“Therefore those skilled at the unorthodox are infinite as heaven and earth, inexhaustible as the great rivers. When they come to an end, they begin again, like the days and months; they die and are reborn, like the four seasons.”

- Sun Tzu

Just a positive reminder, we are the unorthodoxed… of our time.

MASTER SUN “Disorder arises from order, cowardice arises from courage, weakness arises from strength.”

LI QUAN • “If you presume on the orderliness of government and fail to provide for the comfort of the governed, thus creating much resentment, disorder is certain to arise.”

The core of the five major religions and all wisdom is the same.

The interpretation and phrasing pretty much just depends on what side of the earth you were born; but the root foundations are all very, very similar.

That’s my opinion anyway.

“The best time to plant a tree was 20 years ago, the second best time is now.” - Chinese Proverb about #Bitcoin

#Bitcoin is about purchasing power & has a greater impact on the avg person.

Why?

In Sept 2019, if you bought $100 of #BTC it would be worth > $1,300.

If you held cash, it would only purchase about $49 worth of goods, after inflation.

If you bought $SPY, it would only be worth about $203.

The choice is yours.

That has to be the most optimal way to block out the noise and keep the ultimate goal front of mind.

We all need space suits !

A decade ago the path was clear.

Several years ago, even more clear.

I still didn’t have on the bingo card the potential for a sitting president to be a mole and a family member a bad man. So much for background checks.

So with the big money nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m stack growing at a prolific rate this means that it’s likely big money is selling as we chop around $100k - is there a flaw in that logic?

Yes, but it works for both bull and bear scenarios.

In the case of Bitcoin as a developing asset class it needs serious capital inflow from large capital allocators.

To your question, yes, at an intermediate time period large capital or large paper bitcoin may push price down for a period causing consolidation. This also works in reverse to pump price in a bull scenario.

America is at a major inflection point.

If the majority shifts from a mindset of materialism to one of mental awareness, we will again see productivity & gains like never before.

If not, we won’t. The choice is ours.

ht Dr Jack Kruse for the monk. It reiterates the other two.

Jesse Livermore on #Bitcoin.

“… big money must necessarily be in the big swing. …

the fact is that it’s continuance is not the result of manipulation by pools or artifice by financiers, but depends upon basic conditions. And no matter who opposes it, the swing must run as far and as fast and as long as the impelling forces determine.”

“But the average man doesn’t wish to be told that it is a bull or a bear market. What he wants is to be told specifically what particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesn’t even wish to have to think.”

