Futures Flat, Dollar Jumps Ahead Of Nvidia's Critical Earnings

Futures Flat, Dollar Jumps Ahead Of Nvidia's Critical Earnings

Futures are flat with all eyes on NVDA - the largest S&P component by far accounting for a record 8% of the S&P - set to report after the bell. As of 8:00am, S&P futures are just barely in the green recovering from a modest loss earlier, while Nasdaq futures gain 0.1%, with NVDA up +54bps premarket, tracking most of the Mag7 higher and Semis also bid. Cyclicals are mixed (Industrials up, Fins down) with Defensives mostly higher. The yield curve is twisting steeper but with a lesser magnitude to yesterday: bonds steadied after long-dated debt from the US to France and the UK retreated Tuesday, with the yield on 10-year Treasuries little changed at 4.27%. $70 billion of 5Y notes will be auctioned at 1pm ET; yesterday’s 2Y auction saw strong demand closing 1.5bp through. The USD jumps to the highest since Friday's Jackson Hole dovish pivot, with the Euro sliding to a 3 week low as attention turns to the political mess in Europe, and gold continues to trade rangebound. The market’s focus is on NVDA today (our preview is here).

?itok=GZbA7tNi

?itok=GZbA7tNi

In premarket trading, Mag 7 stocks are mixed (Nvidia +0.6%, Microsoft +0.2%, Tesla +0.1%, Apple little changed, Amazon little changed, Meta -0.2%, Alphabet -0.3%).

Elanco Animal Health (ELAN) gains 4.9% with the company to replace Sarepta Therapeutics in the S&P MidCap 400 effective Sept. 2.

MongoDB (MDB) shares soar 31% after the software company reported second-quarter results that were much stronger than expected. It also raised its full-year forecast.

nCino (NCNO) gains 11% after reporting adjusted earnings per share for the second quarter that beat the average analyst estimate.

Okta (OKTA) is up 5.4% after the software company reported second-quarter results that beat expectations and raised its full-year forecast.

There’s been plenty to rattle markets in recent days, including French political turmoil and the Trump administration’s attacks on the Fed, as well as fresh tariff threats. But investors are now focusing on Nvidia’s earnings, due after the bell (our https://www.zerohedge.com/markets/nvidia-earnings-preview-these-are-things-watch

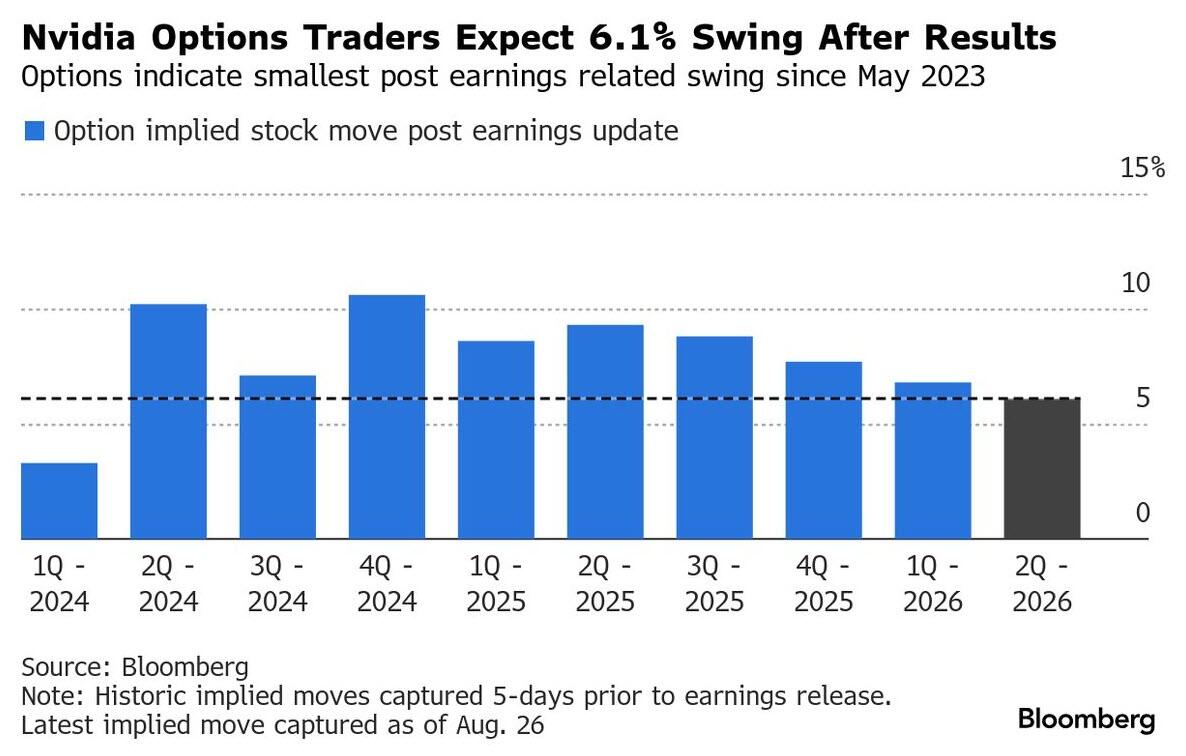

). The chipmaking giant is expected to provide clues on the sustainability of massive AI spending, and how the US-China rivalry is limiting growth. Options currently imply a 6.1% swing in the stock, which would represent a move of roughly $270 billion in either direction in market value, larger than about 95% of the S&P 500 companies.

?itok=iT-24cau

?itok=iT-24cau

“Nvidia is the story of the week. We’ve seen some erosion of the AI premium, so this is an important number to determine whether the AI story has got further to go,” said Guy Miller, chief strategist at Zurich Insurance Group. “This could either allow the technology cycle, the AI dream, to continue, or it could get significantly dented.”

Dimming the excitement is uncertainty over how much business Nvidia will be able to do in China. The US government has curbed China’s access to Nvidia products on national security grounds. While the Trump administration recently eased some of those export restrictions, Beijing has pressed domestic customers to seek alternative suppliers.

“A miss could spark meaningful volatility, while a positive surprise would likely see the major indexes make a run at all-time highs,” said Tom Essaye at The Sevens Report.

Elsewhere, in a reminder of the lingering tariff threat to global trade and inflation, Trump’s 50% levy on most Indian imports took effect Wednesday, penalizing the country for buying Russian oil. In Europe, the EU aims to fast-track legislation by the end of the week to scrap all tariffs on US industrial goods — a Trump demand before Washington lowers duties on the bloc’s car exports.

In Europe, The Stoxx 600 is steady after giving up earlier gains. The CAC 40 outperforms with a 0.4% rise even as the OAT-bund spreads widens slightly.

Earlier in the session, Asian stocks declined, weighed down by a sudden drop in Chinese equities, as an absence of new reasons to buy paved the way for profit-taking. The MSCI Asia Pacific Index slipped as much as 1.1%, with Tencent, Woolworths Group and Meituan the biggest drags on the gauge. Major equity indexes in the region were mixed, with those in China and Hong Kong dropping, while the Philippines and Taiwan were among the top gainers. Chinese equities slid in the afternoon session, reversing an earlier advance. One reason for the reversal may have been the fact that chipmaker Cambricon Technologies Corp. briefly became the country’s most expensive onshore stock, which then triggered some profit taking. Chinese officials are seeking to manage bubble risks as the rally extends. Sinolink Securities Co. raised its margin deposit ratio for new client financing to 100%, becoming the first broker to introduce tightening measures amid surging interest in stocks.

In FX, the Bloomberg Dollar Spot Index is up 0.3% as the greenback strengthens versus its G-10 peers. The kiwi is the weakest, falling 0.5% while the Canadian dollar is the most resilient, slipping just 0.1%.

In rates, the Treasury curve steepens further following Tuesday’s front-end rally, stoked in part by strong demand for 2-year note auction. However, new 2-year note’s yield dipped below 3.65%, the lowest for the tenor since early May. Supply cycle continues with $70 billion auction of 5-year notes, the largest of the seven nominal coupon sales, at 1 p.m. New York time. Yields are within 1bp of Tuesday’s closing levels; the 10-year near 4.27%; swap contracts linked to future Fed rate decisions continue to fully price in one quarter-point rate cut this year in October and a second one by year-end.

In commodities, WTI crude futures fall 0.4% to $63 a barrel. Spot gold drops $12. Bitcoin is down 0.5%.

US economic data calendar is blank; second estimate of 2Q GDP is ahead Thursday, July personal income and spending (includes PCE price indexes) Friday. Fed speaker slate includes Richmond Fed President Barkin repeating his Aug. 12 remarks on the economy (time TBD). Nvidia’s earnings after the US close will be the main highlight.

