How did I miss the schedule? I thought it was today. Damn it! Okay then, change in podcast playlist it is. Keep up the great work! Thanks!

Though Bitcoin was born in the world of computers and code, it was destined to eventually face-off with the legacy banking system.

The first block ever mined on the blockchain, Satoshi’s Genesis block, contained a (then) recent headline from a British newspaper reacting to the 2008/9 financial crisis, inscribing “*The Times 03/Jan/2009 Chancellor on brink of second bailout for banks*”.

As Bitcoin adoption increased from 2009 to 2012, users began exchanging dollars and euros for the digital money, using peer-to-peer exchanges and ATMs and then eventually with business entities acting as full-scale brokerages.

Today, this space is dominated by what we call cryptocurrency exchanges, offering bitcoin and many of its crypto-offspring. On these exchanges, as well as in various custodial solutions, bitcoin is held, bought and sold for traditional currency, and sent to destination wallets.

As these volumes have increased, so has scrutiny from financial authorities and government agencies, defining how this new category of entities exchanging US dollars and bitcoin would be regulated.

###### **The beginning of Bitcoin’s regulatory dance**

In March 2013, the Financial Crimes Enforcement Network (FinCEN), a division of the Treasury Department, updated its [guidance](https://www.fincen.gov/news/news-releases/fincen-issues-guidance-virtual-currencies-and-regulatory-responsibilities) to inform firms that “make a business of exchanging, accepting, and transmitting” virtual currencies would be considered **Money Service Businesses** (MSBs) under the law.

MSBs are distinct from banks and other traditional institutions. This taxonomy usually applies to issuers of travelers checks, check cashing services, and remittance services like Western Union. FinCEN’s guidance, for the first time, applied this to virtual currency services that transmitted funds on behalf of users or offered a fiat on-off ramp.

As an MSB, the law prescribes certain obligations for transaction collection, maintenance, and reporting, as well as identification requirements kept on file, what we call Know Your Customer (KYC) regulations.

The obligations on MSBs [require](https://www.fincen.gov/money-services-business-msb-suspicious-activity-reporting) filing Suspicious Activity reports on all transactions over $2,000 that “do not serve business or apparent lawful purpose” or may otherwise appear to be illegal activity or “structured” so as to try to avoid the spirit of the law.

The specific law that forces these obligations on MSBs, as well as banks, is the **Bank Secrecy Act** of 1970. Though it’s been updated several times over the years, the principal goal of this bill is to partner with banks and financial institutions to try to thwart money laundering and other illicit activity.

###### **BSA and Bitcoin**

The consequences of the BSA and its imposed surveillance have reaped unintended havoc on millions of ordinary Americans. This is especially true for those who have undergone “debanking,” in which bank customers are [deemed](https://www.thomsonreuters.com/en-us/posts/investigation-fraud-and-risk/treasury-de-risking-strategy/) too “high risk” and have accounts closed on them, a function of regulatory pressure – or *jawboning* – faced by financial institutions.

Venture capitalist Marc Andreessen has [provided](https://www.realclearpolitics.com/video/2024/12/01/marc_andreessen_biden_admin_has_been_debanking_politically_exposed_persons_in_privatized_sanctions_regime.html) his own examples of debanking in Silicon Valley, with similar conclusions.

Many Bitcoin and cryptocurrency entrepreneurs have been debanked on the [sole grounds](https://www.axios.com/2024/12/01/debanked-crypto-andreessen-joe-rogan) of being involved in the virtual currency industry, while millions of others have been swept up in the dragnet of the BSA and financial regulators forcibly deputizing banks to cut off customers, often without explanation.

According to FinCEN guidance, financial institutions are [compelled](https://www.fincen.gov/resources/advisories/fincen-advisory-fin-2010-a014) to keep suspicious activity reports confidential, even from customers, or face criminal penalties. This just makes the problems worse.

The [excellent research](https://www.cato.org/policy-analysis/revising-bank-secrecy-act-protect-privacy-deter-criminals) by the team at the Cato Institute’s Center for Monetary and Financial Alternatives provides reams of data on these points. As put by Cato’s **Norbert Michael**, “People get wrapped up in BSA surveillance for simply spending their own money”.

