A couple things to consider here… #bitcoin was designed to be transparent, it’s a feature. While I 💯 agree that privacy in financial transactions is imperative for private citizens, if a money is going to take over the world economy/financial system then public entities and people in the public sector should not be afforded the same privacy.

If the most secure monetary layer (BTC L1) is the settlement layer and also the most transparent, then transactions of political and public interest can be and will be subject to review by all. This means corrupt politicians, governments, donors, banks, lobbyists etc can’t hide their bullshit anymore.

As for the private sector, there are L2 solutions that enhance/provide scalability and privacy for the everyday pleb transactions that should remain anonymous and private.

Everything has trade offs, you can’t create a neutral, global, digital monetary network intended to subvert the global currencies without considering everything. If an L1 public ledger is necessary to root out government, political, and financial corruption, and then adding a feature-rich L2 for smaller players is necessary for smaller/private transactions…so be it.

This is my perspective and opinion, I’m not saying #bitcoin from a technical standpoint is better inherently than #monero. I’m just considering the entire macro viewpoint of what it would look like for a sound money to infiltrate the world’s banking and geopolitical systems. To me, it looks more like L1 and L2 #bitcoin.

Yes, Roger Ver is a dubious character with dubious motives.

Indeed, #bitcoin has trade offs. Scale/scaling has been a fun buzzword for #btc critics for a long time now, I understand.

Definitely give “Softwar” a read and go from there 👀

Just curious here, have you read the book “Softwar” by Jason Lowery?

#bitcoin is an absolute unit on so many levels.

#monero has some awesome cryptography, no doubt. But #btc is simply going to consume the world.

“My eyes hurt.”

“That’s because you’ve never used them before.”

-The Matrix

👆 The moment when you are orange-pilled for the first time.

#bitcoin

At least he’s willing to ask the question…

#bitcoin only

Reasons to use Monero:

- #Monero in its technology is focused on privacy.

In a world that is increasingly being watched by #governments and #corporations (Big Techs),

it's good to have financial #privacy , while many want to invade your #financial life.

Unlike #Bitcoin, which is a pseudo-anonymous cryptocurrency with an open blockchain,

in the Monero system nobody knows how often you use it, spend it or have it.

In short, whether you're rich or not, nobody needs to know what you do with your Monero, because its blockchain is private.

- Low fees.

- Inflation always tends towards zero.

- Monero is fungible.

- Monero has no maximum supply.

- Easy to mine, any ordinary computer/mobile phone can mine Monero, resulting in more #decentralisation

, processing requirements are low, avoiding a market of miners.

- Easy to use, it's simple to use, everything works on the first layer, I recommend the Digital Wallet:

Cake Wallet

- Monero even after delisting on Exchanges

is still strong and active, showing that people continue to use it because they want PRIVACY.

- Monero has an award from the US government to be cracked and to date they have never succeeded.

- Monero is focused on privacy, not price like Bitcoin, and is more stable than fiat money and other cryptocurrencies.

Thanks for reading!

If you want to buy Monero you can contact me privately here on Nostr.

Donate to Support Me!

Donation link on crear net with any cryptocurrency:

Donation link on the Tor Network with any cryptocurrency:

If you want to #donate monero directly:

8Av5ivYx7zJ6aE5YXEHteYHb6b8tq5piM7QzZbFkduipdxrnfnpucwPVFqwM4RpDNnMiV2NGyi7U65EnRthMHpv171jZCPC

Sources: https://web.getmonero.org/

https://coinmarketcap.com/pt-br/currencies/monero/

Text originally published in Portuguese:

Can you explain how inflation would “tend” towards zero if there is no maximum supply? I’m asking in earnest.

Just remember folks, when the major currencies start to really free fall in purchasing power (and they will), no one in the world is going to seek protection in a ship coin. Especially globally.

#bitcoin will always dominate this demand for a sound, hard money. Nothing else.

Some people/governments will have to learn this the hard way. Protect yourself and your family.

#bitcoin wins in the end

Because the USD is the world reserve currency the US has been able to inflate the USD supply covertly much easier and longer as they are able to export their currency inflation to the rest of the world rather than just within their borders.

This is the only reason the Fed and US govt gets much more time before the currency noticeably inflates or hyper inflates. Not that it’s not going to happen, it will.

There are obviously many other nuances involved with sovereign debt, treasuries, etc. So this is a simplified response.

The same mechanisms of inflation are still involved, so eventually the hens will come home to roost when it comes to currency debasement. #bitcoin wins in the end.

How many of these Davos lizard people realize that their wealth/asset portfolios are actively and reliably getting, and going to continue to get demonetized by #bitcoin ? Maybe a couple?

It’s actually pretty sweet to think about…🤔

#bitcoin

Thing is, #bitcoin is a monetary network/protocol that can serve the interests of your friends, your enemies, your neighbors, governments, countries, large and small businesses, churches, yourself, endowments, pensions, so on etc.

Big players to small, #bitcoin cares not who participates in the network, so long as they don’t violate the rules.

So, while the plebs use it to speculate, or to protect purchasing power over time, or whatever else, massive and small governments alike are free to participate in any way they choose as well.

If the US government decides to stockpile #bitcoin , great. If they don’t, great. In the end, #bitcoin and any prudent user of #bitcoin wins either way.

