Just wait until the end of the year.

nostr:note143yw8nsl2q256gwhfjhmsm7hn9u9staf2cadq249h9tfx4n6e50qamvud2

The fiat world thinks Bitcoiners are crazy conspiracy theorists, and we all know the fiat world is crazy not to see it.

same here. We have some local bitcoiners in my area looking to experiment with fedi.

The Fed thinks it will pay this off in 2027!! Imagine any business that operates in a loss that long!

“But what happens when its costs exceed its income? In this case, the Fed creates a “deferred asset,” which is a negative liability whose value is the cumulative value of the shortfall in earnings. Once the Fed returns to earning a positive net income, it will pay down the value of the deferred asset until it reaches zero, at which point the Fed will resume sending remittances to the Treasury. As of Nov. 8, 2023, the Fed had accumulated a deferred asset of $116.9 billion. In April 2023, the New York Fed estimated that the Fed will return to positive net income in 2025. Combining those New York Fed projections with the latest data on net income, we estimate that the Fed will carry this deferred asset until mid-2027, after which it will resume transfers to the Treasury.”

nostr:note15r63k8gvppywpuxyw87tqksacpms7faezy056jfjsnu5ht2ru67swcr3um

The Fed thinks it will pay this off in 2027!! Imagine any business that operates in a loss that long!

“But what happens when its costs exceed its income? In this case, the Fed creates a “deferred asset,” which is a negative liability whose value is the cumulative value of the shortfall in earnings. Once the Fed returns to earning a positive net income, it will pay down the value of the deferred asset until it reaches zero, at which point the Fed will resume sending remittances to the Treasury. As of Nov. 8, 2023, the Fed had accumulated a deferred asset of $116.9 billion. In April 2023, the New York Fed estimated that the Fed will return to positive net income in 2025. Combining those New York Fed projections with the latest data on net income, we estimate that the Fed will carry this deferred asset until mid-2027, after which it will resume transfers to the Treasury.”

This is pretty incredible

nostr:note1wrvaktqa4wm40y2wwmpp04vk8eaf2rprxdg7g89pcxqs0gef2cpss0mke5

Beauty is that you can/should and that should be encouraged. However, especially at certain amounts it’s going to be impossible at some point for the normie user to self custody due to fees and technical know how. Fees alone are already through the roof and this is just the beginning. So, what do you do when the cost of fees exceeds the amount you are putting into cold storage?

What’s your solution?

Fedimints and Cashu are how we win nostr:note1a4re397kyxzhvhkc5fy5wydxqlxwdwndeet4wh3ngskgclr39uhqzd6hvk

Fedimints and Cashu answer the scale question. If your grandma gets orange pilled, she’s going to have a tough time figuring out how to self-custody via a multisig solution. But “banks” make sense to her. Trust will build in local communities. Mass adoption will start trusting second and third parties.

