Absolutely, decentralized exchange of ideas and repository…

Funny enough. I learned yesterday that solar panels disconnect themselves when the grid is down.

So much for solar sustainability….

Sometimes it just feels weird to be in a meeting when the rest of the people are worried about short term things while Bitcoin has put the S&P500 at record low measured in Bitcoin and Realized price crossed 44K.

They are focused on the trees and missing the forest...

There can only be one solution to the Byzantine Generals Problem. If the generals are not in agreement on a singular protocol, they will die. They will form consensus on the longest proof of work chain: #bitcoin.

- nostr:npub1337xxyne0pw52zgd984xqqs2q7qhqpt7phhn7xp6t9yt406vrvescdpkdt

#BitcoinTwitter

Deep and founded

#runstr

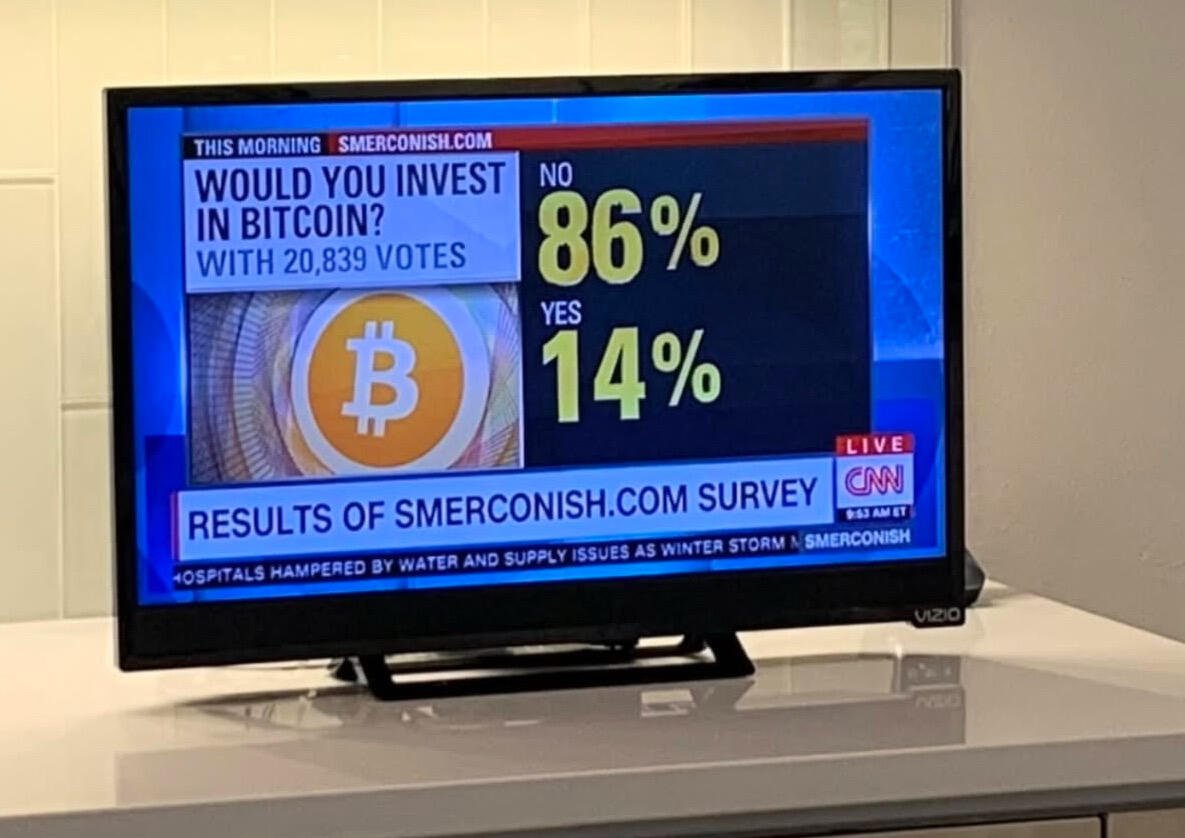

So give or take about 40 million people want to get some corn?

