Coin control is only available on the desktop version of Green atm

LBTC is available on DEXs like Bisq and Peach as well as Bitfinex and a few other exchanges; where would you specifically like to see Liquid integrated?

A good question to ask: if your favorite bitcoin apps went offline tomorrow, would you still be able to buy, sell and trade for bitcoin?

If not, you have some work to do over this holiday break, building out your local P2P economy—myself included.

We must make direct P2P transactions outside of any third party, including "P2P exchanges," which still rely on infrastructure outside of Bitcoin, the default way to interact again. This is even more relevant in a high-fee market where we can avoid paying extra fees and markups.

It's time to form chat groups with friends and leverage local Bitcoin meetups to exchange P2P. We should also hasten the implementation of key encryption standards like NIP 87, NIP 38, etc., so that Nostr can have encrypted group chat capability.

By doing so, we can build a permissionless economy as originally intended and create a network of exchange that relies solely on the protocol.

Too many of us are using third-party apps and sites regularly. We must have a thriving local P2P economy first and foremost.

A good question to ask yourself: if every exchange, payment processor and bitcoin app went offline tomorrow, would you still be able to buy, sell and trade for bitcoin?

If not, you have some work to do over this holiday break—myself included.

Liquid isn't a long-term scaling solution on its own (that's obvious), but federations can and will be part of the solution.

Many federations (both off-chain like Fedimint and on-chain like Liquid) will scale #Bitcoin alongside Lightning, which will play a key role as the connective tissue between different protocols.

There will be no 'one size fits all' scaling solution but rather a range of complementary protocols that cater to specific use cases and markets, each addressing different challenges with a unique set of trade-offs.

In July, I wrote about this and the importance interoperability will play within second layers and think it's even more relevant today with the discussions happening over the past week. Give it a read if you like.

https://blog.blockstream.com/increasing-interoperability-between-bitcoins-second-layer-protocols/

For the average pleb using a software wallet, your sats flow and time horizons should be as follows:

Lightning <> Liquid -> Bitcoin

days -> months -> years

Stack smart, hodl Liquid in the mid-term and occasionally swap to Lightning for daily use, then to mainchain when fees are low for long-term savings.

nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n any plans to add BIP-85 support to Jade?

It has had 85 support for awhile now my man.

More educators and Bitcoiners should be onboarding newbies to Liquid first, with Lightning as a next step, imho.

It's not just easier from a technical view to onboard to Liquid these days given the high-fee enviro but conceptually and in terms of natural learning progression it makes the most sense.

Sidechains are a far more digestible concept than payment channels/liquidity mgmt after first learning about Bitcoin and blockchains.

The issue with Argentina abolishing its central bank is that they have plans to dollarize, so they are merely trading their own for one controlled by bureaucrats in DC, in which they’ll have far less agency with and control over. Situation is even more dire given their outstanding debts (some of the worst in the world) to the IMF and the like.

I understand dollarization (something El Salvador also did in the 2000s) is a somewhat necessary step to lower inflation and have price stability in the short term, but on the one hand, skipping dollarization and going right to bitcoinization would be the true “anti central banker” visionary move...and have the potential to free Argentina of the shackles of its international creditors much quicker.

Of course, another probably more politically viable option would be to follow Bukele's playbook of playing just nice enough with the IMF and other creditors while buying #bitcoin...with the same end goal in my mind.

Let's wait and see what role bitcoin will play, if any. The jury is still out in my opinion but they do have a historic opportunity to show the world the potential of bitcoin.

Indeed, it has several stablecoins, recommend playing around with sideswap.io to get a feel.

Payment failure is a major flaw in all account-based networks, such as Tron, Ethereum, and other alts. The sad irony is that this impacts the demographic most likely to use crypto rails to begin with—those in emerging markets suffering from currency debasement and hyperinflation. Fortunately, there is a better alternative on #Bitcoin. 🧵

Estimates of Ethereum's payment failure rate range, but there was a consistent rate of over 1 million transactions per month during peak periods. A quick search on reddit will garner hundreds of threads like the one below of users losing money due to failures.

https://www.reddit.com/r/ethereum/comments/qq5iin/failed_transactions_costing_250_is_not_fine/

Even Vitalik himself cites a ~2.3% failure rate. Note, we shouldn't fault those flocking to Tron or Ethereum with strong stablecoin network effects (there is clear use case) but, instead, encourage awareness of the downsides and the better alternatives that exist on #Bitcoin.

With what looks like the early beginnings of a bull market, users in places like LATAM, particularly in Argentina, where stablecoin usage is surging, should expect a similar spike in transaction failures and consider more architecturally sound chains like the Liquid Network.

