Thanks. I'm fully expecting it to be ignored, but important to get on the record nonetheless.

You also set out a plausible playbook for them. But I find certain things encouraging - not least that the more people learn about CBDCs, the more they hate them. The Bank can't create one without a change in primary legislation. We need to make sure MPs realize that if they vote for one, they'll be punished at ballot box. a

All they care about is keeping their seats.

Also we need to keep showing people where the lifeboats are, to make sure they have a means to transact even after CBDC imposition.

If you look back over previous #Bitcoin cycles, you find a lot of evidence that while history doesn't repeat, it definitely rhymes.

This time the waffle is 'tokenisation of RWAs'. We've had this before, with 'tomatoes on the blockchain' in 2017. Previously, we also had NFT mania, 'blockchain not bitcoin', metaverse tokens, AI tokens, you name it.

Sadly, 'the blockchain' seems to be THE most efficient vehicle ever for tokenising and selling absolute bullsh!t to unwitting investors.

All this will fall away, and in the end, at the start of the next cycle, #Bitcoin will still be standing, but likely knee-deep in the effluent from a cloaca of pitch decks, all attempting to sell you something, which you should studiously ignore.

Some examples of this madness:

https://www.coindesk.com/markets/2021/12/31/here-are-the-top-10-cryptocurrencies-of-2021/

https://inc42.com/features/2021-in-review-nft-mania-and-the-celebrities-that-caught-it/

The Bank of England is currently running ‘working groups’ on aspects of their #CBDC proposals.

Bitcoin Policy UK have submitted the paper in the link below, giving detailed feedback on our privacy concerns.

TLDR: While we remain opposed to the creation of a #CBDC in its entirety, our view is that the ‘least worst’ option would be a form of anonymous Chaumian e-cash, which no third party can monitor, control or censor - namely, a digital bearer equivalent to physical cash.

To quote Silkie Carlo of Big Brother Watch, “Anonymous, private, low threshold e-cash could have a future - but Western Countries like Britain won’t accept anything that looks like a ‘spycoin’.”

Key points from our paper:

1. We remain opposed in principle to the creation of a digital pound or CBDC, and our policy position is unchanged - that it is a solution in search of a problem; one that will serve no useful purpose not already served by existing forms of digital money.

2. The proposals to give ‘tiered’ access to the #CBDC in return for the surrender of more and more personal data should be abandoned.

3. These proposals effectively treat personal and transaction data as a form of currency themselves - the digital pound would become more useful the more personal data is surrendered by its users, who would pay for increased usability with the currency of their personal data. It is therefore an unfair and exclusionary model of money.

4. There is little to no sense in expending time, personnel, money and other resources in replicating a system that will be broadly identical to the modern system of commercial bank accounts, while having none of the advantages of the physical cash system. If a CBDC has to exist at all, then better privacy may be afforded by the implementation of Chaumian e-cash.

5. For the Bank’s CBDC truly to replace physical cash, or to offer a genuine digital alternative, it needs to mirror the key features of physical cash. These include being a bearer instrument, offering strong anonymity for transactions and ownership, (the former two characteristics being of particular relevance to this privacy consultation) and must also allow direct claims against the central bank by the public.

6. Without these characteristics, the CBDC is unlikely to be attractive enough to compete with existing digital payment options, leading to public mistrust, low adoption, high running costs, and eventually the failure of the entire enterprise - which is not an outcome with which we as an organisation would be disappointed.

#NoSpycoin #NoToCBDCs

Remember, it's never ‘time to gamble on Bitcoin', as you may have seen in the papers over the weekend.

🚨A health warning🚨! We’re going to see a lot of these headlines as the price spikes. Unfortunately, the price is almost always what attracts attention.

By all means, get curious. But I’d exhort you not to dive in because of price euphoria, without having read around the subject first, and understood a little more deeply what might be going on here.

I’m writing with the perspective of more than a decade in the space, and the more I have learned about Bitcoin, the more ignorant I feel and the more I realise how much I still have to learn. To steal a line from Newton, “I seem to have been only like a boy playing on the seashore, and diverting myself in now and then finding a smoother pebble or a prettier shell than ordinary, whilst the great ocean of truth lay all undiscovered before me.”