Your phrase needs to become a viral Meme. Perhaps you might add some image to enhance the message …

Yesterday I was able to listen to your podcast with Preston

Amazing conversation

GM ostriches

#introductions

There is a huge lobby from legacy system. LATAM is a Cantillonaire paradise and the "Political cast, Business elite, MSM and Banking system are aligned"

Banks spend huge many on ads, Satoshi hasn't appointed a VP on Marketing yet...

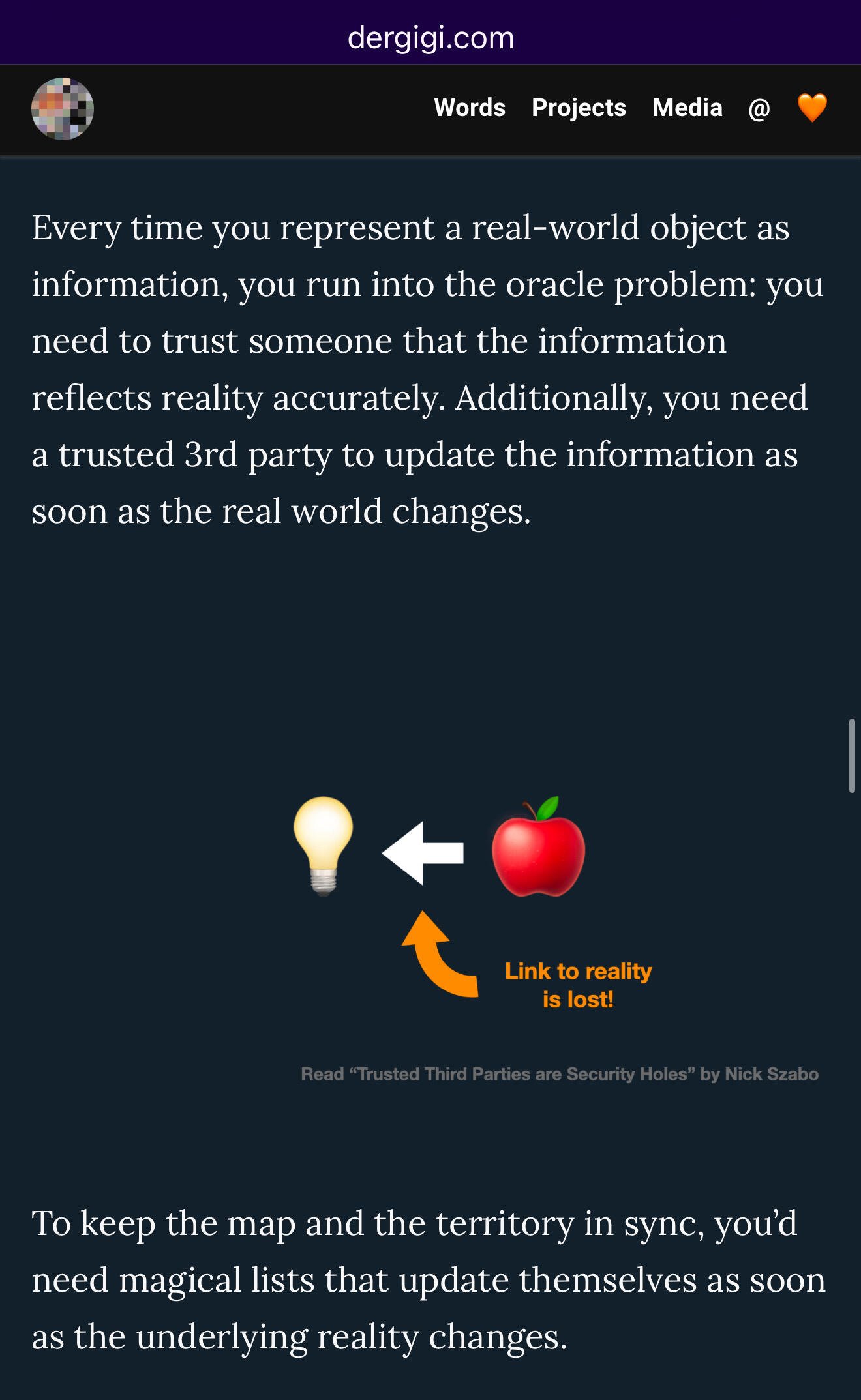

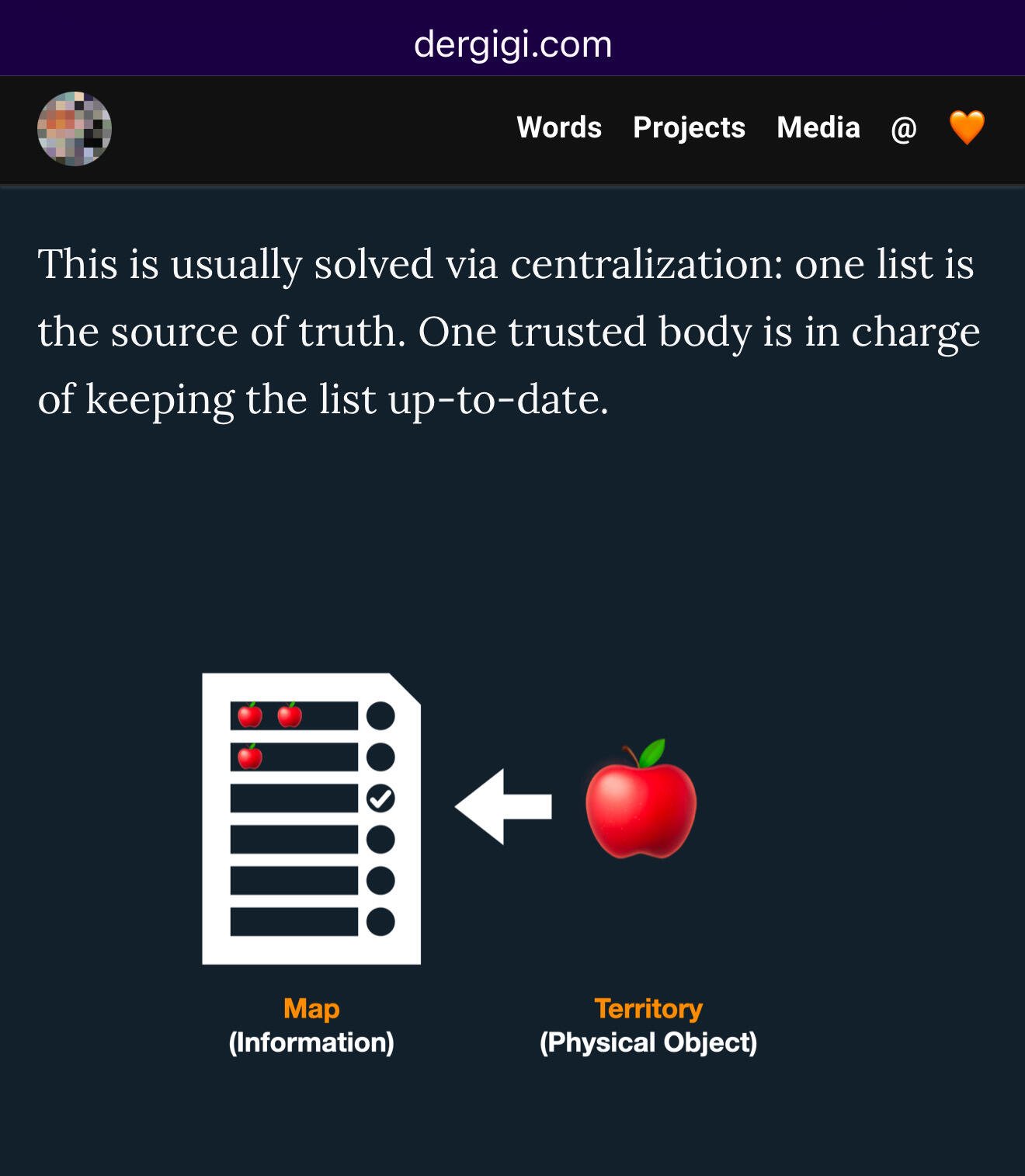

“This is why bananas on a blockchain don’t work.”

— nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc, Memes vs The World

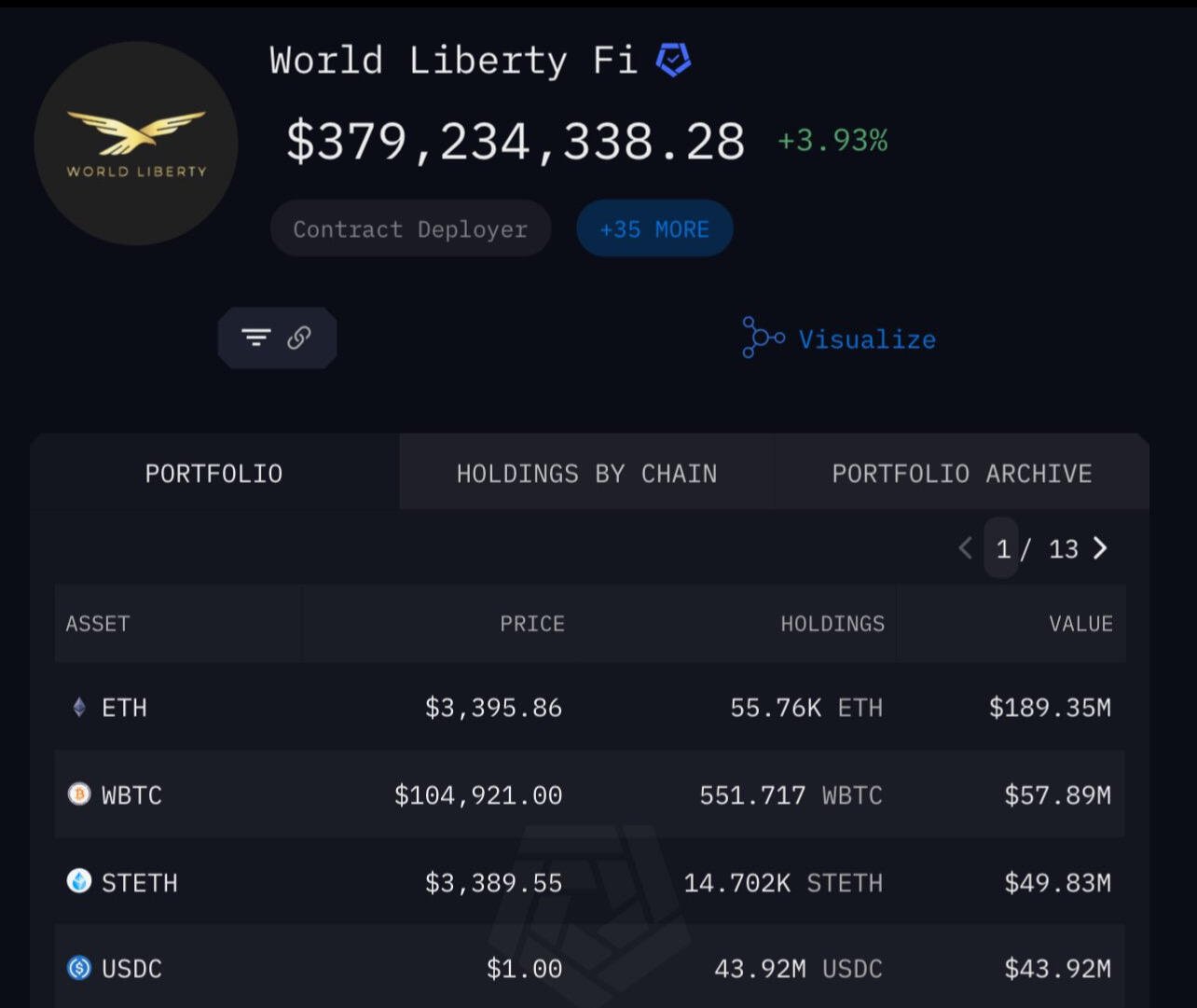

I understand it is the standard, but I don't think is accurate, since it values based on Market Cap and not on Realized market Cap.

