Another good one by Rogan, with Marc Andreesen.

https://open.substack.com/pub/kanemcgukin/p/change-is-afoot-careful-who-you-follow-2d1

There are a few common traits in every #Bitcoin cycle.

Here are the 5 stages of a Bitcoin Cylce

1. Bear mkts bring a new hero 🦸♂️

2. A new narrative creates a top

3. 1st time buyers FOMO in; learn pain

4. A hero falls from grace

5. Repeat 🔁

I’m still bad.

The truth is, if we are serious about stopping corruption, human trafficking, et el. Then we will raid all corporate boardrooms and political offices. This is no longer speculation or “conspiracy”. Follow the money, find the problems.

Additionally, we should turn off the printing press at the FED. Not because of #inflation, but because it is the dollars they incessantly print that the criminals drum up bad ideas for.

The truth is, incentives drive actions and we are incentivizing bad actions. There will always be good and bad, corrupt and evil, though every once in a while a cleansing has to happen. A jubilee is normal and has been forgone.

#bitcoin doesn’t fix this. But learning and understanding Bitcoin brings a level of awareness that challenges one to either continue to participate or chose a better incentive structure.

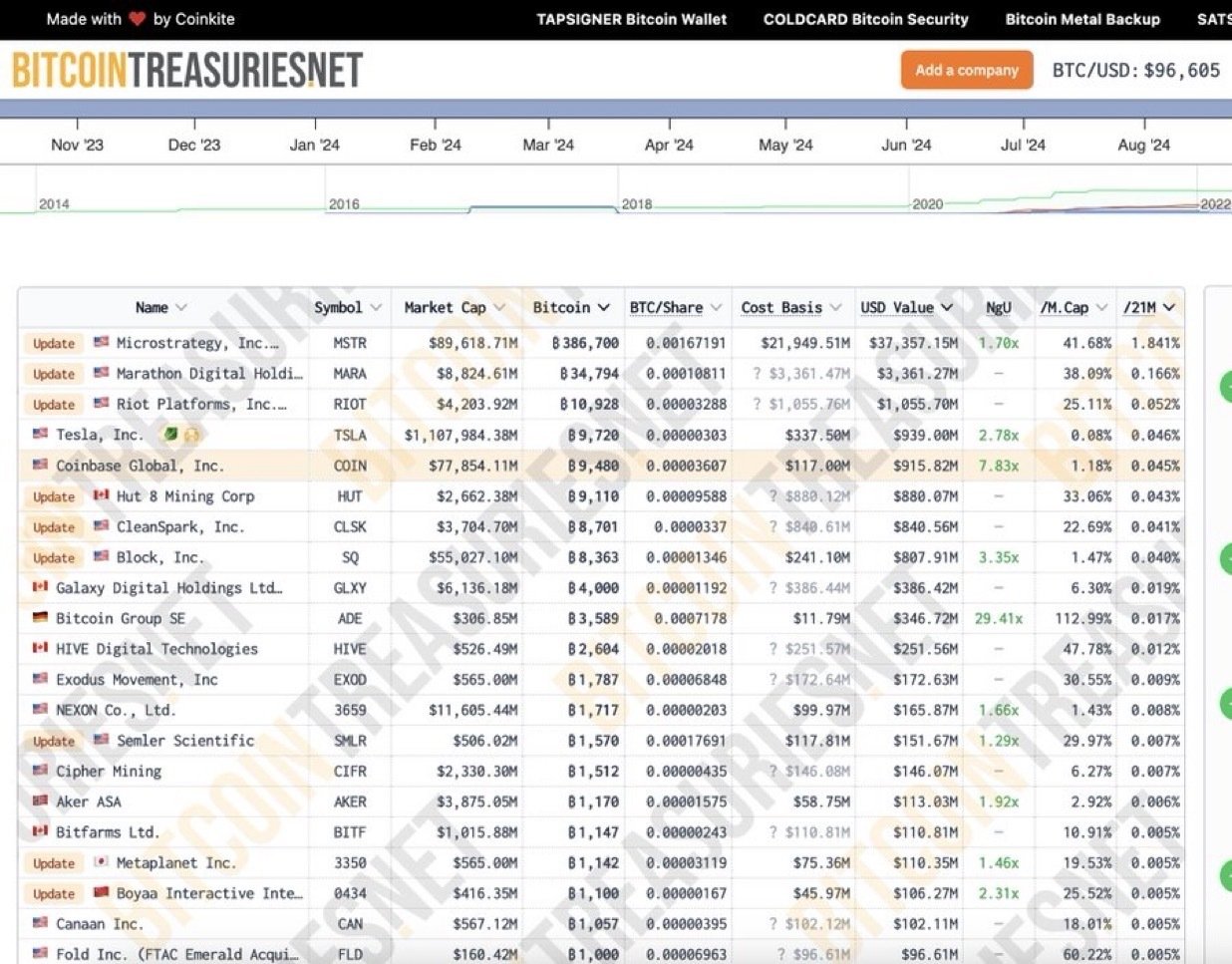

When #Bitcoin eclipses $100k it will also overtake Google as the 6th largest asset by market cap.

That will be a pretty big event.

Most problems today start and end with profit motives.

They center around growth at all costs which tends to lead towards good choices for those at the top, at the expense of the people within and customers on the outside.

The obsession with growth is the problem. It’s fueled by perverse incentives. Unfortunately, no one is willing to standup in the moment. In the rare occasion they do, they are ostracized and villainized.

See Snowden and Assange as prime examples.

They went against the grain to fight for what is right and were/have been treated as badly as one could be… for taking the high road.

We have very few people on earth willing to make this stand because the incentives aren’t aligned to push us in that direction. Additionally, the power is too consolidated within the hands of those with misaligned interests and that forces actors to play along if/when they don’t agree. Those playing along do so out of fear. Fear of income loss, being left out, or fear of being the lone dissenter.

This is a hard truth for most people to see. It’s the ultimate “you were wrong”, about everything!

It’s not a popular opinion but $COIN will be the JPM of the cryptocurrency ecosystem as it eats traditional banking, lending, and investments.

If you compare their tentacles and make up to JPM’s structure between 1900-1920. They look very much alike.

The one thing I think gets really overlooked is Base.