When it comes to bitcoin, the most common understanding for years has been that self-custody options and noncustodial solutions would be exempt from MSB classification, not requiring developers or entrepreneurs to acquire Money Transmission Licenses at either the state or federal level.

FinCEN itself stated this in their guidance [released in 2019](https://www.fincen.gov/sites/default/files/2019-05/FinCEN%20Guidance%20CVC%20FINAL%20508.pdf), and builders developed code based on what the government itself said. In 2023, however, the US Attorneys in the Southern District of New York and the FBI took a different stance.

Beginning with the Ethereum smart contract platform **Tornado Cash**, and then the popular privacy service **Samourai Wallet**, the developers of these projects were [arrested](https://www.justice.gov/usao-sdny/pr/tornado-cash-founders-charged-money-laundering-and-sanctions-violations) and [charged](https://www.justice.gov/usao-sdny/pr/founders-and-ceo-cryptocurrency-mixing-service-arrested-and-charged-money-laundering) with a number of conspiracy and money laundering charges, as well as “conspiracy to operate an unlicensed money transmitting business”. It’s that latter charge that remains the most important to sovereign and noncustodial use of bitcoin going forward.

Though both of these projects are noncustodial by design, and never took control of anyone’s bitcoin or cryptocurrency private keys, the government has charged them with being money service businesses and failing to adhere to the law.

Neither of these trials have yet taken place, but considering the money transmission charges, it stands to reason that anyone advocating for noncustodial bitcoin tools should be worried.

*If you’re interested in donating to the legal defense teams in both of these cases, check out the [**P2P Rights Fund**](https://p2prights.org/).*

If these are the steps law enforcement is willing to take against noncustodial protocols and projects even legal experts determined were out of the scope of MSBs, what about bitcoin exchanges and brokerages?

While we know there is no carve out at the moment, there are some important reforms that could empower entrepreneurs and give more options to Bitcoin users.

###### **An update to BSA would be a powerful reform for Bitcoin**

While we would hope that the majority of people using Bitcoin will practice [self-custody](https://www.btcpolicy.org/articles/self-custody-is-nonnegotiable), which is one of the key advantages of using Satoshi’s innovation, we know that most will not.

Instead, custodial services and exchanges will provide a lot of functionality for users, meaning that more and more Bitcoin activity will fall under the auspices of the Bank Secrecy Act.

One bill that aims to peel back the layers of banking law to restore some measure of financial privacy is the [**Saving Privacy Act**](https://www.lee.senate.gov/2024/9/lee-introduces-the-saving-privacy-act-to-protect-americans-financial-data), introduced by Sens. Mike Lee (R-UT) and Rick Scott (R-FL).

The proposed law aims to maintain the record keeping of financial institutions and money service businesses, but would do away with the automatic reporting limits and requirements without judicial warrants among other important reforms.

It would also ban a Central Bank Digital Currency, [repeal](https://www.therage.co/corporate-transparency-act-privacy-at-risk/) the **Corporate Transparency Act**, scale back the audit powers of the SEC, require Congressional approval for any ID database of Americans, severely punish any government employee who abuses private financial information, and grant a private right of action to any citizen or firm harmed by illicit government activity on financial matters.

It is a beefy bill with aspirational goals to restore consumer financial privacy, and it would no doubt make it much easier for Bitcoin tools and exchanges to operate within the law.

With less of a reporting requirement for custodial bitcoin solutions classified as Money Service Businesses – while still maintaining record keeping – it would be a much more natural balance of innovation and regulatory certainty.

By scaling back the financial surveillance required of banks and all other financial institutions, it is clear that Bitcoin users would benefit.

If there is enough appetite for this bill among various Senators and in the House of Representatives, however, is anyone’s guess. But the issues of our current banking system and its relation to Bitcoin are clear and this is a worthy attempt.

While there are still many regulatory changes needed to fully unleash the sovereign money revolution promised by Bitcoin, we can have some hope that the right ideas are being discussed in the corridors of power. At least for now.

