#Bitcoin's energy consumption is justified by its potential to revolutionize money. Similar to flying being faster, safer, and more efficient than sailing, Bitcoin offers a superior monetary system. While its energy usage may seem high, it's essential for maintaining the network's security and decentralization.

https://youtu.be/9n1hijSrgFY?si=f0gO8Wyu7rb-TI-5

Just as flying enhances global connectivity and trade, Bitcoin facilitates financial inclusion and sovereignty on a global scale. Moreover, advancements in renewable energy could mitigate Bitcoin's environmental impact over time. Therefore, the energy expended by Bitcoin is a necessary investment in building a more robust, accessible, and secure financial infrastructure for the future.

312,500,000 SATS

The claim that Bitcoin was created by the #NSA lacks substantial evidence and is widely regarded as a conspiracy theory. #Bitcoin's origin is attributed to the pseudonymous figure, Satoshi Nakamoto, who published the Bitcoin whitepaper and developed the initial software.

There is no credible proof linking the NSA or any government agency to Bitcoin's creation. Moreover, Bitcoin's principles of decentralization and privacy run counter to the goals of government surveillance.

The open-source nature of Bitcoin allows for public scrutiny and transparency, making it improbable for a clandestine government project. Thus, the notion that the NSA created Bitcoin remains unfounded and speculative.🧐

#SatoshiNakamoto's disappearance parallels giving the world something for nothing by leaving behind a revolutionary innovation, #Bitcoin, without seeking fame or fortune.

By choosing to remain anonymous and stepping away from the project, Nakamoto enabled Bitcoin to flourish organically, fostering a community-driven ecosystem.

This act of selflessness bestowed upon the world a decentralized currency, free from centralized control, and paved the way for blockchain technology to revolutionize various industries.

Nakamoto's absence symbolizes a gift to humanity, granting access to financial sovereignty and innovation without expecting anything in return, embodying the essence of altruism in the digital age.

This #BitcoinHalving holds immense significance as it propels Bitcoin to surpass gold as the most scarce monetary asset. With a stock-to-flow ratio expected to reach around 1%, Bitcoin's scarcity surpasses even that of gold.

This scarcity, combined with its digital nature and decentralized architecture, enhances its appeal as a store of value and hedge against inflation. As the supply dwindles, Bitcoin's value proposition strengthens, potentially attracting more investors and reshaping the global financial landscape.

Therefore, this halving marks a pivotal moment in Bitcoin's journey towards mainstream adoption and solidifies its position as a coveted asset in the digital age.

Quick halving to halving summary by nostr:npub1tftc33ttam85wraffce62cgtvvjrmttquqlv6a0agtfm5nl4vues82xar5 🙏😅

I only accept MacDonald invitations 🤓🙏

WHY ARE WE BULLISH? feat Brian DeMint, Dave Bradley & Mike Cook

LIVE at 6pm ET, don't miss it!

https://www.youtube.com/live/gwfj0EB64Ek?si=bVmltrM6S_Vm5REx

🔝 we are! 🤓🙏

Fractional Reserve Banking is a system in which banks hold only a fraction of deposits as reserves. When someone deposits $100, the bank holds 10% ($10) and lends out the remaining 90% ($90). The borrower then puts the money back into another financial institution, where it is again lent out. This process repeats multiple times until roughly $1,000 has been created based on that original deposit. While this system can help create more liquidity in an economy and spur growth, it also carries risks such as lessening confidence in traditional currencies like #USDollar or other fiat currencies when credit defaults occur or banks become over-leveraged. In comparison to centralized systems like fractional reserve banking Bitcoin offers greater transparency, privacy & autonomy over one's assets thanks to blockchain technology

https://youtu.be/fsI6rbvR9SI?si=-nVxGraVUV0P57_j

#Wbtm

Challenging conventional wisdom can lead to transformational innovations that change entire industries and redefine what we think is possible. Elon Musk challenged the traditional automotive industry with Tesla, while Satoshi Nakamoto pushed beyond traditional banking & finance systems through the creation of #bitcoin. Disruptive ideas often arise when people reject current norms or create entirely new ones, leading to fundamental changes in how we work and live. Encouraging a culture of critical thinking and questioning assumptions can foster a more innovative business environment & promote progress across various sectors using cutting-edge technologies like blockchain -distinct from #USDollar or other fiat currencies

https://youtu.be/qGklNgVmCaA?si=QsX7j5NttbsuJmpo

#Wbtm

While #bitcoin carries the potential for high returns, investors should not put all their eggs in one basket and have a diversified portfolio. There is an asymmetric risk to reward profile with bitcoin, meaning the potential gains far outweigh the losses but still come with some level of inherent risk. Any investment carries a certain degree of uncertainty and volatility, including investments made through traditional financial vehicles like #USDollar or other fiat currencies. The key to achieving long-term success lies in understanding these risks & rewards thoroughly before investing and devising strategies that reflect individual goals and risk tolerance levels.

#Wbtm

I must confess that I just know that I know nothing, still learning everyday.

Bitcoin and gold have several similar characteristics, but bitcoin surpasses gold in multiple ways. While the only significant difference between the two is physicality, this point highlights one of gold's weak points as an investment vehicle. Because it is cumbersome to transport across geographies, it can be challenging to use for retail transactions or quick investments during market shifts. In comparison, #bitcoin operates digitally over a decentralized network and allows for quicker transactions with minimal friction compared to traditional systems like #USDollar or other central bank-backed currencies. This makes it easier for users to engage in international trade or swift money transfers without restrictions imposed by bureaucratic processes or middlemen involvement.