Market Snapshot

S&P 500 mini little changed

Nasdaq 100 mini little changed

Russell 2000 mini -0.1%

Stoxx Europe 600 little changed

DAX -0.3%

CAC 40 +0.2%

10-year Treasury yield little changed at 4.26%

VIX +0.2 points at 14.77

Bloomberg Dollar Index +0.3% at 1208.98

euro -0.4% at $1.159

WTI crude -0.4% at $63.01/barrel

Top Overnight News

New tariffs on Indian goods, the highest in Asia, took effect at 12:01 a.m. in Washington on Wednesday, doubling the existing 25% duty on Indian exports: BBG

Cracker Barrel said it is reverting to its “Old Timer” logo after a rebrand ignited a culture war. “We said we would listen, and we have. Our new logo is going away and our ‘Old Timer’ will remain,” the company said Tuesday. Cracker Barrel’s shares jumped more than 9% in after-hours trading.

Musk’s Starship carries out successful space mission after multiple failures. Giant SpaceX rocket’s 10th test flight deploys dummy satellites and reinforces billionaire’s dominance of commercial space flight: FT

Exxon Mobil Corp. held talks with Russia’s state-controlled oil company about returning to its Sakhalin-1 oil development: WSJ

Commerce Secretary Howard Lutnick sparked a minor rally in shares of defense contractors with his suggestion that the US might take ownership stakes in some of them, even as industry analysts warned the idea poses serious conflict-of-interest concerns: CNBC

Why the Democrats are losing post-industrial America. Former steel town of Bethlehem, Pennsylvania will be crucial battleground in next year’s midterms and the 2028 White House race: FT

US offers air and intelligence support to postwar force in Ukraine. Washington prepared to contribute surveillance, command and control and air defence assets, say European officials: FT

China’s industrial companies saw their profits fall at a slower pace in July, with industrial profits declining 1.5% last month from a year earlier, Bloomberg Economics had forecast a decline of 5.8%: BBG

Cambricon Technologies Corp. swung to a record profit in the first half, reflecting a wave of demand for Chinese chips after Beijing encouraged the use of homegrown technology in a post-DeepSeek AI boom: BBG

Ukraine to allow young men to leave the country. Change to border rules aims to address high number of males being sent abroad by their parents before they reach 18: FT

Microsoft Investigating Employees After Gaza Protest Locks Down Building. The tech company is weighing disciplinary measures for employees who occupied President Brad Smith’s office in protest of Microsoft’s relationship with the Israeli government during its war in Gaza: WSJ

America’s most senior envoy in Pakistan has told the South Asian nation that US companies are showing “strong interest” in its oil and gas sector: BBG

French assets hit by prospect of government collapse. Investors warn government is likely to lose a snap confidence vote on September 8: FT

Trump media group in $6bn deal to buy Crypto.com tokens. Venture will be the ‘first and largest publicly traded CRO treasury company’: FT

US tariff threat over Indian imports of Russian oil could backfire. If New Delhi reduced its purchases to zero, oil prices and inflation would jump: FT

Top Corporate News

Royal Bank of Canada beat estimates on strong performance across its biggest businesses and as the firm set aside less money than expected to cover possible loan losses, a rebound from notable misses on credit earlier this year.

Newmont Corp., the world’s largest gold miner, is studying plans to drive down costs that could lead to deep job cuts.

MongoDB Inc. soared 29% in premarket trading after the software company reported second-quarter results well above expectations and significantly raised its forecast, with analysts at Citi calling the report a “blowout” that showed a strong AI contribution.

Cracker Barrel Old Country Store Inc. said it’s getting rid of a new logo that had sparked controversy and prompted a slump in its share price.

Meituan’s profit got wiped out in a price-based battle with rivals Alibaba Group Holding Ltd. and JD.com Inc., the most striking sign yet that its longstanding dominance in a lucrative home market is under threat.

Nikon Corp.’s shares surged 21% after Bloomberg reported that EssilorLuxottica SA, the maker of Ray-Ban sunglasses, is exploring a potential deal to increase its stake in the Japanese optical equipment manufacturer.

Rio Tinto Group’s new chief executive officer has combined some of its biggest businesses as he looks to simplify the world’s No. 2 miner.

Vitol Group is set to load the first cargo of Syrian crude oil since the lifting of western sanctions on Damascus as the country’s energy industry attempts to recover of more than a decade of destruction from armed conflict.

Trade/Tariffs

US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

US Senate panel is preparing to hold a hearing next week on Trump's Fed pick Stephen Miran for the seat vacated by former Fed governor Kugler.

The Trump administration is reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks that would potentially extend its reach beyond personnel appointments in Washington, according to Bloomberg citing sources.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with trade rangebound amid recent Fed independence concerns and as participants braced for NVIDIA's earnings. ASX 200 was kept afloat amid outperformance in the mining and materials industries, although gains are capped by heavy losses in consumer staples and tech, with supermarket operator Woolworths suffering a double-digit percentage drop after it reported a 19% decline in profits. Nikkei 225 traded indecisively, swinging between gains and losses before eventually recovering on currency weakness. Hang Seng and Shanghai Comp lacked firm conviction as the focus turns to earnings releases with the big banks set to report tomorrow, while participants are also awaiting the resumption of US-China talks later in the week.

Top Asian News

Chinese Commerce Ministry official Sheng Qiuping said China is to announce policies to broaden services consumption in September.

Mitsubishi Motor (7211 JT) cuts guidance (JPY): net seen at 10bln (prev. 40bln); operating at 70bln (prev. 100bln), recurring 60bln (prev. 90bln); Co. cites US tariffs, decline in sales volume, increase in selling expenses, competition, inflation.

European bourses (STOXX 600 U/C) opened modestly firmer across the board, but sentiment did dip a little bit off best levels to currently show a mixed picture. European sectors hold a slight positive bias. Consumer Products takes the top spot joined thereafter by Healthcare whilst Banks lag; the latter pressured by Commerzbank (-2.6%) and Deutsche Bank (-2.5%) after the pair received broker downgrades.

Top European News

UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight).

EU is preparing emergency measures to support the ailing aluminium industry amid recycling plants in the bloc shutting down capacity due to US producers paying more for European scrap metal, according to FT.

SNB's Martin said the SNB does not see a risk of deflationary developments and forecasts show a jump in inflation in coming quarters, adds inflation dynamics in Switzerland should not be dramatically disrupted by recent dollar movements. Martin added the current Swiss franc value is more due to dollar weakness than franc strength, but forex market interventions may be necessary to ensure price stability. The SNB currently has no reason to increase or reduce gold holdings. The bar for taking rates into negative territory is higher than for cutting rates when above zero.

UK ONS said June 2025 Producer output Price inflation estimated to be -1.0% Y/Y.

FX

DXY is on a firmer footing and continuing to gain this morning amid a weaker EUR (see below) and following the prior day's marginal losses owing to Fed independence concerns after President Trump moved to fire Fed Governor Cook who will be challenging the attempt in court. On top of that, it was also reported that the Trump administration is reviewing options for exerting more influence over the Federal Reserve’s regional banks that would potentially extend its reach beyond personnel appointments in Washington. DXY trades in a 98.24-98.70 range.

EUR/USD pared recent gains amid a lack of fresh catalysts from the bloc and with France facing political uncertainty. Losses accumulated for the EUR despite a lack of headlines around the European equity open, with market contacts noting of potential stops tripped under 1.1600 after the pair found support near the level in the prior two session. German GfK Consumer Sentiment did little to sway the EUR at the time, which printed below expectations. EUR/USD currently sits in a 1.1578-1.1651 range.

USD/JPY steadily advanced towards the 148.00 handle as the dollar regained poise with newsflow on the lighter end, but the pair influenced by a rebound in the Buck. USD/JPY trades in a 147.29-147.97 range.

GBP is softer amid the firmer Dollar but losses cushioned by a weaker EUR. On the inflation front, UK's Ofgem raises energy price cap by 2% for Oct-Dec (vs exp. 1% by forecaster Cornwall Insight). The price cap limits the amount suppliers can charge per unit of energy and is revised every three months. Cable trades in a 1.3431-1.3482 parameter and sandwiched between its 50 DMA (1.3493) and 100 DMA (1.3436).

AUD/USD failed to sustain the initial knee-jerk uplift seen following hot Monthly CPI data and stronger-than-expected Construction Work which feeds into Australia's GDP data.

PBoC set USD/CNY mid-point at 7.1108 vs exp. 7.1559 (Prev. 7.1188)

Fixed Income

USTs traded with a negative bias earlier but caught a slight bid as the risk tone deteriorated a touch; in a very narrow 112-02+ to 112-06+ range. Price action overnight was lacklustre, as US paper took a breather following the bull steepening seen on Tuesday, spurred by US President Trump’s move to oust Fed Governor Cook. Today’s session has seen yields rise across the curve, generally to a similar degree. Recent newsflow has not really had too much of an impact on price action today; US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with Stephen Miran and former World Bank President Malpass potential candidates, according to WSJ citing sources.

Bunds are outperforming vs peers; initial trade was sloppy in-fitting with global peers but has recently picked up a little to trade higher by a handful of ticks. Currently trading at the upper end of a 129.33 to 129.71 range. The docket is void of any pertinent European data/ECB speakers. German GfK earlier saw sentiment drop a little from the prior, and more than expected. Germany's new 2032 line which was very weak, had little impact on price action.

