Acquiring scarcity can be highly addictive.

I learned this from all the Bitcoiners, art collectors, and wealthy people I've met.

They all obsess with scarcity. It’s a human nature and a part of our DNA.

LFG

Congratulations to all my followers who have front run Bitcoin ETFs. You deserve it!

In the light of Bitcoin ETFs and institutional adoption like BlackRock's, I want to express concerns about the future of Bitcoin-only companies.

ETFs will intensify competition for these companies. Most new investors, both retail and institutional, will likely prefer ETFs for Bitcoin exposure, leading to increased competition, reduced market share, and slower growth for Bitcoin companies.

Bitcoin ETFs offer an 'Amazon-like' experience: easy access with a single click, no extra KYC or brokerage, simplified custody, and straightforward exposure, leverage, and estate planning. Moreover, they have massive marketing budgets and a vast network of financial advisors. These are advantages that Bitcoin-only companies lack.

Bitcoin companies must find ways to differentiate from ETFs. This could be through education, self-custody, direct Bitcoin ownership, or technologically advanced Bitcoin products. The path isn't clear in the short term, but in the long term innovation is the key. These companies need to focus on building infrastructure based on Bitcoin and its layers, a challenging but necessary strategy to thrive and out compete institutional players.

The next four years will be critical. I expect many Bitcoin companies wouldn’t survive the competition and get out compete by the Wall Street incumbents. However for those who survive, they will become more valuable.

For full disclosure, I own shares in many companies focusing exclusively on Bitcoin. I express my views based on my investing experience in the Bitcoin industry and my role in running a family office. My unique blend of experience enables me to think critically about various aspects of the market that others might overlook.

Many people are unaware and underestimate the amount of international capital that will flow into Bitcoin ETFs.

My banker at UBS told me that every client will be able to buy Bitcoin ETFs once they start trading.

UBS has HNW clients everywhere, including US, China, Japan, Taiwan, Switzerland, and Singapore. They will sell Bitcoin ETFs to their billionaire clients just like they sell treasury bonds, corporate bonds, and funds.

If you think #Bitcoin will stop innovating after the introduction of ETFs, you don't understand its nature as a monetary protocol, and you are essentially betting against Bitcoin and its innovations.

“Yes I know the dangers, but I’m having some anyway.”

The world has never seen an asset with a finite supply being applied to ETFs.

#Bitcoin

The biggest winner in this cycle is not the issuers of the Bitcoin ETF but the #Bitcoin hodlers who have front run the Wall Street for 15 years.

Gold 4x after the GLD ETF was launched.

What about Bitcoin after the iBTC is launched?

I think a 10x increase is possible.

100 hours till Bitcoin ETF is approved.

The world will change forever.

In hindsight, it was inevitable that Bitcoin would overtake Gold as the king of commodities. The reason is very simple: digital finite scarcity.

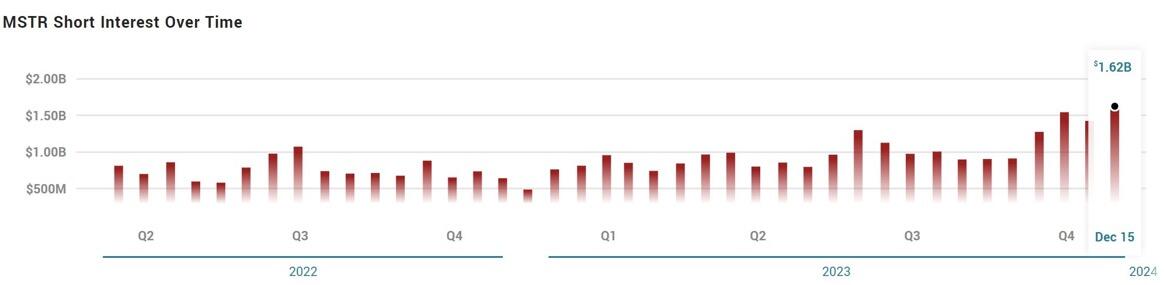

As of Dec. 15, $MSTR had $1.6B worth of short interest which represented 19.56% of shares.

Most shorts are now rekted. If they keep on adding, we will see a massive short squeeze when #Bitcoin gets another big leg up.

HNY Odell. Great to see again in 2023.

Res tantum valet quantum vendi potest.

2024 is the Return of The Bull Run.

Happy Mew Year!

As 2023 ends, I'm noting down my thoughts for the next 20 years about #Bitcoin 's evolution 📝👇

What is money?

Money functions as a store of value, a medium of exchange, and a unit of account. Bitcoin, serving as money, will eventually fulfill all these roles.

Currently, Bitcoin is in its store of value phase, protecting value from dilution. This phase might end in the next 8 years or after two halving cycles, with the Bitcoin ETF as a key indicator of this shift. At the end of this phase, Bitcoin could be trading at or above 1 million dollars.

Following this, we'll likely witness significant adoption and innovation in Bitcoin's layers and applications, focusing on its use as a medium of exchange. This phase will see a surge in companies developing on Bitcoin layers. Post this phase, Bitcoin might trade around 10 million dollars, with nearly everyone on the planet owning a wallet or using Bitcoin apps.

As for its role as a unit of account, I don’t see it happening in the next 20 years. I believe this will occur automatically after the store of value and medium of exchange functionalities have reached their maximum. My timeline for this to occur is before 2140, at which point Bitcoin will become the default money for everyone.