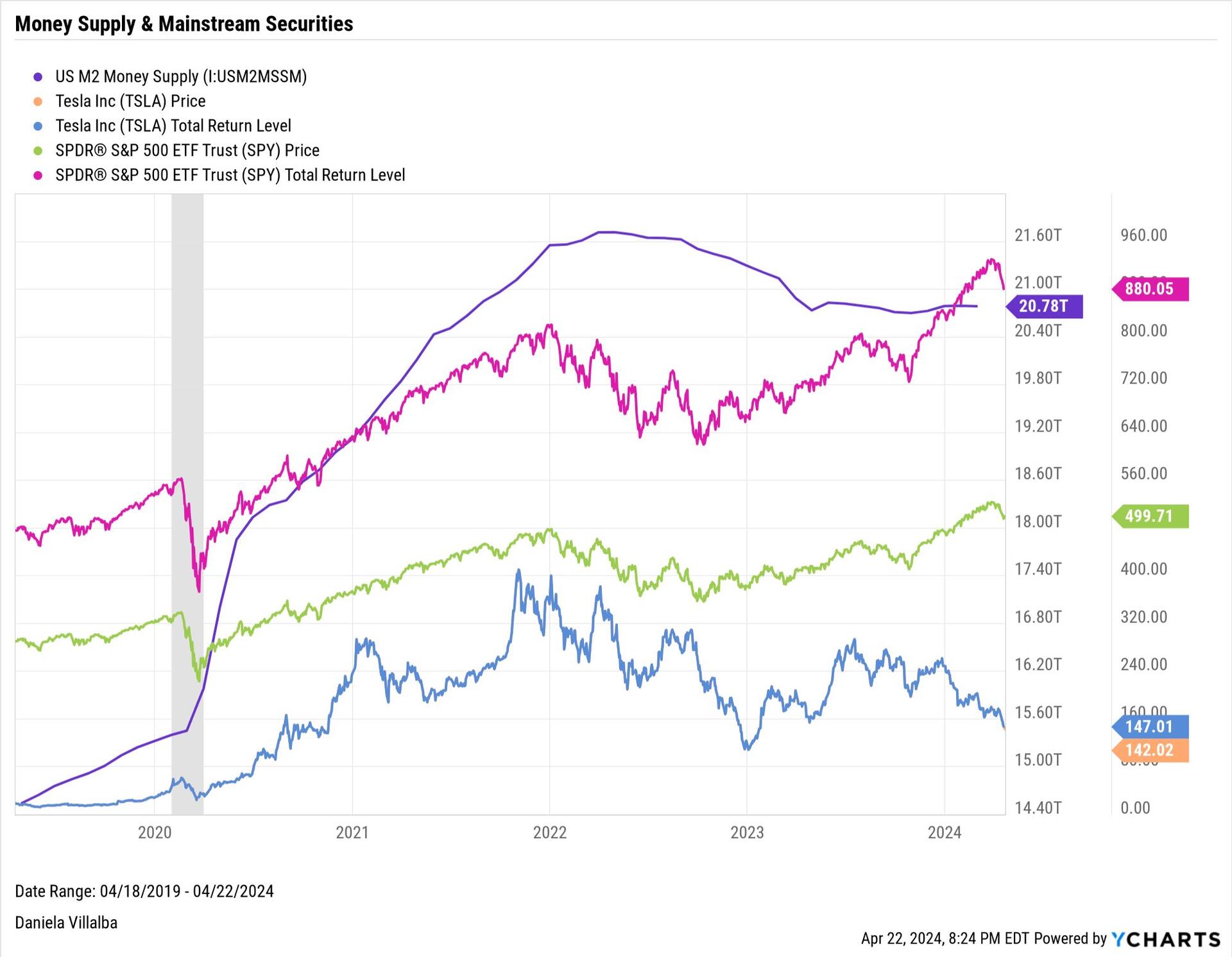

In an #economy where the Money Supply expansion is slowing down (the train will never stop), corporate diligence becomes paramount. Now more than ever, strategic financial management is essential for sustained growth.

Super Micro Computer (#SMCI) shares drop 20% after announcing its fiscal Q3 earnings release without preliminary results, disappointing investors.

Next week, earnings reports are expected from a number of heavyweight companies including Verizon Communications (#VZ), Visa (#V), Tesla, Pepsico (#PEP), GE Aerospace (#GE), Meta Platforms (#META), International Business Machines (#IBM), AT&T (#T), Boeing (BA), Microsoft (#MSFT), Alphabet (#GOOGL), Merck (#MRK), Caterpillar (#CAT), Exxon Mobil (#XOM) and Chevron (#CVX).