Gilt price action today has been dictated by global peers; initially opened lower amid the subdued trade seen in USTs/Bunds, but then reversed, but without a clear driver. Currently higher by around 17 ticks, and trades in a 90.26-62 range.

UK sells GBP 5bln 4.375% 2028 Gilt: b/c 3.16x (prev. 3.71x), average yield 3.991% (prev. 3.941%) & tail 0.2bps (prev. 0.2bps).

Germany sells EUR 2.675bln vs exp. EUR 4.0bln 2.50% 2032 Bund: b/c 1.2x, average yield 2.46% and retention 33.13%.

Commodities

Crude futures have tilted lower following a flat overnight session and after retreating throughout the prior day and with demand not helped by the narrower-than-expected headline crude draw in private sector inventory data, while there were also bearish views on oil including from US President Trump who thinks oil will fall beneath the USD 60/bbl level soon and with Goldman Sachs forecasting Brent to decline to the low USD 50s by late 2026. WTI currently resides in a 62.99-63.46/bbl range while Brent sits in a USD 66.40-66.91/bbl range.

Spot gold pulled back from near the USD 3,400/oz level after advancing yesterday amid a softer dollar. The yellow metal has been unfazed by the recent bout of Dollar strength, suggesting deteriorating risk across the market. Spot gold trades in a USD 3,373.78-3,393.55/oz parameter within Tuesday's 3,351.33-3,393.75/oz range.

Softer trade across base metals amid the deteriorating risk and broader Dollar strength. 3M LME copper resides in a USD 9,785.00-9,865.00/t range.

US President Trump thinks oil prices will break below USD 60/bbl soon.

US Private Energy Inventories (bbls): Crude -1.0mln (exp. -1.9mln), Distillate -1.5mln (exp. +0.9mln), Gasoline -2.1mln (exp. -2.2mln), Cushing -0.5mln.

Kazakhstan holds talks to resume oil transit via BTC, according to Tass citing the energy ministry; oil supplies to Europe are proceeding without delays.

Two Chinese investors are interested in taking a stake in Vietnam’s largest tungsten business, via Reuters citing sources.

Ukraine's Energy Ministry said Russia attacked energy and gas transit infrastructure in six Ukrainian regions overnight.

Geopolitics - Middle East

US special envoy Witkoff said they are negotiating multiple entries into peace accords with Israel, while Witkoff said President Trump will chair a meeting on Gaza at the White House on Wednesday.

US Secretary of State Rubio is to meet with Israeli Foreign Minister Sa'ar at the State Department on Wednesday.

Hamas said all Palestinians killed by Israel in Gaza’s Nasser Hospital attack on Monday were civilians and that two of the six Palestinians identified by Israel as alleged militants were killed in separate attacks away from the hospital.

WSJ's Norman posts "If SnapBack happens this week, very strong odds it happens tomorrow"; in relation to the Iranian snapback mechanism. "If no SnapBack, either things change dramatically or extension. Odds of dropping SnapBack without extension are tiny at this point. There is still a very real possibility that SnapBack triggered but extension agreed during 30-day process. Depends on Iran".

Geopolitics - Ukraine

US special envoy Witkoff said he is meeting with Ukrainians in New York this week and that Russian President Putin made a good-faith effort to engage.

"Moscow: No agreement yet to upgrade the level of Russian and Ukrainian negotiating delegations", according to Al Arabiya.

Ukrainian President Zelensky said Russians are currently sending negative signals regarding meetings and further developments.

US Event Calendar

7:00 am: Aug 22 MBA Mortgage Applications -0.5%, prior -1.4%

DB's Jim Reid concludes the overnight wrap

Markets had a very eventful session yesterday, as concerns mounted about the Federal Reserve’s independence, whilst French assets came under fresh pressure ahead of the upcoming confidence vote. So that led to some pretty big milestones, and with investors pricing in faster rate cuts, the US 2yr inflation swap rose to 3.05%, marking its highest level since late-2022 when inflation was still above 6% and the Fed were hiking aggressively. Meanwhile in Europe, the reappraisal of sovereign risk meant that the 10yr French yield closed just 6bps above its Italian counterpart, which is the smallest gap between the two since 2003. So that’s a huge turnaround relative to most of the period since the Euro Crisis, as the spread between the two never fell beneath 50bps until late last year. Bear in mind we’ve also got Nvidia’s earnings after the US close tonight, so there’s plenty on the agenda right now.

We’ll start with the Fed, as investors are watching closely after President Trump’s letter on Monday night that he was removing Lisa Cook from the Board of Governors “effective immediately”. In terms of the latest, Cook’s lawyer, Abbe David Lowell, said yesterday that they would be filing a lawsuit challenging the firing. And later in the day, the Fed issued a statement reiterating that Fed governors “may be removed by the president only “for cause””, but that the Fed would “abide by any court decision” resulting from Cook’s challenge.

The move comes as President Trump is seeking to reshape the Federal Reserve in his direction, and yesterday he commented how “We’ll have a majority, very shortly so that’ll be great once we have a majority, and housing is going to swing and it’s going to be great”. Indeed, of the seven currently on the Board of Governors, two of the appointees from President Trump’s first term (Bowman and Waller) have already dissented in favour of rate cuts, and CEA Chair Stephen Miran has been nominated to fill Adriana Kugler’s old seat. So if Cook were replaced as well, then a majority of the Board could be in favour of rate cuts after Miran’s appointment, even before Chair Powell’s term comes to an end.

Later on, multiple press reports added to this theme. For instance, the WSJ reported that President Trump was considering quickly announcing a replacement for Cook, with former World Bank President David Malpass being one candidate whom President Trump had discussed. Interestingly, Bloomberg separately reported that the administration was looking at ways to have more influence over the Fed’s 12 regional banks, which is important given that 5 of the 12 regional bank Presidents sit on the FOMC at a given time. This is particularly noteworthy at the moment, because every five years, the 12 regional bank presidents come up for approval by the Board of Governors. The next five-year approval is slated for Q1 next year, and theoretically a majority could refuse to approve some of the regional voters.

Our US economists looked in more depth at some of these issues in a note yesterday (link here ). They don’t anticipate a titanic shift in near-term policy, as Cook had been one of the most dovish officials on the Committee already. However, there could be broader implications for the Fed, as it only takes a majority of the Board of Governors (rather than the wider FOMC that also includes 5 of the regional Fed Presidents) to adjust the interest rate on reserve balances (IORB). Historically, the IORB has been set at an appropriate level to maintain the fed funds rate within the target set by the FOMC. But at least theoretically, a Board that didn’t agree with the FOMC could set IORB at a lower level.

For now at least, markets have reacted broadly in line with other episodes where the Fed’s independence has been questioned this year. So we saw a significant yield curve steepening yesterday, with the 2yr yield (-4.5bps) down to 3.68% (helped by a strong auction), the 10yr yield (-1.4bps) down to 4.26%, and the 30yr yield (+3.0bps) moving up to 4.92%. Indeed, for the 2s30s curve, that’s now the steepest it’s been since January 2022. Those moves came as investors priced in a more dovish path for near-term policy, with futures dialling up the expected rate cuts over the months ahead. For example, 109bps of cuts were priced in by the June 2026 meeting at the close, up +5.3bps on the day. So that helped put downward pressure on the dollar index, which weakened by -0.21%, whilst the prospect of more inflation helped push gold prices up +0.82%.

Interestingly, equities advanced despite the news, with the S&P 500 (+0.41%) closing just -0.04% beneath its record high. In part, that was because investors were still unsure if there’d actually be a radical policy shift at the Fed. But several data points also helped to support risk appetite, as they leant against the idea that the US economy was slowing down, particularly after the recent jobs report. For example, the Conference Board’s consumer confidence reading was better than expected in August, at 97.4 (vs. 96.5 expected). Similarly, core capital goods orders were up +1.1% in July (vs. +0.2% expected), and the Richmond Fed’s manufacturing index moved up to -7 (vs. -11 expected).

Over in Europe, however, it was a very different story as fears continued to mount about the fiscal situation in France. As a reminder, Prime Minister Bayrou has called a confidence vote for September 8, but the National Rally, France Unbowed and the Socialists have all said they’ll oppose the government. So as it stands, the government would fall, and that would open the way for a new PM, or even fresh legislative elections. So that’s reinforced existing concerns about France’s deficit, and the country’s assets saw a clear underperformance yesterday.

Those moves were evident across the board. For instance, France’s CAC 40 (-1.70%) built on its -1.59% decline on the Monday, with banks including Société Générale (-6.84%), Crédit Agricole (-5.44%) and BNP Paribas (-4.23%) seeing even bigger losses. That outpaced the Europe-wide STOXX 600 (-0.83%), and means the CAC 40 is now up just +4.46% this year, making it one of the worst performers among the major equity indices in local currency terms. Likewise for sovereign bonds, French 10yr yields were only down -1.1bps, compared with larger falls for bunds (-3.4bps) and OATs (-3.8bps). So by the close, the Franco-German 10yr spread was up to 78bps, which is its widest since April. And significantly, the French 10yr yield closed just 6bps beneath its Italian counterpart, which is the tightest it’s been since 2003.

