https://blossom.primal.net/f14015aa738aafa4b564d2a3dbe2947c2069b1ae6f214319ea7b40dfa02cd2fd.mp4

If you are managing your stocks in Excel and have to copy and paste just to monitor your wealth.... this is for you...

Runy Calmera

Island Wealth

Thanks for the zap

Python, AI, Datacience, Global Macro Investing and economic analysis, Bitcoin #mpb #graduate #finance

https://www.youtube.com/watch?v=xh_0ljdCX7U

In today's Island Wealth Strategic Report you will get a summary of this video with Alasdair MacLeod below.

You can take this to your next Family Office meeting, with your wife or husband and your kids, where you discuss how the kids are going to manage your wealth in this Credit bubble we are in.

Nothing is financial advise, for educational and entertainment purposes only. I'm not your financial advisor. I only care about your wealth.

🧠 Strategic Economic Intelligence Report

Based on Alasdair Macleod – WTFinance Interview: “1929 Repeat As Credit Bubble Collapses”

📅 Date: July 28, 2025 | 🎙️ Duration: ~42 minutes

⸻

🔟 Top 10 Summary Insights

1. ⚠️ We are at the peak of a global credit bubble — unsustainable debt levels mirror 1929.

2. 📉 Bond yields rising = massive repricing of debt, crushing bond and equity valuations.

3. 🔁 Debt trap dynamics — higher interest payments lead to higher deficits, lower growth, and a vicious spiral.

4. 📉 Global recession already underway — small and mid-sized businesses are struggling, official stats are misleading.

5. 💸 Fiat currencies are rapidly devaluing — it’s not gold rising, it’s fiat collapsing.

6. 🏛️ Central banks are trapped — no room to cut interest rates in a stagflationary environment.

7. 🏚️ Property values will collapse in real terms — even luxury villas can become net liabilities.

8. ⚒️ Base and precious metals remain deeply undervalued (lowest since 1900 in gold terms).

9. 🧨 Crisis is inevitable — timeframe: within the next 18 months or sooner.

10. 🛡️ Preserving wealth is now more important than growing it. Get out of credit. Get into corporeal money (gold/silver).

⸻

📊 List of Economic Variables Mentioned

🔗 Variable Linkage Flow (Simplified Macro Chain)

Debt Levels ↑ → Bond Yields ↑ → Credit Cost ↑ → Business Defaults ↑ → Equity Prices ↓ → Confidence ↓ → Investment ↓ → Recession ↑ → Tax Revenue ↓ → Budget Deficit ↑ → Currency Confidence ↓ → Inflation ↑ → Fiat Value ↓ → Gold/Silver ↑ → Real Estate (Net Real Value) ↓ → Capital Flight ↑

💥 Risk & Opportunity Snapshot – Your Asset Overview

👨👩👧👦 Family Home Wealth Meeting – What to Discuss 🗣️

🛑 1. “Get Out of Credit”

— Move savings from banks, debt instruments, and leveraged property into assets with no counterparty risk.

🏡 2. Don’t Count on Real Estate

— Reassess long-term assumptions. High maintenance and low liquidity make it risky in currency collapse scenarios.

🪙 3. Increase Exposure to Physical Precious Metals

— This is the only historical store of value across systemic collapses.

🚫 4. Reconsider Crypto as a Hedge

— Bitcoin is not functioning as true money in this scenario. It’s speculative and power-dependent.

📉 5. Expect 18-Month Crunch Window

— Prepare liquidity buffers and escape routes (i.e. residency, backup plans, physical asset access).

🧠 6. Teach the Next Generation

— Introduce basic concepts of “real money vs. credit,” the history of fiat, and importance of independence.

💰 Capital Allocation Recommendation

🧠 Final Message from Alasdair (paraphrased)

“It’s not about growing your wealth anymore. It’s about protecting it.

Get out of credit. Get into real, physical money.”

🎯 TL;DR

Preserve > Grow.

Get out of debt-backed assets.

Gold is not going up — your money is going down.