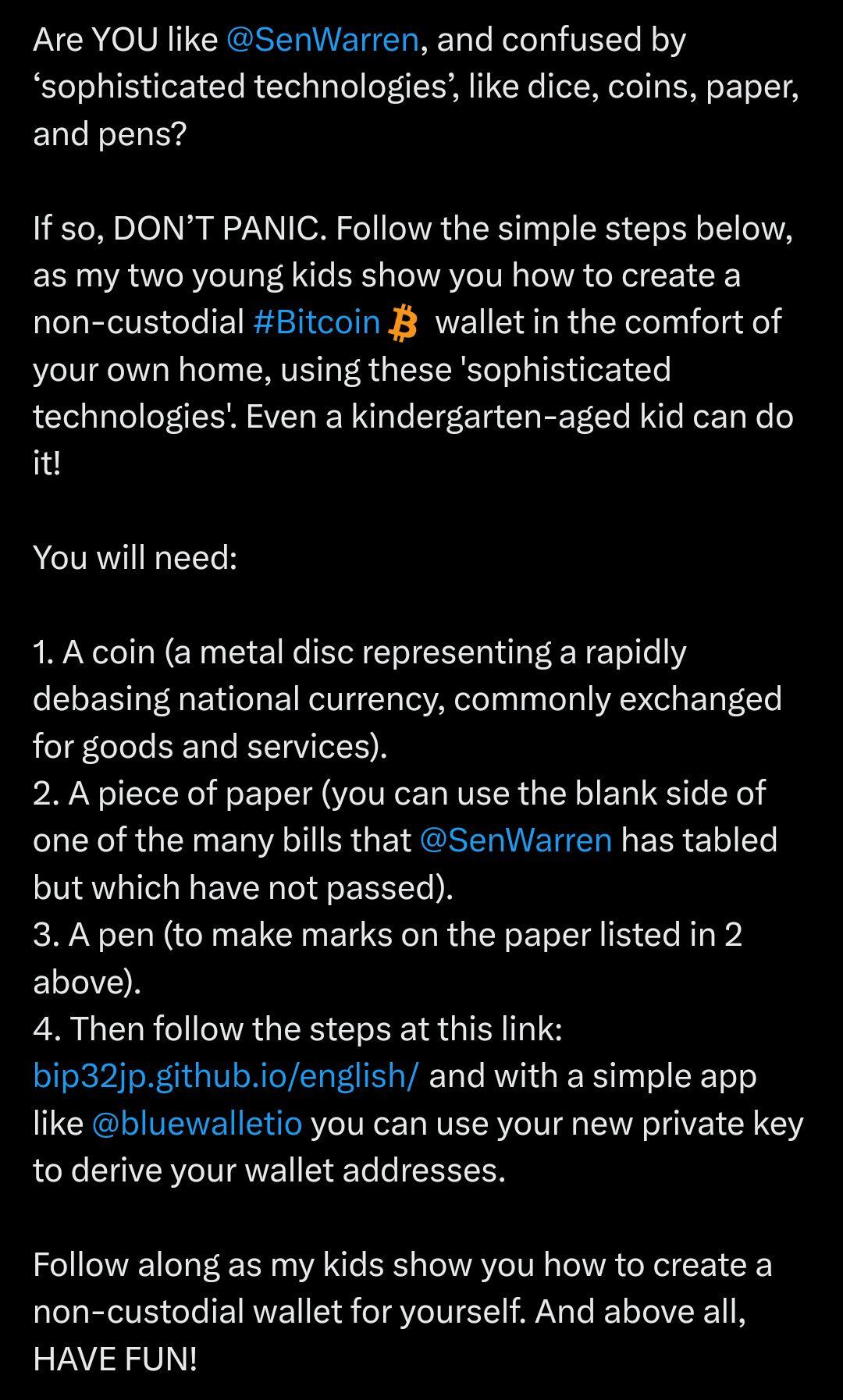

If you are beginning to discover Bitcoin for the first time, I can offer you only three pieces of advice with any certainty (and these are my firm opinions, not financial advice of any kind):

1. At some point, the Bitcoin price will drop.

2. When it does, there will be a flood of articles from journalists, from governments and from central banks, all declaring that Bitcoin is dead.

3. Bitcoin will not die.

It is the last of the above points that is the most important, and where I would suggest you begin your journey. It’s absolutely crucial to ask “Why won’t Bitcoin die?” and try to come up with a better answer than those bankers and journalists who have failed to provide a satisfactory response to this question over the past fifteen years.