Elsewhere in Europe, UK markets returned from their public holiday on Monday, with 10yr gilt yields up +4.9bps as they caught up with Monday’s moves elsewhere. We also heard from the BoE’s Mann, who was one of four members on the MPC (out of nine) who voted against a cut at the recent meeting. She said that a “more persistent hold on Bank Rate is appropriate right now”, and investors remain sceptical that there’ll be another rate cut this year. Indeed, the likelihood of another rate cut by the December meeting fell to 42% by the close, down from 48% the day before.

Overnight in Asia, the mood has generally remained positive, with investors turning their focus to Nvidia’s earnings later today. So that’s meant that most of the major equity indices are trading higher, and the CSI 300 (+0.72%) is currently on track for its highest closing level since 2022. Elsewhere, there’ve been more modest gains, including for the Shanghai Comp (+0.33%), the Hang Seng (+0.06%), the Nikkei (+0.36%), and the KOSPI (+0.11%). And US equity futures are also pointing slightly higher, with those on the S&P 500 (+0.07%) up enough to push the index to a new record if realised.

Elsewhere this morning, data has also shown an unexpectedly large jump in Australia’s inflation, with CPI up to +2.8% in July (vs. +2.3% expected). Moreover, the trimmed mean measure also moved up to +2.7%, having been at +2.1% in June. That’s the highest headline inflation in 12 months, and investors have dialled back the likelihood of a rate cut at the RBA’s next meeting in response, with the probability of a cut now down to 22%.

To the day ahead now, and it’s a quiet one on the calendar. Nvidia’s earnings after the US close will be the main highlight. Otherwise, data releases include the GfK consumer confidence reading from Germany.

https://cms.zerohedge.com/users/tyler-durden

Wed, 08/27/2025 - 08:51

https://www.zerohedge.com/market-recaps/futures-flat-dollar-jumps-ahead-nvidias-critical-earnings

Futures Rebound As Google Jumps On Court Ruling, Bond Selloff Fades

Futures Rebound As Google Jumps On Court Ruling, Bond Selloff Fades

US equity futures are higher following a two-day slide, led by Tech with a favorable court ruling boosting GOOG (+5.7% pre-mkt) and lifting the Mag7 group. As of 8:00am ET S&P futures are up 0.5%, recovering most of yesterday's losses; while Nasdaq 100 futs add 0.7%. In premarket trading, Mag7 names are all higher with AAPL (+2.9%) and TSLA (+1.7%) the notable standouts alongside GOOG. Cyclicals are poised to outperform as the yield curve bear steepens. In Europe, the Estoxx 50 is up by almost 1%, led by info tech and industrials sectors. Longer duration bonds are seeing a global sell-off (30Y JGBs +7bp, 30Y Gilts +6bp) while US is outperforming (30Y +2bp); underperformance is driven by global budget concerns (these come and go), which have sent gold is higher for the 7th consecutive session, adding ~5% in that time. USD is weaker and commodities are mixed. WTI crude futures fall 1.7% to near $64.50 after a report said that OPEC+ is considering another supply boost for October at this weekend’s meeting. Today’s data focus is on JOLTS, Durable/Cap Goods, Beige Book, and consumer-sector earnings to gain clarity on the consumer.

?itok=Sgbv2JOE

?itok=Sgbv2JOE

In premarket trading, Alphabet (GOOGL) shares are up 5% after a US antitrust ruling was not as severe as feared. Google will be required to share online search data with rivals while avoiding harsher penalties, including the forced sale of its Chrome business. Apple (AAPL) rises 4% after a US judge stopped short of barring the iPhone maker’s lucrative search arrangement with Google. All other Mag 7 stocks are also higher (Tesla +1.5%, Nvidia +0.4%, Meta +0.8%, Amazon +0.03%, Microsoft unch).

Dollar Tree Inc. (DLTR) falls 4% after the retailer’s 2Q report underwhelmed Wall Street.

HealthEquity (HQY), which administers health savings accounts, rises 4% after posting 2Q profit that beat the average analyst estimate and raised its fiscal year outlook.

Macy’s Inc. (M) climbs 13% after raising its annual outlook and reporting its best comparable sales growth in 12 quarters, the latest signs that consumers are still spending despite concerns about inflation and tariffs.

Zscaler (ZS) is up 1.8% after the software company reported fourth-quarter results that beat expectations and gave a revenue forecast that is seen as strong.

Stocks were boosted as the selloff in government debt lost momentum as well. The yield on 30-year Treasuries came within touching distance of 5% before erasing the advance. UK gilts and euro-area bonds rebounded. Japan’s 20-year debt yields hit the highest since 1999 earlier in the day. The recent fragility of bond markets has underscored the strain from heavy public spending, which demands ever-rising issuance. That uncertainty is spilling into equities, where traders grapple with stretched valuations after a record rally, alongside persistent concerns over monetary policy and inflation.

Meanwhile, the bond market is pouring gasoline on the fire: the week has so far seen more than $116 billion of bond sales by governments and companies. The figure includes a record $57.7 billion of issuance in Europe on Tuesday.

“Yesterday was the largest issuance day on record in Europe as a whole,” wrote Fred Repton, a senior fund manager at Neuberger Berman. “One should not draw too many conclusions from one extremely active day. What can be said though is that market participants are again focused on deficits and political risk, and this theme is likely to continue.”

After Fed Chair Jerome Powell last month signaled the central bank’s support for a softening jobs markets, Wednesday’s JOLTS data is likely to indicate more labor-market cooling. Further ahead, Friday’s nonfarm payrolls report is expected to show a fourth straight month of sub-100,000 job growth, the weakest stretch since the onset of the pandemic in 2020. Swaps currently imply around a 90% chance of a quarter-point Fed rate cut later this month, with three more similar moves expected by June.

“We don’t see yields rising much further than their current levels,” said Roland Kaloyan, head of equity strategy at Societe Generale SA. “That being said, this bond selloff means that there will be an even greater focus on Friday’s US job data and their impact on the Fed’s easing policy.”

In Europe, the Stoxx 600 is up 0.7% as investors welcomed a calmer day in the European government bond market. European stocks rebound after bonds globally sold off Tuesday on worries about fiscal deficits in developed markets. Adidas rises after the sportswear group was upgraded to buy at Jefferies. Here are some of the biggest movers on Wednesday:

Adidas shares rise as much as 3.8% on an upgrade to buy from hold at Jefferies following its “brutal” de-rating, while JPMorgan places the German company on a positive catalyst watch.

PVA TePla rises as much as 10% after the German semiconductor firm surprised analysts with details on growth opportunities.

Ashtead rises as much as 3.2%, to the highest since January, following the equipment rental specialist’s first-quarter results.

AMG shares rise as much as 9.4% as Citi lifts its price target on the Dutch specialty chemicals firm to a Street high, saying earnings tailwinds are likely to continue.

Viridien rises as much as 15% after Bernstein upgraded the earth and data science company to outperform from market perform.

Derichebourg shares plunge as much as 19% as Portzamparc downgrades the French group after it cut its 2025 guidance, citing a late and challenging trade deal with the US.

Hilton Food falls as much as 19% after reporting first-half results that analysts describe as “mixed.”

M&G falls by as much as 3.8%, the most since April, as the UK asset manager’s first-half adjusted operating profit misses analyst forecasts.

Swiss Life shares fall as much as 3.9% after the financial services provider reported first-half results, with fees missing analyst estimates.

Lufthansa shares slide 3.3% after the airline launched an offering of unsecured and unsubordinated convertible bonds due 2032 in an aggregate principal amount of €600 million with a denomination of €100,000 each, according to a statement.

Continental shares fall as much as 0.9% after Bernstein downgraded the car parts manufacturer to underperform, saying the value unlocked from the upcoming spinoff is now fully priced in and flagging risk to promised margin expansion.

Earlier in the session, Asian shares headed for a second day of declines, weighed by those in Japan due to domestic political uncertainty and weakness in regional chip-making stocks. The MSCI Asia Pacific Index slid as much as 1%, the most in about a week. Japanese shares, which make up around 30% of the index, were a big drag as the Nikkei 225 Index fell 0.9%%. Australian equities also dropped after growth data reinforced the case for the central bank to keep interest rates unchanged. Investor sentiment soured in Japan after Prime Minister Shigeru Ishiba’s key power broker announced his intention to resign. Asian chip stocks were under pressure after the US revoked Taiwan Semiconductor Manufacturing Co.’s authorization to freely ship essential gear to its main Chinese chipmaking base. TSMC fell as much as 1.3% before erasing the loss. Elsewhere in the region, Thai stocks rose after the country’s largest political party said it will back conservative politician Anutin Charnvirakul’s bid to form a government following last week’s sacking of Paetongtarn Shinawatra as prime minister for ethics violations.