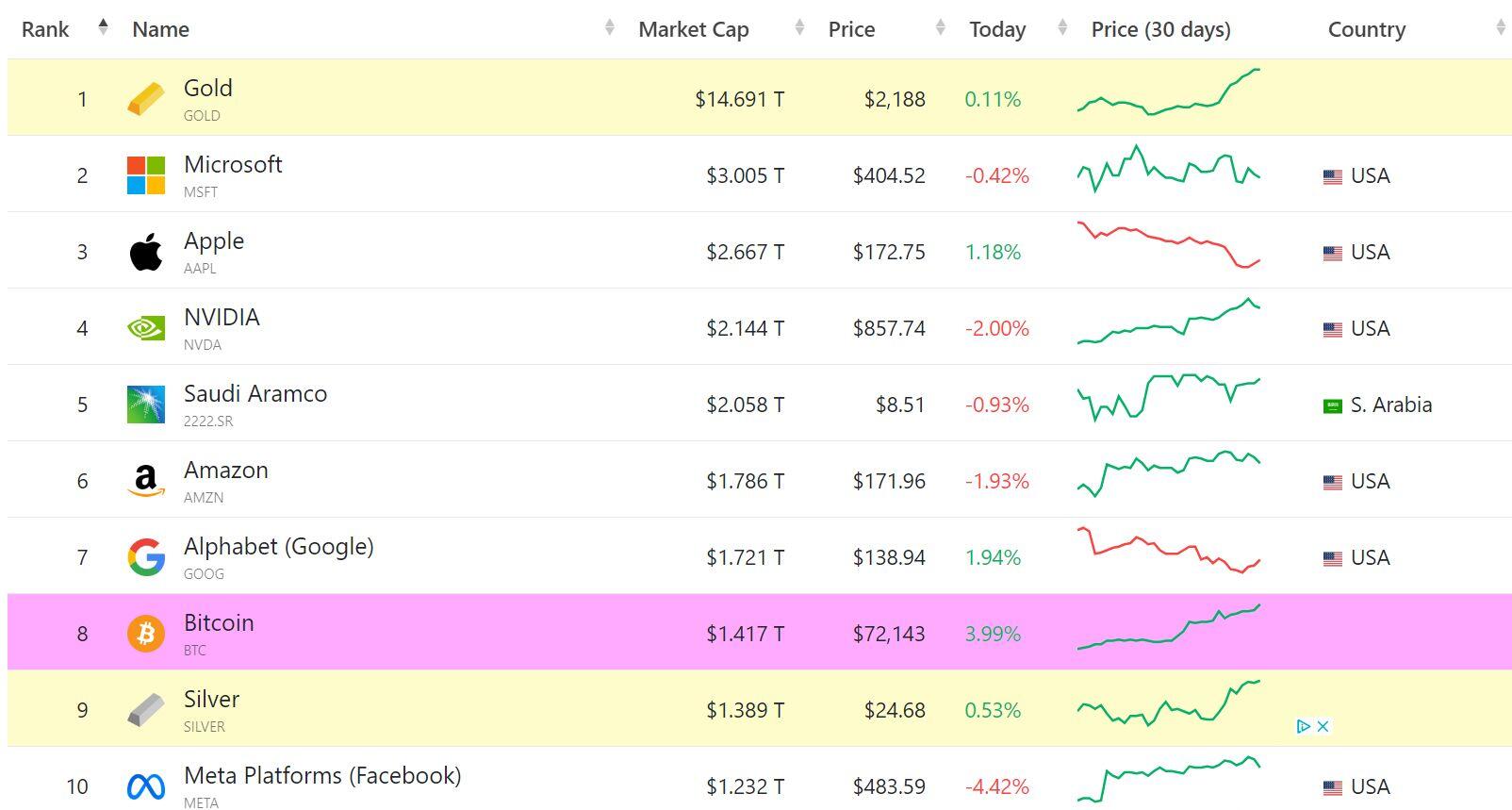

Now is a great time to remember everything will go towards 0 compared to #Bitcoin  .

.

The price of all goods trend towards their marginal cost of production.

When the marginal cost to produce the system's reserve currency is essentially zero,

Save in #Bitcoin or risk watching your wealth bleed out towards 0.

The repurchase of $200 million worth of #Treasury Securities, particularly targeting long-dated securities, is underway. This move marks a significant step, reminiscent of actions taken during and after the global financial crisis of 2008, when the U.S. embarked on large-scale debt buybacks. The Federal Reserve initiated several rounds of Quantitative Easing (QE), notably QE3 (2012-2014), yet major buybacks have been absent since then.

With the current US debt exceeding $34 trillion, it's a staggering figure that underscores challenging economic conditions. Imagine if this debt were evenly distributed among every household in the US over 30 years; each household would be responsible for approximately $1,008,577 annually.

