Looks amazing. Going in a week or so but going to stick to the mtns this trip…

Can’t wait for the casados… I will miss the best ceviche.

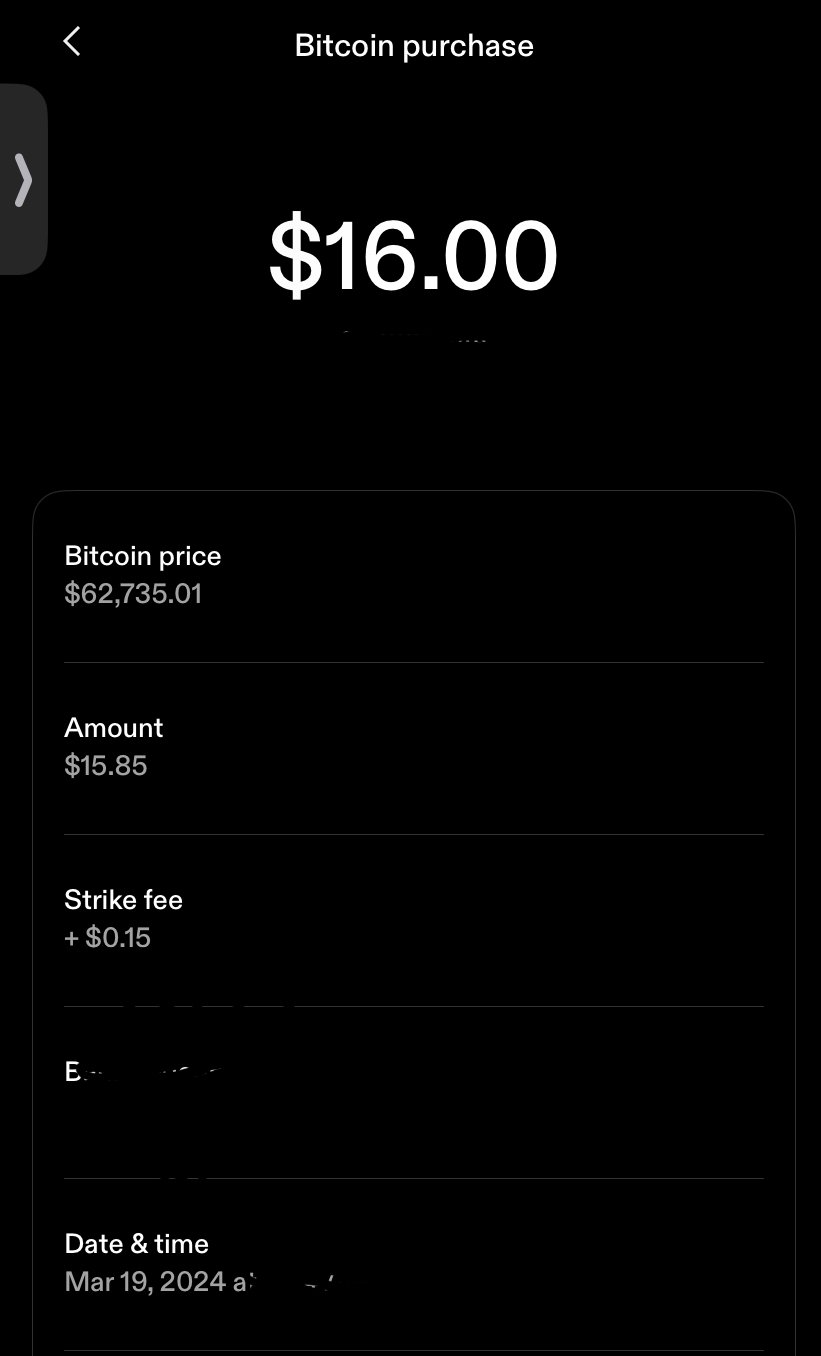

Please shill me businesses that take bitcoin in Santa Elena and La Fortuna if you know

Ya all my spam is relay based rn

Tell us what you dropped haha

“Trey, who dis?”

High limit slots. Sounds fun. How high do you have to be tho really

2.5 lbs in the first flush.

#chestnutmushrooms #gourmetmushrooms #shroomstr #foodstr #mushstr #bitcoin https://video.nostr.build/bc70dc733407f65a8cb8ea37bb0c1d4655ea6475393e5f71843f89207e44a78f.mp4

They look like what we call honey mushrooms… armillaria… the same? Beautiful flush…

Nostr is a freedom of speech protocol.

— nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx

An exceptional GM protocol

Learn how the nostr:nprofile1qywhwumn8ghj7mn0wd68ytfsxyh8jcttd95x7mnwv5hxxmmd9uq36amnwvaz7tmwdaehgu3dxqezu7tpdd5ksmmwdejjucm0d5hsz9thwden5te0wfjkccte9ejxzmt4wvhxjme0qqsd70fk9ftws2nw7gfehjnnvr4sc5pyy482p4vfdrnrkeec83m9ajgzcmt3n SDK fits into Greenlight with nostr:nprofile1qyxhwumn8ghj7cnjvghxjme0qy88wumn8ghj7mn0wvhxcmmv9uq3samnwvaz7tmjv4kxz7fwvd6hyun9de6zuenedyhsqgrxc2ftac9xns3p467j72y0lc004gckxgt3v8y48yehu2cd64gndgcenqn3 Co-Founder nostr:nprofile1qyxhwumn8ghj7cnjvghxjme0qyvhwumn8ghj7un9d3shjtnndehhyapwwdhkx6tpdshsz9nhwden5te0v4jx2m3wdehhxarj9ekxzmny9uqzpj79aa4srj73l73vh9df2ncycwz6jdkp4phphwwvmuk0pa8tatxtac0ydw . https://youtube.com/shorts/WBmWMonKjpY

Haha the still frame though…

I honestly think some people say “our nation” from the perspective of owners. They think it’s clever doublespeak.

Due to the nature of productive humans exchanging money, the equilibrium would be that it’s distributed… which is why a new money adoption is so radical.

The de-linking of gold is impressive to me. And Satoshi’s distribution scheme and disappearance, too.

If you want to look, maybe try sandyish soils near flowing water. There is a great crowd sourced map of morel finds here: