#Bitcoin.

If they were wrong about #Bitcoin becoming irrelevant, what else are they wrong about?

One thing that comes to mind are #CBDCs.

https://cointelegraph.com/news/bitcoin-up-170-since-ecb-last-gasp-16-4-k

I wonder about that too 😉

The way I see it, your allocation to #Bitcoin should be proportional to your understanding of Bitcoin.

As your understanding increases, your allocation increases.

This helps no-coiners have a smooth onboarding experience.

There are many hurdles to overcome as a new Bitcoiner.

To name a few:

The violent price action and anxiety that comes with it.

The relentless influx of FUD narratives constantly testing your conviction.

The never ending studying required to stay informed.

The skeptical looks you get from friends and family.

The patience required to see it all unfold.

You will be thoroughly tested.

However, by the end of it your conviction in #Bitcoin will be unshakable.

Savings should be difficult and painful to spend; they embody the energy and time you invested to create value.

Protecting your savings is analogous to protecting the time and energy you spent.

#Bitcoin is the ultimate savings technology. Unlike #Fiat money, it is designed to maintain its purchasing power through its immutable fixed supply. Therefore, spending Bitcoin savings should be extremely more difficult and painful than spending Fiat savings.

Owning and properly securing your #Bitcoin is a low time preference endeavor.

It takes time to build conviction and to acquire the necessary skills to confidently hold and secure this asset.

I promise you it's all worth it.

Many struggle with the concept of #Bitcoin lacking a designated leader. A figure to hold accountable if anything were to go wrong. This absence of a central authority often prompts skepticism, with individuals labeling Bitcoin as dubious, a scam, or a Ponzi scheme.

They usually ask:

What if the creator reemerges to alter the code?

Could there be a covert backdoor allowing Satoshi to rug users?

As Bitcoin enthusiasts, our common response involves emphasizing the open-source nature of the code, making it auditable by anyone. However, our response tends to be overly simplistic, offering a superficial answer to a complex and unconventional system. It's important that we transcend this mindset.

In reality, our history is packed with centralized entities. Having a clear target to go after provides a level of comfort, even though seeking justice is often difficult, time-consuming, and unattainable. The aftermath of the 2008-2009 financial crisis serves as an example. Banks, engaging in excessive risk-taking with depositor savings, triggered a catastrophic collapse. Lives were upended, jobs were lost, and yet, the leaders and public figures responsible remained immune to prosecution.

The crucial point is that being able to identify a leader in a corrupt and unjust system offers no real benefit as our ability to confront and find vindication against them is a mere illusion.

Centralized systems project an illusion of safety and accountability, relying on our trust and blind faith to function. The fact is, they are inherently corruptible and susceptible to the flaws of human nature.

Satoshi Nakamoto eliminated the need for such trust.

In doing so, a decentralized monetary system emerged - Bitcoin.

The desire for a recognizable figure to steer the ship arises from the need for someone to be held accountable if the ship sinks.

But, if no one is steering the ship, and the ship itself is unsinkable, the need to hold someone accountable dissolves.

Bitcoin operates on an immutable set of rules. It is an unsinkable ship and therefore does not need a captain to man the wheel.

NO!

Don't let them fool you and gaslight you.

#Inflation is caused by the expansion of the money supply and deficit spending.

When you create money out of thin air, goods don't magically get created.

The result is more money in the system for the same amount of goods.

Put simply, if you double the money supply and the amount of goods remains the same, the price of these goods doubles.

Don't fall for the narrative. It's not your fault, it's THEIRS.

#Bitcoin is the solution to inflation.

Not your keys, not your #Bitcoin.

ALWAYS self-custody. DO NOT be complacent.

Be your own bank and don't trust anyone else with the fruits of your labor.

#Bitcoin is to modern man what fire was to Homo Erectus.

However, the threats have evolved. Today, politicians, central bankers, and bankers pose similar challenges as the weather, wild animals, and the darkness did to Homo Erectus.

I don't think the halving is priced in.

Have we ever experienced a 50% supply issuance cut before for a hard asset?

As adoption increases and given the fixed total supply of #Bitcoin the halving may have exponential consequences on price.