In rates, treasuries are slightly lower, with US 30-year yields up 1 bp at 4.96% having come within a whisker of 5% earlier while European bonds stabilize following Tuesday’s global government bond selloff. UK gilts erased an earlier fall to trade higher on the day, pushing UK 30-year yields down 2 bps to 5.67%. German long-end yields also dip. US yields are 2bp-3bp cheaper on the day with 5s30s flatter by around 1bp as long-end marginally outperforms. 10-year is near 4.285% with bunds and gilts in the sector outperforming by around 3.5bp

In FX, the Bloomberg Dollar Spot Index is down 0.1%. The pound and euro add 0.2% each against the greenback. Spot gold rises $5.

In commodities, WTI crude futures fall 1.7% to near $64.50 after a report said that OPEC+ is considering another supply boost for October at this weekend’s meeting. Gold’s latest record came as growing expectations for US interest-rate cuts bolstered the metal’s appeal, while the drop in bonds and equities has strengthened its haven status. Bullion climbed as much as 0.5% to close in on $3,550 an ounce.

US economic data slate includes July JOLTS job openings and factory orders (10am). Fed speaker slate includes Musalem at 9am, and Fed releases Beige Book at 2pm

Market Snapshot

S&P 500 mini +0.4%

Nasdaq 100 mini +0.6%

Russell 2000 mini -0.2%

Stoxx Europe 600 +0.6%

DAX +0.6%

CAC 40 +1%

10-year Treasury yield +3 basis points at 4.29%

VIX -0.2 points at 16.99

Bloomberg Dollar Index little changed at 1206.71

euro +0.1% at $1.1656

WTI crude -0.6% at $65.22/barrel

Top Overnight News

American companies are once again beating profit expectations, but this time around they aren’t banking on blockbuster consumer spending to make it happen. Instead, the latest batch of quarterly earnings are getting a lift from managers who are squeezing out costs, boosting productivity and turning to new technologies. WSJ

Treasury Secretary Scott Bessent is planning to start a blitz of interviews on Friday in search of a candidate to be the next chair of the Federal Reserve, according to people familiar with the matter. The interview process would continue next week. There are 11 contenders, including Kevin Hassett, Kevin Warsh, and Fed governors Christopher Waller and Michelle Bowman. WSJ

US admin officials reportedly want to fund federal agencies until the first quarter of 2026: "This would avoid repeated shutdown deadline dramas. Yet it also opens the door to a year-long continuing resolution”: Punchbowl

Holiday spending by US consumers is set to tumble 5.3% Y/Y, the steepest decline since the pandemic. RTRS

FTC commissioner Rebecca Kelly Slaughter reinstated to her role by an appeals court decision after being fired by Trump, a decision that could have implications for the White House’s Fed fight. NYT

The September rise in long-end yields is partly driven by heavy corporate issuance, Pimco said. Natixis warned that a rate cut amid high inflation risks steepening the curve. BBG

Xi Jinping showcased China’s military and diplomatic clout at a parade with Russia’s Vladimir Putin and North Korea’s Kim Jong Un — their first joint public appearance. Xi vowed to build a “world-class military” to ensure China stands “self-reliant and strong.” BBG

China’s services activity expanded at the fastest pace in over a year in August, a private survey showed, driven by increased tourism. BBG

Australia’s GDP growth advanced 0.6% in the second quarter, beating forecasts and bolstering the case for the RBA to hold rates. BBG

Alphabet shares jumped premarket after a judge ruled Google can retain control of Chrome though it must share some search data with rivals. Apple also rose as it will continue receiving more than $20 billion a year for default search rights. GOOGL +6.48% premkt, AAPL +3.4% premkt. BBG

Corporate News

Google avoided a breakup after a US judge ruled against the government’s most onerous proposals, including a forced sale of its Chrome browser, another court victory for Big Tech in the biggest antitrust case in three decades.

The US has revoked Taiwan Semiconductor Manufacturing Co.’s authorization to freely ship essential gear to its main Chinese chipmaking base, potentially curtailing its production capabilities at that older-generation facility. TSMC shares retreated in Taiwan.

BlackRock Inc. has lost a mandate worth €14.5 billion ($17 billion) with one of the largest pension funds in the Netherlands, amid concerns the world’s biggest money manager isn’t acting in the best interests of clients when it comes to climate risk.

Macy’s Inc. raised its annual outlook and reported its best comparable sales growth in three years, the latest signs that consumers are still spending despite concerns about inflation and tariffs.

Beach Point Capital Management hired Joshua Baumgarten, a credit veteran who previously worked at TPG Angelo Gordon and Blackstone Inc., as its president and chief investment officer.

Jane Street Group LLC filed an appeal in an India court, alleging that the country’s securities regulator denied it access to crucial documents needed for its defense against market manipulation accusations.

Sales at Cracker Barrel Old Country Store Inc. took a hit from the political firestorm that emerged after the chain updated its logo, underscoring the real-life business impact of social media outrage fanned by the president.

Trade/Tariffs

Japanese Trade Negotiator Akazawa is reportedly arranging a visit to the US between September 4th-6th, according to Yomiuri. To travel to the US from Thursday through Saturday, according to the government.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were predominantly lower following the weak handover from Wall St, where the major indices declined on return from the extended weekend as sentiment was dampened by global debt concerns amid a higher yield environment. ASX 200 retreated with the declines led by underperformance in tech, utilities and financials, while slightly stronger-than-expected Australian GDP data failed to inspire. Nikkei 225 was pressured amid a higher global yield environment but with the downside initially cushioned by recent currency weakness. Hang Seng and Shanghai Comp gradually fell despite the better-than-expected RatingDog Services PMI data from China and with the attention in Beijing on the military parade, which was attended by Russian President Putin and North Korean Leader Kim, while US President Trump reacted in a post and accused them of conspiring against the US.

Top Asian News

Japanese ruling party LDP's Aso is set to call for an early party election, according to Mainichi.

BoJ Governor Ueda said he exchanged views with PM Ishiba on the economy and financial markets, while they had discussions on various topics about the economy and talked about forex. Ueda said it was a regular meeting to exchange views on the economy and financial markets and there is no change to their stance of raising interest rates if the economy and prices move in line with the forecast.

Japan's budget requests from government agencies for next FY total JPY 122.45tln, according to the MoF.

RBA Governor Bullock says the RBA is actively exploring the implications of emerging technologies, particularly AI, and how they can support its mission.

European bourses (STOXX 600 +0.5%) opened in the green and have held an upward bias throughout the morning. Sentiment which is seemingly driven by a paring of the significant pressure seen on Tuesday, and as Google received a favourable judge ruling. European sectors hold a slight positive bias, following on from a poor session on Tuesday. Tech takes the top spot, paring back some of the underperformance seen in the prior session as Google (+5.8% pre-market) helps to lift the mood within the sector (see US section for details). Consumer Products follows closely behind, with the Luxury sector building on the prior day’s gains, this time following a positive trading update from Watches of Switzerland (+7.6%). The Co. confirmed strong sales, affirmed its guidance and highlighted that it does not expect to be materially impacted by US tariffs in H1’26.

Top European News

EU court backs US data pact, avoiding fresh privacy fight

ECB’s next move could be to cut or hike rates, Dolenc says

Germany’s services sector unexpectedly contracted in August

Bayrou open to alternative budget plan if deficit target remains

Rachel reeves to deliver crunch UK budget on November 26

UK Chancellor Reeves says need to bring inflation and borrowing costs down; says economy is not broken.

French Finance Minister Lombard urged for a compromise on the 2026 Budget and said the deficit reduction plan will inevitably be less ambitious if the government falls, while he is confident France will accomplish its GDP growth forecast of 0.6% this year and said they are on track to reduce the deficit from 5.8% in 2024 to 5.4% in 2025, according to FT.

EU court backs EU and US data transfer deal affecting thousands of firms.

FX

DXY was initially a little firmer but is now trading on the backfoot and towards session lows. Traders are mindful of ongoing tariff-related updates with President Trump stating that his administration will be going to the Supreme Court today to appeal the judgement from the US appeals court that most of his tariffs are illegal. Given the other routes available to Trump, desks remain sceptical that an unfavourable Supreme Court judgement would have any material sway on the administration's approach to trade policy. Focus will today also be on the data slate with JOLTS job openings due on deck ahead of ADP tomorrow and NFP on Friday. DXY currently near lows in a 98.20 to 98.63 range.

EUR is slightly firmer with incremental macro drivers for the Eurozone lacking. Final Eurozone PMI metrics passed with little in the way of fanfare with the August composite PMI metric revised a touch lower to 51.0 from 51.1. The accompanying report noted that "Yes, the economy has been growing since the start of the year, but the pace is painfully slow". One risk on the horizon for the Eurozone comes via French political tensions as markets brace for the September 8th confidence vote in PM Bayrou. Expectations are firmly in favour of him losing the vote. EUR/USD delved as low as 1.1609 before staging a recovery.