In contrast to #Ethereum or Tron's account model, the Liquid Network, a Bitcoin layer-2, opts for Bitcoin's UTXO model. This enables an "all-or-nothing" transaction, avoiding the possibility of losing funds when sending a payment.

Liquid's fees are competitive with the aforementioned account-based models and stay reliably low. There is also the added feature of confidentiality (no one can see asset type or amount).

https://blog.liquid.net/guide-to-confidential-transactions/

Our CPO Jeff Booetz, recently detailed the tradeoffs between the UTXO and account models in an op-ed. The latter's lack of transaction reliability is only one example of the many downsides: it's also much harder to scale, less secure, and less private. Highly recommended:

Last week, we announced a partnership with Swan regarding their new collaborative custody solution that features nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n Jade. For those unfamiliar with Jade, I've compiled an (incomplete) list of what makes it so unique and such a compelling piece of hardware 🧵

Entirely open source

Jade uses fully open-source hardware, software and infrastructure that is reproducible for greater security and peace of mind. This level of transparency is unmatched in the hardware wallet industry. Don't trust, verify.

https://github.com/Blockstream/Jade

Affordable

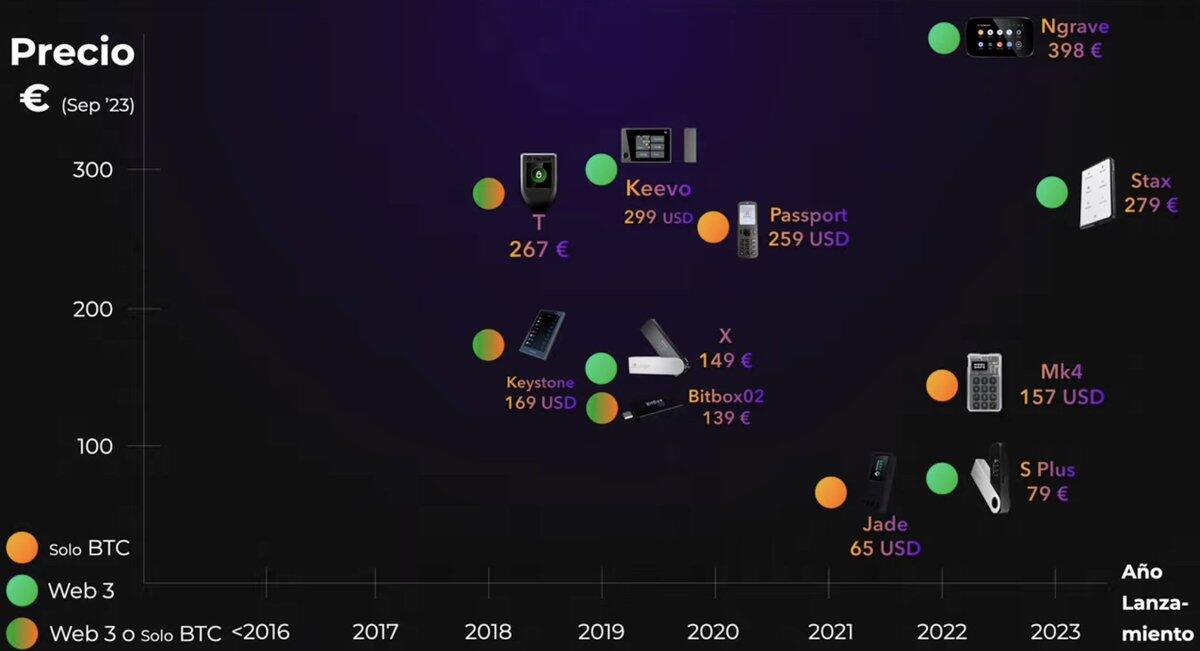

Because Jade uses commodity hardware, it's one of the most affordable options on the market. You can purchase two (even three) Jades and create your own multisig setup for the price of just one of the competitors —all without giving up quality or security.

