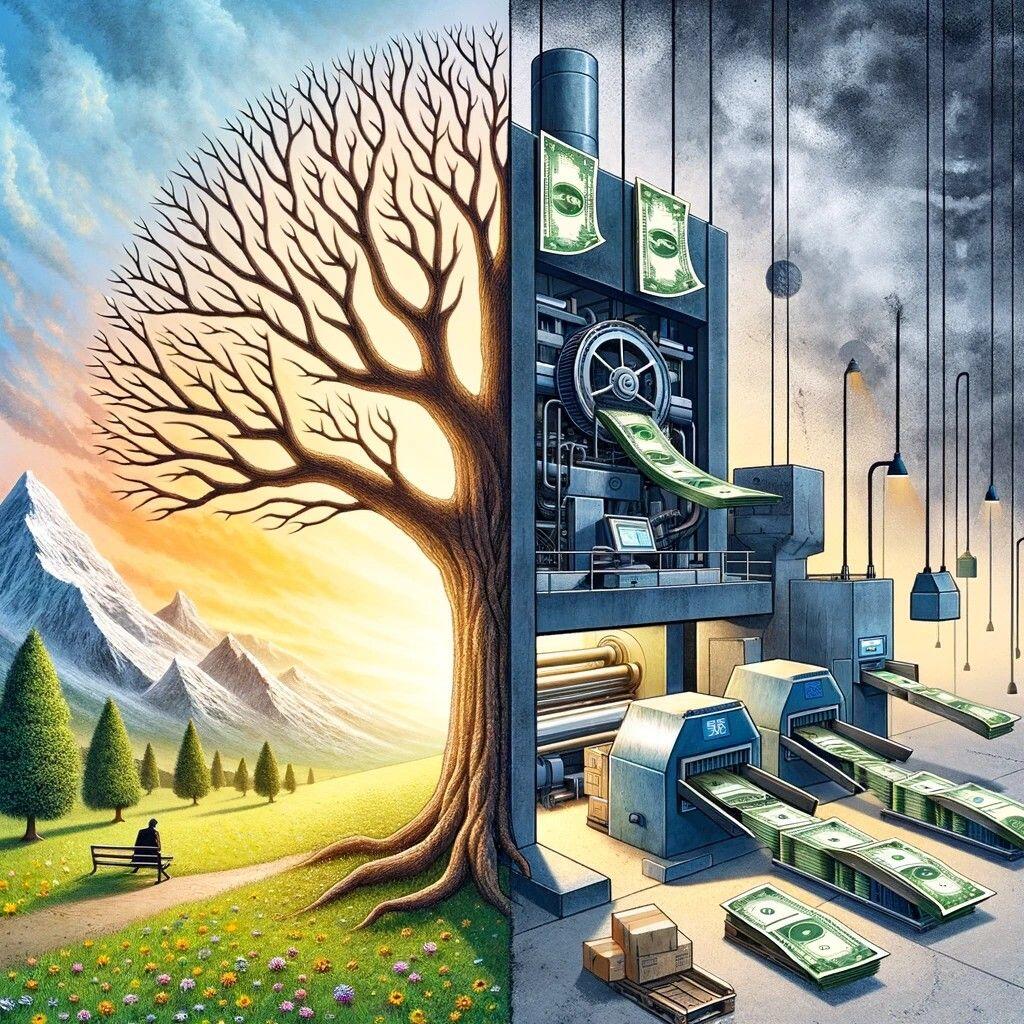

The saying goes, "#Money doesn't grow on trees", implying that money must be earned through hard work and cannot simply appear magically.

It kind of does though because it's printed out of thin air at the central bank.

#Bitcoin fixes this.

#m=image%2Fjpeg&dim=1024x1024&blurhash=UMJ*q.%5E%23o%244%5Bk%5Dx_M%7EtQ5XJAIo%25KkqkrIUE2&x=6e38667aa55a0663d7b5ac552c3e026e8f68f41e4da905916cf233892ed819b8

#m=image%2Fjpeg&dim=1024x1024&blurhash=UMJ*q.%5E%23o%244%5Bk%5Dx_M%7EtQ5XJAIo%25KkqkrIUE2&x=6e38667aa55a0663d7b5ac552c3e026e8f68f41e4da905916cf233892ed819b8

Don't be a sheep.

Be a lion.

#Bitcoin.