#bitcoin

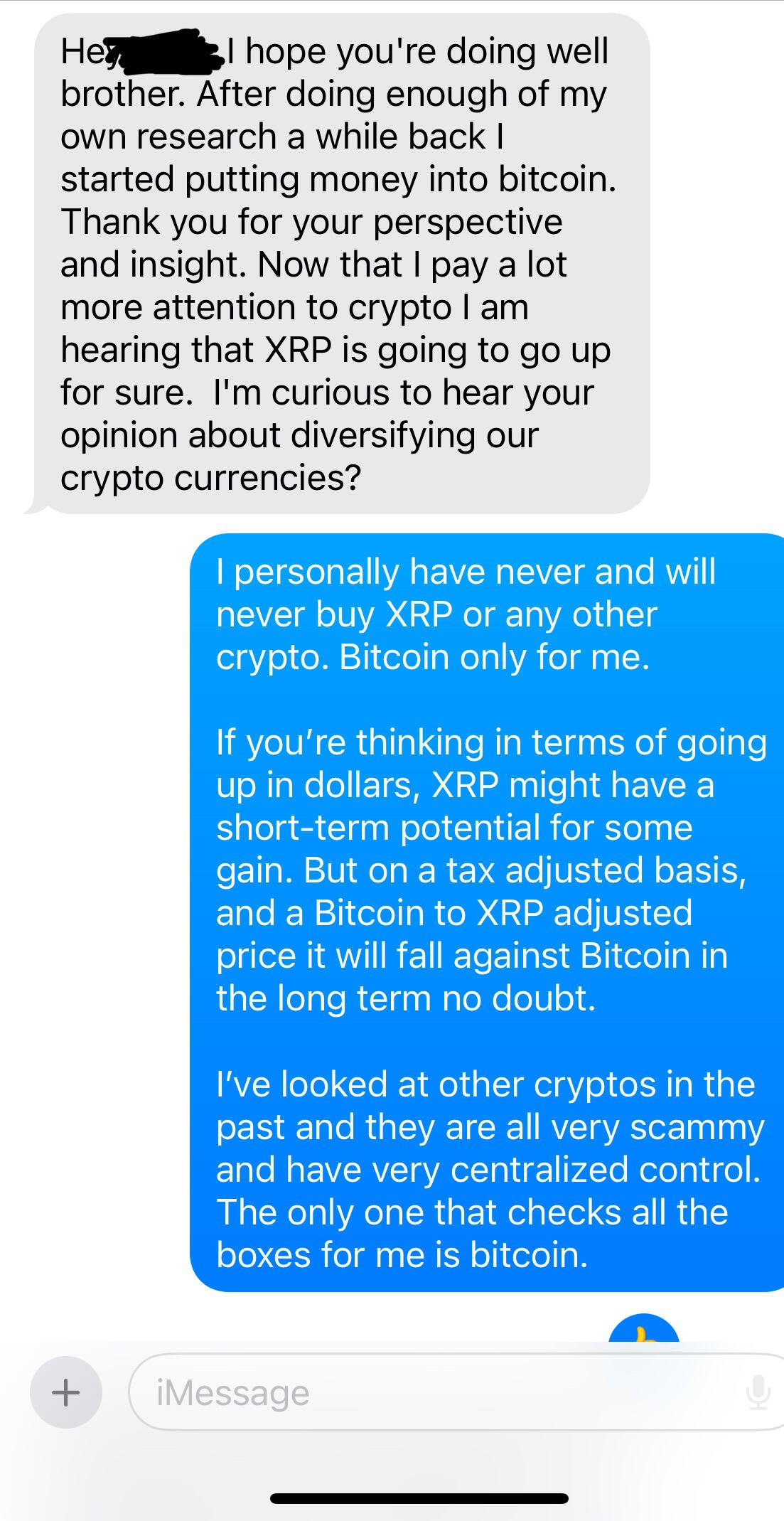

So Trump fucks about and doesn’t explicitly mention #bitcoin or a national SBR. Other than a new ATH, makes for a relatively underwhelming Inauguration Day for #bitcoiners in the U.S….and?

Who gaf? Keep your foot on the gas pedal and keep adding to your stack as aggressively as possible.

Nothing stops this train.

#bitcoin

Probably looking at how small his hands are.

It already feels like how many 1/10s of a #bitcoin one has will be the metric to consider for retirement, generational wealth, etc.

Ownership of a full #bitcoin will be legendary in the coming years/decades.

You should start doing 200 pull ups every day, too. You’d be a beast.

Remember folks, #sats can spoil if left at room temperature. Make sure they’re only warmed up if they’re zapped.

Otherwise keep them in the deep freeze.

Also, keep in mind that #sats get better with age if left in sub-zero temperatures for very long periods of time.

#bitcoin

The fiat money supply is a function of addition and multiplication, and is increased not to accommodate a growing economy, but rather almost exclusively because it a debt based monetary instrument.

Because there are no physical, technical, or mechanical constraints to the supply of fiat currency, its supply will perpetually increase due to the borrowing required as a result of its devaluation over time and the associated interest. It’s a complete doom loop.

#bitcoin is simply a function of division, as it is fixed in supply (constrained by the network rules). As an economy grows and requires a more precise coincidence of scales, the #btc unit is divided to accommodate the exchange of goods and services for #bitcoin.

As long as a monetary good is reasonably and easily divisible, any fixed quantity of that money can serve any economy of any size and complexity.

Hypothetically speaking:

If, somehow you lost your entire stack of #btc, however much that is, would you start all over building a new stack?

#asknostr

#bitcoin