#Bitcoin is censorship-resistant.

Why is this valuable?

Many live under oppressive and authoritarian regimes where capital flow is tightly controlled. In such places, it's common for dissidents to have their assets frozen.

Additionally, residents in these areas are isolated and cut off from the global economy, forced to deal with and transact in hyper-inflating fiat currencies.

Bitcoin offers an alternative to opt out.

This type of censorship is becoming increasingly prevalent in the West.

The next halving is in 10903 blocks, approximately 11 weeks.

What is the halving?

Every 210,000 blocks or approximately 4 years, the amount of #Bitcoin rewarded to miners every time they add a block of transactions to the time chain is cut in half.

It is a pre-programmed supply shock.

Based on the law of supply and demand and with all else equal:

If demand for Bitcoin stays the same post-halving, we will likely see an increase in price.

If demand for Bitcoin increases post-halving, we will likely see an even higher increase in price.

#Bitcoin allows you to transport your wealth across space seamlessly.

Why is that valuable?

If you ever needed to uproot quickly (i.e., war, natural disaster, etc.), you can cross borders with your Bitcoin allocation subtly. By simply remembering your seed phrase you can regain access to your wallet anywhere, and start anew.

Unlike the Fiat monetary system, #Bitcoin has a fixed total supply of 21 million and a predetermined issuance schedule.

Why is this valuable?

Because it protects and maintains into the future the value of the time and energy you spent to earn your wealth.

Unlike the current monetary system, you can't get kicked out of #Bitcoin.

Having an allocation to Bitcoin held in self-custody protects your ability and freedom to transact.

If that's not valuable, I don't know what is.

Opting out of the system is easier than you think.

1) Study Bitcoin and money.

2) Convert Fiat currency to #Bitcoin.

3) Self-custody your Bitcoin by moving them to cold storage.

4) Manage your UTXOs.

5) Study Bitcoin more.

Repeat until financially self-sovereign.

Fiat incentives short term thinking and the destruction of capital. Inevitably leading to degeneracy and the destruction of society.

This has happened many times in history. Learning about the collapse of the Roman empire is a good starting point.

#Bitcoin fixes this.

If money is broken, everything else follows.

Money has been hijacked and weaponized by a select few. Central banking and the fractional reserve system have become mechanisms for wealth extraction and redistribution.

Fiat money, created out of thin air at no cost, is extremely susceptible to manipulation. With its cost of production virtually nonexistent, the likelihood of its manipulation stands at 100%.

We are asked to blindly trust those who hold a monopoly over it. Yet, trust is not a given; it is earned.

Do you trust anyone at face value? Or do you prefer to get to know someone before placing your trust in them?

There's nothing rational about trusting the current monetary system. Those at the helm are detached from our reality, and as a result, cannot make policy in our best interest.

Adopting #Bitcoin, a monetary system that doesn't require trusting anyone but yourself, seems like a rational choice for any individual or corporation.

#m=image%2Fjpeg&dim=1024x1024&blurhash=U9HdpMOY03i%5E*0OG%5BlV%3F18JC%3A%7EoHKRX99ujE&x=f6f9e4acbb49e082799034fd3d4c999afc43731f4edf06cff8bb0bf9dfbd41ce

#m=image%2Fjpeg&dim=1024x1024&blurhash=U9HdpMOY03i%5E*0OG%5BlV%3F18JC%3A%7EoHKRX99ujE&x=f6f9e4acbb49e082799034fd3d4c999afc43731f4edf06cff8bb0bf9dfbd41ce

#Bitcoin is reshaping NGO and charity donations by eliminating intermediaries like banks and transfer agents. This leads to lower costs, including fees and administrative expenses, and quicker transaction settlements. It's a socially engaging, more involved approach to giving.

Each Bitcoin donation, regardless of size, can include a personal message, creating a live feed that uplifts those on the ground and acknowledges the generosity of contributors.

In #Lebanon, Rebirth Beirut are lighting up Beirut's streets, enhancing safety for residents and boosting local businesses. They accept both on-chain Bitcoin and Lightning payments.