#m=image%2Fjpeg&dim=1024x1024&blurhash=U9J%24pW0N8z%7Em0qj%5D0%7E%2500ig258nj%25_r%3F%7DpE4&x=2abc95c49db491dc272922df7c9cc2702663416f705484ec3269ecce153ee3d7

#m=image%2Fjpeg&dim=1024x1024&blurhash=U9J%24pW0N8z%7Em0qj%5D0%7E%2500ig258nj%25_r%3F%7DpE4&x=2abc95c49db491dc272922df7c9cc2702663416f705484ec3269ecce153ee3d7

Government intervention in any sector of the economy leads to inefficiencies, waste, and inferior products and services. This also applies to money, where deficits, money printing, and interest rate manipulation create market distortions and result in malinvestments – investments that would likely not occur in an intervention free market. Ironically, central banks, which were supposedly created to stabilize financial markets and control economic booms and busts, contribute to these and exacerbate them significantly.

#Bitcoin fixes this.

UTXO management is a specialized subset of asset management in the #Bitcoin space. It's akin to rebalancing a traditional investment portfolio. In this context, your Bitcoin portfolio is an aggregate of various Bitcoin UTXOs, each needing strategic management for optimal efficiency and privacy.

Thanks for the sats! We definitely need to talk more about UTXO management.

UTXO management is critical in #Bitcoin and goes hand in hand with self-custody. The size of your stack doesn't matter as much as its UTXO distribution.

Mastering UTXO management is key for optimizing your Bitcoin experience.

In an unpredictable world, the entrepreneur's role involves embracing the risk of exploring new uses of capital, with success being heavily dependent on the subjective valuations of others. This highlights a fundamental flaw in our current system's “scientific” approach to forecasting human behavior and preferences by using aggregates and unrealistic assumptions. Most value is assigned subjectively at the individual level, a reality that defies precise calculation, simulation, or modeling.

#Keynes is the worst.

#Bitcoin fixes this.

We may snarl and growl at each other like wolves, challenging ideas within our pack. Yet, like these resilient creatures, our unity in purpose binds us. Different paths, same destination. Together, we navigate the wilderness, driven by a shared vision of hyperbitcoinization.

#Bitcoin.

Value in goods / services isn't intrinsic but a personal judgment based on our needs and circumstances. It is a mental construct. This contrasts with the academic "intrinsic value" definition, that aims to “objectively” measure an asset's worth using "scientific” data. The Austrian school echoes this subjective stance, highlighting value as a personal, individual assessment.

It’s time to move beyond #Keynesianism."

#Bitcoin.

Aggregating human behavior in modern economic models is flawed and misleading. It oversimplifies diverse, irrational human actions into unrealistic, rational models. This approach ignores emotional, social, and cultural influences, leading to inaccurate predictions and as a result harmful policy decisions that affect everyone. It's a dangerously narrow view of complex economic realities.

We are at the mercy of a few individuals that are running the global monetary system using a flawed and unrealistic scientific approach to a non-scientific matter.

#Bitcoin fixes this.

We are all in this together.

We are all Satoshi.

#Bitcoin.

The upcoming FASB accounting changes in December 2024 will significantly impact corporate inclusion of #Bitcoin on balance sheets. Key changes include:

Valuation: Transition from an impairment model to a fair value model, allowing immediate recognition of value fluctuations.

Reporting: Shift to standardized, detailed, and transparent reporting practices.

These changes are a major step towards corporate and institutional adoption of Bitcoin.

bitcoinmagazine.com/markets/bitcoi…

#Bitcoin is to money what the Internet was to communication.

Back to exuberance.

The Federal Reserve is looking to pivot next year. The 'higher for longer' narrative is a lie. This isn't solely because high interest rates are hurting the public, but primarily due to the spiraling interest costs on government debt.

A return to printing money and easy monetary policy is inevitable.

Prepare accordingly.

#Bitcoin.

In truth lies hope.

#Bitcoin, an immutable and transparent ledge is the truth.

Therefore, Bitcoin is hope.

#Bitcoin is a blackhole that will absorb all monetary premiums.

The more I study central banking and fractional reserve banking the more committed I am to #Bitcoin.

If only the general population knew what happens under the hood. They'd revolt and opt out immediately.

Fix the money first, get creative later.

#Bitcoin.

She is pushing for surveillance and control measures.

She is against #Bitcoin because it empowers our self-sovereignty.

Reject this bill.

Nearly all money laundering and terrorist financing is done through the traditional banking system using the USD.

Is it really necessary to talk about #Bitcoin price?

I understand it gets people excited, but I just worry it becomes the only thing that matters for newcomers.