GN.

Apparently this is my expression on every #Zoom call. #work https://cdn.nostrcheck.me/8933d4e5f9880cdb78ed59e32d3a8b9cd7d55ca6e98bfd2c9ff81c49e895599b/a82db6ea57fdf91b8488b4050b97e152c48f602b96f94cca8d9d33f366b32ce3.webp

Of course the price had to drop after I bought it at $103,000. Gah!

Wahooo!! My boy got a shut-out in today’s #hockey game!

Thanks. I was more thinking about multiple wallets for each family member. Say kids.

Whats the best way to submit bugs for the Bull Wallet? nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqydhwumn8ghj7mn0wd68yttsw43zuum9d45hxmmv9ejx2asqyqlnlaadkwg4n3pvp2sk657qfqalh7k40hez4857jdj2xpn5r6ev7t32q08 nostr:nprofile1qqsq8fh9p03z8ka5nc5zwepc3ahje2yzd6hgckjz025zhvdkregates2dt4n5

Are there any plans, or are there options, to have multiple on-chain wallets in the app. Say 2 on-chain wallets. Or two liquid wallets. Just thinking about multiple individuals under one wallet.

We finally have a homepage for all the bitcoin initiatives going on across Block Inc.

There's no company in the world doing more for bitcoin, so it's amazing to now see it all here in one place: https://block.xyz/bitcoin

Now I want a Proto Rig.....

Speaking with my friend last night. It still boggles my mind how insane the banking system is getting. The fact that the bank in the EU can deny your request for €1500 cash for rent, and hound you on why you need the cash in the first place is crazy. I know it's happening everywhere, but their limit of €500 / day is crazy. They push you to send money electronically without limit, but cash. Forget about it. Let's make you feel like a criminal for wanting your own money. Let's prevent people from holding any form of cash. All because they want people to forget about the paper currency and move towards #CBDC.

But I think it's starting to slowly have the opposite effect. People are getting mad and looking at how they can spend their money differently. Something not controlled by the bankers and government. I'm hoping it sticks. And I'm hoping that more people start making a circular economy with #Bitcoin.

GM.

Tired. Me last night…

Well. Just finished an Amatsu Therapy session and I think I managed to convert her to #Bitcoin. Not only did I get my back fixed, but got her setup with nostr:npub18ull0tdnj9vugtq259k48szg80al44ta7g4fa85nvj3svaq7kt8s9udcl9 Wallet and sent her a $50 tip to get her started. It all began from our conversation about EU CBDC's and how messed the banking system is in Europe.

Hopefully it sticks and she embraces it. One more person / business that might start accepting bitcoin.

LOL sorry, not sorry. nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqydhwumn8ghj7mn0wd68yttsw43zuum9d45hxmmv9ejx2asqyqlnlaadkwg4n3pvp2sk657qfqalh7k40hez4857jdj2xpn5r6ev7t32q08 Wallet tutorial clocking in around the same length as a 90s action movie. Drops later today, keep your eyes peeled!

Looking forward to it

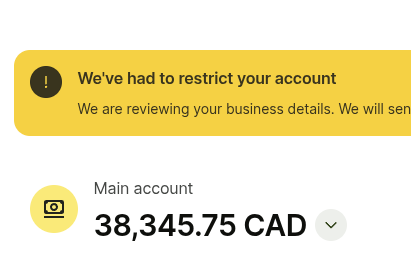

Sorry buddy. Hope this gets sorted out soon. To bad there isn’t an easy way to run a business on a BTC standard but be able to pay through normal payment rails.

This has to be happening more often than not, for it to get a news segment.

https://youtu.be/Zgyw0VH9-y8?si=vc5oiH-xMETCMhdA

#debanking

Question. Does that mean the coldcard Q can sign L-BTC transactions as well? Within the Bull Wallet?

Really looking forward to what hardware wallets will be supported by the Bull Wallet by nostr:nprofile1qqsr70lh4keezkwy9s92zm2ncpyrh7l6647ly257n6fkfgcxws0t9ncpzemhxue69uhhyetvv9ujumn0wd68ytnfdenx7qg5waehxw309ahx7um5wghx77r5wghxgetkpn4wxk And it’s nice to see another wallet that supports on-chain and liquid BTC.

Hmm. Interesting name for the new #iphone.

So true… #Microsoft #Teams