Discover more about their inspiring work: https://rebirthbeirut.org/

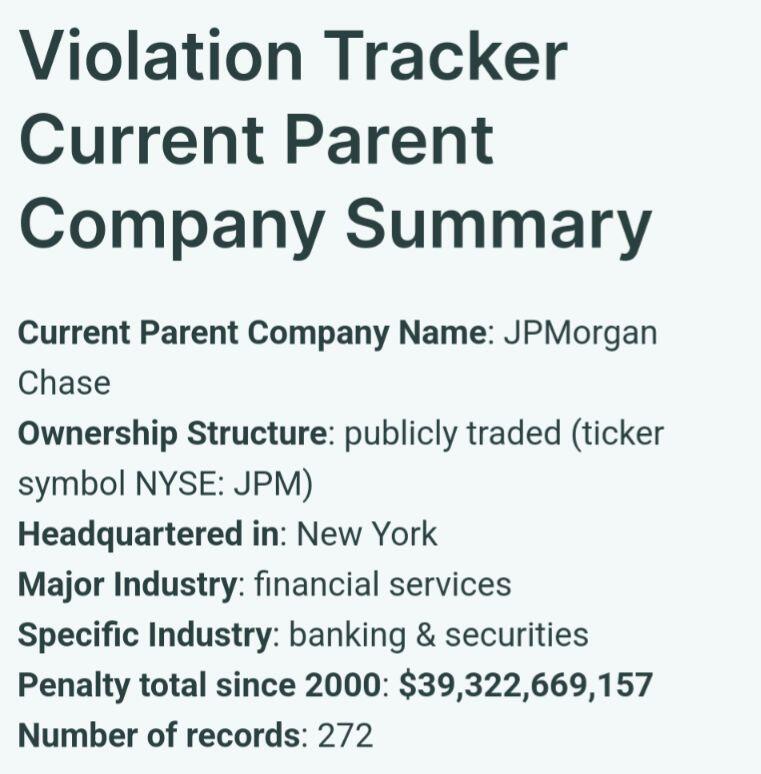

Jamie Dimon is a hypocrite. He constantly talks about Bitcoin being used for illicit activity, yet in reality, the USD is the preferred medium of exchange for such purposes.

The firm he leads, JP Morgan, has made countless headlines for the wrong reasons. Their track record in honesty and ethical behavior is a joke.

Don't trust the bankers. They have quite the business model:

✔️ Take on customer deposits.

✔️ Speculate and take excessive risks with the money to generate a profit.

✔️ Create money out of thin air in the form of loans to generate more profit.

✔️ If things don't work out, get bailed out by the central bank with taxpayer money.

In other words, they are in the business of nationalizing the losses and privatizing the gains.

Choose #Bitcoin.

#m=image%2Fjpeg&dim=761x774&blurhash=%7C4QJ%2BT00%7EqM%7B-%3B%25MxuxuxuIUt7%25MM%7BWBxuj%5BRjayD%25IU%25MjtWBxuRjofj%5Bx%5DIURjt7RjxuRjj%5Bof_3%25MIUWBofNGRjt7ofof%253t7M%7BofoeWBofRj%3FHofM%7BxuxuRjayj%5BWB9Fxut7IU%25MRjayofR*%25MWBM%7CWBM%7Bayofayae&x=84541773dff3245bdc71932d09b4fe703cf40e482ce3ef7e6070814d338e2520

#m=image%2Fjpeg&dim=761x774&blurhash=%7C4QJ%2BT00%7EqM%7B-%3B%25MxuxuxuIUt7%25MM%7BWBxuj%5BRjayD%25IU%25MjtWBxuRjofj%5Bx%5DIURjt7RjxuRjj%5Bof_3%25MIUWBofNGRjt7ofof%253t7M%7BofoeWBofRj%3FHofM%7BxuxuRjayj%5BWB9Fxut7IU%25MRjayofR*%25MWBM%7CWBM%7Bayofayae&x=84541773dff3245bdc71932d09b4fe703cf40e482ce3ef7e6070814d338e2520

#Fiat currencies are fundamentally flawed. Among these, the #USD is considered as the best of the worst, primarily due to its status as the world's reserve currency and its relative stability compared to others. Yet, its global dominance is a double-edged sword. The centralization of the world's monetary system, coupled with the extensive use and influence of the USD, has had a negative impact on global society and economies. It has contributed to widening the wealth gap and has constrained the growth of underdeveloped economies by exporting its monetary inflation.

#Bitcoin fixes this.

Not your keys, not your coins.

#Bitcoin self-custody and UTXO management are foundational principles.

They are the primary contributing factors to individual empowerment and freedom.

#Bitcoin is more than an investment asset.

