A piano. It can play whatever you throw at it. A waltz for your first dance with the bride. And also, a background theme for yet another brainwashing video. The instrument is just a tool that can be used for a variety of purposes.

The same is true about technology.

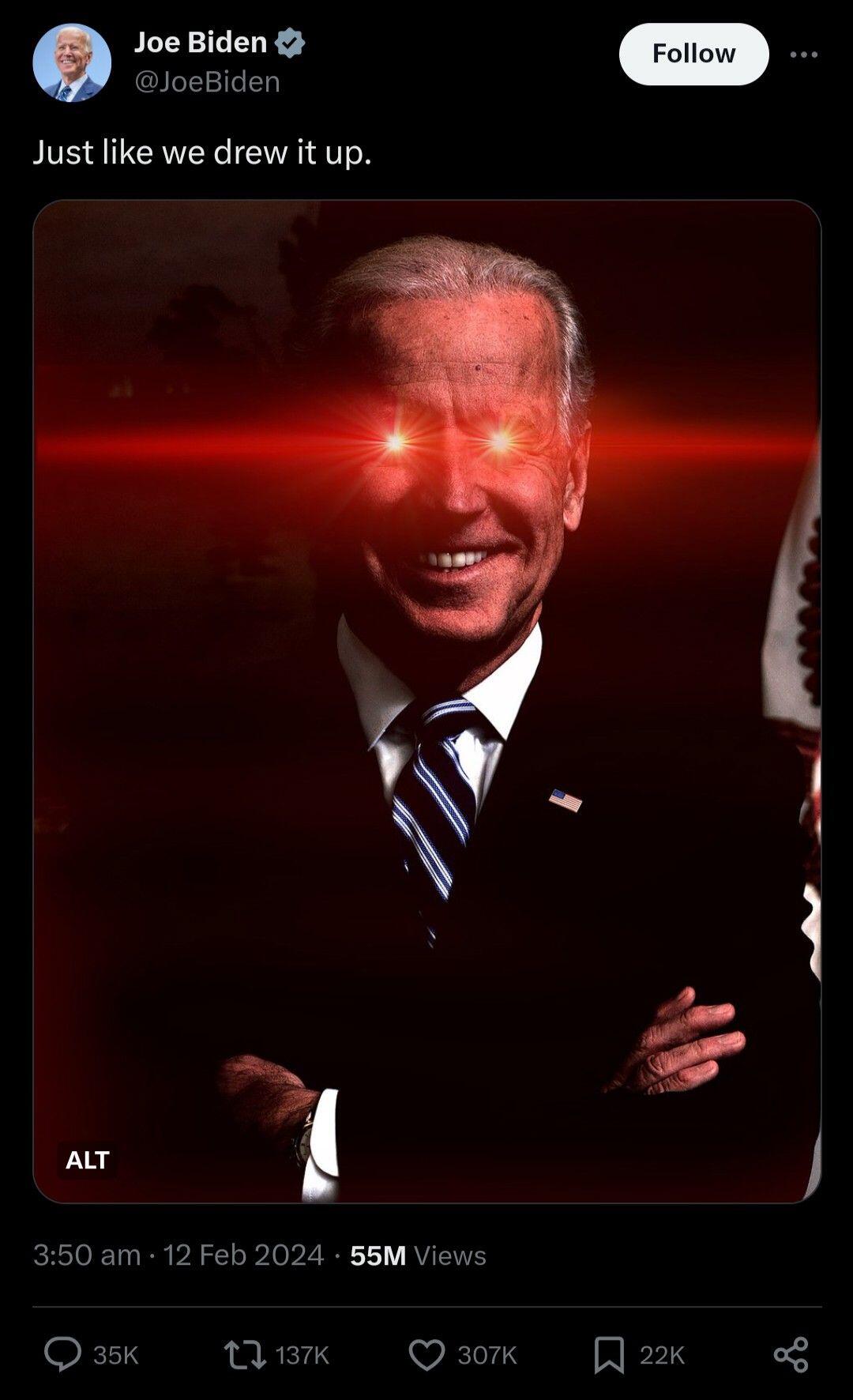

Some people do stuff that really makes you think this is how their hands must be.

The police. It's not about protecting you, it's about protecting the state FROM you.

There is no alternative 😄

It'll get better

Glad that you're here and we can read your posts man. Fuck twitterx

Based

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z

#negr0art

#m=image%2Fjpeg&dim=1080x1088&blurhash=%7CUFr%3Bb_N-%3DofMxIURPRjj%5DxuIAM%7BWARiWBWBWBofWAoft8xuWVfkWBWBj%5Bxu%25MofRjM%7BRjfkj%5DofWCWBf6j%5Bogoft7ayaet7t7j%5DfQRjRjayfRj%5BayofV%40j%5BWBWBofj%5Bayt7ofWBofj%5DWBofWBWBofofWBayWBWBt7ofj%5B&x=bcb4eb1ed231ab03688b162fe8d3fe88f7767ae293413ef607602cb8152ea3d1

#m=image%2Fjpeg&dim=1080x1088&blurhash=%7CUFr%3Bb_N-%3DofMxIURPRjj%5DxuIAM%7BWARiWBWBWBofWAoft8xuWVfkWBWBj%5Bxu%25MofRjM%7BRjfkj%5DofWCWBf6j%5Bogoft7ayaet7t7j%5DfQRjRjayfRj%5BayofV%40j%5BWBWBofj%5Bayt7ofWBofj%5DWBofWBWBofofWBayWBWBt7ofj%5B&x=bcb4eb1ed231ab03688b162fe8d3fe88f7767ae293413ef607602cb8152ea3d1

Dis Tucker?

Seems like TuckerCarlson does a JMilei and is crashing the World Governments Summit party.

Guess that's the new trend to smash the globalist utopia propaganda to smithereens. Take the narrative fight to their forums.

https://www.youtube.com/live/tNk91kjqtGQ?si=uN4CTY0BO51BNdJy

This is even better than the interview with Putin.

Pushups are not enough to get you there 😄

Good morning 🥱