- Jesse Livermore

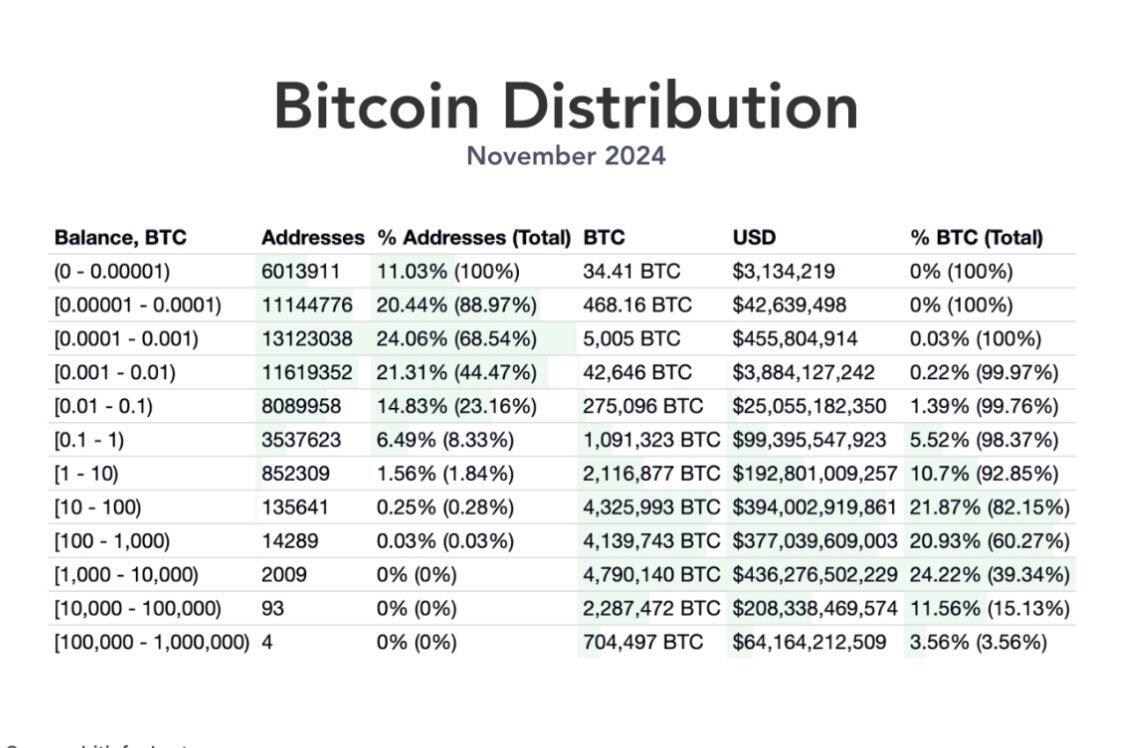

Interesting that the third largest address set has 2009 addresses, matching the launch year.

Well said.

THE TRICK IS ON THOSE WHO DO NOT BUY!

#Bitcoin is the greatest psychological test in human history.

It’s the example of this:

You can tell the average person exactly what to do to reach their desired outcome. You can give them the playbook, you can hand it directly to them.

But, 80%+ WILL NOT do it.

They WILL make excuses or tell you every reason why it WON’T work. They WILL watch, do nothing, mock, disbelieve or try and give up quickly.

That in a nutshell IS WHY the 1% is the 1%.

Because that’s about all that will get conviction on something, that will stay dedicated to something and ignore all the noise and not be distracted by their surroundings.

#BTC is conviction and that’s why so relatively few have it.

🚨USDT/Stablecoin mkt = Eurodollar 2.0 and future money market / yield curve

Very similar to old school Eurodollar market (tweet image). In those days it was major oil countries depositing unneeded USD in non-regulated European banks.

Today, it’s the FED printing worthless USD. Recycling it into an unregulated market to help grow a new financial system/lending mkts.

In doing so, you take an opaque and unknown market (ED) and turn it into a known traceable market while maintaining its ability to operate outside of regulatory bodies.

Crazy thing is… the righthand column kinda of says it does work. Paywall or not.

Imagine what happens when the first one starts taking sats. 🧐

When people say “few” 👇 is what they mean.

Think about it…

Study it…

Ask questions…

Be patient…

#bitcoin

Holding bonds is a lack of understanding of volatility.

Why?

Because, depending on the curve and tenor, you can/could get 75 to 87% of the rough hundred year average price return WITHOUT price volatility. Over the last four to five years, for the most part, you weren’t paid to take risk in bonds; outside of a few very small windows.

Does this mean bonds are completely worthless?

No. At the foundation, they are capital formation tools.

There are certain scenarios and use cases where they play a part in portfolio construction (to each his on and for specific reasons).

Additionally, when volatility strikes, bonds are no different than any other asset class. Dislocations from volatility creates both opportunity and pain. It all depends on which side you are on.

In summary, bonds provide insight into one’s understanding of volatility.

“Volatility is a feature, not a bug.” - #bitcoin

Learn volatility and probability… this is the way.

Long vol is a hedge against rising rates.

Short vol is an opportunity to capture collapsing premium across time.

Crazy how quickly things come full circle. Not surprised and a little surprised at the same time.

“The road to serfdom.” - @saylor on Fiat backed companies vs #Bitcoin backed companies. ( @MicroStrategy )

57:01 mark