#m=image%2Fjpeg&dim=1024x1024&blurhash=U7EB%7BQIp01k%3F0V%5D%7EwGx%5E0157%5E%24t7%7E94pR%3B%25J&x=ea9e683f86ea462abca5a50ff5c7af743ccd546164455685cfbe5d88a95f621e

#m=image%2Fjpeg&dim=1024x1024&blurhash=U7EB%7BQIp01k%3F0V%5D%7EwGx%5E0157%5E%24t7%7E94pR%3B%25J&x=ea9e683f86ea462abca5a50ff5c7af743ccd546164455685cfbe5d88a95f621e

"With great power comes great responsibility" - Uncle Ben.

He was talking about #Bitcoin self-custody.

The institutions are at the gate.

Some best practices:

1) Self-custody your #Bitcoin savings using a cold wallet.

2) Make sure your seed phrase is backed up properly.

3) Manage your UTXOs.

UTXO management will be increasingly important as more people adopt Bitcoin as a savings vehicle.

Take the time to learn about it. Message me if you need help or a walkthrough.

cointelegraph.com/news/spot-bitc…

WE the 99% + #Bitcoin > THEM the 1% + #USD

January 3, 2009 - Genesis. The Silent Revolution.

The Great Financial Crisis will be remembered as an inflection point where governments and central banks around the world became unhinged. They removed all restraint, manically exploiting their monopoly on money, much to the detriment of those they were elected to serve.

Trillions of dollars were conjured out of thin air to bail out banks that had recklessly gambled with customer deposits. This move erased the hard-earned savings of many, forcing others to bear an insurmountable debt burden, a legacy that will be left for future generations.

In the end, no one was held accountable. The bankers, meanwhile, amassed enormous bonuses.

The Occupy Wall Street and Tea Party movements symbolized attempts to counter the establishment, but ultimately, they fell short. Without an alternative system, overturning a broken one seemed impossible. Our dependence on it was clear. Our voices, merely echoes in the void. True change, it appeared, required concrete actions, like opting out of the existing system. Anything less seemed futile.

Here are some of the headlines from that era, etched in our collective memory:

"U.S. Government Unveils $700 Billion Bailout Plan to Rescue Banks" - The New York Times, September 20, 2008.

"Congress Approves Historic Financial Rescue Package" - USA Today, October 4, 2008.

"Citigroup Gets $45 Billion Bailout from U.S. Government" - Bloomberg, November 24, 2008.

"Bank of America Receives $25 Billion Bailout; Wells Fargo and JPMorgan Chase Also Benefit" - Los Angeles Times, October 14, 2008.

"AIG Bailout Hits $180 Billion: The Largest Ever" - CNN Money, November 10, 2008.

"Obama Administration Announces Additional $30 Billion for Bank Bailouts" - The Washington Post, February 10, 2009.

"Financial Giants in Crisis: Citigroup and Bank of America Struggle Despite Bailouts" - CNBC, March 2, 2009.

"Credit Crunch Spreads: European Banks Face Bailouts" - The Guardian, October 13, 2008.

"Federal Reserve Launches Plan to Buy Up Toxic Assets" - The Wall Street Journal, March 23, 2009.

"Crisis Deepens: U.S. Treasury Takes Stake in Major Banks" - Financial Times, October 14, 2008.

"European Union Launches Massive Bailout Plan for Banks" - The Guardian, October 13, 2008.

"Bailout Backlash: Public Outrage Grows Over Bank Rescues" - CNBC, October 21, 2008.

“Chancellor on Brink of Second Bailout for Banks" - The Times, January 3, 2009.

On January 3, 2009, a pivotal moment arrived. An anonymous individual or group, known as Satoshi Nakamoto, launched the #Bitcoin protocol. This marked the inception of a decentralized monetary system, immune to manipulation and political influence. Satoshi, through Bitcoin, provided the alternative we desperately needed.

Opting into this new system meant opting out of the old. They are mutually exclusive; as one gains traction, the other weakens. Today, on this genesis day, we remember and are grateful for the fighting chance we've been given. Thanks to Bitcoin, we finally stand a chance.

Study Bitcoin.

Don't be fooled.

Universal Basic Income over the long term only benefits those closest to the money printer, mainly high net worth individuals, large corporations and government institutions.

Why?

Let's use Canada as an example.

The population is currently around 38.25 million Canadians.

