Same here! There is no second best. Not even wrapped tradfi Bitcoin 😂

This over 10 year article is at least interesting to read and maybe still valid.

Interesting times ahead.

https://www.smh.com.au/money/investing/whos-to-blame-for-great-gold-collapse-20130419-2i4pb.html

That does seem like a great article to read in light of recent events. Kinda proves the irony behind the SEC dilly dallying around for a decade to “avoid manipulation” when the ETFs could very well be where the manipulation begins!

Interesting point, I’ll be looking forward to seeing if the institutions will foil the greatness we know as Bitcoin.

Only time will tell.

Care to elaborate?

$4.6 Billion worth of volume was seen during the #Bitcoin ETFs first day of trading.

The race for market dominance so far has been led by BlackRock (no surprise there), but it is far from over. Personally I’d like to see $BRRR or $HODL take the lead, but that’s solely for my humor-prone ways.

Grayscale hit the jackpot by converting its #BTC trust into an ETF, they own the worlds largest #Bitcoin ETF (~643.6k #BTC(~$28 Billion))…but will they be able to maintain this position with less than competitive fees?

I won’t be buying any ETFs and I would never recommend it over the REAL DEAL #BTC.

This process has been in the works for a decade+, don’t be too soon to draw conclusions! Imo we haven’t seen a sell the news or a frenzy of demand, both could still be on the table. I’ll be sticking to my regular accumulation schedule and hope for the best.

#Bitcoin is chilling at yearly highs, if bears can’t come in strong enough or soon enough, faces may start to melt prior to the halving.

There’s a new financial ballet in town called “The Bitstacker”, it’s set on Halving Eve at the foot of a god candle in a young pleb’s imagination.

You either are for global, financial liberation starting with the individual through #Bitcoin or you’re NGMI. Sometimes it’s scary to be so blunt, but people close to me do not have enough exposure and I can’t help but feel responsible for being too kind. Maybe I should’ve pushed harder or been meaner, it’s hard orange pilling the people you care about without straining the relationship. I’m hopeful the ETFs will ease this process with their mainstream validation. Sooner would have been better, but there’s no such thing as too late to #Bitcoin.

This is a common misconception that leads to 💩coining.

The “retired” options trader in me is ecstatic about potentially being able to trade the price movements of #BTC to stack more spot #BTC. Everything naked of course. I have no interest whatsoever in holding stocks…SOOO last century.

The toxic maxi in me might whoop tail and put the money that would have gone towards options towards my weekly stack. Who knows…bullish on my inner turmoil.

Here it comes.

The amount of people looking to sell will not be able to keep up with the people looking to add exposure for long.

I’ll diversify when a diversified portfolio outperforms a 100% #Bitcoin portfolio. So far nothing has come close. I don’t feel like I have a high risk appetite either. To me, I feel like I’m taking the least risk with my value when I’m storing it in #BTC ESPECIALLY over longer periods of time.

It seems like the stars are aligning for #Bitcoin. I think we are all in shock and awe over what just happened, it’s been a long time coming, and it doesn’t seem real, but reality is bound to set in.

Soon everyone will be jumping on the #Bitcoin bandwagon, even those who once were it’s biggest critics.

ETFs have been approved, but they are yet to start trading, this lackluster reaction from the market still has time to be a delayed ecstatic reaction, I’m hoping not because I would like to stack more at these levels, but as we all know #Bitcoin likes to choose max pain.

If you are reading this it means you don’t need the ETF. #Bitcoin is Free Open Source Software, meaning with the proper education you can custody your own funds FOR FREE!!!

I was thinking the same!!!

Buckle up, things are about to get very interesting.

#Bitcoin is better than gold, but it has yet to surpass the market cap of gold, this would just be the beginning. After #BTC surpasses gold we will see HOW MUCH better it is than gold. My prediction is A LOT.

ETFs are still yet to be approved. SEC got hacked.

