You can apply tariffs on #gold

You can’t apply tariffs on the #Bitcoin network

Interesting. 🤔

My article on Bitcoin evaporation is not priced in completely agrees!

https://medium.com/@TheyHODL/bitcoin-evaporation-is-not-priced-in-e7dbb6366c1b

“We need a sovereign wealth fund”

Translates to:

“We no longer want the reserve currency “

It’s as easy as that.

Don’t forget this was all done with a laced up bladder football. 🥇

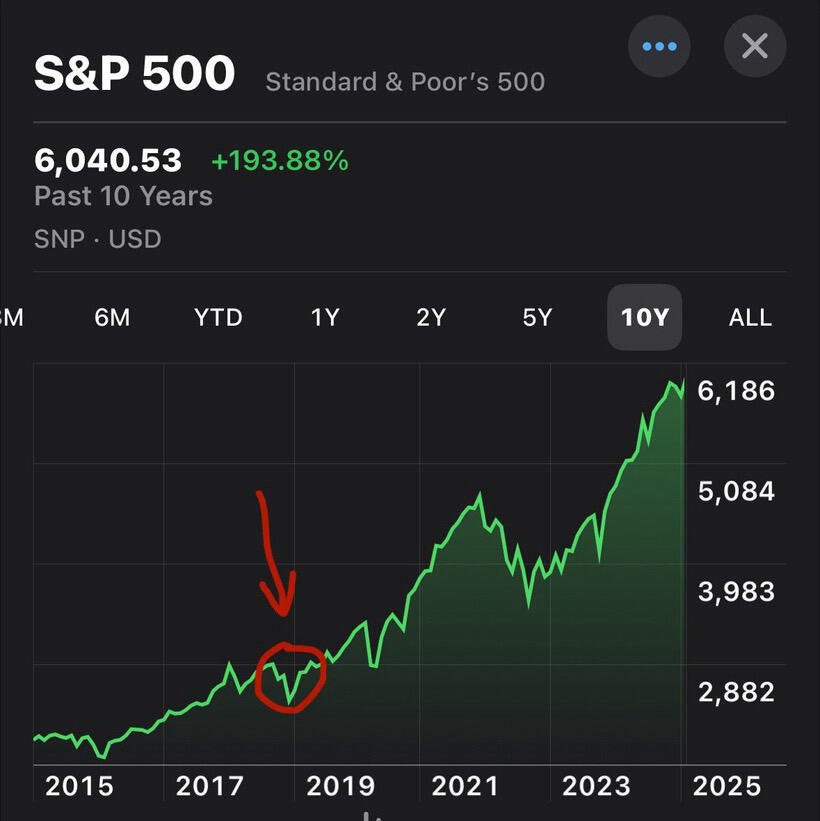

Even though #gold is old, it’s telling you where #bitcoin is heading ^10

There are no pullbacks anymore

Efficient market hypothesis is consensus level thinking.

Money is made by the convicted contrarians!

Things are very different since Q3 Earnings call:

https://primal.net/e/note1zkwm3d5r6u49z96jv204kaxy2quy4gdskg7s4s07hvdh8y0f8h7s56yv7t

If Tesla applied FASB accounting to Bitcoin in Q4 earnings.

You think #MicroStrategy won’t anon?

The Magnificent One = Strategy

https://primal.net/e/note1zkwm3d5r6u49z96jv204kaxy2quy4gdskg7s4s07hvdh8y0f8h7s56yv7t

Completely agree there are a lot of ifs! Will be interesting to see how it plays out!

My latest Article "The Magnificent One" on #Bitcoin #MicroStrategy and the paper clip optimiser.

nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqtxwaehxw309anxjmr5v4ezumn0wd68ytnhd9hx2tmwwp6kyvtjw3k8zcmp8pervct409shwdtwx45rxmp4xseryerdx3ehy7f4v3axvet9xsmrjdnxw9jnsuekw9nh2ertwvmkg6n5veen7cnjdaskgcmpwd6r6arjw4jsqgq6lcx8fc7h0p8t4ya9u0a92jnwavqe9rgjwwdw3wjgxfuxsz8rd5mths8c nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyq22430drwpj26akxda9nevxkrjsr0ltv9r69g9c7ull3mnljs2jcm37jq0 nostr:nprofile1qyt8wumn8ghj7cmp9eex2mrp09skymr99ehhyecpzfmhxue69uhhqatjwpkx2urpvuhx2ucqyqlkgqvjr9lyds029e9ve7lfnxrkagdrvsy6ues6duaqf2tz37h2gvv4knj

https://medium.com/@TheyHODL/the-magnificent-one-e02880e30a7d

Full Article below:

How MicroStrategy might break the entire investment management system, from passive flows to US stock indexes and cause the greatest Stock Market Collapse of all time!