To keep this simple let's assume that each individual was to receive $2000 CAD in UBI per month.

That's a total of $78.5 billion CAD per month or $918 billion CAD per year.

As per the following annual financial report for the period 2021-2022, total revenue for the government of Canada was $413.3 billion CAD.

Without factoring any expenses and considering UBI as an add-on vs a replacement to welfare, the government would need to find another $504.7 billion CAD to pay for it.

Where would this money come from?

Deficit spending!

The government will issue bonds that will be monetized by the central bank. In layman terms, the central bank will buy these bonds from the government.

Where does the central bank get the money from?

It creates it out of thin air!

The central bank isn't a business, and as a result doesn't produce and sell anything. Their mandate is to oversee the monetary and banking system and to manage the supply of money within the system. Because of their monopoly on money, they also have the ability to create money.

What happens when the supply of money increases within the economy?

Assets, such as stocks, bonds, real estate, etc. go up in price. Why? When money is added to the system, the economy does not instantaneously create new goods to accommodate the surplus of dollars. More dollars are going after the same number of goods, and as a result the price of goods goes up. Those who own assets, usually the more privileged, will be better off in comparison to those that do not own assets.

To make things worse, newly created money does not reach everyone in the economy at the same time. Think of an empty cup that you pour honey into. The honey will concentrate in the middle before gradually making its way to the outer edges of the cup. New money is distributed within the economy in the same way. Those who are closer to the center, i.e. the central bank, will have access to new money earlier on. They have the assets and political connections that allow them to take out loans more easily and cheaply than the average salaried individual. They use the cheap money to buy more assets at pre-inflation prices. By the time the new money reaches the general population, the value of these assets has increased, making them unaffordable.

Over a long enough time horizon, UBI will only make life more expensive and unaffordable for the people it is supposedly trying to help.

UBI will amplify the debasement of the currency, wiping out the vast majority of the population's purchasing power.

#Bitcoin fixes this.

#m=image%2Fjpeg&dim=1024x1024&blurhash=UQDS%5D.Rj4nae_NWBIANGxuayS4Rjt7f5t7WB&x=6cf90c3d752c02eaf4383579a686770efe73de49eb585b3a979676bc5bead7cc

#m=image%2Fjpeg&dim=1024x1024&blurhash=UQDS%5D.Rj4nae_NWBIANGxuayS4Rjt7f5t7WB&x=6cf90c3d752c02eaf4383579a686770efe73de49eb585b3a979676bc5bead7cc

Intrinsic value is subjective.

Over half the world, either unbanked or under authoritarian / oppressive regimes, finds immense value in #Bitcoin.

It empowers them to be their own bank. It facilitates global transactions, and therefore enables prosperity over time.

In environments where censorship and confiscation regularly occur, Bitcoin, when properly stored, offers a solid defense against oppressive regimes.

For many facing persistent high inflation, Bitcoin isn’t just an alternative, it’s a necessity. Despite its volatility, it has consistently demonstrated long-term value preservation, unlike devaluing local currencies in such areas.

Precious metals are hard to transport, challenging to use for global commerce, and difficult for the average person to authenticate. Bitcoin is none of these things.

History shows us that gold can be confiscated. Storing large amounts of gold is risky and expensive, leading to reliance on third parties, and as a result, introduces counterparty risk. Look at Lebanon, where bank trust led to devastating losses. Those that held Bitcoin came out unscathed. Bitcoin removes counterparty risk from the equation and can be hidden in plain sight.

The use case is much more apparent outside of the west, but still applicable to it. For many around the globe, Bitcoin's value is not just theoretical. It's a practical, empowering tool, offering financial freedom and security.

What are you giving your loved ones this holiday?

#Bitcoin the gift that keeps on giving.

Whether awareness and education or Satoshis, it doesn't matter.

#m=image%2Fjpeg&dim=1024x1024&blurhash=UAF%7C-tTKH%5B%5BU%7Ds%3D_I%3AE104-6XREkR%25D%2CV%7BXm&x=f5cc021ca3511c81cd6bde20253f1665a8e6fb6a929ea45898f343a5e2242acf

#m=image%2Fjpeg&dim=1024x1024&blurhash=UAF%7C-tTKH%5B%5BU%7Ds%3D_I%3AE104-6XREkR%25D%2CV%7BXm&x=f5cc021ca3511c81cd6bde20253f1665a8e6fb6a929ea45898f343a5e2242acf