It’s impossible to answer this question in a short Twitter post, so without going into the technical, social, financial, or game theoretical reasons why Bitcoin will not die, I’d like to leave you with just one breadcrumb at the start of this trail – ultimately, this isn’t about Bitcoin at all.

It is about a realisation that the financial system, and the way money is created, are gratuitously unfair, and that this unfairness is buried deep in the way that our systems operate, so deeply that it is barely visible and rarely thought about.

It is understanding that if you are not born into a vanishingly small percentile of the population, then the dice are loaded against you from the first day of your life, and that all your efforts to change your destiny by exchanging your time and your work for government-issued money will be undone, by the ability of governments and central banks to create that money from nothing, and to ensure that it flows to those closest to the point of creation – and not to you.

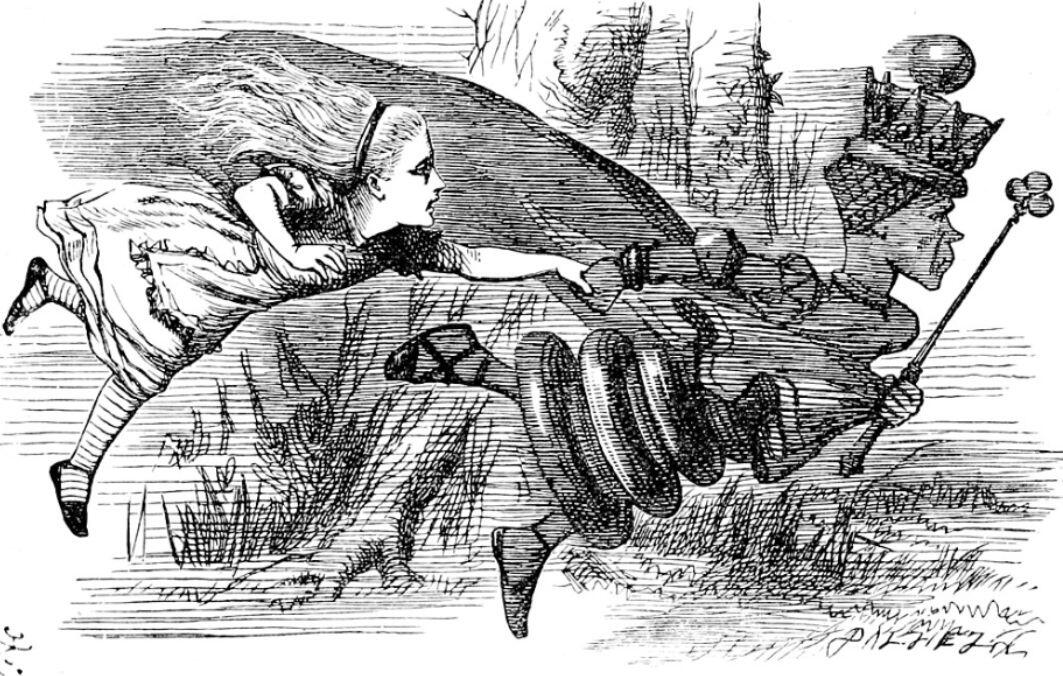

It is the realisation that your time, and your work, will be debased and diluted by the actions of governments and banks throughout your life, and like Alice Through the Looking Glass you will have to sprint alongside the Red Queen of the financial system for all of your days; sprinting just to stay in the same place, and ever at risk of falling behind.

Bitcoin is not a gamble. Its mere price will rise and fall. But its actual value is, strangely, not in itself but in what it represents, and in what it preserves – the value of human time, immune to manipulation and debasement. It represents something of yourself that cannot be taken away or diminished by a third party without your express consent.

Others have written far more eloquently about these ideas and I encourage you to seek them out. Then, when the price has fallen again, you may be able to decide if you want to let go of the Red Queen’s hand and choose another path through the Looking Glass world.

At that point, "It might make sense just to get some in case it catches on."

Imagine a company that began with no external funding of any kind, and which initially made no money at all. In fact, running this company would cost money, in the form of electricity bills. It has no marketing budget, no lobbyists, no highly paid consultants, and for a very long time its product has no market value. It is subjected to relentless and irrational attacks in the media, from politicians, and from those in banking and finance who begin to suspect that its product may disintermediate or replace them.

But it endures; and its product begins to monetise in real time, even in the face of this determined resistance, and without any external assistance aside from those who begin to believe in its thesis.