OH THE IRONY

So, here we are, with people putting their faith in a regulator that's about as secure as a cardboard box in a rainstorm, to oversee their investments in a protocol that's more secure than Fort Knox.

Last post I swear, today my little brother got sent home with papers that have the #Bitcoin logo on them…It’s not related to #BTC, but I was tickled to see it.

Also look at this deck we’ve been building over the past few months, I’m happy with how it turned out!

Fiat mining for #Bitcoin!

THE HALVING EVENT CAME WAY SOONER THAN EXPECTED…at least for these rounds 😏

Here’s my PoW

#Bitcoin gives me wood.

Hard money. https://video.nostr.build/e469d6ea2edbc00dd2ed6025e1979cfdd2f9aaf736697130ad7a055f0919b009.mp4 https://video.nostr.build/17634528f96793f9a9e463a873702acf438394998491e6ff1b544558eb87b8ea.mp4

BREAKING NEWS: January 10th is the new January 9th, which was the new January 8th, which was the new January 7th, which was the new January 5th, which was the new January 3rd, which was the new before 2024.

It’s almost like the #Bitcoin ETF approval rumors…ARE RUMORS. 🤔

I get the hype, it is a huge catalyst, but it’s not going to change much for me.

Rest assured knowing the ETF will get approved on a day that ends with y.

#Bitcoin doesn’t need the ETFs for adequate demand for #BTC or block space, however I am curious to see the effects the approval will have in these senses.

We don’t want a “FOMO Warning” from the SEC…we want REGULATORY CLARITY…what are these people smoking??? 😭

The SEC’s favorite game is cat and mouse. This won’t affect my conviction. #Bitcoin is the MOST legitimate financial instrument in my eyes.

The ETF approvals continuing to get kicked down the road coupled with “okay, now they GOT TO APPROVE IT…OKAY NOW, they GOT TO APPROVE…PLEASE, APPROVE IT I’M PLAYING FIAT GAINS” 🤡

The bear market seems over, this doesn’t mean you should forget to stay humble!

Good point. I would probably leave anywhere that makes self custody illegal!

Gotta vote with your feet when your voice won’t do the trick!

Are the #Bitcoin ETFs eking forward or getting ready to shake out the market again? Only time will tell. I’ll patiently wait in my solvency to find out.

One catalyst that is not up for debate: the halving event. It’s inevitable that we will see it in 2024.

Mainstream acceptance is upon us, the masses won’t be directly buying #Bitcoin, but they will be stimulating demand for it, they will start to see the value behind #BTC and realize they could self custody to eliminate counter-party risks.

The biggest advantage #Bitcoin has over every other asset is its ease to self custody and maintain, it seems difficult because it’s new, but Facebook was new once too, now everyone and their grandma can use Facebook. #BTC is not far behind.

Nothing is priced in.

How do I know this?

Sidelines are still absolutely crowded, all in wait for ETFs.

A survey by Bitwise says, “88% of respondents interested in purchasing #Bitcoin on behalf of their clients are waiting for an ETF to be available.”

~9 out of every 10 financial advisers/asset mangers are waiting for an ETF to buy #BTC.

While only 11% of their clients currently want exposure, this number will likely increase as the bull market returns.

Imo, bull doesn’t return until $58k 😘 (few.)

“Buy the dip” mentions on social media have hit an almost 2 year high after the most recent dip (for ants).

Is this amount of optimism in the face of a flash crash priced in?

Obviously not, or it never would have happened in the first place.

Hype isn’t the same as “priced in”. The hype will go away, but the ETFs won’t. No one is hype enough.

The FUD-eviscerating validation that the ETFs will bring is getting slept on.

After ETFs you won’t be trying to convince your family members that #Bitcoin isn’t a scam; you will be trying to convince them to buy real #BTC over the ETF.

Higher timeframes are making me so bullish, it looks like something crazy is en route.

