No algorithms and censorship free.

Great pic and Happy Birthday to Julian!

Hash price has rarely been this low. Within 10% of an ATL. Generally a good indication that the bitcoin price is near a bottom.

#Bitcoin

#HODL

#Patience

Haven’t seen the Fear Greed Index this low since 9/11/23 when bitcoin was in the mid $20ks.

Likely near a bottom.

Have not seen this Fear Greed index this low since 9/11/23, when bitcoin was in the mid $20ks.

#HODL

#Bitcoin

Stay away from Dick Van Dyke though, an American legend.

The thing is, in the worst part of the bear market, although they won’t want to admit it, even the best of Hodlers has doubts as to whether bitcoin will recover.

Every bitcoin bear market builds discipline, conviction, and character.

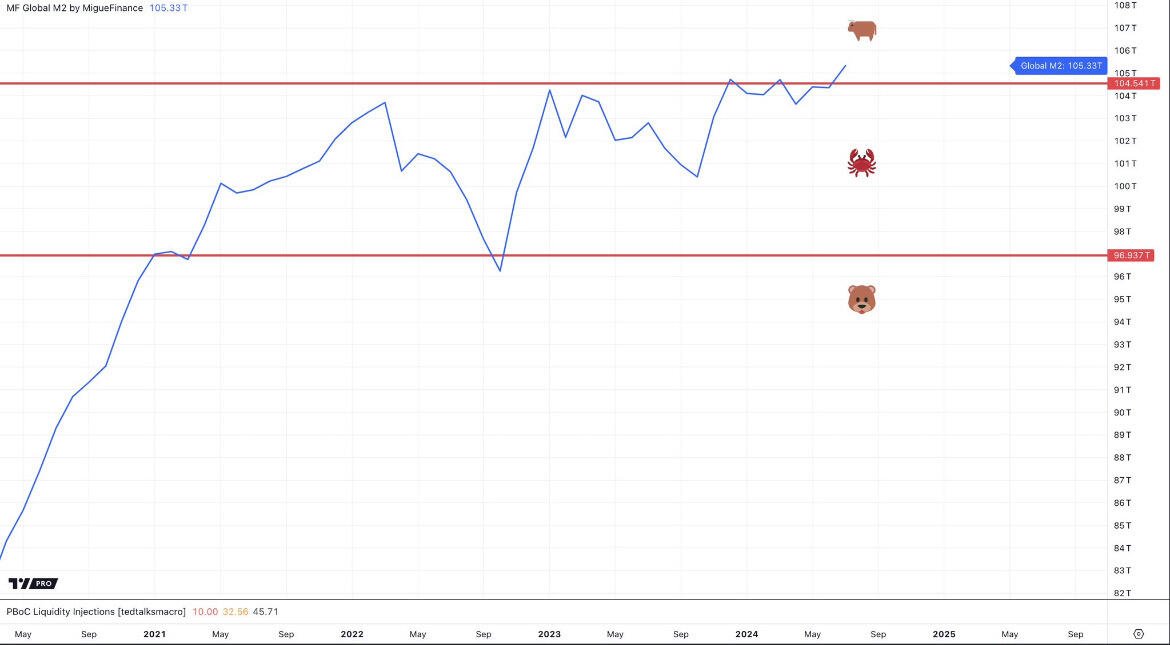

Ctrl + P

Problem solved.

