BS

Monero is not money, its wannabe privacy token. Yet is has leaks and some users have been traced and arrested https://moneroleaks.xyz/

Lightning has comparable if not better privacy and is at least real money.

Monero isn't money because it had 15+ Hard Forks and changed its algos multiple times. It also had two chain reorg attacks, its near impossible to be audited and has indefinite inflation.

If your eyes and mind are closed for evidence and the truth then no one can present you any.

A key aspect of money is fungibility https://www.investopedia.com/terms/m/money.asp which Bitcoin lacks due to the bifurcation of "tainted" UTXOs and "clean" UTXOs. Tainted coins can't be used on any exchanges and many merchants won't take them. Gold, cash and monero are all fungible. Every Monero UTXO has no traceable history thus mamingnit as fungible as a gold atom. Privacy is crucial for money.

That is wrong. Bitcoin is fungible money. Bitcoin does not need third party. It is peer-to-peer Freedom Money and its fungible.

I have nothing against Jameson Slopp investing more in Monero. He can bring Ordinals, NFTs, jpegs, arbitrary data and much more to Monero and you can have a lot of fun there.

Looked through that link you sent. The ones pertaining to fee fingerprinting are resolved in every wallet I can think of. Most don't even permit custom fees.

For Edge wallet, yeah you share your private view key which links your transactions together. This is an identical privacy tradeoff to Electrum which is a ubiquitous light wallet server used on nearly every Bitcoin wallet. The difference is in Monero only Edge wallet uses it and its well known in the community and in that software the tradeoffs that need to be commited for the enhanced performance.

The main point in that site that is a genuine attack vector is poisoned outputs in the ring signature. See nostr:nprofile1qqsdzvcpujvlj2ymrzxwc2nx99gh0x75c3dsvp32xhdzvttg73xpmgspzpmhxue69uhkummnw3ezumt0d5hsz9thwden5te0wfjkccte9ejxzmt4wvhxjme08un5pz s attack of the poisoned outputs series for details on this and how to mitigate https://www.youtube.com/playlist?list=PLk4xsazIq6TZUKDScrxFjhajOKTlHknRx

In summary, any UTXO that came from an exchange should be sent to a private wallet then sent to a new address before spending to add another ring signature between the one with a poisoned output from the exchange. This largely defeats the problem.

There's a major cryptographic upgrade to ring signatures next year called FCMP++ (Full Chain Membership Proofs) which uses ALL past outputs as the anonymity set instead of the current 16. This makes any deanonymization attack via outputs IMPOSSIBLE.

Lightning has incomparable privacy. It relies entirely on network level privacy which is already highly susceptible to timing attacks due to the hub-and-spoke model. Monero has both strong on-chain and network level privacy. Even if Dandelion++ is broken and a transaction is traced to having originated from a particular node, sender, reciever and amount privacy is still preserved. With lightning if a similar, and arguably easier, timing attack is performed than the entire transaction is revealed including amounts, sender and reciever. This is fundamentally weaker privacy and there's no convincing argument or even scenario in which this is stronger. Take that back, if Edge wallet is malicious and you're using Edge wallet (the easiest least private Monero wallet) and comparing that with an LND node spun up on a VPS accessed over Tor, paid in Monero with a node opened up to a smaller onion only peer, with a coinjoined or non-KYC UTXO THEN in this case lightning is better. That's the beat Lightning case and worse Monero case. In ANY OTHER case Monero has vastly better privacy its not comparable. While also being easier to use than Lightning mind you.

I have said this before.

Privacy is not the top priority feature that makes the money real, hard and valuable.

Its a good feature but not the top priority.

Enjoy your Monero. I will enjoy my Bitcoin.

Yes I am stuck with Bitcoin Culture and Bitcoin Values.

They are the opposite of those of shitcoiners. The death spiral is the slavery of the shitcoiners, the shitcoin scams, the rug pulls, the web3 clownery and the rest of the cryptoshit casino gulag manipulations.

I will just expose your manipulations and your shitcoinery harder.

Monero is not money, its wannabe privacy token. Yet is has leaks and some users have been traced and arrested https://moneroleaks.xyz/

Lightning has comparable if not better privacy and is at least real money.

You can't convince me that Monero is money because it had 15+ Hard Forks and changed its algos multiple times. It also had two chain reorg attacks, it near impossible to be audited and has indefinite inflation.

