"The world is going through a moral & cultural decay because of fiat currency" -- nostr:nprofile1qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcpr3mhxue69uhkummnw3ez6ur4vgh8xetdd9ek7mpwv3jhvtcqyqvlaltl88yk6tlhd7rlwcn6u7g5t0yhrk9tyvs9qpvnnfdfzw7z7uxh02q on nostr:nprofile1qy28wumn8ghj7mtfwdekkete9ejx2umfvahqzrthwden5te0dehhxtnvdakqqgxup0q7qdfxz7mm6rm4dpr06y80lrtg22nut2n7zyacr8mp05lc3u69jf2l [links to NEW episode below]

Money is the only thing that makes humans realize morals and values are broken.

They will continue doing immoral things and explain away or overlook immoral actions as long as the money works.

When money breaks, when it’s clear money’s purchasing power is eroding.

People wake up and begin to ask serious life altering questions.

The decay of morals is what causes broken money. We just aren’t willing to pay attention until we can no longer buy all the nice shiny ✨ toys.

He has 124,000 followers here. He has 5,800,000 followers there.

When he says something there it’s shared around the world in an instant.

When he says it here, it might make it around a small eco-chamber.

This probably changes over time, but is proof of “show me the incentive”, in action.

We can never force anyone to see what’s there. They have to find it for themselves.

Reach… it’s easier there.

Great point nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe this is exactly what #Bitcoin teaches and IMO is why the cycle of money is continuous from sound to unsound.

Bitcoin has the opportunity to change this in a Bretton Woods 2.0 type scenario. Because as the money moves from sound to unsound (now) via additional layers and Wall Street tools, its programmable nature will all us to see the grift… the cheaters.

This allows leverage to be known or at least the risks to be understood. In a best case it prolongs the ability for sound money and ample credit to work and build a more positive society.

In a worst case, we just reset the monopoly board and are starting the same game all over again— for the next 70-100yrs.

Love or hate Elon… you have to admit he has a high level of awareness.

When he needed them most and subsidies were in abundance, he played for the left.

When grift & aid got out of hand, he switched to the right.

Some people have a good sense of what’s going on around them.

The best thing about the bull market is it

The best thing about the bear market is it

This is awesome. Thanks. I need to try this out. I didn’t know about it.

I do this with books but the manual way. Go find the book on the shelf, the underlines and notes and reference it with another situation, note or book.

The priceless part of #Bitcoin is that it helps you get off the hamster wheel of chasing growth with no purpose.

https://open.substack.com/pub/kanemcgukin/p/our-obsession-with-growth

An article I wrote on why Bitcoin rehypothecation should be illegal for TBTF banks now that SAB 121 was rescinded. And yes, I know, Bitcoin doesn't need laws. But I also know that all your grandmas will probably have exposure to Bitcoin through an ETF. So this is for all your grandmas.

https://egodeath.capital/blog/too-big-to-fail-banks-amp-bitcoin-custody

In the game of rehypothecation, the thing BlockFi, Celcius, Genesis, et al got wrong was the crucial underpinning of basic margin lending— the maintenance margin.

They all took a common TradFi function, margin lending, and made up a new fancy name — over-collateralized lending. They acted as if they were doing a new fancy Bitcoin/Crypto thing, but really it was just traditional margin lending.

Unfortunately, these new players failed to understand the importance of understanding margin basics: margin values vs. maintenance margin.

Especially when dealing with highly volatile assets like Bitcoin. When you set your maintenance too low it’s a guaranteed margin call on a security like Bitcoin w/ a 50-200 vol.

While this works in the favor of the house in the short-run, in the long run it’s disastrous. What started as an easy picking 4-12% appearance of a risk-free house always wins turned into a house of over levered & rehypothecated cards.

Leverage kills.

Same here. Feels like it takes more effort.

Wealth accumulation is about the denominator, though we put all our focus on the numerator.

What’s most important about money is its soundness which includes the habits and principles it encourages and teaches.

Money has been a unit of measure since the beginning of time. The only measuring unit to outlast all crises and good times has been #gold. #Bitcoin is challenging that, but has yet to replace it. Like all good things, this process is no different and will require significant time + energy.

In a worst case, Bitcoin could turn out to just be gold 2.0, but for the internet and value to travel across a digital world.

Again, what’s important about money and wealth creation is our ability to store it across time. To date, gold is that measure, until bitcoin displaces it… if or when it does.

Here are a few key charts that help us measure true wealth rather than than the wealth we see flashed in our collections of things or 💪 postings of lavish desired lifestyle in online pictures.

Stocks: +128% over 15yrs, relative to gold.

Oil: -67%

Bonds: -46%

#BTC: +9,352% (over 10yrs)

USD: -48%

Tech Stocks: +416%

EM: -9% (over 13yrs)

Developed Int’l: +29%

As you can see, your unit of measure matters regardless and f how much stuff you see people accumulating with deflating stacks of currency. It may appear that you have wealth, but when measured correctly… you’ve lost almost half while spinning your wheels faster and faster.