Bitcoin, of course, is not a company. But it has arisen from nothing, in the face of unified attacks from across the established world, and it continues to be attacked – fruitlessly – to this day. In some senses, we can say that Bitcoin actually needs these attacks in order to prove its thesis; that it is an unstoppable monetary and messaging network that no one can kill or shut down. If it were to crumble in the face of its opposition, then it would not be fit for purpose.

Bitcoin and the mythological Hydra have much in common. Slaying the Hydra was one of the Labours of Heracles, and one of the hardest; each time he cut off a head, three more grew in its place. He was able to triumph – or so he thought – with the help of his nephew Iolaus, who assisted him in burning the stumps and preventing new heads growing back. Heracles then dipped his arrows in the Hydra’s blood, and they remained a deadly, poisonous weapon during the rest of his life.

But the Hydra had the last laugh in the end. The centaur Nessus, felled by one of those poisoned arrows, begged Heracles’ wife Deianira to soak a robe in his blood as a ‘love potion’ and to give it to Heracles if ever his love wavered. When at last she put it on him, the Hydra’s venom ignited and devoured Heracles – the creature reached back out of the past and brought down the most powerful man of the ancient world.

Governments across the world have tried to ban or kill Bitcoin. So far, all have failed.

Central and commercial bankers mock Bitcoin daily. Each day that Bitcoin survives, producing new blocks and transferring value across the globe, they look more and more foolish.

We want Bitcoin’s enemies to understand that they cannot kill it, and they cannot turn it off. It is here, with us in the world, and it cannot now be uninvented.

And with this understanding, we want them to find a way to work with Bitcoin, not against it. To understand its many benefits, and to use them for all our interests, in our financial, energy and infrastructure systems.

They do not need to fight the Hydra and don the robe of Nessus – there is another way.

#m=image%2Fjpeg&dim=1078x1071&blurhash=%7CSG*s5s%2C%3FawcocxZt7ae%251_Lt6tkR*s.R%2BkBr%3Fj%5BE%2Bt7EMsmWBRkWXRkNHkCWVV%5BW%3BR%2Bs%3AWqNbRkS%24RkxFNHjZofxFt7V%5BofRks%2CWBM%7CxEj%40kVn%25W%3DxDofoyV%40WBWqWCX8kDWBoMxZnhj%5BoLo0oyoeNHS2WrWBkCWCj%5BoJ&x=aa086e5df25c632f9d9b06bd0b8ab7185c9cbe824038d5b8c1663692be0db4ec

#m=image%2Fjpeg&dim=1078x1071&blurhash=%7CSG*s5s%2C%3FawcocxZt7ae%251_Lt6tkR*s.R%2BkBr%3Fj%5BE%2Bt7EMsmWBRkWXRkNHkCWVV%5BW%3BR%2Bs%3AWqNbRkS%24RkxFNHjZofxFt7V%5BofRks%2CWBM%7CxEj%40kVn%25W%3DxDofoyV%40WBWqWCX8kDWBoMxZnhj%5BoLo0oyoeNHS2WrWBkCWCj%5BoJ&x=aa086e5df25c632f9d9b06bd0b8ab7185c9cbe824038d5b8c1663692be0db4ec

It's all thoroughly depressing, but your last point is on the nail. Once they work out how to make the gravy train continue by making money from Bitcoin, they'll be all in.

When I was a junior lawyer at a Big Law firm, my peers and I often used to wonder how the partners could treat us as they did. Sometimes, I’d arrive at the office on Monday, and not leave the building till Thursday, sleeping one or two hours a night on the floor under my desk, or not at all. We had people in our team fainting in the corridors, and falling downstairs from exhaustion, cracking ribs. Once, I worked for 48 hours without a break, and with no sleep at all. I would have done anything, and told anyone whatever they wanted to hear, if they'd just told me I could go to bed.

We used to think the partners couldn’t possibly treat us like this if they thought we were human; and of course, we were right. We were looking at the question entirely the wrong way round. To the partners, we were not human; we were revenue-generating assets with a fixed cost base (our salaries), and we generated that revenue with our time. So the more revenue they got us to generate over time, the better for them. Only once we came to this realisation did it all make sense.

In the same way, we tend to look at journalism the wrong way round. If we are labouring under the misconception that journalism is a search for truth, then articles like this from Jemima Kelly in the Financial Times can be hard to comprehend. But when we realise that journalism is, fundamentally, no longer a search for truth, but for attention, then it becomes much easier to understand. We have also been looking at this question the wrong way round. Jemima is certainly winning attention for the FT ; witness this post. QED!