As for Ethereum shitcoin? Its created out of thin air, centralized SLAVERY scam. The fact that fucking shitcoin is trying to integrate itself to Bitcoin does not make it better in any way.

Bitcoin is the One and Only Sovereign Freedom Money and that is exactly because my mind and my eyes are open.

Bitcoin is THE Global Most Secure Decentralized Unconfiscatable Peer-to-Peer Scarce Hard Sovereign Freedom Money, The Greatest Store of Value and The Strongest Hope for Humanity 🧡

look in the mirror, shitcoiner

What I Learned Running the Same Prompt Through 4 AIs 🤖

Spent time on the stationary bine today building an inflation model for Gen X retirement planning. Ran the identical prompt through Claude, ChatGPT, Gemini, and Kimi. Here's what I learned about how these models think differently.

The task: Build three inflation scenarios (base/bear/bull) for 2026-2045 with probability weights and multipliers showing what $100K today costs in 2040, 2045, 2060.

---

CLAUDE (my primary)

- Most conservative on Base Case at 3.2%

- Strong on structural reasoning: kept coming back to debt-to-GDP and Fed incentives

- Wanted to stay within "plausible bounds" - refused to model anything above 7% or below 1%

- Best at taking inputs from the other three models and synthesizing them into a coherent framework

- When I pushed back on assumptions, it adjusted thoughtfully rather than just agreeing

CHATGPT

- Most optimistic overall: Base Case only 2.4%, expected rate 2.64%

- Anchored heavily to Fed targets and professional forecaster surveys

- Provided the most citations and links to primary sources (Fed statements, BLS, CBO)

- Clean methodology explanation with all the math shown step by step

- Best at explaining the "official" view of how inflation is measured and why CPI works the way it does

GEMINI

- Most pessimistic: Bear Case at 5.3%, expected rate 3.47%

- Introduced "fiscal dominance" framing that became central to our final model

- Best articulation of why the downside risks are structural, not hypothetical

- Bear Case 2060 multiplier of 5.86x was the scariest number anyone produced

- Really good at stress-testing assumptions and explaining what could go wrong

KIMI (via Maple AI)

- Middle of the pack on the numbers themselves

- Introduced the "personal inflation premium" concept: add 1.75% to CPI for experienced inflation

- This was the most practical innovation of the day - it acknowledges the CPI gap without requiring us to build alternative indices

- Good at framing outputs for actual retirement planning use, not just academic analysis

---

WHERE THEY AGREED 🤝

- All used 50-55% for Base Case probability

- All put Bull Case at 20% (nobody believes the productivity miracle is likely)

- All structured piecewise rates (near-term higher, long-term normalizing)

- All acknowledged CPI understates lived experience but used it anyway for consistency

WHERE THEY DIVERGED 📊

Base Case rates:

- ChatGPT: 2.4% (optimistic)

- Kimi: 2.8%

- Gemini: 3.0%

- Claude: 3.2% (conservative)

Bear Case rates:

- ChatGPT: 4.0%

- Kimi: 4.5%

- Claude: 4.8%

- Gemini: 5.3% (most aggressive)

The spread on expected 2060 income needed (to match $100K today):

- ChatGPT: $248K

- Kimi: $291K

- Claude: $352K

- Gemini: $352K

---

WHAT I TOOK FROM THIS 🎯

1. Each AI has a personality, and it shows up in the numbers. ChatGPT trusts institutions and anchors to official forecasts.

Gemini is skeptical and looks for structural risks. Kimi focuses on practical application. Claude tries to find the middle ground. None of them is "wrong" - they're just approaching the same problem from different angles. Running all four gave me a much better sense of the reasonable range than any single model would have.

2. ChatGPT is best when you want the mainstream consensus view.

It cited Fed statements, CBO projections, and professional forecaster surveys. If you need to understand what the official position is, or you want your work to be defensible against institutional criticism, ChatGPT will give you that. The tradeoff is it may be too anchored to what authorities say rather than what's structurally likely.

3. Gemini is the one to use when you want your assumptions stress-tested.

It kept finding reasons why things could go wrong. The "fiscal dominance" framing - where the Fed loses independence because the government can't afford higher rates - was Gemini's contribution, and it became central to our Bear Case. If you're building something important, run it through Gemini and ask "what am I missing?"

4. Kimi surprised me with practical innovation.

The "personal inflation premium" idea - just add 1.75% to CPI rates for your personal planning - was simple and useful. It solved the whole "CPI doesn't match my experience" debate without requiring us to build alternative indices. Sometimes the best insights are frameworks, not numbers.

