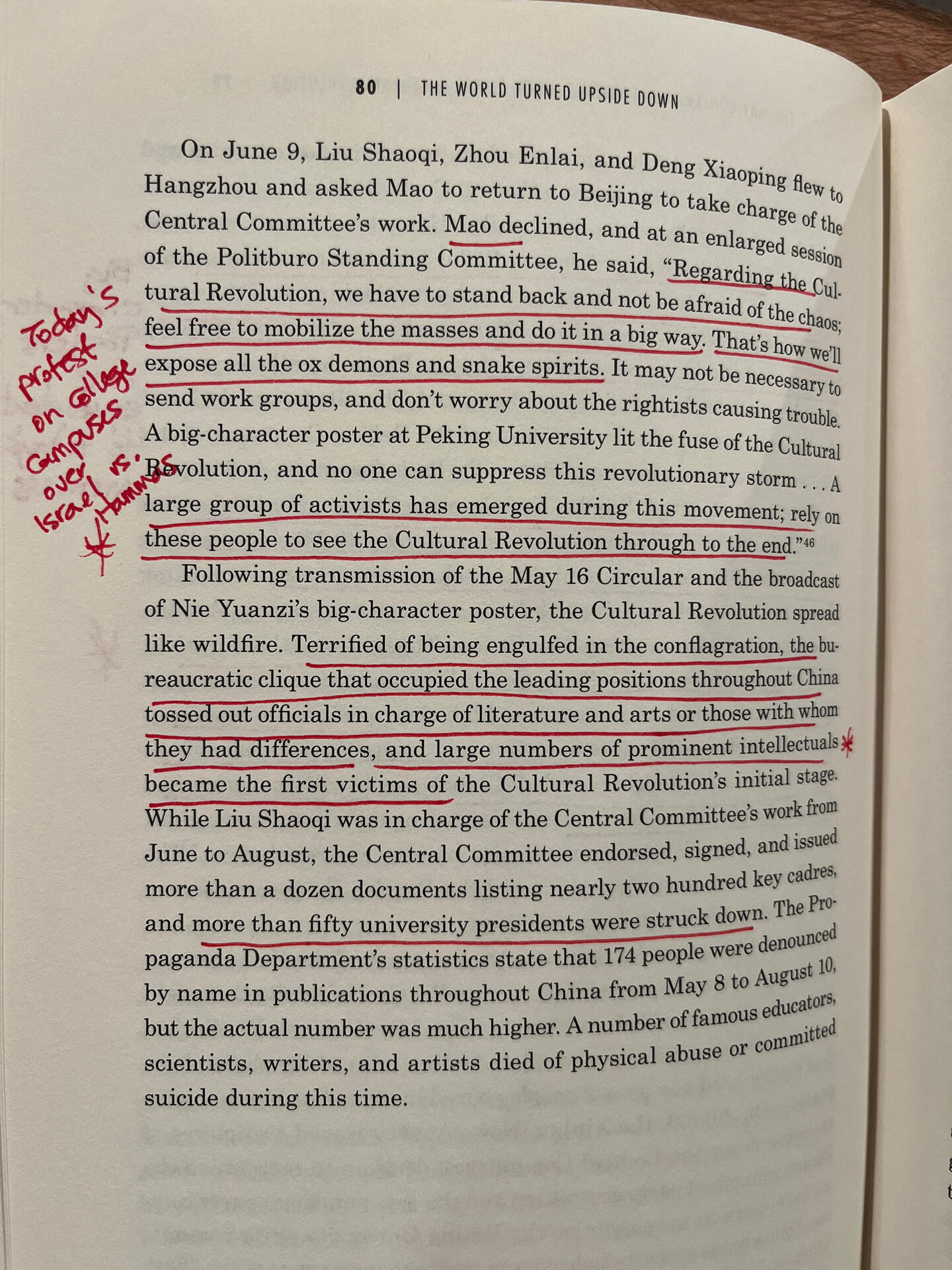

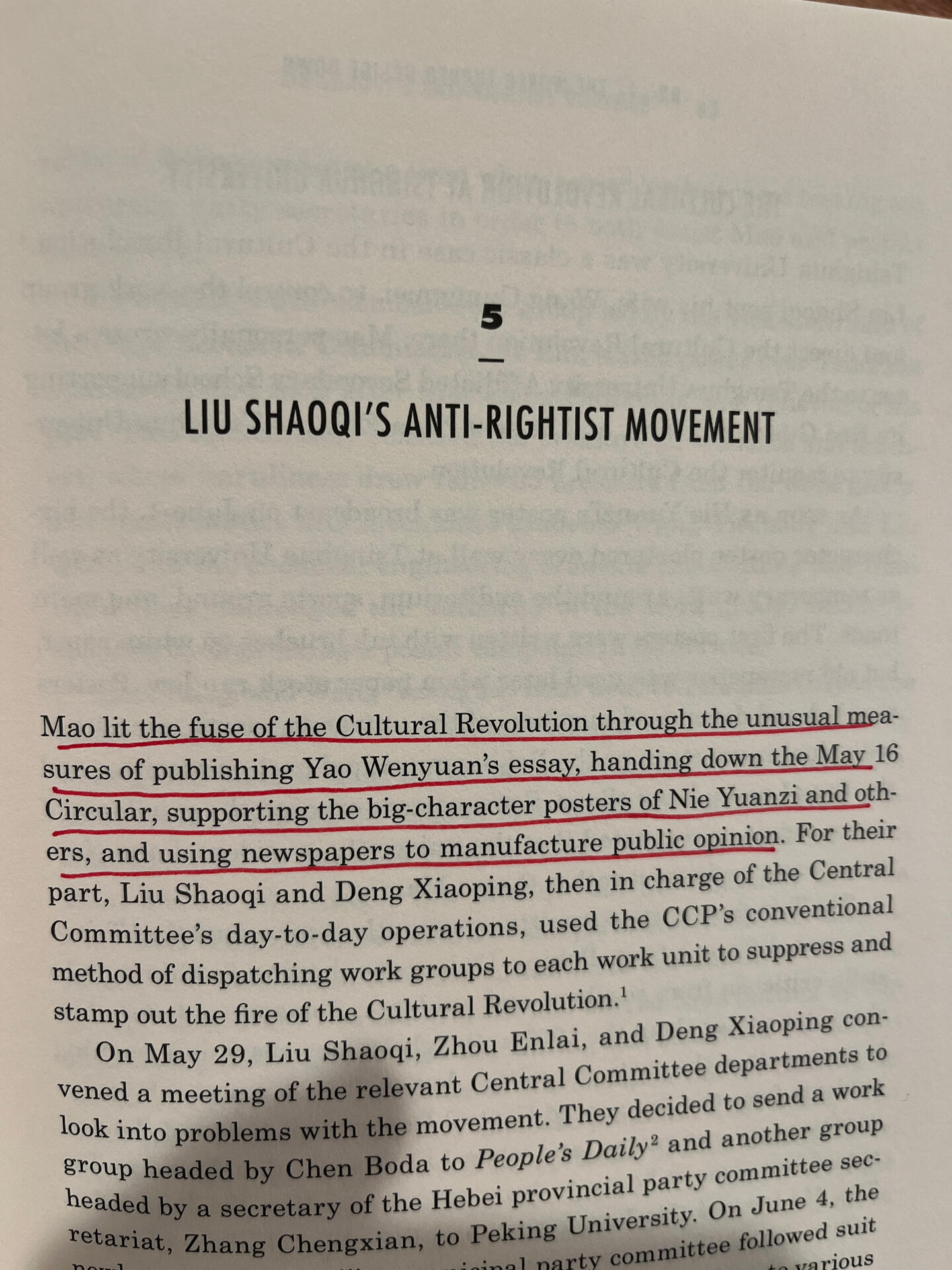

Reading historical accounts puts 4th Turnings into perspective (Acts 26).

Humans are no different than wild animals.

We attack our own just the same as an angry pack of wolves hunts their prey.

We’re more civilized but, across history, show the same genetic traits.