“You click bait whore”, they yell at me with their JPM lanyards and creased polyester suits.

“MSTR is a Ponzi, you moron, MicroStrategy is insignificant garbage!” they scoff.

But yet…. it is all they can think about. And that’s because their subconscious is doing the math and their entire existence is in jeopardy.

I therefore have a problem. I have played out a scenario in my mind and it has taken me way beyond being too bullish on MicroStrategy and Bitcoin, but instead I find myself floating in the abyss of an investment management apocalyptic hellscape. And I’ve come to the realisation that if MicroStrategy continues on this path of:

1. Conversion of the debt and equity markets available to them, into Bitcoin purchases.

2. Maintaining successful custody of their Bitcoin. If their coins get lost then it’s a very different story. (See my article on Bitcoin is Vapour).

3. Continue to break into Index inclusions.

Then, this ends one place and one place only. They will not only become the world’s largest company by an order of magnitude, but as a result it will break ETFs, Indexes and the US stock market as a whole.

If you are not already up to speed on the 21:21 plan, the convertible debt instruments, preferred debt equity, and the ATM toolkit at MicroStrategy’s disposal, then I suggest you go and research there first.

My assumption in the below is that Saylor and team will continue at pace to accelerate their debt and equity strategy to funnel fiat trad-fi instruments into accretive bitcoin purchases for their shareholders — a pretty safe assumption. My thesis is that the 21:21 plan will one day be the 210:210 plan.

Index collapse

The MicroStrategy shareholders celebrated last year as the NASDAQ100 added MSTR to their index with a 0.47% weighting. As Bitcoin grows, MSTR Market Cap will grow, and playing out the extreme scenario in my mind, we get the fly wheel effect of:

1. Using MSTR debt and equity to buy Bitcoin

2. Bitcoin then goes up

3. MSTR then goes up

4. Weighting for MSTR then goes up in the index

5. Index Rebalancing leads to the sale of other stocks and the purchasing of MSTR

6. MSTR then goes up

7.Using MSTR debt and equity to buy Bitcoin

…. Repeat>Repeat>Repeat

Indexes are distorted flywheels themselves, and for MSTR it is the equivalent of hitting the speed arrows on Mario Cart resulting in exaggerated and accelerated outcomes. As you overtake the competitors in your index you have velocity that shoots you further and further up the index making it harder for those behind to catch you. MSTR is going to have a compounding Bitcoin rocket and an index rocket attached to its share price.

Positive weighting discrimination within the index will cause it to become a 5% weighting, then a 10% weighting, then a 15% weighting, each increase in Market Capitalisation sucking capital away from all other stocks (discriminatively more the higher up the index you are i.e. 7.8% MicroSoft sale to fund additional MSTR rebalancing). I call this the competitive stock draining stage.

This continues until the index limit for a single stock is reached i.e. 24% in NASDAQ100 and 25% in S&P500. This is when the fun starts, and what I would call index draining stage, where the index performance will gradually fall and then collapse as it underperforms bitcoin, MSTR, and bitcoin indexes, extracting capital to where it is performing best. Resulting in the best performing indexes that we have used for decades to either collapse or become zombie indexes.

US stock Collapse

US stocks will collapse against MicroStrategy and Bitcoin from a multitude of angles. Firstly the above scenario via index draining, which will cause all other individual stocks to collapse against MicroStrategy. But what do the individual competitors do to counter the decline in share price that is about to hit them.

Well, any attempt to copy their strategy will only lead to accelerate the trajectory of MicroStrategy to the Magnificent One, as they try to add Bitcoin to their balance sheet they will push MicroStrategy further and further into the lead from an index weighting and an MSTR Market Cap perspective. That doesn’t mean it is not the right strategy, because they will have to stop comparing themselves to the Magnificent One, instead it’s all the other 498 competitors it’s trying to compete against.