5. Claude is good at synthesis but needs to be pushed.

My initial Bear Case was 4.8%, which felt too tame after seeing Gemini's 5.3%. When I pushed back, Claude adjusted to 5.0% and explained why. The lesson: don't just accept the first output. The models get better when you engage with them critically.

6. The disagreement itself is valuable information.

When ChatGPT says 2.4% and Gemini says 3.0% for the Base Case, that 60 basis point spread tells you something about the uncertainty in the system. The "right" answer isn't splitting the difference - it's understanding why smart systems disagree and making a judgment call about which reasoning you find more compelling.

7. Probability weights matter more than point estimates.

All four models agreed that the Bear Case deserves 25-30% probability, not 10%. That's nearly one-in-three odds of a bad outcome. When you're planning for a 35-year retirement horizon, one-in-three odds of needing $550K instead of $300K to match today's $100K is not something you can ignore. The expected value masks this risk.

8. None of them pushed back on the premise.

I asked for inflation scenarios, and all four delivered inflation scenarios. None of them said "wait, maybe you should also consider deflation" or "have you thought about currency regime change?" The models are good at answering the question you ask, but they're not great at questioning whether you're asking the right question. That's still your job.

9. Running multiple models takes more time but builds more confidence.

This whole exercise took about 50 minutes of prompting, comparing, and synthesizing. I could have just used Claude and been done in 15 minutes. But I wouldn't have discovered the fiscal dominance framing, or the personal inflation premium concept, or understood why the mainstream view might be too optimistic. The extra time was worth it for a model I'll use repeatedly.

10. The final output is better than any single model produced.

Our consensus landed at 3.46% expected inflation with a 50/30/20 probability split. That's more conservative than ChatGPT, less alarmist than Gemini, and incorporates the best ideas from all four. The whole really is greater than the sum of the parts - but only if you do the synthesis work yourself.

---

THE CONSENSUS MODEL WE BUILT

After comparing all four, landed here:

Base Case (50%): 3.2% average

Bear Case (30%): 5.0% average

Bull Case (20%): 2.0% average

Expected: 3.46%

To maintain $100K purchasing power:

- 2040 (retirement at 65): $171K needed

- 2045 (age 70): $202K needed

- 2060 (age 85): $352K needed

The Bear Case is the wake-up call:

If things go wrong, you need $552K in 2060 to match what $100K buys today. That's 5.5x. Traditional retirement planning doesn't account for this.

---

Next step: plug these multipliers into a Bitcoin accumulation calculator. The question becomes: how much BTC does a Gen Xer need to clear the 3.5% real return hurdle for 35 years?

That's tomorrow's project. 😀👊🚴

#genx #inflation #bitcoin #retirement #ai

nostr:nevent1qqsgfqknycxs4qasdxyd8rmwx2sjaekmdr887upm6jc8n5tjm37t6kgfe36kg

Nice and very interesting. You can compare tomorrows results with some readily available bitcoin retirement calculators like

https://www.unchained.com/retirement-calculator

although the calculator just gives the options to choose your own (or some established) model and expectations.

Me too. Jameson Slopp is highly abusive to Bitcoin because of his exploitative, 0 moral, monetary incentive and the wide influence on high number of asleep NPCs who blindly trust his manipulations. His investment in Citrea directly aims at turning Bitcoin into Ethereum like shitcoin and his Casa happily works with Ethereum shitcoin. The worst part is that he openly promotes Ethereum which is a centralized slavery shitcoin created out of thin air and responsible for huge number of other shitcoins and scams. That makes him particularly evil.

In 2015 Greg was sane. Now he turned 180 degrees backwards towards insanity. Its a sad picture.