Jemima does ask “Is it time for the likes of me to admit we were wrong” about #Bitcoin . Although you can probably guess my answer to this, I actually wanted to address her conclusion, which is that in relation to #Bitcoin, “there is still no there there.”

In her defence, Jemima has, like many of us, grown up in a world where digital scarcity is an oxymoron. Our whole lives, up to the invention of Bitcoin, have been filled with digital abundance, where anything digital can be endlessly replicated without cost. In such a world, it might be forgivable to think that everything digital or intangible behaves in the same way. Most intangible things do – if I send you an email, we both have the same copy, and other copies exist on servers across the internet. If I tell you an idea, we both have the same idea afterwards.

But Bitcoin is not like this.

If I have a Bitcoin, and send it to you, I cannot reverse that transaction, and I lose control of that Bitcoin forever. It cannot be replicated, and it cannot be copied. It is utterly unique, and in sending it, I have lost it.

This is a poor analogy, but Bitcoin can be thought of as an email I can only send once, and a copy of which I cannot retain once sent. It is an idea that vanishes forever from my mind once I tell it to someone else. It is the discovery of digital scarcity in a world of endlessly copiable digital abundance, and we have never seen anything like it before.

If your job, in any sense, involves the pursuit of truth and the exploration of new ideas, then you should seize the chance to explore and understand something like this with both hands. You should not let the chance slip away, or go on repeating the same facile points for more than a decade after the facts have proven you comprehensively and thoroughly wrong.

https://www.ft.com/content/c4fd2c69-c69a-49e4-9e93-d687aa801e87?sharetype=blocked

#m=image%2Fjpeg&dim=1080x664&blurhash=rAMbGYpJH%3Dx%5Eo%7EZ%7EyYMc%25h.TDNyEMws%3Ax%5ER3tnMdDi%25iIAtSf%2BROtSROt8%25NRjofWAj%3Foef%2Bo0bINGaJo%7EWAjFo%23emg4V%3F.9SiV%40ozWVjEX8nhbc&x=b48893738dcb8b98e462ca6881143c8b7ac4cac71195ddbca872dc317dc6f5bc

#m=image%2Fjpeg&dim=1080x664&blurhash=rAMbGYpJH%3Dx%5Eo%7EZ%7EyYMc%25h.TDNyEMws%3Ax%5ER3tnMdDi%25iIAtSf%2BROtSROt8%25NRjofWAj%3Foef%2Bo0bINGaJo%7EWAjFo%23emg4V%3F.9SiV%40ozWVjEX8nhbc&x=b48893738dcb8b98e462ca6881143c8b7ac4cac71195ddbca872dc317dc6f5bc

CALL TO ACTION!

@bitcoinpolicyuk have just submitted our consultation response to the European Securities and Markets Authority on the sustainability credentials of #Bitcoin mining. But now we need YOUR help.

ESMA and the EU are still labouring under the misapprehension that mining undermines our sustainability goals, when in fact the very opposite is true. Please read our submission at the link below, and feel free to quote from and use any of the research we have produced.

Please also read @DSBatten 's post below, and if you can, help out as follows:

Send a draft of 1-5 pages to

@jardemalie or @lyudakozlovska

using succinct objective language and evidence, by THIS FRIDAY 7 DEC or email lyudmylakozlovska@odfoundation.eu

In your submission, highlight:

- why and how Bitcoin can be a net-benefit to the environment

- point out that a framework which only evaluate only negative externalities of a technology is incomplete, unobjective/ unscientific

- DO NOT say "its energy use is justified because", "Other assets use more energy", or debate whether climate change is occurring or use language that personally attacks any one

- DO highlight that every technology initially has a carbon footprint, use evidence to show that emissions are not increasing and that there is a realistic chance Bitcoin can become the first industry to fully mitigate emissions without offsets, point out known limitations in current models, use your own examples of Bitcoin's positive environmental impact that are less well known.

THANK YOU in advance!

https://twitter.com/DSBatten/status/1731806907860758612?t=bmHU2dtEPrcHi9TKyf25WA&s=19

Bitcoin and Freedom - an article for the new and the curious

Are you waiting for the next block to be found or something?

Thank you, Satoshi.

True in 1958. Still true now.

