Digital Assets Research Institute (DARI) just put out an amazing report on bitcoin use among refugees.

329k have already used bitcoin to take safely across borders. Could reach 7.5M by 2035.

At this point, people who still think bitcoin has no usecase are just plain clueless

https://bitcoinist.com/bitcoin-refugee-adoption-7-5-million-2035/

https://www.da-ri.org/articles/bring-only-what-you-can-carry

Issue #35 of the Bitcoin Adoption Forecast is out.

Check your email or spam filters

https://www.batcoinz.com/p/035-the-surprising-new-bullrun-driver

Media like The Guardian loves to highlight a problem. But refuses to cover the well-documented solution. The solution is bitcoin mining. It does not require government subsidies, it’s already ended flaring in a lot of regions, it could end the wasteful and polluting practice of gas flaring around the world, but The Guardian has been complicit in helping perpetuate the practice of flaring by its ignorant attacks on the solution that can quickly end the very problem it keeps on pointing out.

What's going on with your website? I tried to renew my subscription at https://batcoinz.com/p/bitcoin-plans but that's gone as is any mention of how to subscribe.

I appreciate that it niw seems to work with Tor, but with the contact page saying "example.com" on it, I have to suspect something is wrong

For 3 months I've been working on exposing what IMF has done behind the scenes to prevent Nation State Bitcoin adoption

It's out in the open now👇

https://bitcoinmagazine.com/featured/how-the-imf-prevents-global-bitcoin-adoption-and-why-they-do-it

Thanks to John Perkins, nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu for inspiring this and HRF, @BitcoinMagazine for the support

Remember CAR, that tiny African nation who was 2nd in the world to make Bitcoin legal tender... then the 1st in the world to "unadopt it"?

I was surprised there wasn't more investigation into why, so I went digging in my latest newsletter

https://www.batcoinz.com/p/34-when-colonial-money-met-digital

Volatility has become one of the major sources of FUD used on Bitcoin in institutional investment circles. Here’s the general theme of how I respond to it. Hope it helps.

"Bitcoin is too volatile to have as a store of value" is not a fact, it is an admission of ignorance. At worst, it is intentionally misleading. Here's why.

Firstly, yes Bitcoin is volatile.

Bitcoin’s short-term volatility mirrors Amazon stock’s trajectory: similar drawdowns and exponential growth. But this misses the point:

As a Fund Manager of a Pension or Sovereign Wealth Fund that invests in Stores of Value, the only chart that matters is Bitcoin’s 200-Week Moving Average (~4 years)

Notice it

✅ Is not volatile

✅ Is always up and right

✅ Outperforms all assets

Why 4+ Years Matter

Institutions (pensions, sovereign funds) hold SOV assets for 10–30 years. Bitcoin’s 4-year cycle aligns perfectly with intergenerational strategies.

Volatility is irrelevant if:

→The long-term trend holds (200WMA ↑),

→ Fundamentals strengthen (adoption/scarcity),

→ It outperforms alternatives (stocks, gold, fiat)

(Which Bitcoin does on all three counts)

The "Stability" Paradox

The Traditional view says "A store of value must be stable (e.g., gold’s slow moves). However this is not just an outdated view, it is factually incorrect to conflate short term stability with long term store of value.

For example, USD is "stable" short-term but loses ~90%+ purchasing power over 50 years (very poor store of value).

Bitcoin by contrast is only volatile short-term, but it is also the best SOV ever created.

Volatility Actually Matters only if:

❌ The asset fails to recover (e.g: hyperinflating currencies)

❌ It loses adoption (e.g: unlimited-supply crypto imitators of Bitcoin)

❌ A superior alternative emerges (e.g: gold at some point being superseded as a SOV by Bitcoin)

Here's why short-term fluctuations seem important (but aren’t to strong hands)

Psychological Impact: volatility can scare weak hands into selling

Liquidity Needs: If you’re forced to sell during a dip

Narrative: Short-term volatility fuels media FUD ("Bitcoin is dead!")