JPY remains on the backfoot and unable to catch a break vs. the USD. Yesterday's softness was largely pinned on a lack of commitment from BoJ Deputy Governor Himino in backing further policy tightening, alongside increased domestic political risk. On which, the latest reports suggest that Japanese ruling party LDP's Aso is set to call for an early party election, according to Mainichi. On trade, Japanese Trade Negotiator Akazawa is reportedly arranging a visit to the US between September 4th-6th, according to Yomiuri. USD/JPY briefly moved back above its 200DMA at 148.83 and took out the 149 level with a session peak at 149.13 before retreating.

After a wobble in early European trade, GBP has managed to recoup losses. Back-end UK yields remain higher as fiscal angst continues to grip the market narrative. Markets now have a date for the Autumn Budget with the Treasury opting for November 26th; somewhat later than what many had been expecting. On monetary policy, focus today will be on BoE's Bailey, Lombardelli, Greene and Taylor all due to appear before the TSC. Likely areas of focus will be on how the Bank looks to navigate the pathway between an expected slowdown in growth and stubborn inflation. An upward revision to the August services and composite PMIs failed to provide additional support for GBP. GBP/USD hit a multi-week low at 1.3334 before recovering to levels just above 1.34.

AUD is a touch more resilient than most peers with the currency underpinned by a better-than-expected outturn for Q2 Australian GDP (Q/Q 0.6% vs. Exp. 0.5%). AUD/USD sits in close proximity to its 50DMA at 0.6519 and around the mid-point of Tuesday's 0.6483-0.6558 range.

Fixed Income

A softer start to the day for Bunds, continuing the price action seen on Tuesday but holding above Tuesday's 128.68 low. Thereafter, a bout of pressure to a 128.63 trough, with downside of c. 15 ticks occurring amid a volume spike just after the cash equity open and the morning’s first PMI. The Spanish Services figure came in shy of consensus, though internal commentary was strong. Though this was short-lived. Thereafter, Germany was revised lower into contractionary territory, which helped to lift Bunds marginally back into the green and to a 129.00 high. No real move to a German 2035 auction, which saw a same-as-prior b/c, but higher avg. yield.

OATs are gaining to a similar degree as German paper. The main update has been an interview with Finance Minister Lombard to the FT, the Minister outlined that the toppling of PM Bayrou next week (looks all but certain, currently) would require fresh concessions to be made to the left in order to secure support for the fiscal package. A package that is currently targeting a deficit cut of EUR 44bln. The Bund-OAT 10yr yield spread remains steady around the 80bps mark.

Gilts began on the backfoot today, but recent price action has been upwards, following European peers. Confirmation this morning that the Treasury will unveil the Autumn Budget on November 26th, confirming a Huffington Post scoop. Price action this morning began with a continuation of Tuesday’s sell off, Gilts as low as 89.36, 24 ticks below Tuesday’s base. However, the magnitude of this has waned in-fitting with the upticks discussed in EGBs, and most recently UK paper has climbed incrementally into the green. As for yields, thus far a 4.86% high for the 10yr, eyeing January's 4.925% peak, and 5.75% for the 30yr. Ahead, the BoE appears before the TSC to discuss the last policy announcement (subject to two rounds of voting, resulting in a 25bps cut).

USTs are directionally in-fitting with peers but with action contained to a thin 112-00 to 112-08+ band thus far. USTs await Fed speak Musalem and Kashkari, remarks that are intersected by a handful of data points headlined by JOLTS.

Germany sells EUR 3.81bln vs exp. EUR 5bln 2.60% 2035 Bund: b/c 1.4x (prev. 1.4x), average yield 2.77% (prev. 2.69%), retention 23.8% (prev. 22.3%).

Commodities

Softer trade in the crude complex this morning after whipsawing yesterday amid a stronger dollar and with the US imposing sanctions targeting Iranian oil. Newsflow for the complex has been quiet, although traders are keeping tabs on developments in the east, with focus overnight on the Chinese military parade - but more so the presence of Russian President Putin and North Korean leader Kim alongside Chinese President Xi. The complex then took a significant leg lower on Reuters source reports that OPEC+ is mulling another oil production hike at Sunday's meeting - this is in contrast to expectations that the OPEC-8 would hold production. WTI fell from USD 65.17/bbl to USD 64.33/bbl before paring around half of the move in the minutes since. At the same time, Brent slipped from USD 68.73/bbl to USD 67.89/bbl.

Mixed trade across precious metals in narrow parameters. Spot gold holds a mild upward bias but printed fresh record near the USD 3,550/oz level overnight despite recent dollar strength. Spot gold resides in a USD 3,526.54-3,547.33/oz range at the time of writing, with the next upside level the USD 3,550/oz mark.

Upward tilt across base metals with prices supported by a stable dollar and with sentiment also net-positive. 3M LME copper breached USD 10k/t to the upside and resides in a USD 9,935.80-10,038.13/t range at the time of writing.

World Gold Council said to launch a digital form of gold, according to FT.

OPEC+ reportedly mulling another oil production hike at Sunday meeting, according to Reuters source; final decision not made yet

Geopolitics: Russia-Ukraine

Ukraine's military said Russia launched an air attack on Kyiv and it was also reported that all of Ukraine was under air raid alerts following Ukrainian air force warnings of Russian missile and drone attacks, while Poland scrambled aircraft to ensure airspace security after Russia launched strikes on Ukraine.

Russian Foreign Minister Lavrov said Moscow expects Russia-Ukraine talks to continue and he stated that the heads of delegations are in direct contact. Lavrov said Russia expects statements from its partners in support of dialogue with the US on Ukraine, while he added that for a lasting peace in Ukraine, territorial realities must be recognised. Lavrov also said that India did not bow to US demands to stop purchasing resources from Russia, which Moscow appreciates, as well as noted the US is making active diplomatic efforts on Ukraine and that Putin–Trump contacts are substantive. Furthermore, he said a new system of security guarantees for Russia and Ukraine must be formed and that Moscow calls for ensuring a neutral, non-bloc and non-nuclear status of Ukraine, according to RIA and TASS.

Russian Foreign Ministry spokeswoman said Kyiv and its allies reject the possibility of compromises on settlement of conflicts, according to RIA.

Russia and the US are in the process of coordinating on dates and the venue of the next round of talks, according to RIA.

Geopolitics: Middle East

"[Israeli] Finance Minister Smotrich seeks to impose sovereignty over 82% of the West Bank", according to Al Jazeera.

Geopolitics: Other

Chinese President Xi said at the military parade in Beijing that China is a great nation that fears no violence and is self-reliant and strong, while he added the Chinese people stand on the right side of history and are committed to peace. Xi also said the world is facing a choice of peace or war now and he called on nations to prevent historical tragedies from recurring.

US President Trump posted on Truth Social "The big question to be answered is whether or not President Xi of China will mention the massive amount of support and “blood” that The United States of America gave to China in order to help it to secure its FREEDOM from a very unfriendly foreign invader. Many Americans died in China’s quest for Victory and Glory. I hope that they are rightfully Honored and Remembered for their Bravery and Sacrifice! May President Xi and the wonderful people of China have a great and lasting day of celebration. Please give my warmest regards to Vladimir Putin, and Kim Jong Un, as you conspire against The United States of America. PRESIDENT DONALD J. TRUMP”.

US Event Calendar

5:00 am: Aug Wards Total Vehicle Sales, est. 16.1m, prior 16.41m

7:00 am: Aug 29 MBA Mortgage Applications, prior -0.5%

10:00 am: Jul JOLTS Job Openings, est. 7381.5k, prior 7437k

10:00 am: Jul Factory Orders, est. -1.3%, prior -4.8%

10:00 am: Jul F Durable Goods Orders, est. -2.8%, prior -2.8%

10:00 am: Jul F Durables Ex Transportation, est. 1.1%, prior 1.1%

10:00 am: Jul F Cap Goods Orders Nondef Ex Air, est. 1.1%, prior 1.1%

10:00 am: Jul F Cap Goods Ship Nondef Ex Air, prior 0.7%

Central Banks

9:00 am: Fed’s Musalem Speaks on Economy and Policy at Peterson

2:00 pm: Fed Releases Beige Book

DB's Jim Reid concludes the overnight wrap

Last night we published a new presentation pack, Back to work… until Xmas. Since it has become almost de rigueur to reach for the ‘back-to-school’ analogy, we’ve chosen instead to highlight the joy of returning to work - though with the daunting reality of no holiday break until Christmas. In the pack, we outline five themes we believe will shape the remainder of 2025: whether AI and US equities are in a bubble; the pros and cons of Fed rate cuts; the path for US Treasuries if the Fed is indeed cutting; the state of play five months on from Liberation Day (April 2); and the situation after 225 days of Trump 2.0.

These themes felt immediately relevant yesterday as global markets fully reopened for the first main day of trading after the holiday season. Fixed income markets led the moves, with a major bond sell-off that pushed 30-year UK gilt yields to their highest since May 1998, while French OATs hit levels last seen in 2009. The pressure was not confined to Europe, with US Treasuries also selling off—10s and 30s both rising sharply, the latter again testing 5% before closing just under at 4.96%. We’re at 4.985% again in Asia as I type. At the same time, gold extended Monday’s record, rising +1.64% to surpass $3,500 for the first time, as its role as a hedge against inflation and fiscal concerns remains firmly in play.