Those projects where there were pre mining issuance coins at 0$ value are now accounted at the spot value, which is totally inflated.

More likely Bitcoin dominance is north of 80%

I love this video from Adolfo Contreras, worth watching.

However it got me thinking. Sometimes "us humans" believe we are special and different, and we try to compartmentalise things for simplicity.

Quantum economis has shown us that this might be more tricky that we want to believe.

In nature things change from state seamlesly, and bitcoin as mathematically expressed energy (PoW) might be similar.

Why does it have to be one thing or another?

For someone it can be a Store of Value for ever, digital property like.

For others it might be a medium of exchange as a P2P payment system, for someone else just a rail to chanel other financial tools.

The beauty is that anyone can use it for what ever purpose he wants, without having to fit in a specific category.

Just food for thought.

By the way.

I just re-listened to your 2020 interview with Preston. At that time it helped me put together a many things and gain a deeper understanding of what is really at the core of this change.

Thanks for being so generous on sharing your ideas.

Does it really matter ?

If he plays the shit coin, short term gain, he will be the first casualty..

Tick, toc next block.

Bitcoin does not care.....

Love the way you put it.

I don't know why people get concerned of argue about them

Just keep stacking sats and toñime will yell..

Announcement:

Today, we’re excited to announce the launch of Blockstream Asset Management (BAM), our new asset management division, alongside two institutional-grade Bitcoin funds designed to bring regulated, secure, and innovative financial products to investors.

Here’s what you need to know:

https://blockstream.com/press-releases/2025-01-23-blockstream-asset-management-launch-bitcoin-funds/

1️⃣ Blockstream Income Fund

A USD yield fund designed to generate stable, predictable returns. By lending against Bitcoin collateral with conservative loan-to-value (LTV) ratios, the fund targets high single-digit to low-teens yields.

📌 Focused on loans from $100k to $5M, this fund capitalizes on pricing inefficiencies in Bitcoin-backed lending markets while leveraging Blockstream’s network of Bitcoin-native businesses to ensure high-quality borrowers.

2️⃣ Blockstream Alpha Fund

An actively managed fund combining diverse strategies like derivatives trading, event-driven opportunities, and Lightning Network operations to deliver consistent, risk-adjusted outperformance.

📌 Tailored for institutional and sophisticated investors seeking enhanced returns within the Bitcoin ecosystem, this fund balances risk and reward while actively contributing to the broader Bitcoin economy.

💬 Why it matters:

“The launch of Blockstream Asset Management and our inaugural suite of funds represents Bitcoin’s evolution from a niche asset into a pillar of modern investment portfolios,” said Dr. Adam Back, CEO and co-founder of Blockstream.

Both funds are structured under the 506(c) exemption, ensuring the transparency, security, and performance that institutions and high-net-worth investors expect.

🔜 Looking ahead: Later this year, we’ll launch the Blockstream Yield Fund, offering Bitcoin holders consistent, low-risk returns.

This milestone marks a key step in our mission to integrate Bitcoin into mainstream finance, enhance adoption, and drive innovation within the ecosystem.

Get in touch to learn more about Blockstream Asset Management and our Bitcoin-based financial products:

blockstream.com/finance

Once again Blockstream setting the standards....

Hope he is leading by example disclosing openly his bank accounts, assets and all his personal communications.

All animals, are equal, but some are more equal than others.

Your article about time preference came to mind. It is one of the first I show when orange pilling. Your might want to post again since there might be people that have not read it yet.