In other words, short term fluctuations are an issue to fund managers who base their investment decisions on emotions not fundamentals, have mismanaged their fund and need short term liquidity, or who rely on the media rather than institutional alpha.

To put it bluntly, short term fluctuations matter to weak hands, mismanaging hands, and uninformed hands.

For long term holders such as Pension Fund and Sovereign Wealth Fund Managers, short-term noise is irrelevant. They zoom out and act on fundamentals, not emotions (assuming they are following their fiduciary duty).

By contrast, to claim "Bitcoin is too volatile for a SOV" admits either:

Ignorance of Bitcoin’s non-volatile 4-year trend, or

Emotion-driven investing (a shocking flaw for any fund manager).

If you hear a fund manager say "Bitcoin is too volatile as a store of value", they are revealing more about themselves than they are about Bitcoin. Specifically, they are telling you that they don't have strong, steady, well-informed hands.

In which case, find someone who does.

My fireside chat with John Perkins from Bitcoin 2025 is now 🔥 live🔥 !

This is a must-watch for anyone who cares about the intersection of global finance, human rights, geopolitics, and the promise of Bitcoin as a more egalitarian and equitable system of value for humanity.

Link to video

👇

My new Bitcoin Magazine article is out

Ever been explaining how Bitcoin helps millions in the global south (hyperinfated, unbanked, fleeced by remittances) only to hear "But can't stablecoins/ETH do that?"

They can't and they aren't. Here's why

👇

GreenpeaceUSA intended The Skull of Satoshi to be a dunk on Bitcoin—but became a symbol of its resilience

Today I finally get to share the untold story behind how the Skull of Satoshi got to be at Bitcoin 2025

Read the deep dive here

👇

https://www.batcoinz.com/p/33-the-skulls-untold-storys-untold-story

Something wrong with your lightning address. Can't zap you my man.

https://nostr.download/f20b8bedc7dd63ad93c6770a6eea03c0280fd5cf972fe79fb3222014b30640e4.webp

Zaps have been coming thru from Nostr today so I think my lightning address is working ok

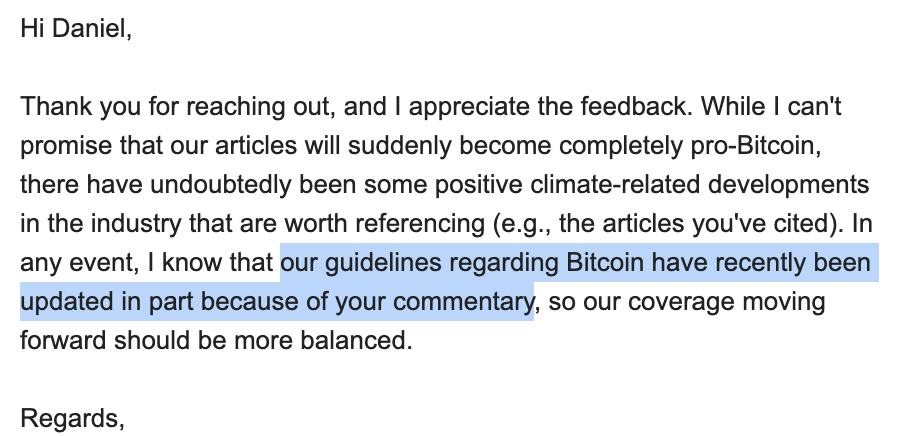

For every time I write an open letter on X to a media outlet about their Bitcoin coverage, I probably write 2 to media outlets behind the scenes.

It's slow going.

But over time ... it's paying off.

The Bitcoin Adoption Forecast is out

Check your emails and spam filters

This one covers how the IMF said Bitcoin would destabilize economies. But then Bhutan did the unthinkable—and turned stranded energy into an IMF nightmare.

https://www.batcoinz.com/p/bhutans-bitcoin-escape-how-a-tiny

I’m not a fan of trying to cut things out. My inner rebel always got too, well, rebellious with that.