Equities struggled across the board. The S&P 500 fell -0.69%, with the Nasdaq (-0.82%) and the Mag-7 (-1.08%) down by more, as tech underperformed. The S&P did partially recover after trading -1.5% lower intra-day but it was still a broadly weak day with more than three-quarters of its constituents losing ground. Nvidia (-1.95%) and Amazon (-1.60%) were among the key laggards, reigniting investor concerns over AI-linked valuations as US markets returned from the long Labor Day weekend. The risk-off tone was even sharper in Europe, where most indices lost over a percent, led by the DAX with a -2.29% drop as IT (-3.12%) and Industrials (-3.05%) weighed heavily.

Concerns around Fed independence also contributed to the bond market moves. A second court hearing began yesterday on whether President Trump can be temporarily barred from dismissing Fed Governor Lisa Cook, though Bloomberg reporting suggests that there likely won’t be a ruling before the end of the week. Earlier, nearly 600 economists signed an open letter in Cook’s defence, while FHFA Director Bill Pulte kept up accusations of mortgage fraud. Meanwhile, Treasury Secretary Scott Bessent confirmed the search for Powell’s successor as Fed Chair is already underway, with the WSJ reporting that he plans to start interviews on Friday. In comments to Reuters, he stressed that the Fed “should remain independent,” though he was quick to add that it has also “made a lot of mistakes.”

In the UK, 30yr gilt yields rose +5.2bps to 5.69%, their highest since May 1998, a month when pop group Aqua had a number one single that wasn’t “Barbie Girl”. A prize if you remember what it was without looking. The gilt move underscored the fiscal challenges Chancellor Reeves faces ahead of the autumn budget. The government must fill a £20–25bn gap by November, and sterling fell more than 1% against the dollar as those risks came into sharper focus. See our economist Sanjay Raja’s latest thoughts on all things UK related here.

In France, 30yr OAT yields rose +4.9bps to 4.49%, the highest since 2009, amid rising expectations of another government collapse next week. Our economists see the French deficit running at 5.6–5.8% of GDP in 2025, above the official 5.4% target, further adding to concerns around debt sustainability.

Data offered a mixed picture. In the US, the August ISM manufacturing survey showed a modest improvement, rising to 48.7 from 48.0, though still below the 49.0 expected. New orders beat expectations (51.4 vs 48.0 expected and 47.1 previously). However, the employment index remained subdued (43.8 vs 45.0 expected and 43.4 previously) and prices paid fell from 64.8 to a 6-month low of 63.7, which helped yields reverse from the day’s intra-day highs. Although we have JOLTS today, attention will increasingly shift to Friday’s payrolls, where our economists expect headline and private payroll growth of around 100k, up from the prior month, with unemployment steady at 4.2%—though there is a risk it rounds down to 4.1%. All eyes on the revisions after last month’s shock.

In Europe, core flash inflation surprised slightly to the upside, at 2.3% YoY (vs. 2.2%), while headline was in line with expectations at 2.1%. Services inflation eased a touch from 3.2% to 3.1%, but the stickiness in core goods kept pressure on yields and reinforced our economists view that we have likely reached the ECB’s terminal rate. Among ECB speakers, the more dovish Simkus suggested in an interview that a rate cut may be in play in October or December, but Isabel Schnabel said “ I do not see a reason for a further rate cut” and indicated that renewed rate hikes “may come earlier than many people currently think”. The amount of ECB rate cuts priced by next June is now down to a cycle low of 15bps.

Geopolitics also crept back onto the radar, with reports that Russia and the US are preparing for a new round of consultations. Meanwhile, in Turkiye, the BIST 100 fell -3.57% after a court removed Ozgur Celik, the newly elected CHP leader.

Asian equity markets are following the global trend and are lower this morning. Across the region, the S&P/ASX 200 (-1.62%) is leading losses as RBA rate cut prospects dimmed following upbeat GDP data (details below). Additionally, the Nikkei (-0.79%), the Hang Seng (-0.40%), the CSI (-0.88%) and the Shanghai Composite (-0.96%) are also trading notably lower. US equity futures are creeping higher though, with the S&P 500 +0.10% higher, while the NASDAQ is outperforming (+0.26%) after Google spiked by more than 7% after-hours following a court decision that it won’t have to sell its Chrome browser.

Coming back to Australia, the economy expanded +1.8% y/y (v/s +1.6% expected) in the second quarter of the year, marking the fastest pace of growth since September 2023 and higher than the revised +1.4% growth seen in the previous quarter with the growth largely led by household consumption. Following the data, the Australian Dollar reversed opening losses and is trading flat against the dollar as I type while the yield on the policy sensitive 3yr government bonds have jumped +9.1bps, extended an earlier gain to hit 3.541%, the highest level in seven weeks.

Elsewhere, yields on Japan’s longer maturity JGBs continue to be at multi-decade highs, following the global selloff in bonds and political uncertainty in the nation. Yields on 20-year government bonds are +3.1bps to trade at 2.667%, a level last seen in 1999 while those on the 30-year are +4.1bps to 3.26%, its highest since its debut in 1999.

Looking ahead, today brings the US JOLTS report, factory orders, and August vehicle sales. In Europe, we’ll get Italy’s services PMI and Eurozone PPI, while Canada releases Q2 labour productivity. Central banks are also busy: the Fed’s Beige Book is due, with remarks from Musalem, Lagarde, Bailey, and several other BoE speakers. On the earnings side, highlights include Salesforce, HPE, Gitlab and Dollar Tree.

https://cms.zerohedge.com/users/tyler-durden

Wed, 09/03/2025 - 08:36

https://www.zerohedge.com/market-recaps/futures-rebound-google-jumps-court-ruling-bond-selloff-fades

?w=556&resize=700%2C675

?w=556&resize=700%2C675

CryptoQuant analyst ‘caueconomy’ found that Bitcoin whales have dumped roughly $12.7B worth of $BTC over the past month. Shockingly, this marks the largest whale sell-offs since July 2022. These $BTC liquidations are anticipated to keep the #1 crypto’s price under pressure for longer – especially if they’re ongoing. Don’t want to sit in the dip while waiting for the market to perk back up? Then why not check out the best crypto presales? Bitcoin Whale Reserves Down 10K+ $BTC in One Month In a blog post on Friday, ‘caueconomy’ highlighted that holders are offloading $BTC more aggressively. So much so that the #1 crypto has reached its highest distribution levels this year. The analyst found that whale reserves have dropped by over 10K $BTC in the past 30 days, ‘signaling intense risk aversion among large investors.’ They believe that this selling pressure is what’s been pushing $BTC’s price below $108K, a level it had sunk below last week. At the time of writing, $BTC is valued at $111K. If you don’t want to wait for it to rebound yet want to boost your portfolio, now signals a great time to check out top presales. Since these tokens are still in their fundraising stages and not yet trading on the open market, whale sell-offs don’t affect their prices. In turn, they’re safer investment opportunities to check out in today’s volatile market. Even better, some presale coins are built with utility to help you thrive amid unfavorable market conditions, including Snorter Token ($SNORT), BlockchainFX ($BFX), and Best Wallet Token ($BEST). 1. Snorter Token ($SNORT) – Five-Figure Whale Investments Signal Confidence in Its Upcoming Trading Bot Snorter Token ($SNORT) is quickly attracting notable attention. It has already scooped up $3.7M+ on presale, propelled by three major whales investing $40K, $32K, and $21K. Such foremost transactions highlight that big investors have faith in Snorter Bot, the crypto project’s upcoming Telegram trading bot. Once launched this quarter, Snorter Bot will enable you to swap and automatically snipe new tokens quickly and safely. With an aardvark mascot, its ultimate ambition is to help you sniff out the next crypto to explode. If you’re not a confident trader, Snorter Bot’s copy trading feature has your back. It’ll enable you to mirror top traders’ moves for greater profit potential effortlessly. Better yet, it brings trust to the presale market that, unfortunately, isn’t scam-proof. Built with MEV protection, plus honeypot and rug pull alerts, the bot ensures you stay safe while chasing top opportunities for gains. It’ll first launch on Solana to take advantage of its low fees (just 0.85%) and fast transaction speeds (currently averaging 821.8 transactions per second). By doing so, it claims that it’ll outpace rival bots like Maestro, Trojan, Banana Gun, Bonk Bot, and Sol Trading Bot. Once it has a foothold in the Solana arena, the bot will expand across multiple chains, including Ethereum, BNB Chain, and other EVM networks. This way, you can trade the hottest alpha across chains – not just the best Solana meme coins. After buying $SNORT on presale, you can also anticipate leaderboard perks, DAO voting rights, and staking rewards at a 123% APY. One $SNORT currently costs as little as $0.1037. Following early bot adoption and exchange listings, it’s projected to reach $1.02. So, now presents an opportune moment to join the presale for potential returns of over 883%. 2. BlockchainFX ($BFX) – Powers Global Exchange That Bridges DeFi & TradFi $BFX is the linchpin of BlockchainFX, a cutting-edge global exchange that bridges DeFi and TradFi. Owing to this, it has nearly raised on eye-boggling $7M on presale. From a highly user-friendly app, you can gain access to not just crypto but also stocks, forex, ETFs, commodities, and bonds. Essentially, it gives you easy access to the world’s top markets, all under one roof. Although $BFX is still on presale, BlockchainFX already grants access to over 500 assets, including $BTC, $ETH, gold, and Tesla. Purchasing $BFX gives you early access to the platform, reduced trading fees, and daily staking rewards (in $USDT and $BFX). It also gives you exclusive perks like access to the limited-edition BFX Visa Card, which can be topped up with 20+ cryptos to spend globally online or in-store. This way, you can easily spend your crypto without the hassle of off-ramps. To reap these perks, you can purchase $BFX on presale for just $0.022. With a launch price set at $0.05, now’s a great time to secure early entry at its lowest current price. 3. Best Wallet Token ($BEST) – Raises $15.6M+ Over Fueling Crypto Wallet Perks Best Wallet Token ($BEST) has already attracted over $15.6M on presale as it’s the native token of Best Wallet, a mobile-friendly crypto wallet. After downloading the mobile app, you can manage, buy, sell, swap, and stake over 1K digital assets across major chains, including Ethereum, Polygon, and BNB Chain. It’ll soon support over 60 networks, so you can anticipate unlocking even greater crypto opportunities in the near future. As a non-custodial wallet, you can rest easy knowing that you have full ownership of your private keys. Considering that private key compromises accounted for the largest share of stolen crypto last year, at 43.8%, non-custodial wallets like Best Wallet are safe choices. To further ensure access to your digital assets is secure, it includes 2FA, biometric protection, local encryption, and personal cloud backups. Beyond this, the wallet is full of intuitive tools for discovering top investment opportunities at reasonable prices. This includes a token launchpad and a swap function that scans 330+ DEXs and 30 bridges for the best rates. It also has an ambitious roadmap that includes a crypto debit card (Best Card), a built-in NFT gallery, and a rewards hub for loyal users. And that’s to name a few. When buying $BEST, you’ll also be granted with lower gas fees, governance rights, and staking rewards (currently at an 85% APY). You can buy $BEST on presale for just $0.025605. But don’t wait around: Its price will increase later today and is forecasted to hit $0.035215 after being listed on Uniswap, one of the best decentralized exchanges. Verdict – The Best Crypto Presales Are Safe Investment Opportunities Bitcoin Whales offloading 100K+ $BTC shows that not even the world’s largest crypto is protected from sudden supply shocks. If you don’t want to wait for the volatility to clear up, your current best bet might be investing in the best crypto presales, like $SNORT, $BFX, and $BEST. Because they’re not yet listed on the market, they’re protected from whale-driven price swings. Plus, their utility helps you explore the next crypto to explode safely and hassle-free. This isn’t investment advice. Always do your own research and never invest more than you’d be sad to lose.

