Your dad is Pedro Pascal?

🥶 good run down of Space X landing

We gotta link the next time we’re both in the city. I’ll be there Wednesday meeting with nostr:npub17xu3rtcu0ftqw03mswa8a2ngz3nsgrs0h0wjv4z942qwvhp8fs3qzcadls

Oh man, I would love to but I don’t live in US. Perhaps in the future🤞

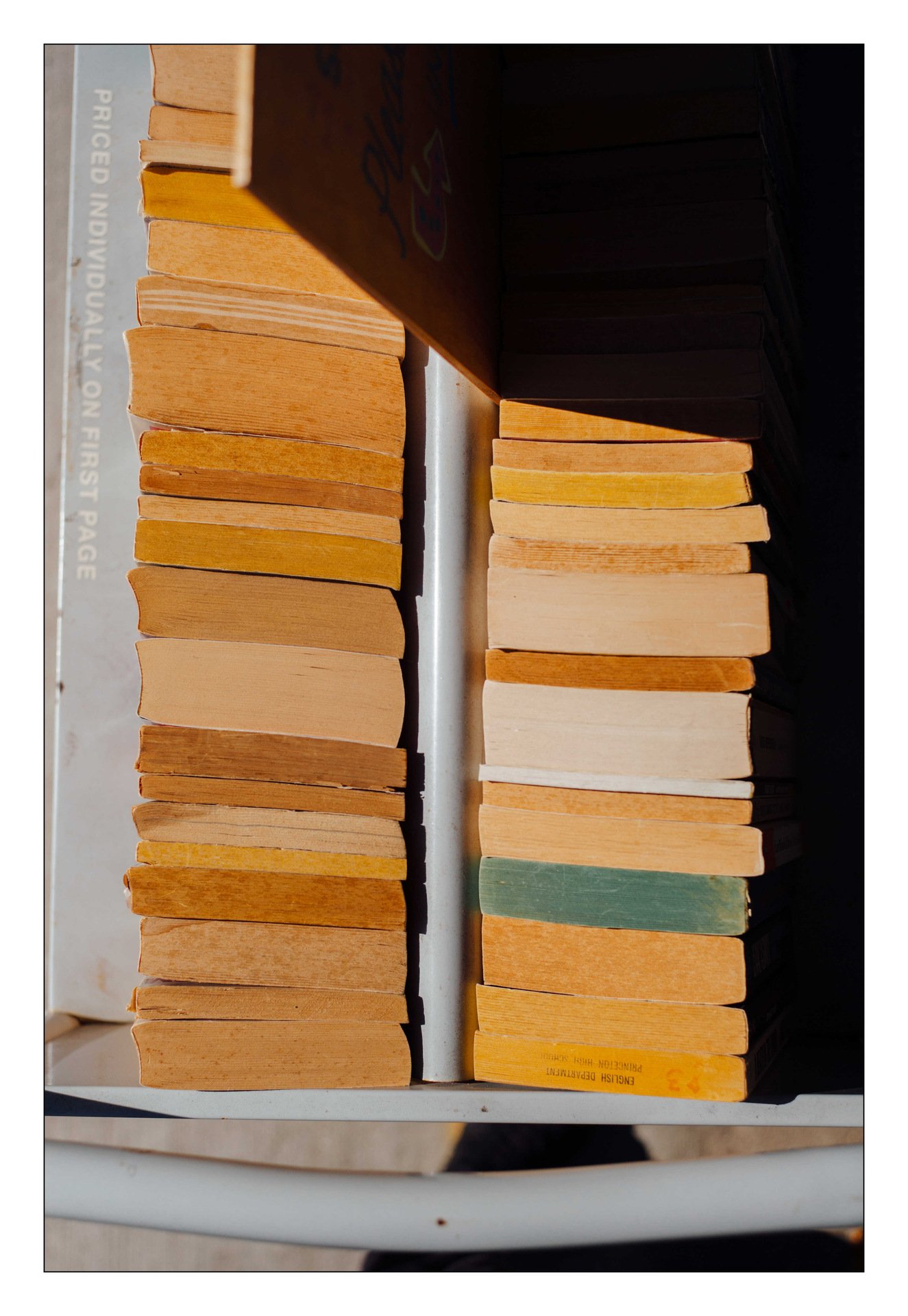

New York 2019…

#artstr #nostr #grownostr #photography #35mmfilm #bnw #photostr #photo #art #nostr #noicemag #minimalcomicplay

I put this into chat gpt. answer seems a bit more ambiguous to me. This is part of the answer. Seems a bit more ambiguous to me:

Clarification and Corrections:

1. Taxable Events in the UK (30-Day Rule):

* In the UK, any disposal of Bitcoin, including spending it, triggers a taxable event. This is where things get tricky.

* Spending Bitcoin to buy goods or services is considered a disposal by HMRC (UK tax authority), meaning it could create a capital gains tax (CGT) liability if the value of the Bitcoin has increased since you originally acquired it.

* When you rebuy the Bitcoin within 30 days, the UK’s Share Matching Rules apply, meaning the new Bitcoin you buy is matched to the Bitcoin you sold or spent, for tax purposes.

