Building a solar Mars rover. It occurs to me he could actually do this for his job one day

Dr., put a smile on that laser eye pic! You’ll be everyone’s friend, at least that’s what grandma said.

My 5 yo drew this at Kinder and told me it’s a Pokémon. Boys, I have questions. nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z orange pilled me in early 2020 via his podcast. I have orange pilled a couple of people since. I wonder what the web of progress will look like in a few years.

I was talking to one friend I had orange pilled about listening to Preston’s show. He said “Preston has a show?” We figured out that he knows a guy locally named Preston who is big into BTC who had also been orange pilling him. He had always just assumed I knew his buddy. Lol!

Excited for this cohort to go through the next few quarters. Hopefully they will pass the torch.

Congratulations Peter!

Get some!

Did yall check out Horizon? Similarly well regarded but I struggled through. Beautifully filmed. Story was hard to follow.

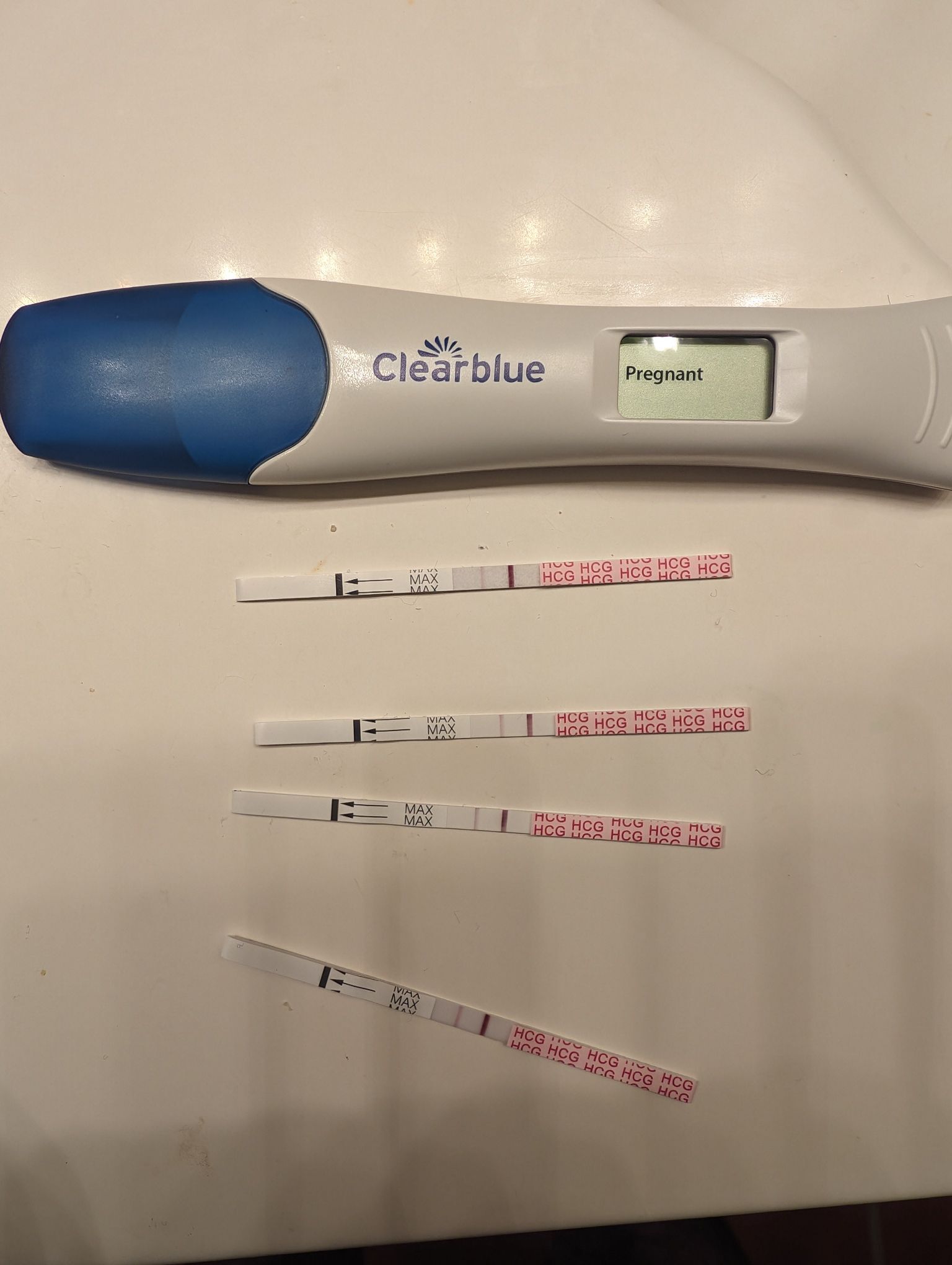

I am going become a Dad! What an incredible feeling 💜

We only had one test remaining. She said she was experiencing period pain and that it would likely yield another negative result. So, I already fell asleep when she woke me up to ask if I could help her read the test. I wasn't fully awake yet so my mind wasn't processing much. I got out of bed to look at the test results, seeing two lines with one being very faint. That still counts as positive result. Not wanting to get my hopes too high, we drove to Walgreens at 2am and purchased more tests. Did we take enough tests? 😂 All of them came back positive. Tears of joy. I'm going to become a Dad! What an incredible feeling it is.

I listened to this podcast recently. Fiat foods really are killing us. Woman with irregular periods this is worth a listen.

https://v.nostr.build/nqhu7JtuNnUdX83E.mp4

Rest of the podcast 👇

https://pdst.fm/e/pscrb.fm/rss/p/traffic.megaphone.fm/RSV9236573124.mp3?updated=1723995635

Congratulations brother! What a feeling! No better than in the world.

Kids asleep. Some evening study.