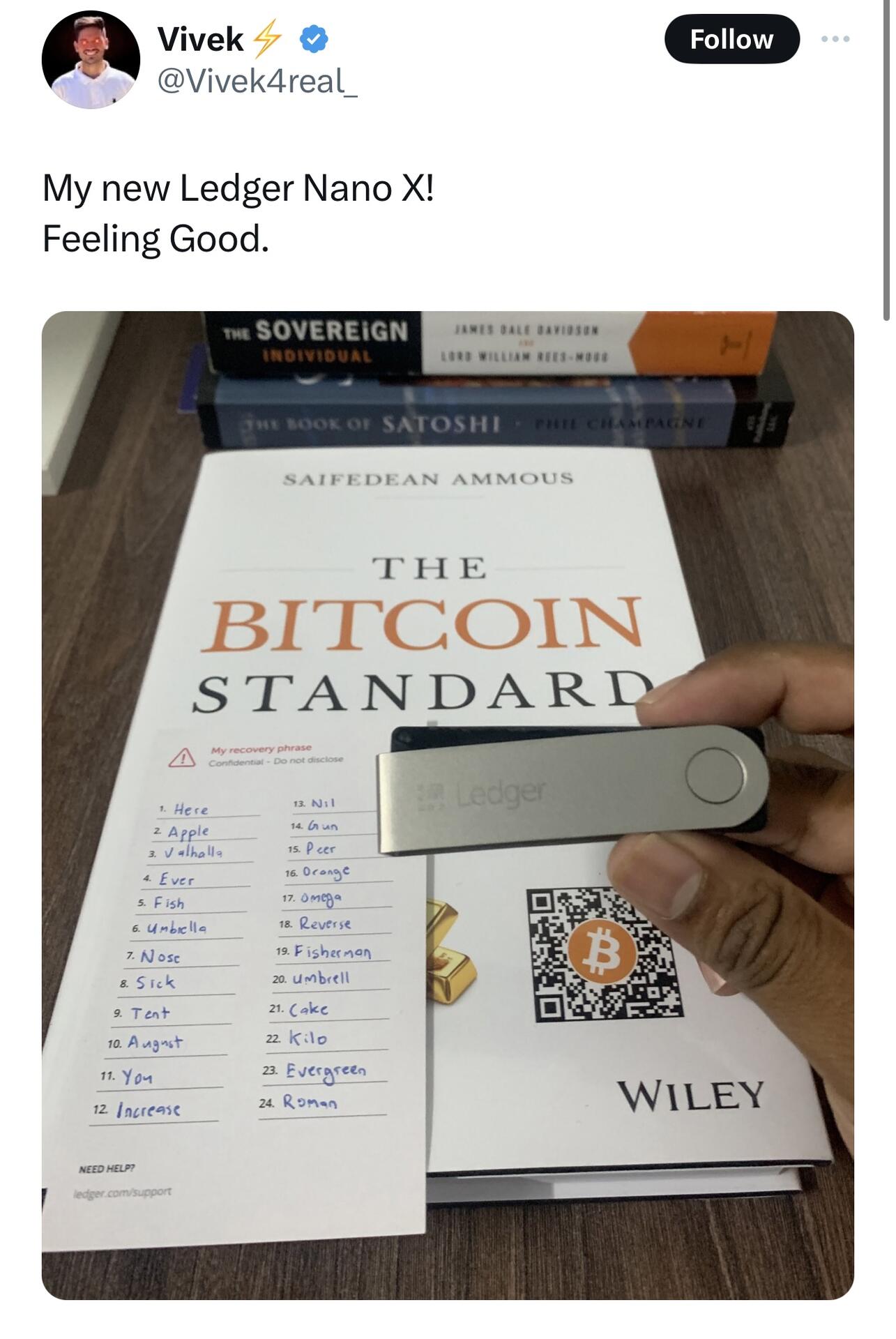

Old but good one! 🤣

#bitcoin

#securityfails

Face to face view of a tropical fish. Eyes are on the left and right.

I saw one of your tweets where you show how ecash implementation basically allows lightning nodes to receive funds with no channels or inbound liquidity. Is this already being implemented?

Couldnt this be a great way to scale custody for your everyday non-technical user? You could technically form a Bitcoin bank for your local community?

I think this exposes the need for us to work hard at L3 solutions (fedimint, cashu, liquid). Scaling custody with normies means we need solutions that uphold as much sovereignty as possible while promoting incredibly easy UX designs.

https://primal.net/e/note1ufx797hm3fg249gfryy9hag9fl4uu6csg5edvvluhge5zalc2smqnuxqgt

We're still way early. Bitcoin is super cheap.

https://primal.net/e/note10mv6jtj6ey4vfufr6qm9yahvtqx955kj2nsvmapqejg9grps229qj4cd5z

We're still way early. Governments have means, tricks, and power to kick the can down the road, but it will catch up. Bitcoin is still cheap.

This is why most hotel gyms stink. You are almost better off getting a day pass at a local gym. Many give these out for free.

Writing a fiction book based on what life might be like in 2065 with Bitcoin at hyperbitcoinization and a polarized world that either has chosen institutional slavery with universal basic income and those that have adopted a #bitcoin standard. Throw in a mix of espionage, innovation, space, treasure hunting, and uncovering the real identity of Satoshi Nakamoto. Would anyone be interested in works like that? #nostr

Lots of eggs and egg whites, whey isolate, chicken, tuna, and beef.

If I wanted to create a store on #nostr using #lightning #bitcoin, what would be the best way to do that?

#m=image%2Fjpeg&dim=1614x1133&alt=InkblotArt+&blurhash=r8B%7CE4%5E%2C%7ETM%7D%25pM%7C%3D%3ARkx-%5Ebt5%25hWCnyaeVraexn0UWBMyt6tUt7FfbYRP9ZWBX7ocV%40n%25WEjsR.%3Fuog-%25WBM%7DWC%251bIx%5EnxaxWCj%3Ft7oKx%5BodRj&x=e44bb943edd1091259a1b3da4461306ee722891b36334f884d4d3f3a5f52fbab

#m=image%2Fjpeg&dim=1614x1133&alt=InkblotArt+&blurhash=r8B%7CE4%5E%2C%7ETM%7D%25pM%7C%3D%3ARkx-%5Ebt5%25hWCnyaeVraexn0UWBMyt6tUt7FfbYRP9ZWBX7ocV%40n%25WEjsR.%3Fuog-%25WBM%7DWC%251bIx%5EnxaxWCj%3Ft7oKx%5BodRj&x=e44bb943edd1091259a1b3da4461306ee722891b36334f884d4d3f3a5f52fbab