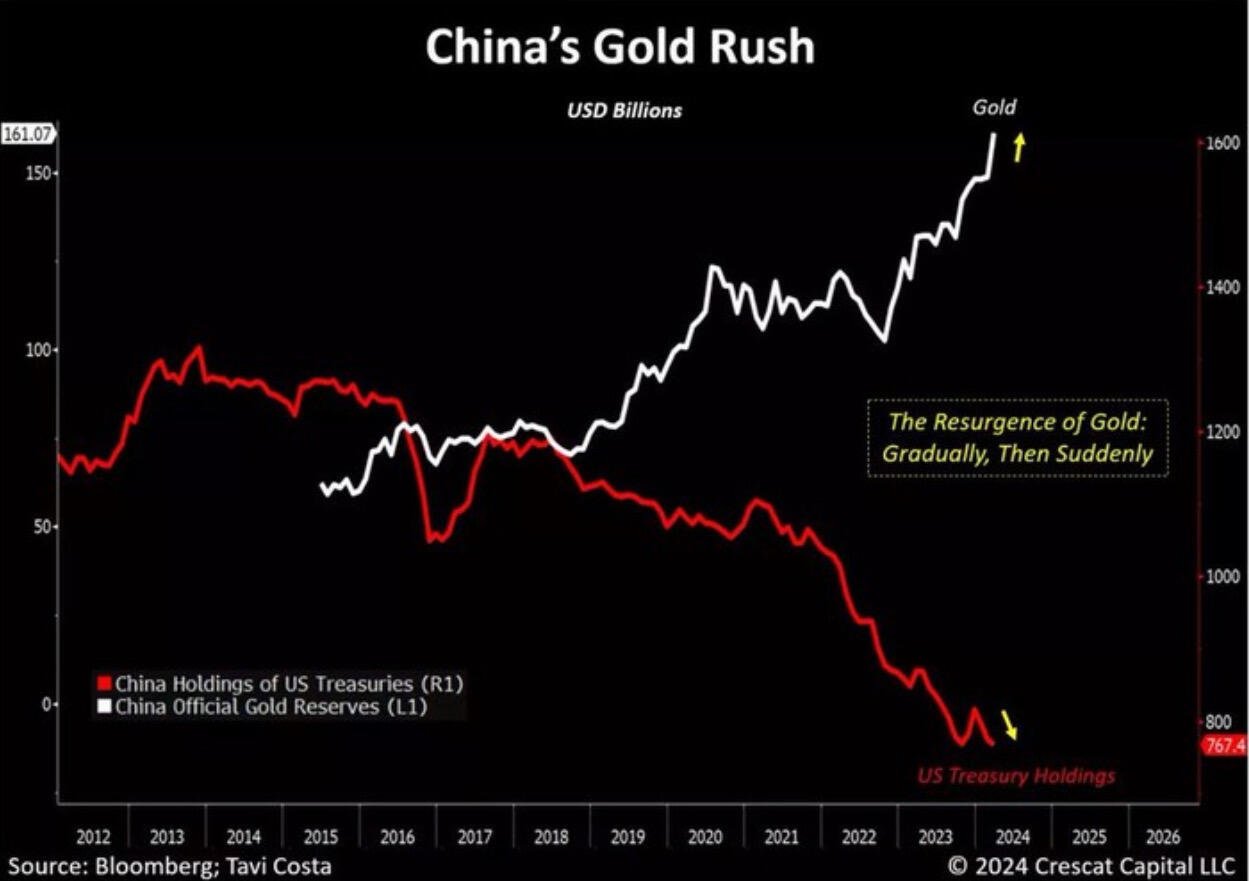

They invade Taiwan once Treasury holdings go to zero.