This time MIGHT be different. 🤷♂️

Stacking regardless, too many people are worried about a 10x, not enough are worried about getting 10 cycles under their belts.

I’m going the distance regardless of the path ahead. I don’t care about fiat gains, I care about friends I’ve made, and guess what??? IM UP BIG 🧡🫂

Leverage will continue to get wiped and their discounted sats will end up in the hands of those who stack spot.

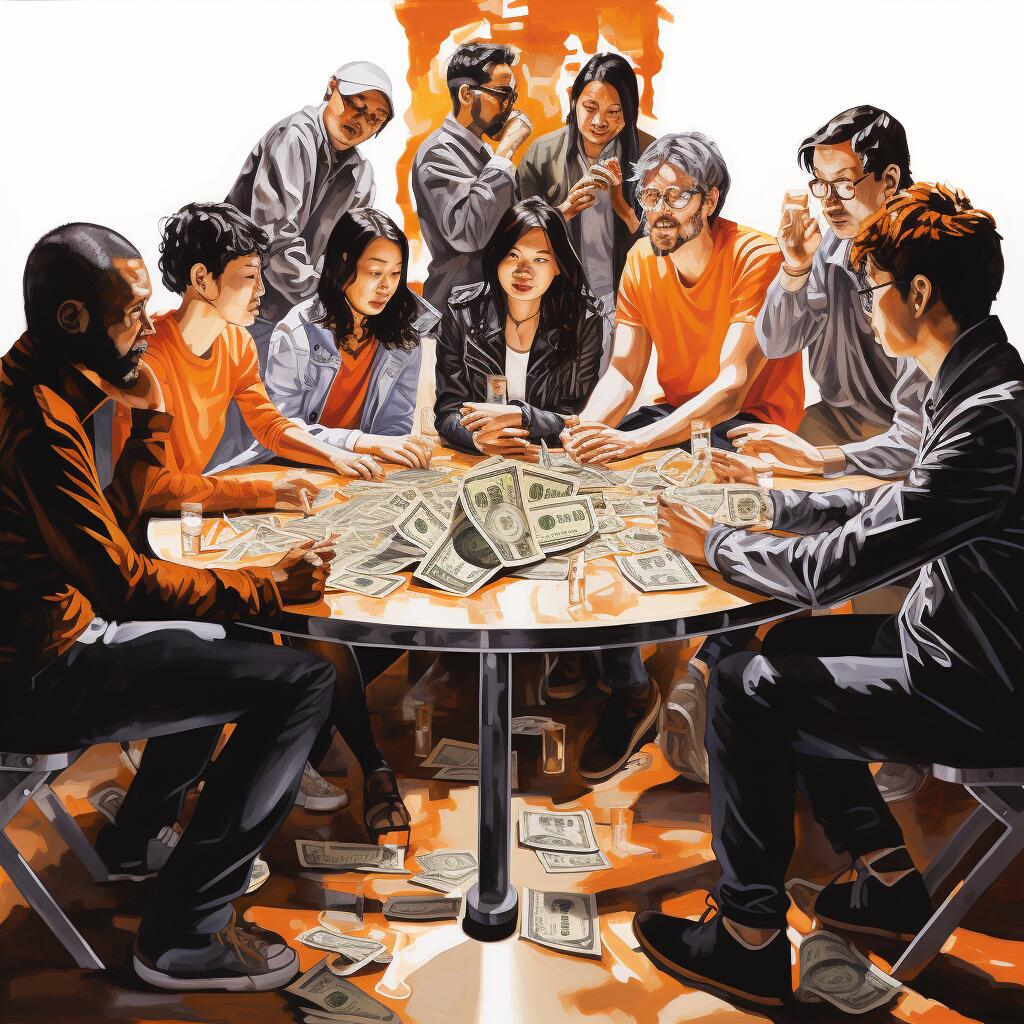

Depicted: before and after 10 cycles, #Bitcoin is peer-to-peer, friends gained > fiat gains.