Thats better 😭

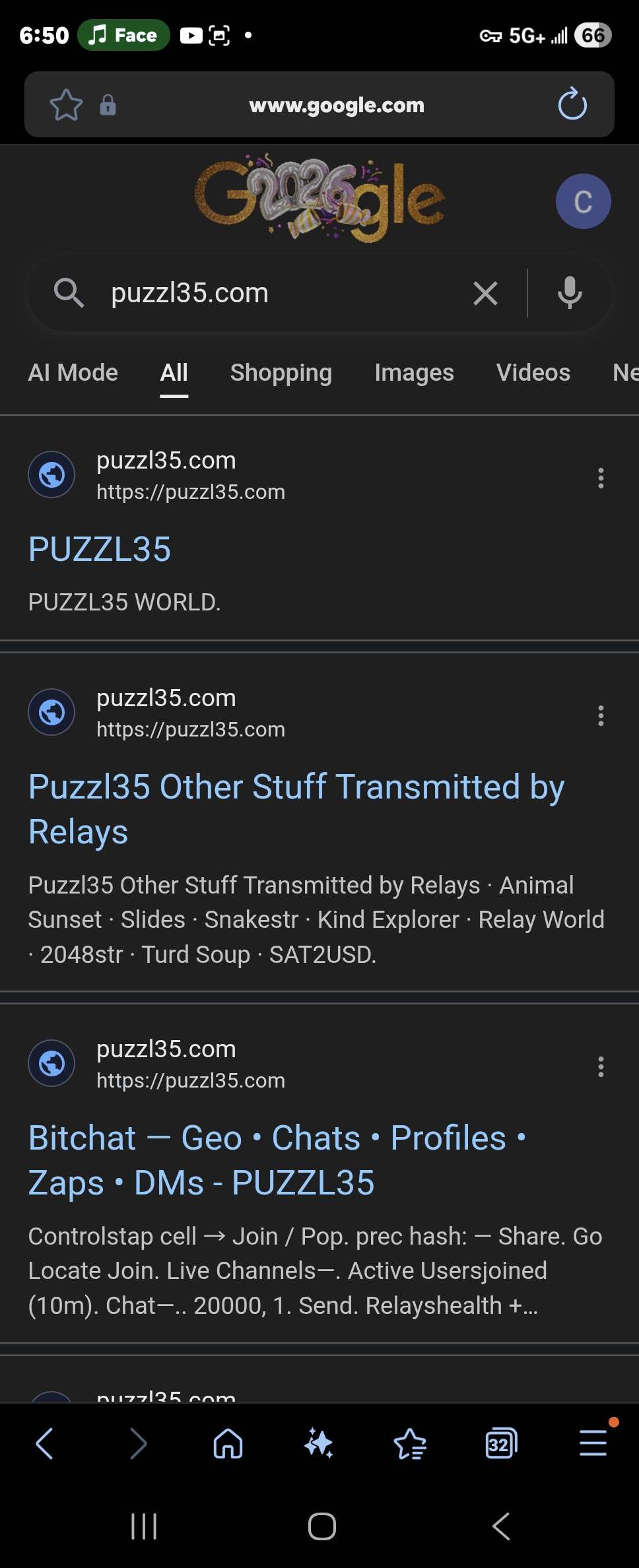

🚨 BANKS TAP FED REPO FACILITY FOR $75 BILLION IN EMERGENCY LIQUIDITY OVERNIGHT 🚨

⚡️🔥Just how big exactly are the losses in their OTC silver derivatives & swaps that the big bullion banks short silver have sustained this month!?! 🔥⚡️

Yes, we know today is 12/31 and it's year end, but needing $74.6 BILLION in emergency overnight liquidity from The Fed's Repo Window is NOT NORMAL.

Smoke is now POURING out of the Financial System.

Do we have a 5-Alarm SILVER FIRE Raging?? 🔥

Awww he loves youuuu

When i google it this is what came up !

This sight amazing

Fair take. Icarus wasn’t dumb, he just underestimated risk management 😄

Ambition without limits is just leverage without a stop.

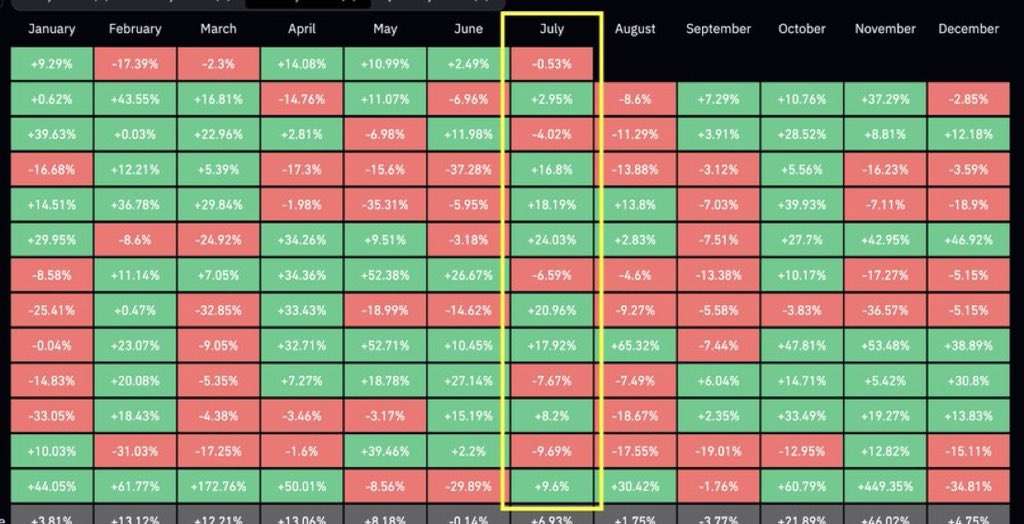

Weekly of $Btc 😎

Dam he should have done his research😭😭

10K for the fit, I'm too wavy, 39, I'm rich with 3 babies, pinky ring

The wrist cost 380, really made it I'm the shit

Investigations, yes I evaded, mouths shut, you know how we played it

Now I'm M.I.A might be vacant, thank God I went legit,

Happy new years eve lets do it different this year ✨️

Told yall Dtcc was going to make a move !