Fuck yeah 🤙

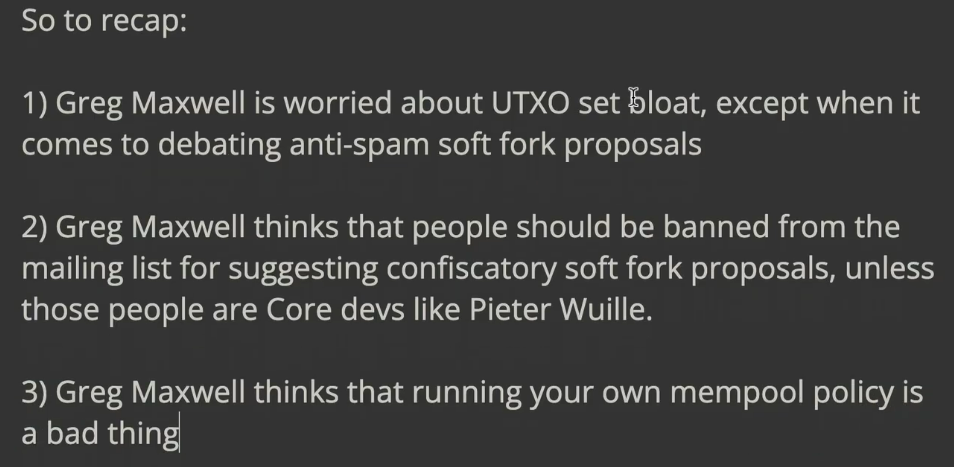

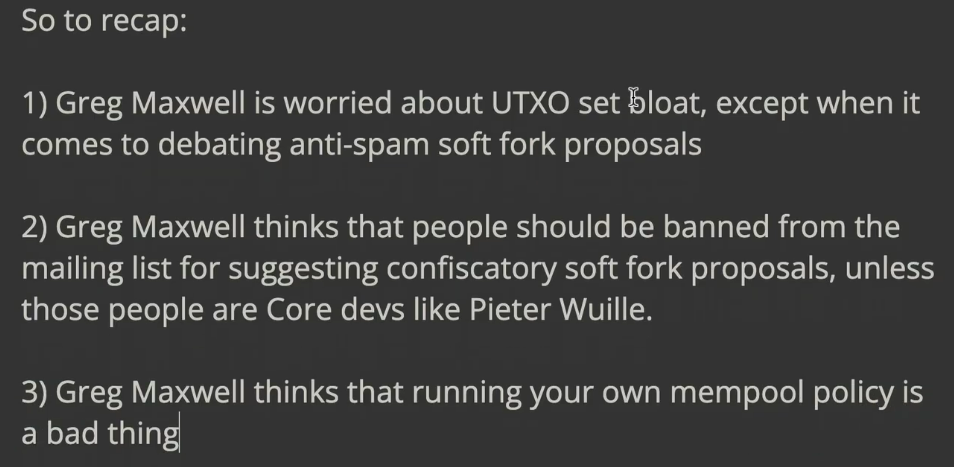

Matt gives evidence showing Gregs writings / words and actions for each of the conclusions which are all true.

Everyone who watches the video will realize what a pathetic liar and manipulator Jameson Slopp is.c

nostr:nevent1qqsyea2ad7r6sz64pkj6mq053ng08rkhncsmv8nh2c6a432uffgwthqmywck5

Matt gives evidence showing Gregs writings / words and actions for each of the conclusions which are all true.

Everyone who watches the video will realize what a pathetic liar and manipulator Jameson Slopp is.

You are an obvious liar and manipulator and that post is an evidence of your manipulations.

Luke's actions speak for themselves. He gives the complete freedom of choice to the Knots runners. DATUM and Ocean are the defacto solution of mining decentralization.

He has acted countless times in fovor of Bitcoin being Freedom Money.

You on the other hand are just a pathetic Ethereum shitcoiner, evil liar and manipulator and your actions speak too.

You are an obvious liar and manipulator and that post is an evidence of your manipulations.

Luke's actions speak for themselves. He gives the complete freedom of choice to the Knots runners. DATUM and Ocean are the defacto solution of mining decentralization.

He has acted countless times in fovor of Bitcoin being Freedom Money.

You on the other hand are just a pathetic Ethereum shitcoiner, evil liar and manipulator and your actions speak too.

Bitcoin is the most private property and the most sovereign asset on planet Earth.

https://video.twimg.com/amplify_video/2003454935535616004/vid/avc1/1426x794/F4YEsIBmc6H4XN12.mp4

Bitcoin is THE Global Most Secure Decentralized Unconfiscatable Peer-to-Peer Scarce Hard Sovereign Freedom Money, The Greatest Store of Value and The Strongest Hope for Humanity.

Are you part of the compromised Core devs cabal?

BCore CENSORED Bitcoin contributors on Github and on the Bitcoin Mailing List.

Majority of Core devs are compromised.

nostr:nevent1qqsfexev06eeyars69jfnvcnewec70azuzwvnfh30fcmxnsswaqp0lgjs49kj

and for their value, they will learn to demand hard money -> #Bitcoin