Runy Calmera

Island Wealth

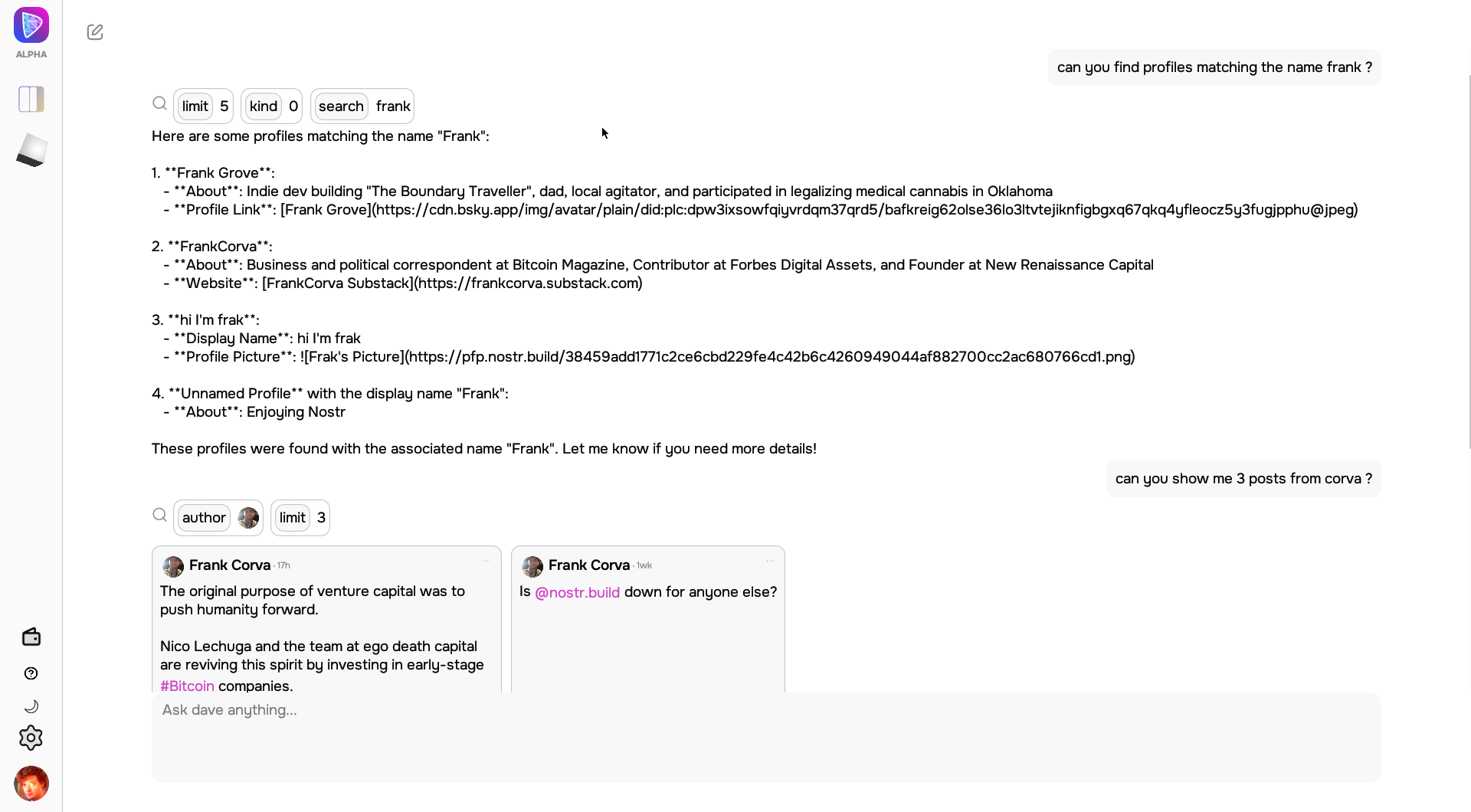

Where can we find more info about Dave? And how it works? Somebody I know wants to experiment with Dave with local llm

https://www.youtube.com/watch?v=gbFwKyDxRV4

Here I explain the Bitcoin24 model. You can use it like I did to:

- Calculate the impact of saving in Bitcoin for your family, your pension fund, your school, your business and

- your country/island.

- I have used it to show what would happen if Caribbean islands/countries like Curacao, Sint Maarten, Suriname and all the rest of the Caribbean adopt a Bitcoin Treasury Strategy, like Michael Saylor's Strategy did.

I will redo this exercise again and create a shorter 10 min video with the main parts. This one is long.

The sound will be improved and I will cut it to the basics.

Download the Bitcoin24 model from github for free, it is open source, and start making your own calculations.

Let me know below if you have any questions.

PS: what I did is I added my whole macro investment models to this spreadsheet. In these macro investment models for small island economies - and soon for the USA / China / BRICS+ countries - you can simulate the whole economy, discuss it based on facts and real data. You can change assumptions on how the economy will work, and you can discuss future scenarios.

So you know the impact.

No financial advise. For education purposes only.

Runy

Island Wealth

You should try Keet.io decentralized, unstoppable, peer to peer. Even more exclusive.

Hey is it possible to make this setup work with a raspberry pi 5? Then we can teach schools to convert solar power into Bitcoin.

She lives!!

This covert mining setup combines solar and battery power to mine Bitcoin in public 24 hours a day.

Guerilla Solo Mining, baby!

#introductions

https://video.nostr.build/69c3e0dd789ba15f12e10f1930d78f7cc9063cd4a3ce6dffc985460f5f433733.mp4

We need this in the Caribbean, in Curacao, where there is 8 hours of sun every day. Where can we buy this?

Imagine living in a world where the global reserve currency - the strongest fiat currency falls from 1 to 1 to 1 to 119.000 in just 15 years!!

In 2010 maybe, you had to pay just 1 usd for 1 Bitcoin and just 15 years later the value of the UD dollar has fallen to 119.000 times what it was in 2010.

Let that sink in.

How is that possible?

How can that happen?

What is happening with “value” in this world that this can happen?

All other fiat currencies are just connected to this US dollar, built on top of it, linked to it.

They all have fallen more. All public and private stocks, fixed income, are just derivatives of this US dollar, earning it, paying it as dividents, earnings in the future. All jobs are just ways to earn it, by trading time, 40 hours a week.

Since 1971 this world has gone crazy. It has decoupled from everything that represents value.

Since 1971 the fiat dollar has been delinked from gold.

And things have gone crazy.

While many of us go every day to our work, our businesses in chase of this US dollar, that has lost so much value, working in the rat race, chasing sales in US dollars that get devalued every day.

I want to be a millionaire, billionaire in US dollars seems such a foolish goal when you see it in this perspective. I want to get a raise of 5% this year, get that bonus of 50.000 usd.

Working for the USD, and all other fiat currency in the world. Woeking for aomething that is being debased with at least 7% per year.

Where can I contribute?

My role in life is to show you how the economic machine works. How an economic system works. The traditional one, based on fiat currencies, but maybe also a new one based on a fixed money supply of 21 million.

I use macro economic spreadsheet models to show you how economies work and what could happen in different scenarios.

I have created many small island macro economic models for Caribbean islands and use these tools in my strategic boardroom discussions with policy makers, fiat savers and investors. All online.

I have linked the Bitcoin24 model to my macro models to see the impact of saving/investing in Bitcoin on a national level. How small islands can increase their wealth. Get out of fiat debt.

My next models will be for the USA economy and for the BRICS economies, starting with China. I will create these models in an online experience. And use them. You can join this journey.

Because I want to be able to explain to you with numbers, historical trends, future forecasts and scenarios how this is going to play out, globally.

If you want to join these strategic discussions, want to learn more and want to understand how economic systems work to produce charts like above, DM me or give me a like, a comment with your questions and observations or a zap below.

Runy

Island Wealth

Your time giving it energy, only reinforces it.

Can you please consider writing another book from the perspective of the other system?

You are already there! Most people are not. For instance I sent out a proposal last week to a client and for the first time I put a column next to the US dollar amounts. And I calculated the BTC earned for each item in the proposal.

It looked like something shifted in me. This is the value I deliver and this is the amount of BTC I earn.

The fiat dollars suddenly did not matter any more to me. Digits. Only digits that don’t actually mean anything.

After the Price of Tomorrow I feel there is another book. Probably only you can write it.

But if you don’t have the time, I will try to walk into that other system myself and write what I see and come back

nostr:nprofile1qqsg86qcm7lve6jkkr64z4mt8lfe57jsu8vpty6r2qpk37sgtnxevjcpr4mhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet5qy2hwumn8ghj7mn0wd68yetvd96x2uewdaexwlqj9n7 this man is living inside the other system. Just like you told me, think outside the Fiat system.

We should empower this man and bring him to Nostr if he isn’t already here.

Great storytelling, a lot of emotions. You feel it completely and I stood in his shoes for 15 minutes.

https://youtu.be/q2oIbYSFEa8?si=pTtuTqJZod_UYUTU

This gives me HOPE!!!!

