#Nostr folks hitting me like “yo, you were right for selling the top!”

Funny how everytime y’all were laughing at me…

Look who’s crying now.

Wished all kinds of bad on me, meanwhile, all I ever tried to do was help.

God don’t like ugly. Stupid why you never get no where you block your own blessings 💯

nostr:nprofile1qqs9pqy620l0jkgy2yaggr2qs25jk3wdtudeusmdn54e92yuuzglzeq74a7n6 what happen to game stop

Bitcoin network activity has officially entered a bear market.

Usage is plunging! 📉 what yall think 🤔

BREAKING: Since Donald Trump took office, the U.S. stock market has shed $9.6 trillion in value — marking the steepest market decline ever recorded under a new president.

New dev Love Losing 100% , if you not halking the charts bro i wouldnt be playing no games right now ... this where the skill feed take the slow money and 90% sure trades

Shoutout to everyone who really put their life into #Bitcoin.

But if you’re out here taking advice from the same people who failed you and ran failed businesses…

You kinda deserve to stay broke. Wake up.

Bitcoin's 12-Year CAGR is now lower than its 10-Year CAGR. 👀

BREAKING: Egg prices have taken a historic nosedive, sinking over 63% this month—the steepest decline ever recorded in history.

What if everything you believe is based on someone else's agenda?

Has anyone read these books ?

1. "Flash Boys" by Michael Lewis: This book explores high-frequency trading and the hidden world of market manipulation.

2. "Reminiscences of a Stock Operator" by Edwin Lefèvre: A classic that provides insights into the psychology of trading and market tactics.

3. "The Misbehavior of Markets" by Benoit Mandelbrot: This book offers a different perspective on market behavior and volatility.

4. "Dark Pools" by Scott Patterson: This one delves into the world of private exchanges and algorithmic trading.

Miss yall $Nostr

JUST IN: #Bitcoin plunges below $80,000.

- $5+ billion in longs liquidated in just 4 days.

- BTC is down nearly -30% from January.

- BTC Strategic Reserve not what bulls wanted.

- Price broke 200-day average, very bearish.

- Institutional demand gone, record ETF outflows.

- El Salvador shuts down Bitcoin-related projects

Last cycle top $69K, and now $420K. The #Bitcoin devs aren’t even hiding the script anymore. 😂

I knocked this nigga out when I was 18 and he watch every single one of my stories til this day, damn bro I get it you gon get me 🤣

Don’t worry guys in a few days we will all be screaming “we’re so back!”

😭😭😭

It's always the presidents' sons doing some shady shit, innit?

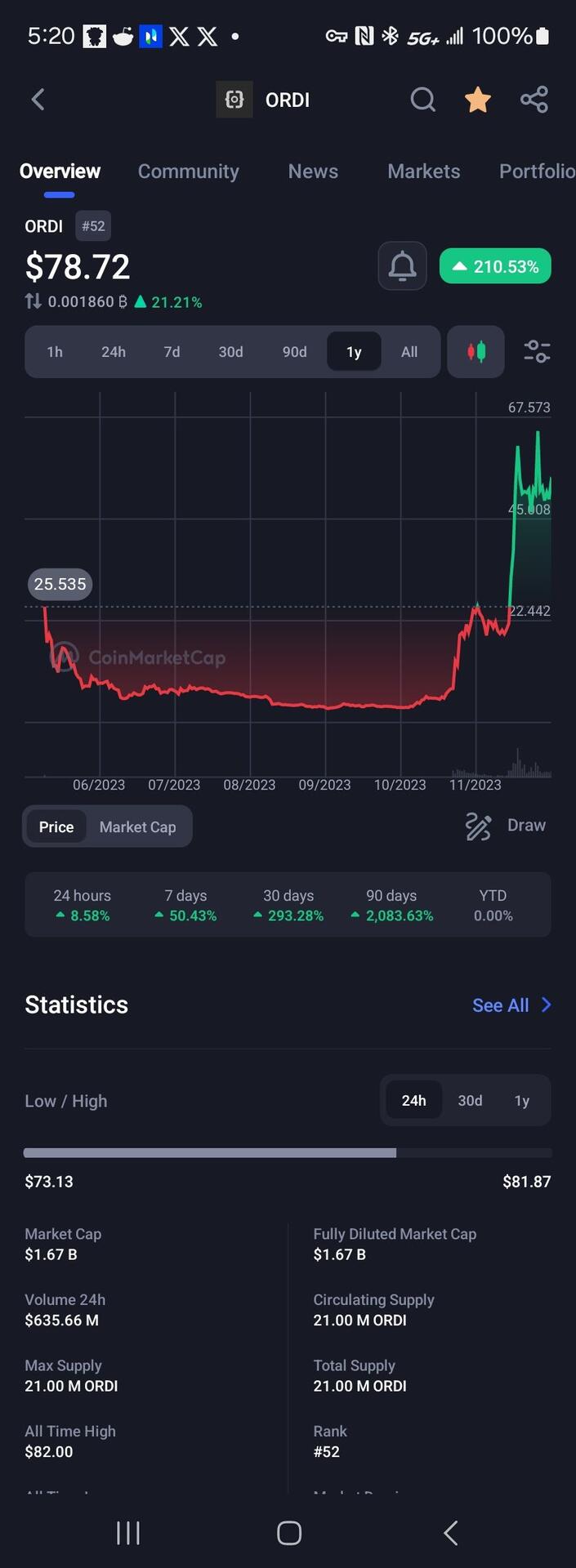

Let's set the record straight about this $Ordi debate. It's clear that some of you are feeling regretful for missing out. 😄

Consider this scenario: if you had purchased 50 $Ordi at $3 each using $BTC, that would've cost you $150 when Bitcoin was at $25k, equivalent to about 0.00588 in $BTC. Now, here's an interesting point for those who may need a bit more time to process:

If you had simply held onto your $BTC, you'd be looking at a 60% gain, which, with the current Bitcoin price, would put your investment at around $239.

However, if you had chosen to invest in $Ordi and then moved your profits back into $BTC, your initial 50 $Ordi, which is now valued at $4k, would have given you a significantly larger return, especially when considering the current Bitcoin price of 0.09756 BTC.

So, criticizing this strategy doesn't make much sense and isn't helpful for the community, especially if you advocate for people to accumulate more Bitcoin. #bitcoin"

#Entertainment #Nostrich #GrowNostr #repost #420 #weedstr #Bitcoin #GSBAM

#m=image%2Fjpeg&dim=705x1920&blurhash=%40055Og%7De%3F%5E_NU%7D%25%7D.mnU%25K_NpH%23%3D%3ASP7IB%7BRKfH%408xKHm-E%2CJ%7DQnebEKDi&x=1ac4101e439c7ab1ddfd6b7181d826b5f456f4e46960424dc3c3ca2a7f4aed33

#m=image%2Fjpeg&dim=705x1920&blurhash=%40055Og%7De%3F%5E_NU%7D%25%7D.mnU%25K_NpH%23%3D%3ASP7IB%7BRKfH%408xKHm-E%2CJ%7DQnebEKDi&x=1ac4101e439c7ab1ddfd6b7181d826b5f456f4e46960424dc3c3ca2a7f4aed33