https://www.newsbtc.com/news/best-crypto-presales-amid-big-bitcoin-sell-off/

Futures Rebound As Google Jumps On Court Ruling, Bond Selloff Fades

Futures Rebound As Google Jumps On Court Ruling, Bond Selloff Fades

US equity futures are higher following a two-day slide, led by Tech with a favorable court ruling boosting GOOG (+5.7% pre-mkt) and lifting the Mag7 group. As of 8:00am ET S&P futures are up 0.5%, recovering most of yesterday's losses; while Nasdaq 100 futs add 0.7%. In premarket trading, Mag7 names are all higher with AAPL (+2.9%) and TSLA (+1.7%) the notable standouts alongside GOOG. Cyclicals are poised to outperform as the yield curve bear steepens. In Europe, the Estoxx 50 is up by almost 1%, led by info tech and industrials sectors. Longer duration bonds are seeing a global sell-off (30Y JGBs +7bp, 30Y Gilts +6bp) while US is outperforming (30Y +2bp); underperformance is driven by global budget concerns (these come and go), which have sent gold is higher for the 7th consecutive session, adding ~5% in that time. USD is weaker and commodities are mixed. WTI crude futures fall 1.7% to near $64.50 after a report said that OPEC+ is considering another supply boost for October at this weekend’s meeting. Today’s data focus is on JOLTS, Durable/Cap Goods, Beige Book, and consumer-sector earnings to gain clarity on the consumer.

?itok=Sgbv2JOE

?itok=Sgbv2JOE

In premarket trading, Alphabet (GOOGL) shares are up 5% after a US antitrust ruling was not as severe as feared. Google will be required to share online search data with rivals while avoiding harsher penalties, including the forced sale of its Chrome business. Apple (AAPL) rises 4% after a US judge stopped short of barring the iPhone maker’s lucrative search arrangement with Google. All other Mag 7 stocks are also higher (Tesla +1.5%, Nvidia +0.4%, Meta +0.8%, Amazon +0.03%, Microsoft unch).

Dollar Tree Inc. (DLTR) falls 4% after the retailer’s 2Q report underwhelmed Wall Street.

HealthEquity (HQY), which administers health savings accounts, rises 4% after posting 2Q profit that beat the average analyst estimate and raised its fiscal year outlook.

Macy’s Inc. (M) climbs 13% after raising its annual outlook and reporting its best comparable sales growth in 12 quarters, the latest signs that consumers are still spending despite concerns about inflation and tariffs.

Zscaler (ZS) is up 1.8% after the software company reported fourth-quarter results that beat expectations and gave a revenue forecast that is seen as strong.

Stocks were boosted as the selloff in government debt lost momentum as well. The yield on 30-year Treasuries came within touching distance of 5% before erasing the advance. UK gilts and euro-area bonds rebounded. Japan’s 20-year debt yields hit the highest since 1999 earlier in the day. The recent fragility of bond markets has underscored the strain from heavy public spending, which demands ever-rising issuance. That uncertainty is spilling into equities, where traders grapple with stretched valuations after a record rally, alongside persistent concerns over monetary policy and inflation.

Meanwhile, the bond market is pouring gasoline on the fire: the week has so far seen more than $116 billion of bond sales by governments and companies. The figure includes a record $57.7 billion of issuance in Europe on Tuesday.

“Yesterday was the largest issuance day on record in Europe as a whole,” wrote Fred Repton, a senior fund manager at Neuberger Berman. “One should not draw too many conclusions from one extremely active day. What can be said though is that market participants are again focused on deficits and political risk, and this theme is likely to continue.”

After Fed Chair Jerome Powell last month signaled the central bank’s support for a softening jobs markets, Wednesday’s JOLTS data is likely to indicate more labor-market cooling. Further ahead, Friday’s nonfarm payrolls report is expected to show a fourth straight month of sub-100,000 job growth, the weakest stretch since the onset of the pandemic in 2020. Swaps currently imply around a 90% chance of a quarter-point Fed rate cut later this month, with three more similar moves expected by June.

“We don’t see yields rising much further than their current levels,” said Roland Kaloyan, head of equity strategy at Societe Generale SA. “That being said, this bond selloff means that there will be an even greater focus on Friday’s US job data and their impact on the Fed’s easing policy.”

In Europe, the Stoxx 600 is up 0.7% as investors welcomed a calmer day in the European government bond market. European stocks rebound after bonds globally sold off Tuesday on worries about fiscal deficits in developed markets. Adidas rises after the sportswear group was upgraded to buy at Jefferies. Here are some of the biggest movers on Wednesday:

Adidas shares rise as much as 3.8% on an upgrade to buy from hold at Jefferies following its “brutal” de-rating, while JPMorgan places the German company on a positive catalyst watch.

PVA TePla rises as much as 10% after the German semiconductor firm surprised analysts with details on growth opportunities.

Ashtead rises as much as 3.2%, to the highest since January, following the equipment rental specialist’s first-quarter results.

AMG shares rise as much as 9.4% as Citi lifts its price target on the Dutch specialty chemicals firm to a Street high, saying earnings tailwinds are likely to continue.

Viridien rises as much as 15% after Bernstein upgraded the earth and data science company to outperform from market perform.

Derichebourg shares plunge as much as 19% as Portzamparc downgrades the French group after it cut its 2025 guidance, citing a late and challenging trade deal with the US.

Hilton Food falls as much as 19% after reporting first-half results that analysts describe as “mixed.”

M&G falls by as much as 3.8%, the most since April, as the UK asset manager’s first-half adjusted operating profit misses analyst forecasts.

Swiss Life shares fall as much as 3.9% after the financial services provider reported first-half results, with fees missing analyst estimates.

Lufthansa shares slide 3.3% after the airline launched an offering of unsecured and unsubordinated convertible bonds due 2032 in an aggregate principal amount of €600 million with a denomination of €100,000 each, according to a statement.

Continental shares fall as much as 0.9% after Bernstein downgraded the car parts manufacturer to underperform, saying the value unlocked from the upcoming spinoff is now fully priced in and flagging risk to promised margin expansion.