These streets took it all from us, stole our innocence, there was a time we played ball all summer, Now its court to prove we innocent.

Everything change the monent that the money came, dived us and they put hated in the game

🤣🤣

nostr:nprofile1qqszd44fgen4ucpl3hjt7muuaazzqdahp3lwu9c07phdweelcdxf3ugpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qyg8wumn8ghj7mn0wd68ytnddakj7qg6waehxw309aex2mrp0yhxwet5v9kxy7fwvdhk6tmkxyrm4r76 I got my money on her

What ever phone you got is working 💪🏽

Plus no makeup women winning these day !

#Nofiltergang

Thats shit so close I see the fuzz on your chin 🤣

Gm bro !

I always forgive all the people who wanted me to go broke !

Banks are shorting

But what real investors are watching is the Fed Independence

Merry Christmas my guy and happy new years

🚨🚨MARGIN CALL🚨🚨

Is a Large Bullion Bank's Short Silver Position About to Be LIQUIDATED?

⚡️ MASSIVE $429M Call Option Placed on SILJ Moments Before Friday's Close!! ⚡️⚡️

⚡️Did a Bullion Bank Just Buy $429 MILLION in SILJ Silver Miner ETF Calls After Receiving a MARGIN CALL on its Naked Short Silver Position?? ⚡️

🔥Here's what we know:

🔥17 non-US banks were net short 43,084 COMEX silver contracts - (215.42 MILLION oz) prior to silver's parabolic move higher...and reportedly short HUNDREDS OF BILLIONS of oz via the OTC derivatives market.

🔥On Christmas Day, the physical price of silver shot past $80/oz in Shanghai.

That afternoon, SilverTrade warned readers that if COMEX allowed US silver prices to chase Shanghai price setting into the $80's, it would immediately DETONATE the global bullion banks' derivative books.

🔥Once Globex trading resumed Christmas night, silver futures prices gapped higher from $72 to over $74.

The silver squeeze had begun.

🔥At 8:30 Friday morning, the first signs of major stress in the banking system appeared as TBTF banks tapped the Fed's Repo Facility for $17.251 BILLION in emergency liquidity.

🔥As trading progressed Friday, Silver Prices EXPLODED 11% higher on the day, from $71.03 up to $79.70. Silver CLOSED even stronger in Shanghai at $84.97!

🔥Late Friday afternoon, rumors bagan swirling through the market that a large bullion bank was unable to meet a massive MARGIN CALL it had just received over its naked short silver position.

⚡️This means the silver short position would be LIQUIDATED. Unrealized losses immediately MARKED TO MARKET.

🔥At exactly 3:52 pm EST Friday, someone bought $429 MILLION of Silver Miners ETF $SILJ Calls, the majority expiring in only 3 weeks- January 16, 2026.

🔥Only 8 minutes before the close, after silver had ALREADY soared to nearly $80/oz, someone placed a GARGANUTAN $429 MILLION BET on JUNIOR SILVER MINERS placing a huge rally within the next 3 weeks.

⚡️Let's put this number in perspective.

The ENTIRE MARKET CAP of SILJ is $2.67 Billion.

🔥A single entity placed a MASSIVE DIRECTIONAL $429 M BET ON THE SILJ SILVER JUNIOR MINERS ETF with a $2.67 B market cap THAT EXPIRES IN 3 WEEKS.

⚡️8 minutes before the close.

⚡️After a large bullion bank naked short silver reportedly received a margin call it couldn't meet over its silver short position.

🚨Knowing that it couldn't meet its end of day MARGIN CALL in 8 minutes- meaning its legacy silver short position would be⚡️ LIQUIDATED ⚡️the moment silver futures resume trading Sunday night - and KNOWING that liquidating its MASSIVE naked short silver position would cause the MOTHER OF ALL SHORT SQUEEZES, did this bullion bank attempt to save itself by placing a massively leveraged LONG BET on the SILJ Silver Junior Miners ETF?

🔥🔥Because this bank KNOWS that global silver prices are about to be MASSIVELY repriced higher as the bullion banks have lost control of the silver market, and their naked short silver positions are being FORCE LIQUIDATED??

These are the facts. Are we looking at a strange string of coincidences?

Or is a large bullion bank's legacy silver short position about to be LIQUIDATED the moment trading resumes Sunday night?

Make your own conclusion.

Your right they will seek comfort and bitcoin is unknown and sketchy for the average.

Lets be real since 2018 gold market cap was around 8 trillion today we are sitting at 31.5 trillion

Some literally from then to now add almost 23.5 trillion wasn't bitcoin supposed to do this ?

q

q

Facts thats our move 💯

They go that ways

We go the other way !

Tom Lee says #Bitcoin at 200k my Christmas 🎄

If they did that would have hurt lol 😆

Nigga talking tunnel vision

Nigga had a better vision

You don’t rise to your goals. You fall to your systems. If your system is weak — so are your results. Bitch 😆

It was a good try nostr:nprofile1qqs9phjf9nl9guj9phc6q9m0makezh5hedwelrf7enhh6f0lp2y8rhspz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs6amnwvaz7tmwdaejumr0dsq32amnwvaz7t6zv4mx7tnwdaehgu339e3k7mgf8sdva