I think he’s comparing the first year of bitcoin ETF with the first year of gold ETF. Subsequent years for gold are the second, third, …… years of the gold ETF. So if subsequent years of the Bitcoin ETF are like the Gold ones there should be a few years of big and increasing purchases by the ETFs in our future.

Uplifting community, real conversations, curate your own feed.

This is great news but we need to pump these numbers up. We should be striving for 100% of the economic activity conducted without government or bank knowledge.

Energy spent on mining could also reduce to match the fees on offer. It doesn’t have to just be fees increasing.

I want to see Microsoft naked short Microstrategy and go bankrupt.

Feeling more resilient and able to solve bigger challenges every day is empowering.

Didn’t access my hardware wallet though. And they wonder why trust in institutions is at all time lows.

My goal is to simply end each month with more bitcoin than I started with.

Same for me. When I moved five years ago I couldn’t find a descent place to rent that wasn’t more than a mortgage payment. I probably used too much of a down payment. But I made amends by taking a HELOC and buying bitcoin. Pretty soon that bitcoin will be worth more than the house.

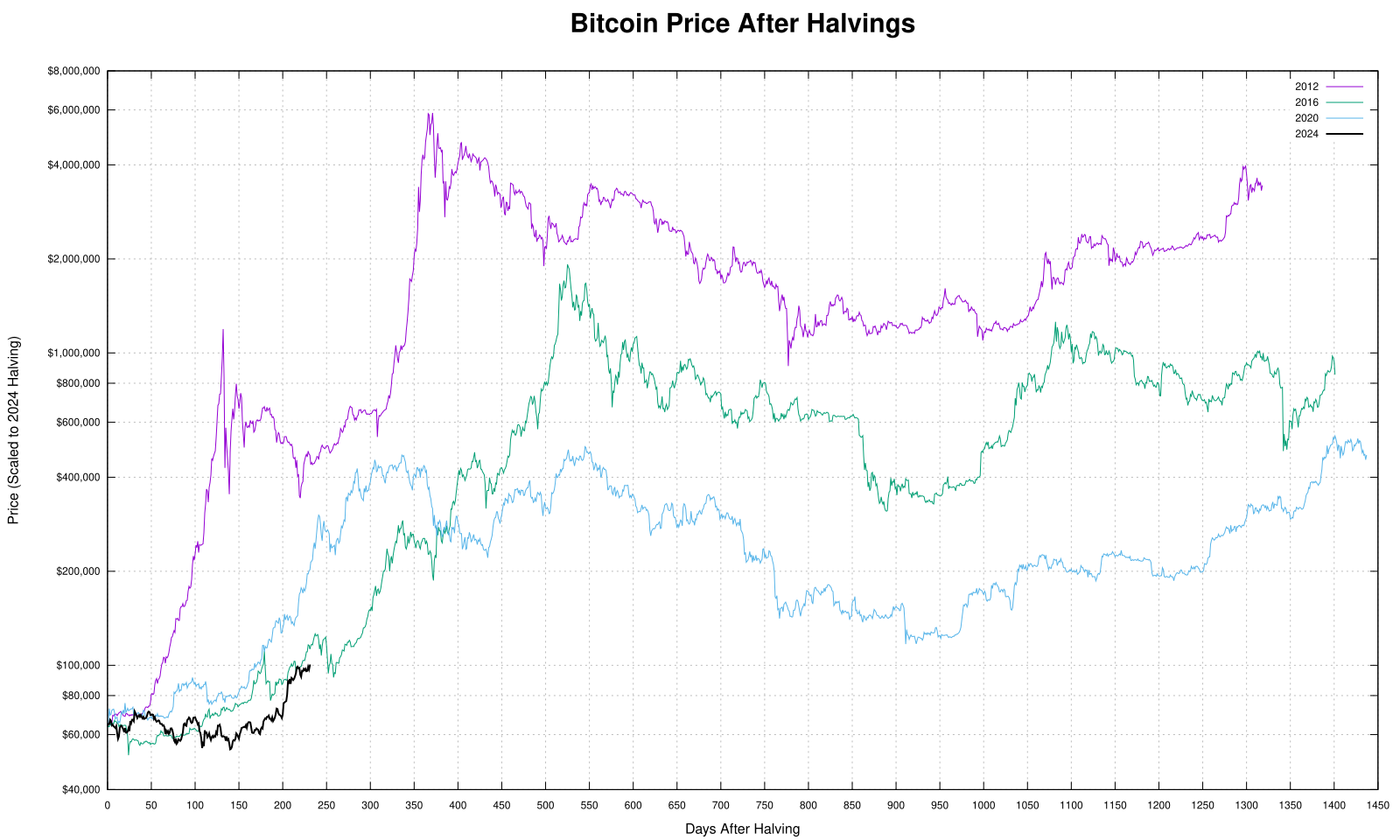

So a cycle peak around Nov 2025

Any Dr. Robert Murphy fans? Interesting article on the future price appreciation of #bitcoin #btc

"To say that Bitcoin has an upper bound of $160 trillion sounds like there’s lots of room to grow, and in an absolute sense, of course there is. However, it’s not going to yield future performance comparable to Bitcoin’s past decade."

https://content.infineo.ai/articles/an-upper-bound-on-bitcoins-appreciation

Not a bad read, seems pretty level headed.

Yes but I get paid every two weeks so I’m only exposed to the price going down for a few days since my last pay and needing to sell some to cover my bills. To your point you need a good savings rate and a bit of runway for this to work without getting stressed or falling short. Yet to be seen how it goes in a bear market. If it doesn’t work I’ll just go back to the old way of getting paid in fiat then buying bitcoin at the end of the month after bills are paid. Order of operations matters.

I convert 100% of my paychecks to bitcoin on Strike then once a month I sell just enough to cover all my bills. Over the last year the bitcoin I have not had to sell is worth as much as my total take home pay. In effect I’ve lived for free. It’s all about having as much in bitcoin for the longest time possible so you can take advantage of the ten crazy up days that happen each year.

Good on ya mate this is the way. I’m still buying every payday, it doesn’t increase my stack much, but I love to think how much time it will be worth in the future.

Sure does. I sold my rentals, bought more bitcoin, made more in 4 months than in the last 4 years with a whole lot less effort.

I was there doing my part scaling the wall like a psycho.

nostr:note1rekfw6k476hj7zvvnm82ds9j972cupwsvcudpk89un4pwzr2w93s3sefg9

nostr:note1rekfw6k476hj7zvvnm82ds9j972cupwsvcudpk89un4pwzr2w93s3sefg9