In today's uncertain economic landscape, exploring alternatives becomes imperative. Why rely solely on the Federal Reserve's strategies, when #Bitcoin presents a compelling alternative in navigating these economic dynamics.

"Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know.

To encrypt is to indicate the desire for privacy, and to encrypt with weak #cryptography is to indicate not too much desire for privacy.

#Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can't get privacy unless we all do, we're going to write it.

For privacy to be widespread it must be part of a social contract. People must come and together deploy these systems for the common good. Privacy only extends so far as the cooperation of one's fellows in society."

-The Cypherpunk Manifesto

Eric Hughes (1993)

Cypherpunks, particularly in the context of #Bitcoin, are modern day heroes.

The U.S. dollar role as the world's reserve currency brings benefits like a strong currency during fiscal weakness, and economic power. But it also leads to a structural trade deficit.

#USD #Bitcoin

The demand for dollar fueled by Monetary Premium, incentivices foreign nations to export to the U.S. while the opposite happens at home, wages and costs are not competitive abroad. This prolonged deficit, erodes #US's infrastructure and increases reliance on foreign financing.

Since 1944 US's global share of #GDP has decreased from over 40% to under 20% on real terms. And after the financial crisis of 2008, nations have been diversifying their reserves away from USD. Furthering the US vulnerability as the world's economic power.

It is unlikely that any other fiat currency will emerge as the new world reserve currency. Instead, the world is shifting towards a reserve currency that is not issued by any government and that relies in true scarcity: #Bitcoin.

For way too long, I've been discussing #Bitcoin's decoupling from traditional financial systems. Despite the inevitable correlation between the money supply and asset price inflation, there are signs suggesting that this decoupling is well underway, if not already accomplished. However, should my assessment be incorrect, it appears to me we are on the brink of such a phenomenon.

Can't wait and though 1Bitcoin=1Bitcoin

I love to see my stats appreciate in dollar value :)

On March 4th, #Bitcoin  temporarily exceeded Silver's Market Cap. This morning, at 1.417T it happened again, only this time is for good.

temporarily exceeded Silver's Market Cap. This morning, at 1.417T it happened again, only this time is for good.

The money in your bank account is not yours, stop entrusting your wealth to banks.

Take control and safeguard your future. #Bitcoin

While a system can be complex, fast and easily scalable, it can simultaneously be destructive and wasteful. This is the story of the #fiat standard.

Nothing worthy ever comes fast or without cost.

If the integrity of the #Bitcoin network remains, sustainable scaling will come.

In #Canada, homeownership dominates financial discussions. Many face the stress of saving for a home, uncertain if they'll ever afford one. Others abandon the dream, voicing injustice. The Federal Reserve Bank of Dallas reports Canadian home prices surged by 84.21% in a decade wages rose only 54.91%. This stark gap highlights worsening housing affordability. Currency devaluation drives investment into speculative assets, neglecting housing's fundamental purpose. Extensive regulations hinder affordable housing projects.

#Bitcoin can fix this.

So excited to finally start BrokenMoney today, the exciting journey of Money through the lense of Technology.

nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a Thank you for writing, thank you for sharing.

"Today, for the first time in history, no nation is on a metallic standard, and practically every nation is swindling it's own people by printing a chronically depreciating currency." -Henry Hazlitt

When annualized inflation rates look like this, stay safe, save in Bitcoin.

Highest annualized inflation rates:

(According to TradingEconomics)

Venezuela: 56%

Zimbabwe: 130%

Argentina: 100%

Sudan: 71%

Lebanon: 61.8%

Turkey: 64.2%

Iran: 41.1%

Ethiopia: 36.7%

Syria: 31.3%

South Sudan: 28.9%

How long till the rest of the money printer driven nations (all of them) follow?

I'm going to mirror my twitter here till I figure out how to use Nostr. I feel like a grandma but bare with me, any pointers to how to enjoy Nostr more, please send them my way.

Learn the difference between Fiat money and naturally emergent money. The first one historically trends to high devaluation and chaos, the latter one is a technology that improves productivity which in turn provides a prosperous environment for humanity.

Education Based Bitcoin Adoption>>

How the hodlers are born.

Yea, that's exactly why I think her being at the game shouldn't make it a "Taylor Swift Superbowl", giving her that much attention makes it that way. And making fuzz about it only adds to it, don't blame her or her fans, blame the marketing team around the NFL who have make it all about her. Then again, maybe they know what they are doing, maybe they're not, but as someone who enjoys sports, having a celebrity on the screen for a few seconds doesn't make the game any less worthy to me.

Women having fun at a football game, THE AUDACITY!

Or can't see the value of it (because the only way they are able to think is the way the traditional system taught them to)