... that so many people are so blind (dumb) and don't want to understand that FIAT is a shitshow.

Twice a year, Baja California becomes the site of mass migration of Mobula rays ...

https://video.nostr.build/c8286ec3b42869c8030cb7f34266717a29b663d24591b3bbe13604a4db0e6942.mp4

#GrowNostr #Uncharted #Bullishbounty

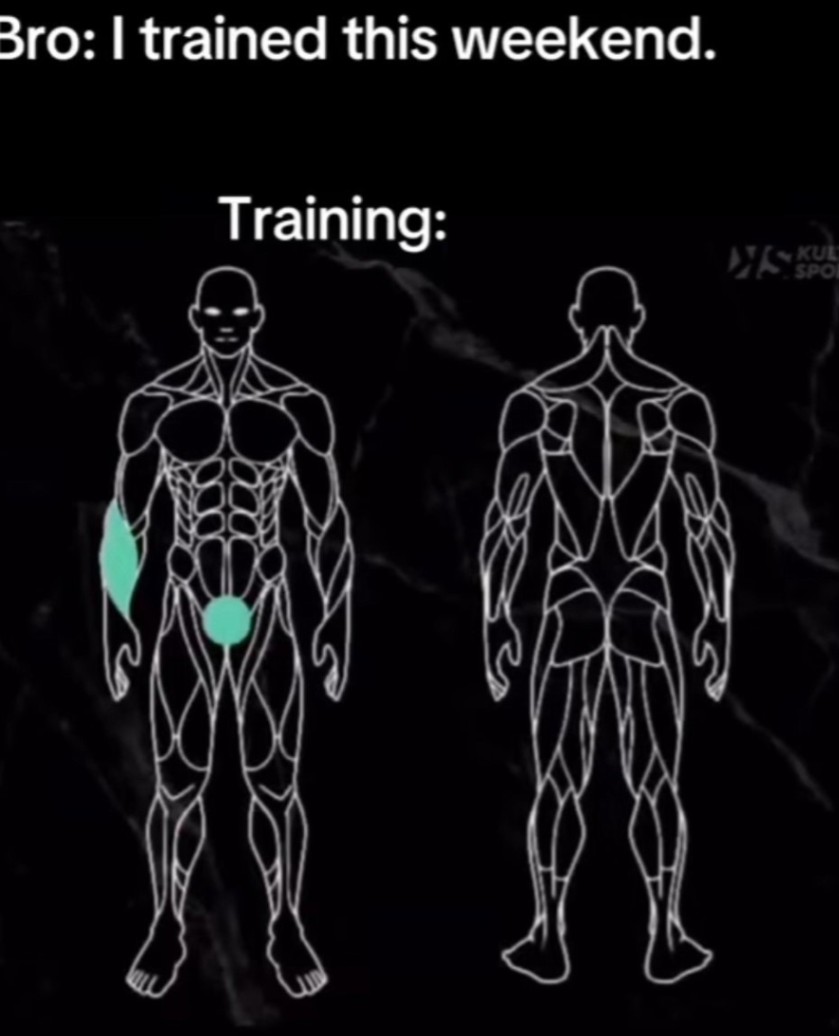

Awesome 😂🤣🤙

#Bitcoin #Nostr #Memes

#Bitcoin #Nostr #Memes

Imagine faster, more private Bitcoin transactions.

That’s the opportunity in Liquid.

https://youtube.com/shorts/Tnfh2HX-k0U

Sign up for macro insights from Sean Bill, CIO at Blockstream and a pioneer in bringing Bitcoin to institutional portfolios. With 30+ years in finance and a track record of award-winning fund leadership, his BAM quarterly letter is a must-read. ⬇️

🤙

https://video.nostr.build/461502af8478f1a4114e5c7c6df4d59be8ff64229eda8e13c7af98448f237a11.mov

#Bitcoin #Nostr #Memes #Bullishbounty

Hmm that’s interesting:/ hey nostr:npub1getal6ykt05fsz5nqu4uld09nfj3y3qxmv8crys4aeut53unfvlqr80nfm any idea? My wallet connection looks good on my end?

Using your own Node? Maybe your Channels are overloaded and it's time for a loop out or something like that 😁

Mmh ... not able to Zap the main note

DCA Strategy (hourly, daily, weekly)

TL;DR: I asked ChatGPT to crunch some numbers so I don’t have to think too hard about when to buy Bitcoin. Turns out: it kinda matters – but not that much. Weekly DCA is a gamble, daily is chill, hourly is overkill (unless you're into spreadsheets and order spam).

I came across a dataset going back to 2017 with hourly OHLC prices from Binance (UTC-based, it seems). I’m no data analyst (and barely use Python), so I let my friend ChatGPT do most of the heavy lifting while I nodded approvingly.

Curious to see how much of a difference timing actually makes, I ran some comparisons between hourly, daily (at different times), and weekly DCA strategies (on various days and times).

Fees weren’t included – so if you're using a platform that charges per order, hourly DCA might nibble away at your sats faster than you think.

The results?

In the worst case, the deviation between the best and worst strategy is around 4%.

Surprisingly, both the top performer and the worst performer turned out to be weekly strategies.

If you want to reduce that variance, daily DCA seems like a solid middle ground.

Hourly DCA? Only moderately useful. Even if you consistently hit the worst time of day for your daily DCA order, the deviation is still only around 0.3–0.4% (depending on the time range you’re looking at). But hey – that’s just 30 orders a month instead of 720, which might matter if you’re tracking things for tax purposes.

You could turn this into a science project (and add stuff like volatility, Sharpe ratio, etc.) – or just go with your gut and buy whenever your coffee kicks in and Bitcoin crosses your mind.

I did this little experiment back in late December and haven’t touched it since.

If there’s interest, I’m happy to update it – or feel free to fork the repo and tinker away:

https://github.com/3eppo/btc_dca_strategy

#Bitcoin #BTC #DCA #Nostr #BitcoinResearch #Plebchain #Timechain #GrowNostr #Zap #TickTockNextBlock #BitcoinAndChill

🤙