If we believe the 21st century is the era of internet money there is no denying #Bitcoin is the base, commodity-like asset. BTC is the asset all digital banking will be priced off of. However, just like people frowned on Amazon & AWS in the age of the internet’s rise with cloud infrastructure, people are frowning on Coinbase & Base as the rise of monetary infrastructure is being rebuilt to better distribute liquidity globally.

In the age of internet money, Base = AWS, IMO.

In the future all companies will need financial integrations (API-money) and connections similar to how all S&P 500, et el, eventually realized they needed TCP/IP connections, websites, and social apps. It’s part of a complete infrastructure overhaul.

The barrier to money will be broken in a similar manner to how the barrier to information was broken with the Internet. I believe it will provide similar growth (GDP) and be as disruptive as the breaking of the barrier to information.

Money always changes at critical juncture’s but banking basics generally stay the same.

Happy to chat more if interested.

Sound asset > margin / lending > leverage; repeat.

Principles and values… Two primary keys to understanding why #Bitcoin matters.

Another exciting thing. The masses, specifically TradFi, will realize this:

#Bitcoin provides the store of value of land and gold, but unlike these two bitcoin is instantly convertible to usable currency.

Land isn’t divisible enough nor timely enough in converting to usuable liquidity.

Gold has better divisibility but is not liquid.

Bitcoin provides all three and the missing link is its ability to quickly convert to usable currency (fiat).

Bitcoin does this in an instant. That’s what is game changer.

It’s crazy that Germany made the two greatest financial mistakes in history… Not once, but twice.

So many examples of this. It’s very true. I can’t wait to get back to a world where people care about what they actually want/like and not what media and social feeds tell them to.

Absolutely true!! What she fails to realize.

One comes with extreme and ongoing costs. The other comes with financial freedom!

What’s are the top three reasons you come on social? Including NOSTR?

It’s about that time. FOMO central is just around the corner!

At some point, debt service is going to become an important metric again.

Sounds old school.

Sounds archaic.

It’s just how money works.

Sadly… with the release of #Bitcoin options many will make a very basic mistake.

A common piece of wisdom will be ignored… don’t write on high-growth names.

It hardly ever ends well. Pain is the greatest teacher in markets.

🤝🫡

#notfinancialadvice

INCOMING:

Next wave of Wall Street “innovation”.

Our #Bitcoin fund’s Sharpe Ratio is better than theirs. 😂

nostr:note100acw23zlzyg53jz8sk7658y9ucygyml6y06pqyc76skpxawt29sju397s

nostr:note100acw23zlzyg53jz8sk7658y9ucygyml6y06pqyc76skpxawt29sju397s