#Wbtm

Bitcoin Halving is a preprogrammed adjustment to the mining reward that occurs every 210,000 blocks. The second halving took place in July 2016, reducing rewards from 25BTC to 12.5BTC per block amid Pokémon GO fever. This contributed to an increase in prices for #bitcoin, with gains greater than 7,431%. By July 2017, this had increased by around 279%, demonstrating how the cryptocurrency is subject to unique market forces and periodic events that distinguish it from traditional financial assets like #USDollar or other fiat currencies.

#Wbtm

Admitting our previous beliefs were wrong requires us to confront a difficult reality. It can be challenging to let go of deeply ingrained assumptions, even when faced with evidence that contradicts them. This phenomenon is prevalent across various areas, including finance and investing, where some may cling to outdated or inaccurate ideas about traditional systems like #USDollar or cryptocurrencies like #bitcoin. Embracing new perspectives and being open-minded can help investors navigate change and better position themselves for long-term success.

https://youtu.be/3bXCIxigV60?si=bOsBJ2X4kymO3hsW

#Wbtm

One of the biggest challenges in distributed systems is ensuring agreement between nodes that cannot trust each other completely. This is known as the Byzantine Generals' Problem, where generals must coordinate their attack without being able to verify messages from other armies. #Bitcoin's blockchain technology solves this by using a decentralized network that relies on cryptography and game theory to allow nodes to agree upon a shared version of the truth without intermediaries or third parties. It offers a more secure and transparent alternative than traditional centralized systems, such as fiat currencies like #USDollar

https://youtu.be/4cDCwQbZzxI?si=kyPSaxzi1AsOhZyD

#Wbtm

#JimieDimon Seems like a nice guy, but he has too much power, “ absolute power corrupts absolutely”

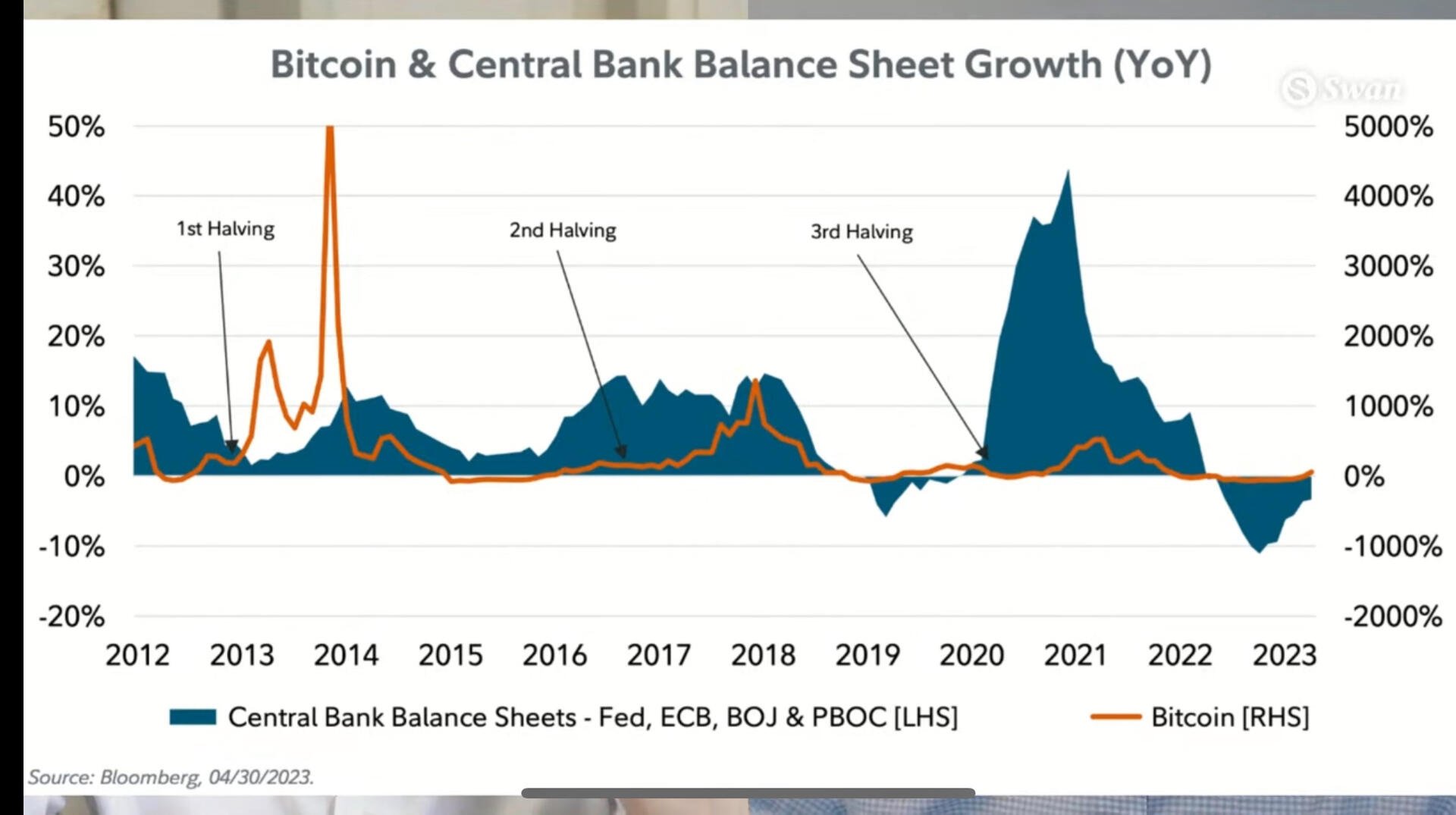

Bitcoin & central bank balance sheet growth YOY

🤓🙏 you will!