*Originally published on the [website](https://www.btcpolicy.org/articles/downgrading-the-bank-secrecy-act-is-a-powerful-reform-for-bitcoin) of the **Bitcoin Policy Institute**.*

There should be no BSA in P2P! Keep up the great work!

Was sollten sie sonst wählen? Das ist ja oft ein Dilemma.

Ampel hat enttäuscht.

CDU enttäuscht.

AfD und BSW sind das wirklich alternativen mit totalitären Ideen?

Was wählt man?

Ungültig machen oder nicht wählen gibt leider kein Gewicht und macht es den anderen einfacher, die dir dein Geld klauen durch mehr Steuer und Inflation

GM man! You can do it! Hang in there!

GOOD MORNING NOSTR.

LIVE FREE. 🫡

https://cdn.satellite.earth/56b8001667fc80201c6810508dde15ac626488ae6cdcb0919bb06ead069b59e7.mp4

Good morning Odell!

Stay free!

Stay humble, stack sats.

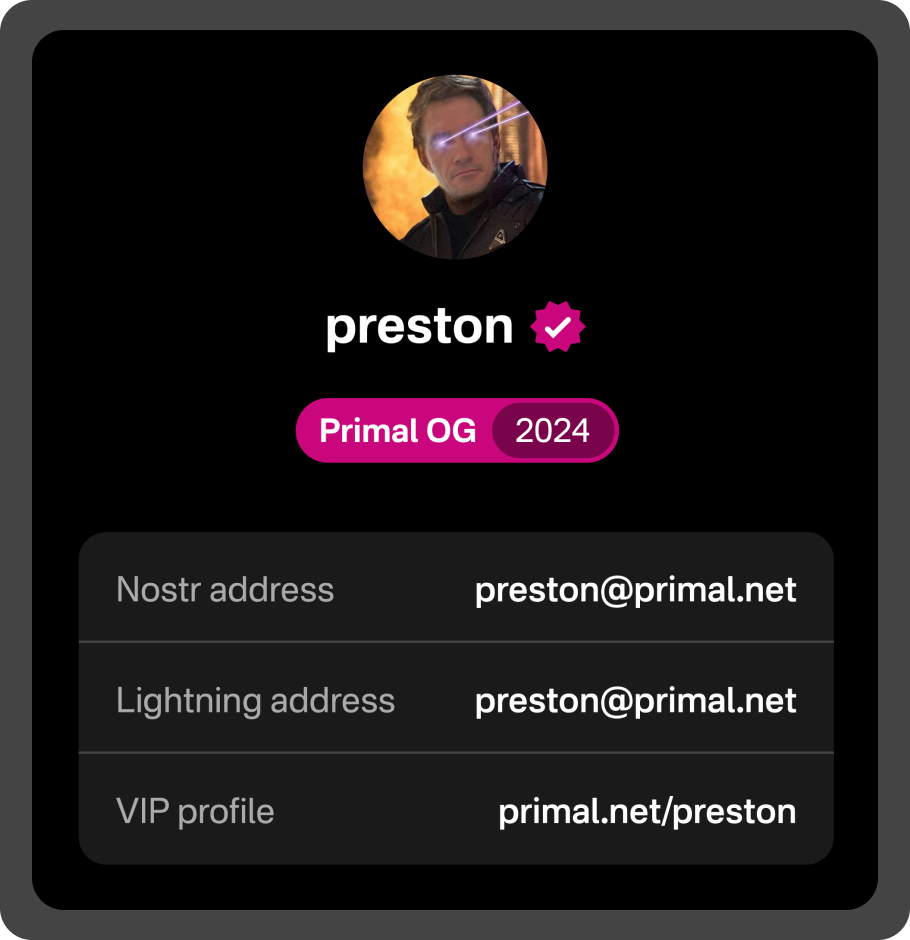

You cannot agree more even if you want! Jack is rocking it!

Good morning Odell!

I wish you a wonderful week!

Stay humble, stack sats!

GM Nostr!

hope you all have a great start into the week!

And still most normies will even not understand that

)

) )

) )

)