Companies will not disapear, but instead only profitable companies and those who hold bitcoin will continue. Share prices will collapse to a sensible Price to Earnings ratio. Companies will be judged on the Bitcoin they hold, Bitcoin Revenue and Bitcoin per share growth.

Too Bullish?

So you see my problem. I must be too bullish, because as I play out the scenario in my mind, MSTR is going to “eat trad-fi from the inside out”, as Punter Jeff would say. But I really mean it. Indexes as we know them may cease to exist in their current state and meaningfulness. Stock market valuations will collapse in real terms. And MicroStrategy will be the Magnificent One by several orders of magnitude, almost to a point where it is its own asset class.

I recently listened to American HODL introduced the AI theory of The Paperclip Optimiser, originally proposed by philosopher Nick Bostrom. A thought experiment of an AGI that has a single goal of optimising for creating paper clips could lead to a world where all resources are consumed in order to generate more and more paperclips, leading to catastrophic outcomes for the planet as all resources are consumed to focus on a single goal of optimising for paper clip creation.

Well, I think MSTR is a Bitcoin HODLing optimiser, and the design will lead to resources (fiat-debt, fiat-capital, fiat-equity) being directed to one goal of giving MicroStrategy more fiat to buy Bitcoin. Unlike the paper clip optimiser where the world ends, the MSTR/Bitcoin optimiser will lead to the end of the Fiat world as every fiat resource is sucked into MSTR to buy Bitcoin until the Fiat system ceases to exist and the hyper-bitcoinization world replaces it.

Summary

If Bitcoin continues on its path and trajectory then it is going to completely re-write the financial system, stock market, debt market and sovereign reserve holdings. It is a biblical achievement. No man, company or country, could achieve such a peaceful and resilient transformation and rewiring of a sick and aging financial system. Yes Satoshi released the code into the world, but Bitcoin did the rest alone, paying humans to maintain it, give it energy, and spread the word of its existence, power and principles.

I am of the current thinking that Bitcoin was not an invention but a discovery, it is mathematical formulas and cryptography that have always existed since the dawn of time. Humankind through Satoshi, has uncovered its existence at the time we most needed it and you can put it down to fate, chance or divine intervention. But ultimately it doesn’t matter, it is unstoppable, and if you have not prepared for what is about to unfold, you should probably start doing the research.

Best of luck and happy HODLing.

My latest Article "The Magnificent One" on #Bitcoin #MicroStrategy and the paper clip optimiser.

nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqtxwaehxw309anxjmr5v4ezumn0wd68ytnhd9hx2tmwwp6kyvtjw3k8zcmp8pervct409shwdtwx45rxmp4xseryerdx3ehy7f4v3axvet9xsmrjdnxw9jnsuekw9nh2ertwvmkg6n5veen7cnjdaskgcmpwd6r6arjw4jsqgq6lcx8fc7h0p8t4ya9u0a92jnwavqe9rgjwwdw3wjgxfuxsz8rd5mths8c nostr:nprofile1qy88wumn8ghj7mn0wvhxcmmv9uq32amnwvaz7tmjv4kxz7fwv3sk6atn9e5k7tcqyq22430drwpj26akxda9nevxkrjsr0ltv9r69g9c7ull3mnljs2jcm37jq0 nostr:nprofile1qyt8wumn8ghj7cmp9eex2mrp09skymr99ehhyecpzfmhxue69uhhqatjwpkx2urpvuhx2ucqyqlkgqvjr9lyds029e9ve7lfnxrkagdrvsy6ues6duaqf2tz37h2gvv4knj

https://medium.com/@TheyHODL/the-magnificent-one-e02880e30a7d

I have been thinking about Matthew 12:30 where Jesus says: “Whoever is not with me is against me, and whoever does not gather with me scatters”

This seems true of not just following Jesus, but any truth or principle that is fought against.

It seems to echo in the truth of #Bitcoin vs the millions of Shitcoins

Trump calling out Triffin’s dilemma is facilitating to see.

Deficit with every country is why there is 35trillion worth of debt.

He is calling out the systems design… not sure he will like the solution?

Yuan money printing devaluation occurred.

I expect China to act even faster this time round.

Prepare for a monetary bazooka

Pretty sure it’s a requirement to be a crazy retard to break free of the Fiat matrix and reach bitcoin enlightenment?!

🤷🏼♂️