Predicting human behavior, especially on a mass scale, is an impossible task. However, #Keynesian economists believe otherwise. One of their primary assumptions is the rationality of market participants, based on which they construct models and aggregates to forecast human responses to various policies. This assumption, however, falsely categorizes economics as a natural science when, in reality, it is not. If predicting the reaction of one individual is inherently challenging, how can we claim accuracy in predicting the responses of millions?

Learn about Austrian economics.

Study #Bitcoin.

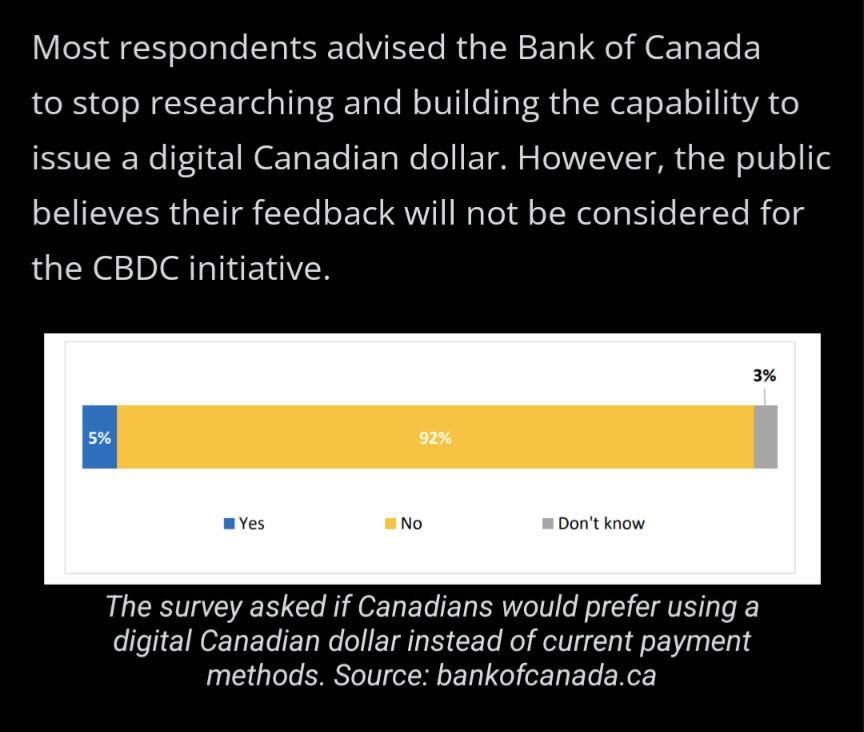

#CBDCs will most likely be pushed on society and the general population will not have a say in it, even if data points to not wanting it.

#Canada and other nation state governments will use the 'for the greater good' narrative to justify a shift to surveillance and control policies, even though the greater portion of their population rejects the idea.

#Bitcoin is your most practical vote out of this.

Getting back on a gold standard isn't going to and shouldn't happen. Gold is too slow and as a consequence will always centralize over time.

Don't get me wrong. Holding physical gold is a good diversifier and hedge. However, moving it is a problem, especially during a crisis when you would need it most.

#Bitcoin solves all of the inherent problems in gold.

Based on some research I've seen 50% or so. Hard to know exactly. So many assumptions.

Real estate is a depreciating asset, with prices rising due to artificially created demand from a combination of bureaucracy and gatekeeping, and it being perceived as a store of value and a hedge against inflation.

The excess value over utility is the monetary premium attributed to it. However, real estate is complex and costly to maintain.

As more people understand #Bitcoin, some, if not most, of this monetary premium will likely shift into Bitcoin.

Don't trust. Verify.

#Bitcoin.

Keynesian economists often argue that a little inflation is beneficial and necessary for the economy but fail to answer the most basic of questions: How much, and who gets to decide?

The Federal Reserve is mandated to target 2%, yet when asked why that specific number, no rational answer is ever given.

That 2% is a sweet spot, where they dilute the population's purchasing power without inciting a revolt.

Opt-out and take away their monopoly on money with #Bitcoin.