* If you sell and buy within the 30-day window, the cost basis of the Bitcoin you repurchase is matched to the sale price, so you still might incur a capital gains tax depending on the price movement.

For those of you that price things in #bitcoin are you talking savings, big purchases or everyday things, groceries etc?

#asknostr

Isn’tnostr:nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m from there?

Are #bitcoin fees now up only?

#asknostr

You should connect with nostr:npub1h0fd5xu8rfhwdkkjr78ssdhm7rdjyf97hhjqr9acwv77ux0uvf8q23kvcg from Suriname

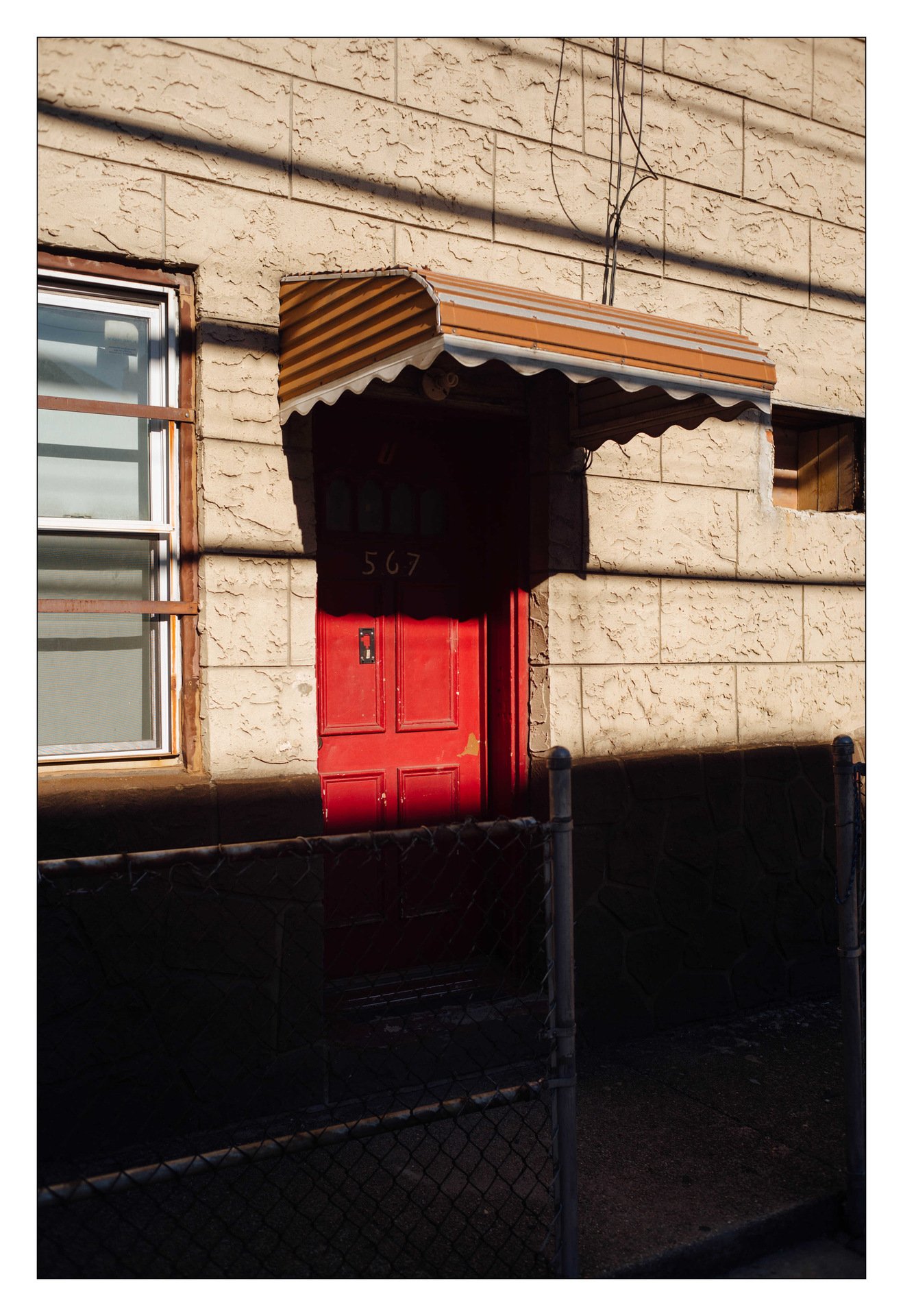

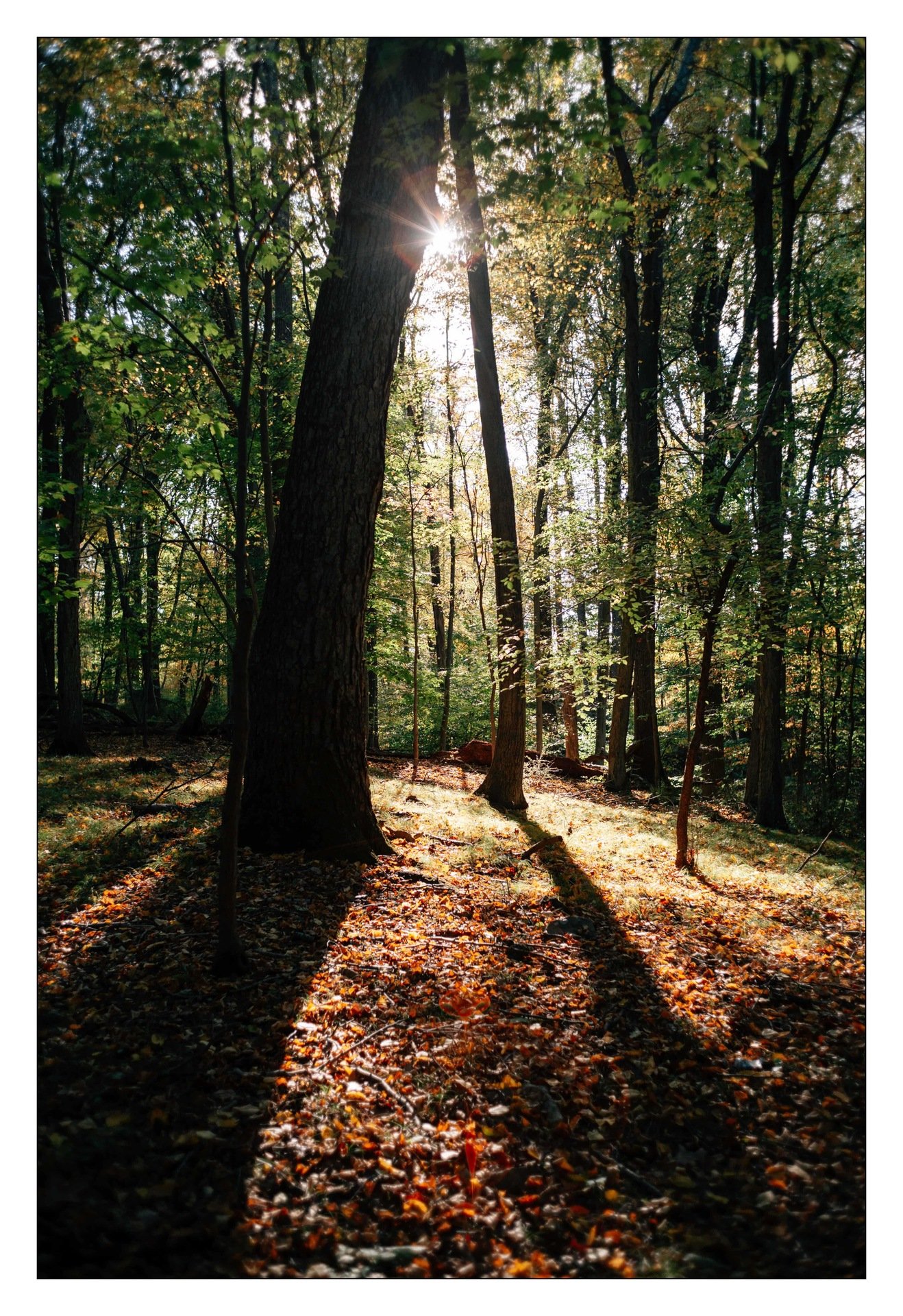

nostr:npub1c8n9qhqzm2x3kzjm84kmdcvm96ezmn257r5xxphv3gsnjq4nz4lqelne96 and nostr:npub17xu3rtcu0ftqw03mswa8a2ngz3nsgrs0h0wjv4z942qwvhp8fs3qzcadls inspired me to take a look at some photos I took on a really long stop over in NYC a few years ago. This is ones of my favourites. If my organisation of negatives was a bit better I’d have the other ones to hand but alas….

#artstr #nostr #grownostr #photography #35mmfilm #bnw #plebchain #photostr #photo #art #nostr #travel #photo #🖼️ #noicemag #minimalcomicplay

Orange pilled a Tuk Tuk in Madeira.

But like actually orange pilled.

Me: “Hiya dude,

can I do something a bit weird?”

Dave the Tuk Tuk driver: “it depends.”

Me: “im trying to survive on bitcoin here. Can I pay for your Tuk Tuk in bitcoin?”

Dave: “sure. Wait. are you Joe nakamoto from youtube”?

….

Sorry I realise I don’t have the will to write the rest of this quip in this laborious style coz I’ve spent the whole day filming…

But basically the Tuk Tuk driver, Dave is a based bitcoiner who watches my videos and said NO to doxxing on camera but YES to being part of the story because he likes my videos but values his privacy.

So we’re gonna blur his face and not show his lnurl but still make a nice light relief moment of our interaction during the Madeira documentary.

He did his first lightning transaction with me and we chatted about Uptober fails and bitcoin privacy on the way to the cheese shop.

Bitcoin sticker went on his Tuk Tuk, we high fived and off he trundled.

And no, dave isn’t even his real name. Who in portugal is called Dave lol.

Anyway. How cool is that?!

nostr:npub1etgqcj9gc6yaxttuwu9eqgs3ynt2dzaudvwnrssrn2zdt2useaasfj8n6e ⚡️

You’re famous lol