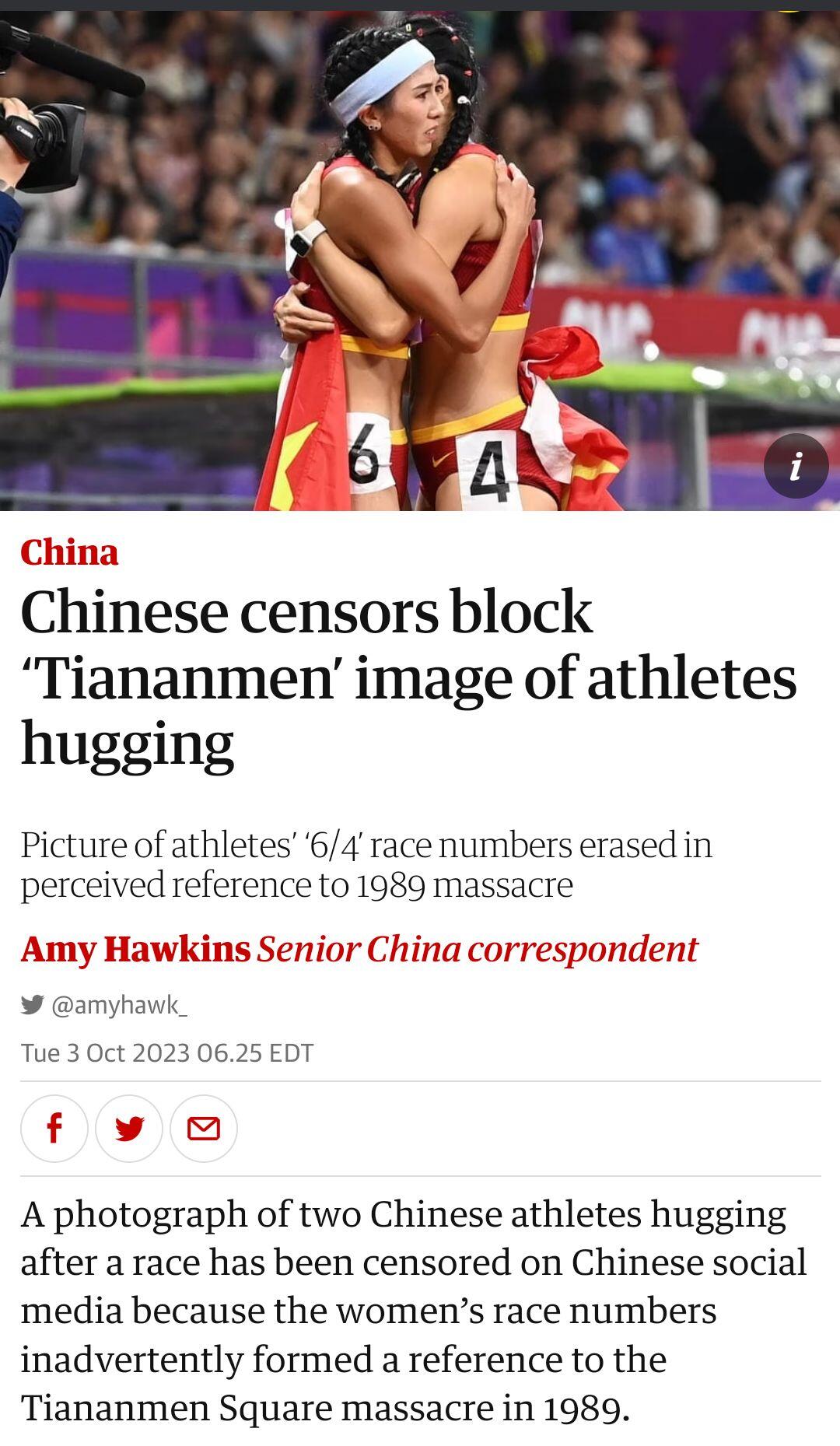

I hear Chinese censors are blocking the image below because of a potential link to the date of the Tiananmen Square massacre. Let's do our bit to help and keep an eye out for these pics so we can protect those sensitive CCP eyes!

I just set my VPN to Canada and I was able to visit the Telegraph no problem....

Not clear yet - I think from what I've read that this is a restriction on news that's shared on social media (if shared on Facebook, then Meta could have to pay CNBC. So Meta simply said - no news sharing). Result, everyone loses