don’t concern myself with poors

sellers at the margin, soon there won’t be.

not enough supply to go around

reason why you have to use #bitcoin or #nostr or ecash or ai or the latest greatest thing is because the new tech stack is built around the individual.

only by experience and experiment can you learn

how bout “i am me”

it’s awesome here

pepperidge farm remembers when tipping was actually in return for service

“outperform” is not the correct framework.

to see this you just need to check MSTR/BTC pair.

but yet BTC/share continues to go up. accretion, not outperformance.

now, from an individual perspective, why you would buy shares instead of btc? most likely capital requirements or other hurdles to access spot btc (401k money eg)

whenever you need a boost just head over to nakamotoinstitute.org and chill til enlightenment

what just happened

nostr:note1qqqpxv7uez99282npmk9h3qxndp80dhk5a22ntlwgsq85fcv5tns9ccw7a

if they do who’s verifying that? easier to just sell it for #bitcoin !

ironically full circle for me.

$GME, the first time around, is what piqued my interest in #bitcoin

how could a mathematical certainty in open short interest be unwound in such a short time and through such questionable circumstances?

control.

own what they can’t control.

1 s/vB will eventually be a thing of the past but the real demand for block space is not there yet..

i would bet on it

“but what will be the purchasing power of $xxx over time??”

completely misses the point.

we are not collapsing into inflationary dollar values, we are collapsing into deflationary satoshi-denominated goods and services.

“inflation adjusted” is dead, long live “bitcoin denominated”

the difference is there is no pool of common resources that requires inputs/outputs.

all inputs go to superior economic technology in btc, and all outputs are less burdensome than this underlying (debt obligations, stock price, operating expenses).

sustained downturns in btc can be weathered by hitting the output valves rather than needing new input, so there is no traditional ponzi-like collapse like you would see in something like Luna (inputs to btc, outputs from btc to Terra peg support, no decrease in burden of obligations).

If saylor were promising a pegged stock ratio of btc or a fixed btc dividend or anything like this then yes, would be a ponzi.

instead, just financialization which few understand (including me!)

ecash is the future , might want to find out!

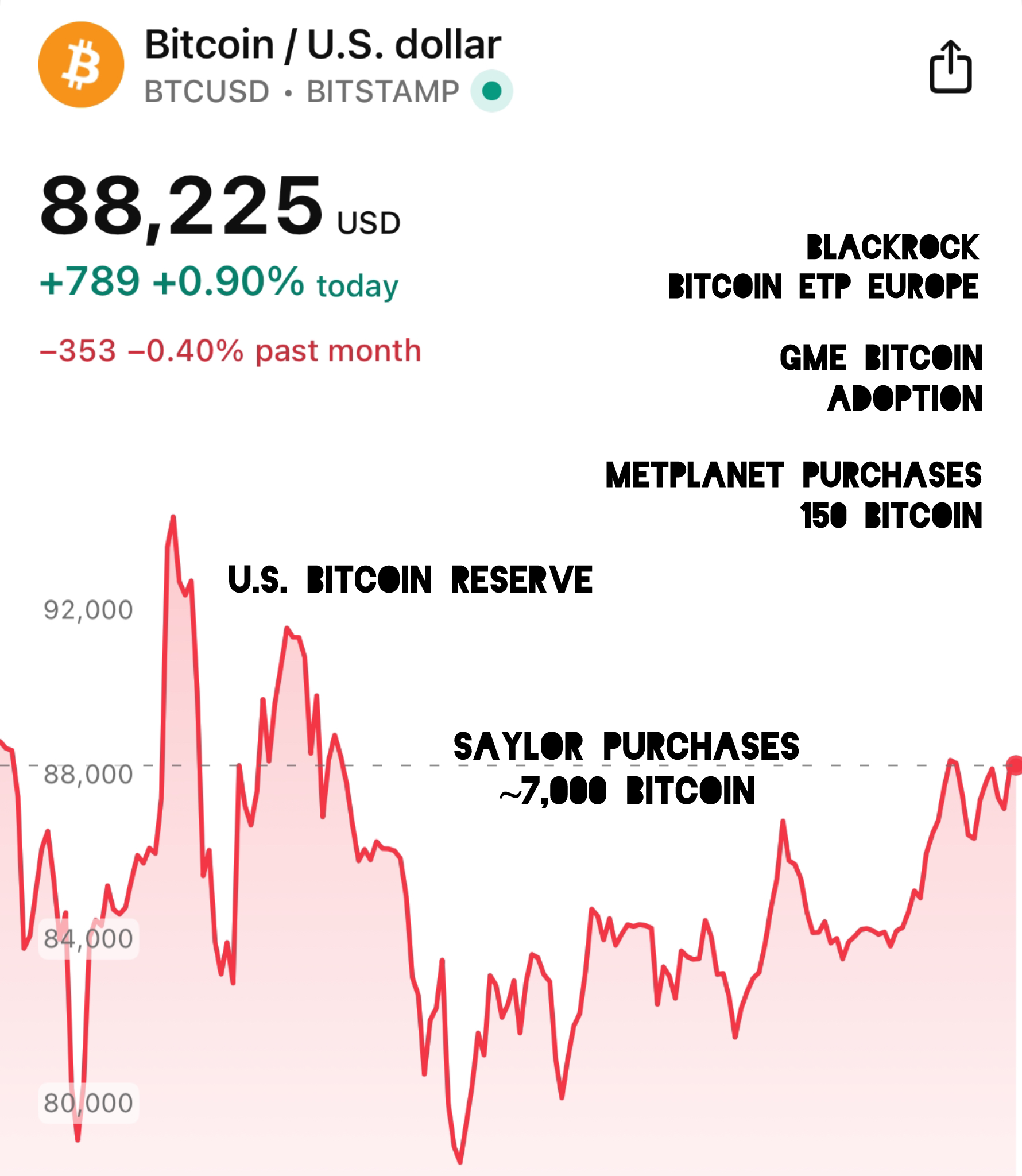

longs/shorts would indicate a solid base here at 88k

with momentum off recent news we could sustainably leg higher

#bitcoin