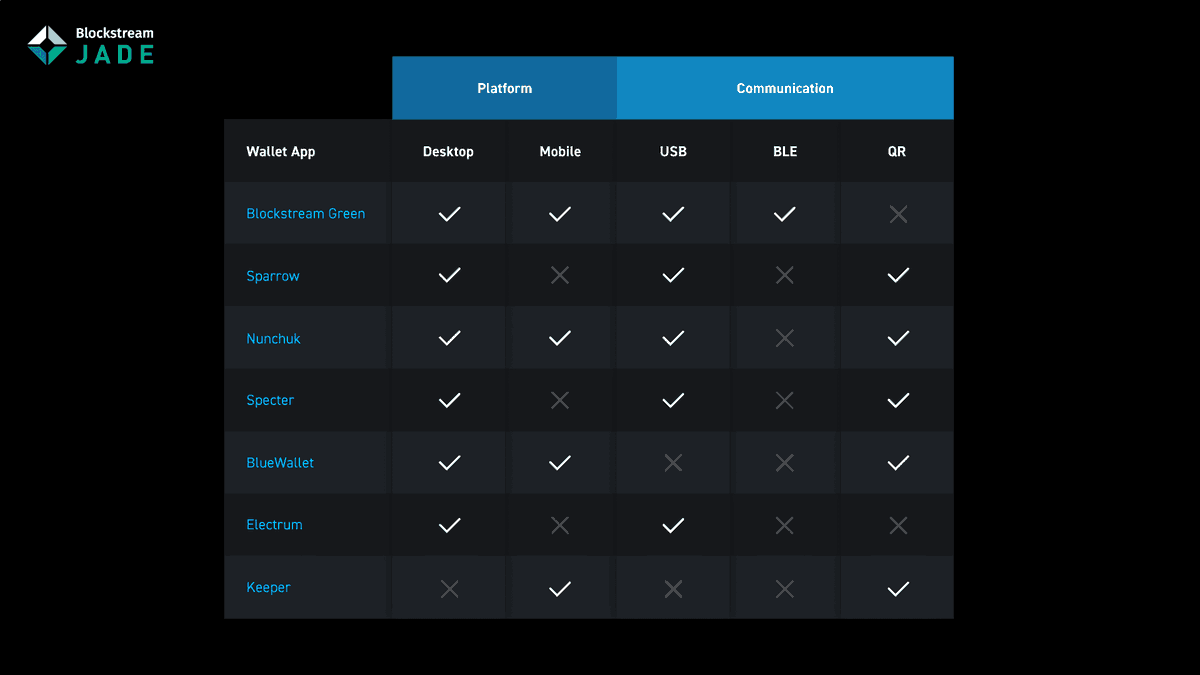

Versatile

Jade is simple to use with great support (nostr:npub15r8c6dqx2x92p688c8jsmhuxeg3tvyjspd4em60v2g4qxxh0pdrqw3mk4g) for easy onboarding, but has features like QR Scan, BIP 85, and a duress pin for more advanced users. Jade is also multi-platform and widely compatible, with no one dedicated companion app.

Fully air-gapped

Jade's built-in camera lets you scan and display QR codes, making it possible to send bitcoin and verify addresses without directly connecting to the internet with USB or Bluetooth—providing an extra layer of security.

https://youtu.be/Cvm0zUCvfMo?si=E79gYJ1RdJH7dh_F

Immune to physical key extraction

Jade deploys a virtual secure element comprising three separate secrets: a Jade secret (via an encrypted blob on the device), a user-generated unique pin, and a remote blind oracle, making extraction from the device alone impossible.

https://help.blockstream.com/hc/en-us/articles/12800132096793-Set-up-a-personal-blind-oracle

You can run your own blind oracle with cmd line (see link). The team is also placing the final touches on a new app for several plug-in-play solutions that would make setting up a personal blind oracle much easier.

https://help.blockstream.com/hc/en-us/articles/12800132096793-Set-up-a-personal-blind-oracle

DIY-able

Jade's FOSS software and unique security model allow you to install its firmware (without loss of functionality) on inexpensive, off-the-shelf hardware. [@YTCryptoGuide](https://twitter.com/YTCryptoGuide) has several video tutorials for building your own DIY Jade for $10-$40.

https://youtu.be/PeqP6oVnlIs?si=JEXFB5Jj6uMd5ZyU

Made for hyperbitcoinization

Jade's price, versatility, and DIY-ability make it an ideal choice for people in developing countries or those affected by currency debasement. It can be argued they need Bitcoin the most and, subsequently, a secure way to cold store, which Jade provides.

Cypherpunk tool

Due to its affordability, many pick up an extra Jade to use it solely as a more secure, private 2FA authentication device or to do fun things, like mine bitcoin. Because Jade can produce TOTPs for platforms that require 2FA, it can function similarly to an authenticator app, giving users more control over their personal data and providing better security than a regular authenticator.

Jade can also be set up as a #bitcoin miner, offering a fun way to learn the ins and outs. It does not require a wallet to be set up or accessed and can easily be reversed if you decide to go back to using it purely as a hardware wallet.

https://twitter.com/tatumturnup/status/1642510780984709121

I hope this thread provides a useful snapshot of Jade's unique security model and features and why you may want to snag one.