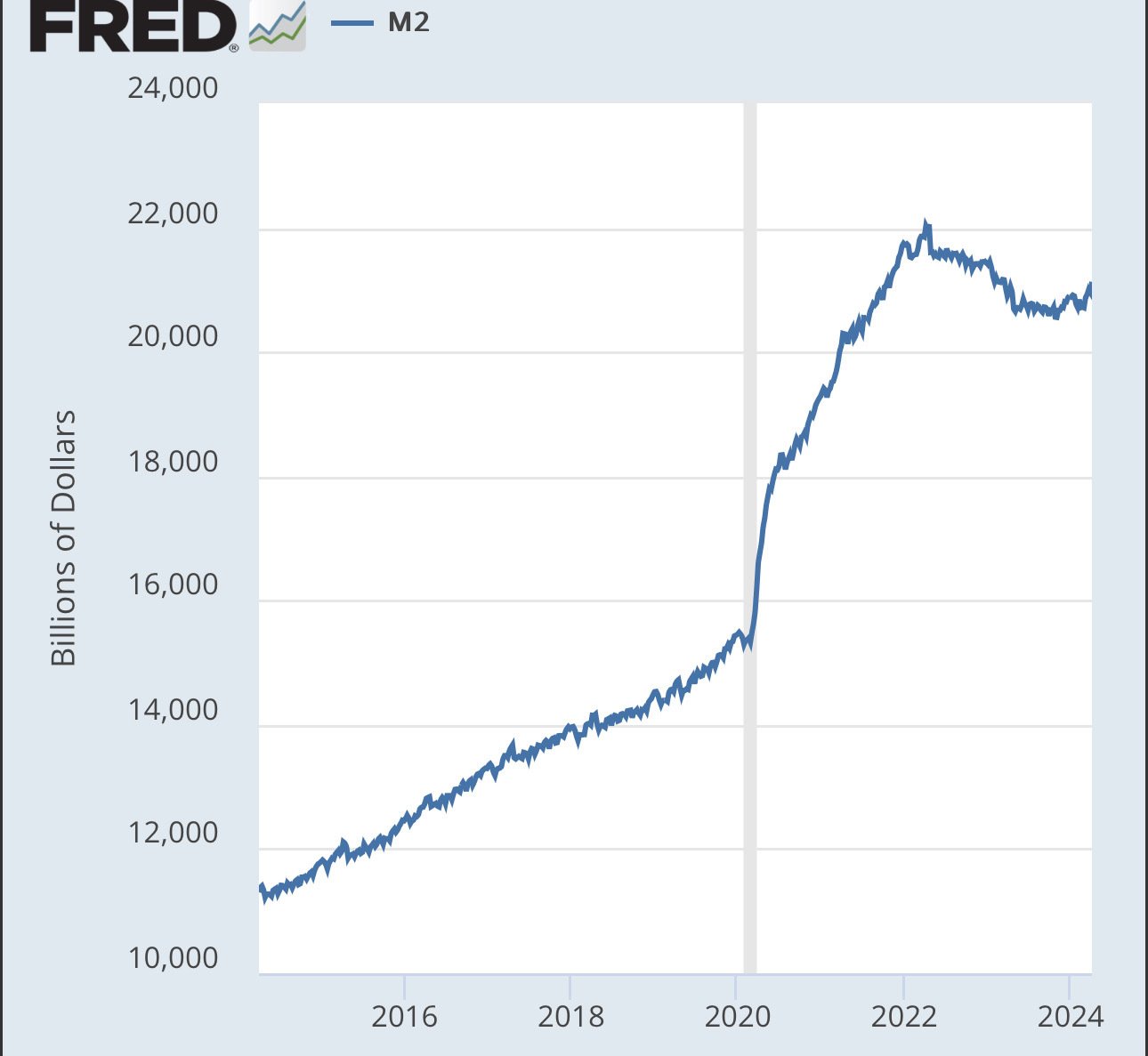

Sorry, but inflation is commonly defined as a general increase in prices. See here and many other sources:

https://www.economicshelp.org/macroeconomics/inflation/definition/

What you are talking about is a monetary base increase-that is not inflation.

You can have monetary base increases that can result in lower prices (deflation) stable prices, or higher prices (inflation) depending on the growth in goods and services being higher, the same as, or lower than the monetary base increase.

If there is $1 in circulation and one oranges are produced, and the next year there are $2 in circulation, but 4 oranges are produced, clearly the purchasing power of the $ went up, not down, even with a monetary base increase.

Inflation is increasing prices. You could increase the supply of money, by creating money out of thin air, and still have prices go down (deflation), if productivity gains increased production more than the increase in money supply. Unfortunately that is rarely the case.

It has come to my attention that this forecast missed by a mile. https://primal.net/e/note1m2j4dkv33e2jax8wpys2r99h3zfqgavfysu8xl3w35xkn59eqadqn2pewd