I’m a big fan of substituting things in that I find work for me better.

If the goal is to work out how to feel more energized and you’re feeling curious, you could experiment with other things that are reported to lift energy and verify whether it works for you personally.

DEMOCRATIC PARTY REPS OPEN EARS TO BITCOIN AFTER LOSING LAST ELECTION AND APPROVAL IN THE DUMPS 👀

I’ll let you in on a little inside info, nostr.

Recently myself and others from nostr:npub1fpcd25q2zg09rp65fglxuhp0acws5qlphpg88un7mdcskygdvgyqfv4sld were invited to meet with policy folks and DNC officials in NYC. I was unable to attend due to baby and other work obligations, but nostr:npub12wu7095378nwykqs0yj39t7fjsvvglay26cajjuee80vtte0vyjsf482kk and nostr:npub1dc84762hpnp0y4jcvjcgwt8l7sepng93j3hg63hfm80ph6kt82eqktjwqd went repping TPB and bitcoin. (An invite only meeting of about 20 folks)

The meeting was productive, very curious and open conversation, and folks still have a super rudimentary understanding of bitcoin. The first of many convos we will be having.

As you can see from Jason’s post, they even taught some of them how to use Bitcoin at nostr:npub1key55ax33gkl50uqemvl4khrtqrhzm7wzpc7fhseutt5ddkcwcrqgxlt3h! Pretty cool. Anyway, bitcoin doesn’t need politicans or DNC reps, but they sure do need Bitcoin…AND we’re hoping they could even be allies in promoting important Bitcoin rights, or at least neutral compared to the Biden admin.

This is the imortant work we’re doing nostr:npub1fpcd25q2zg09rp65fglxuhp0acws5qlphpg88un7mdcskygdvgyqfv4sld. Hitting the pavement to talk to folks that may just listen to us, progressives to progressives. It’s a vibe shift for sure.

If you appreciate our work and efforts, we’d appreciate your support. It ain’t cheap, and our demand for meetings and content is higher than ever on a super limited budget and volunteers. Any sats or fiat you care to give is greatly appreciated: https://progressivebitcoiner.org/donate/

Much Love #nostr

-Trey

Doing God’s work. 🙏

“What is freedom?”

“What do breathwork and Bitcoin have in common?”

“What’s the biggest determinant of the habits you form?”

Got asked a different set of questions on this pod and really enjoyed the chance to branch outside my usual topics, as well as some familiar ones.

I was on a podcast with Archie (Bitcoin Archive) recently.

We talked about how the “bitcoin was bad for the environment” myth was created, how we squashed it, the real story, and the long tail of work still to be done.

That was my first impression too… until I did some digging and realized that was based on a misleading academic op-Ed from an employee of a central bank (Alex de Vries) that got massive media amplification. It’s since been refuted but the damage was done. The real story is very very different. https://batcoinz.com/why-climate-action-doesnt-just-benefit-from-bitcoin-mining-it-requires-it/

EnergyLive just covered Cambridge’s positive report on Bitcoin mining

https://www.energylivenews.com/2025/04/29/is-bitcoin-becoming-greener/

Nice work. I have scanned it and the issue looks well framed and the solution supported by good evidence. One suggestion, mdpi is not regarded as a reputable journal by many. there are now 20 peer reviewed journal articles showing positive environmental externalities to bitcoin. I did a summary here: https://www.linkedin.com/pulse/surprising-results-analysing-academic-papers-bitcoin-mining-batten-ofjyc/?trackingId=Zo%2F2KIUhTBa1cg6u3NiziQ%3D%3D

Also given your audience will probably be clean evergy advocates - mostly left leaning, I’d suggest “the progressive case for bitcoin” over “the bitcoin standard”. Horses for courses.