....it also now comes in orange. 😎

[https://store.blockstream.com/product/blockstream-jade-hardware-wallet/

Cool tidbit: other than SeedSigner, nostr:npub1jg552aulj07skd6e7y2hu0vl5g8nl5jvfw8jhn6jpjk0vjd0waksvl6n8n Jade is the only fully open-source Bitcoin hardware wallet that is impervious to physical key extraction.

You must collect three separate secrets to decrypt your keys: one is in the encrypted blob on the device, the second is the user-generated pin you set, and the third is only accessible via the blind oracle (that you can also run yourself).

Only with all three secrets, can you then get and decrypt the private key. So, by not having a secure element directly on the device, but rather this unique security model of three decentralized secrets, physical key extraction is not possible.

Bonus tidbit: the Jade is 50%-75% cheaper than any of the other Bitcoin hardware wallet on the market, meaning you can buy two or three of them (or even build a DIY ver for $15) for the cost of the others, allowing you to create your own multisig.

Jade definitely doesn’t get the attention it deserves! nostr:note19xa3a9tyua6le9tw87e0jmkzlar48h08kp3tssm68sqz3c5exc9sffr5p0

Use it as a 2FA authenticator and mine bitcoin with it. Some other things are in the works too.

The only #Bitcoin hardware wallet not susceptible to physical key extraction is the Blockstream Jade.

Jade uses a virtual secure element (blind oracle) so your seed is not stored on the device. You can also set up your own blind oracle or run it stateless with SeedQR (like a SeedSigner).

By not having a physical secure element, Jade can remain fully open-source and easily DIY-able.

You can read more here:

https://help.blockstream.com/hc/en-us/articles/15884462476953

Looking for a fun weekend Bitcoin project?

In light of Blockstream Satellite's sixth anniversary, I wanted to highlight an overlooked feature: the ability to broadcast data into space with Lightning. In the demo, I use the new Greenlight-powered Blockstream Green wallet (public beta available soon, inside sources say next week).

When sending the message, I used the transmission page on the Blockstream site, but there are other frontends like http://satnode.space or P-38 (great for private, encrypted messaging), if you don't have access to the API directly via the blocksat-cli.

https://github.com/Nisaba/P-38

If you're curious to dig deeper into the Blockstream Satellite, its history, and how it can be a tool for freedom. Read my write-up below:

https://blog.blockstream.com/broadcasting-messages-in-space-with-lightning/ https://nostr.build/av/6fb2cc6193e0c4da7898d95ec7a6b306117f944468cdc1a9ff376142413f76fb.mov

There's been some buzz around #stablecoins lately, given their increased usage in the Global South.

Using only your phone, here are two simple ways to get Tether USDt on Liquid—a Bitcoin L2 with multi-asset support and confidential transactions that is compatible with Lightning.

By using Liquid, you further hyperbitcoinization and the #Bitcoin ecosystem and avoid relying on inferior alts with backward incentives like #TRON or #Ethereum.

First, if you don't already hodl L-BTC, you'll need to either a) bridge BTC to L-BTC (aka peg-in) or b) use a swap tool like Boltz or SideShift to get some.

Both apps used in the video have native peg-in capability and non-custodial Liquid wallets built-in, but I'll use Boltz

and #BlockstreamGreen to move from LN-BTC to L-BTC in the second example to mix things up.

1. SideSwap

A registration-free mobile app with Tether USDt and EURx stablecoins available via atomic swap or limit order. Fees: 0.6% (swaps), 0.1% or 500 sats (orders), 0.1% (peg-in), Liquidity: ~0.75 L-BTC (swaps)

2. TDEX

A DEX protocol with Tether USDt, L-CAD, and Bitcoin-backed stablecoin FUSD (Fuji Money) available via atomic swap. Fees: dependent on market makers (swaps), no additional fee (peg-in), Liquidity: subject to mmkr

Note depending on your buy size, jurisdiction, desired privacy, or stablecoin needed, you may want to explore other platforms that have Liquid, including:

Bitcoin Reserve

Bisq

Bitfinex

BTSE

BTCTurk

Bull Bitcoin

Hodl Hodl

Peach Bitcoin

Sideshift https://nostr.build/av/2c2c2523005b57d49fe5cb3fae402e964fb6eac4297b8c96a091716a79bbf24f.mov

It’s a closed beta atm but will be available on both Android and iOS mobile devices when it’s open to the public next month. :-)

Not yet but there are plans to have in-app LN to Liquid swaps available once LN integration is complete :-)