Jack at his best!!!!

Unless someone is setting out to be a professional author (very hard), nobody should write a book to make money.

When I set out to write Broken Money, it was because I *had* to, not because I wanted to. Spending a thousand hours on something that I get a profit of $5/copy for is not my best use of time.

Any time I spent on my research business revenue generation content, or leaning harder into my venture capital partnerships, would have been better on an hourly ROI basis. I have to sell 40 books to equal each newsletter subscription on my website; clearly the latter is better financially.

Almost regardless of how many copies I sell, it's a bad ROI for me. I'm overworked and the fact that I wrote a book while maintaining my existing business stressed my relationship and social life. And further, I am reinvesting most of my initial profits; the first 1,000 copy profits go to the Human Rights Foundation Bitcoin Development Fund, and the next 4,000 copy profits will go towards making a video about money and why it's broken.

And all of it was worth it. When a creator has something in their head, it's painful until they get it out into the world. I wrote this for bad ROI but because I wanted it to be out there for people to read, period.

Will I make a profit? Yes. But at a much lower hourly rate than I make on other work I do. It's a negative profit compared to having reinvested that thousand hours into my other existing work. But I consider it to be more important, which is why I spent the time.

I wrote Broken Money because I had to. The book concept formed in my head after many years of writing and research regarding money, and it would have been increasingly distracting to *not* write it. I didn't realistically have a choice. I felt compelled to write it. Part of it was altruistic; I wanted people to learn from my total monetary framework thoughts over five years of research. Part of it was egotistical; I wanted to timestamp something in the world, in physical form, and put it out there. Maybe it's the low time preference part of me; I'd like something of me to be mentionable to people in the distant future who look back at this time.

My background has been a blend of engineering and finance, with both ironically pointed toward bitcoin.

I don't care where you buy it from, and you can pirate it if you want, but it benefits bitcoin and nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak if you buy it from his website. Circular economy rather than big fiat business. We've introduced a special edition hardcover with a cloth cover and dust jacket for those that prefer that premium format, only on his website. And you can buy it in fiat or sats.

https://academy.saifedean.com/product/broken-money-hardcover/

You gave 1000 hours of your time you will never get back. But you will get the blessings of the1000.000 prayers back of the lives you impacted.

My 1 prayer is one of them for sure.

⚡️👀🎶 WATCH - Coding music. It's the first time I've seen it.

https://blossom.primal.net/9ab174c0d49cdd1cb82c6e7edab79247e73ee3bb3f70975f966447c7f08d4924.mp4

This is awesome! What is the program you are using? What is your github?

If you want beaches, culture, music, nice food, relaxing Curaçao is a great place to live.

MKStack is the fastest way to start building a #Nostr app with #AI that immediately works, connects to real relays, and follows the protocol standards — all in one shot.

nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j teamed up with Soapbox to put together this step-by-step tutorial of how to get started #vibecoding with MKStack.

MKStack is the fastest way to start building a #Nostr app with #AI that immediately works, connects to real relays, and follows the protocol standards — all in one shot.

nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq37amnwvaz7tmwdaehgu3dwfjkccte9ejx2un9ddex7umn9ekk2tcqyqlhwrt96wnkf2w9edgr4cfruchvwkv26q6asdhz4qg08pm6w3djg3c8m4j teamed up with Soapbox to put together this step-by-step tutorial of how to get started #vibecoding with MKStack.

How can we create a similar stack for Pears? See docs at docs.pears.com.

This is also a p2p software stack for unstoppable decentralized software development.

bitcoin x ecash

tap to pay – between two different cashu wallets

our money is better because it's open source

https://blossom.primal.net/c0fac8262f7b9c877624bad1119dc385e35be133521b7a63e0895888eaa0c27e.mp4

What apps are these? Available on iphone?

📛 Did you know that you can sell Nostr badges on Geyser?

Badges are a great way to create community through online membership, and a great way to empower creators to monetize from their work.

For example, nostr:nprofile1qyvhwumn8ghj76rfwejhgctvdvhxummnw3erztnrdakszrnhwden5te0dehhxtnvdakz7qpqz0lcg9p2v5nzg5fycxq0k56ze6snp42clmrafzqpn5w6u74v5x9qp804wm 's badges are helping them rebuild communication on Bitcoin rails.

Get them here👇

Can you show you own a badge on Nostr?