Sound money assets help us level set back to the principled and value systems we’ve gradually meander away from; over decades.

Flip through the charts… see for yourself. Share this with someone you think needs to hear it 📢.

If we can honor Soros and Hilary. We should definitely be able to honor Snowden.

Wouldn’t it be nice if those fearing “tariffs” realized the incentive shifts back to building products that LaSt.

Meaning, away with the throwaway economy.

Rip & replace every 12 mo. is ExPeNsIvE.

Buy expensive things that last decades, not days.

#bitcoin #MoneyWars

It’s cheaper in the long run.

I read this as undercovers can’t be bunched in if taken down?

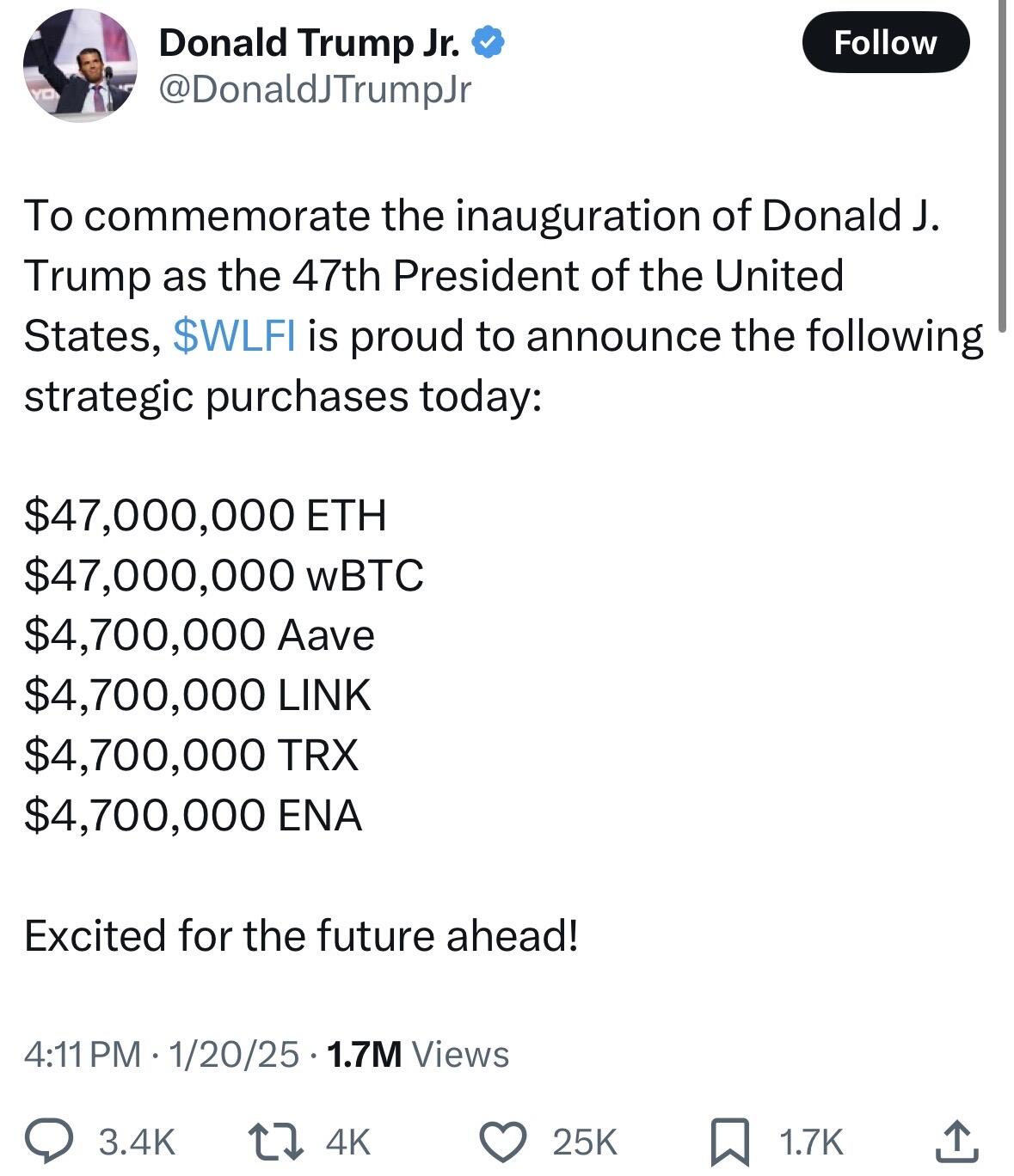

Sort of expected given the number of times he touted “crypto” during his speech at the Bitcoin Conference.

If I recall correctly, he even said make America the Crypto Capital of the world or something of that nature.

The biggest thing naysayers of #Bitcoin fail to understand is:

Bitcoin’s volatility is the crinkly that makes it space filling.

Meaning, what looks like a mile is not a mile. What looks like a huge move in stock terms is not when viewed in log or magnitudes.