This highlights a few of the bigger hurdles that have stymied use to an extent but also is great stuff bc we continue to see much progress and innovation.

1. Invoicing is super clunky for people just looking to pay, before you have to deal with setup, time constraints, failures, etc. - big win - have a need, hit pay.

2. Point one feeds into probably the BIGGEST win in general. “Venmo-like payment” - this is the major win.

Like it or not TradFi still has the upper hand on point two (unless you are not in a developed nation w/ payment rails).

Point two mixed with point one creates a massive hurdle for adoption by the masses and that is before you get to explaining what a pub/private key is, which goes where, why you need them, what happens if you expose or lose them. Then you have to get into what open-source means and why it’s important which tends to put you in the tinfoil hat land.

Yes, I get it, it’s early tech, clunky and unfriendly.

However, with this ability it works almost to the point a “normie” can do it. Sure there’s probably some custody involved but that’s the reality at some point.

This is a great step if we are close to having payments that can compete with the seemless nature of Venmo, Zelle, ACH, etc.

It’s 30-50 years of bad policy. We don’t have leaders today willing to stand up and do the right things, and they don’t have constituents beneath them who are willing to either.

We don’t have people running, or in office, who are willing to attempt to resolve the issues.

So, regardless of Republican or Democrat, each and every president will continue to spend more than the last.

Show me the incentive (👉 grift) and I’ll show you the outcome.

While history doesn’t repeat itself, it often rhymes.

The World Turned Upside Down… far too many similarities.

#Bitcoin 2024 conference takeaways.

I question whether people really care about facts anymore.

The past few years give the vibe that most care more about being a fanboy, promoting narratives, or planting yard signs for the latest cause.

If we wanted facts our behaviors would be different. That’s the unfortunate hard truth.

Biden wouldn’t have known either way.

Where we are today. Welcome… to the 21st Century.

The “war”, is one of information/disinformation, psychological conditioning/marketing, & semantic manipulation.

Based on a 100 yrs of psychological research & 30+ yrs of “data lakes”, now being parsed for statistical probabilities that lead to almost certain, desired outcomes.

It’s crazy we live in a society that’s played along and not asked real questions until now.

The buildout of our digital infrastructure looks like this:

1st: The Internet 👉 information 🌊

2nd: Social Media 👉 FAANG 🌊

NOW: 💵 + Energy 👉 AI/EV/“crypto”

The clamp down proves how powerful a tool fear can be.

People don’t “get #bitcoin ” bc you zap sats to a lightning wallet.

Numerous apps do this: @PayPal, Zelle, @Square & the funds are usable w/o off-ramps.

People “get #bitcoin ” when they see its value allows them to purchase more while their other options purchase less.

Where do you find more news on here though? Serious question? There are just bitcoin meme pictures for the most part??

Thanks. Good post, I appreciate being able to see all angles and have good conversations with other people’s thoughts; such as yours!

Black Swans are the obvious issue most don’t see because the average person just plays along with irrational explanations.

There are a small, but quite a few, that see Black Swans because they think logically, rationally prepare, and *can* wait long enough in a position. They can wait for the adverse event to unfold. Most can’t.

It’s not that Black Swans are unseen or unknown.

It’s that *most* choose to ignore the obvious signs.

Typically, because it means not taking the easy route, or making a big change to one’s lifestyle. So, only a few are willing to do this and are rewarded handsomely for doing so.

Ex: in 2008 it was *very* clear that Central Banks were becoming absurdly large hedge funds that had lost control, with no bigger fish to come in and backstop them.

However, it was not until a decade later that they finally began failing. 2018 - 2022.

It is very clear that US College Education is and has been an enormous bubble. Subsidized by govt grants and funding, & supported by issuing enormous bond amounts to overbuild. They can’t pay the interest expense so they raise tuition every year and use that raise to pay bondholder interest expense. The definition of ponzi.

This Black Swan has failed to happen… yet. But is very, clear, obvious and open.

Also, it says does not include mobile users. I’d bet 95% rarely login to X online.

To me this shows the level of wokeness in the US. And the level at which the average American prefers to be conditioned by leftist/socialist ideals.