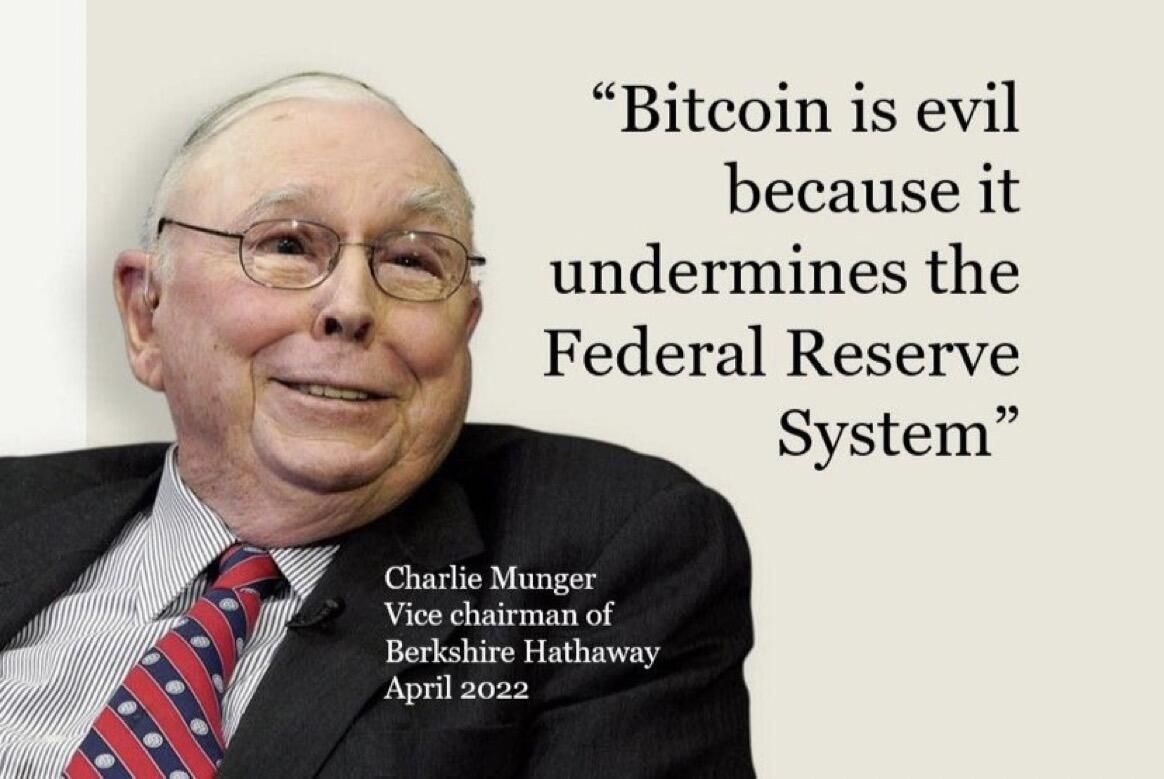

The winner decides who is the evil.

Bitcoin > Index Fund > Active Fund

Adding Bitcoin to your balance sheet or portfolio is equivalent of adopting internet to your business. It’s an essential tool for navigating a world where money is broken.

People can do whatever they want with their bitcoin. Sometimes the reason may sound absurd to you, but you have to carry on and mind your own business. All I can say is, do not sell your Bitcoin.

As of today, the New 9 has added 8,486 BTC, now sitting at a total of 133,767 BTC in AUM.

Another 6,261 BTC are added to the New 9. They’re now sitting on 125,209 BTC.

Another 10,618 BTC are added to the Bitcoin ETFs. They’re now sitting on 119,200 BTC. Just matter of time they surpass MicroStrategy’s stack.

Nobody becomes extremely wealthy merely by buying or selling real estate, equity, art, or any scarce, desirable asset. It's those who own and hold onto these assets that create generational wealth.

I was thinking US regulated Bitcoin ETFs can be globally accessible on day one. I was wrong. There are a lot of push back and prohibition coming from governments and companies like Vanguard and UBS.

To protect wealth against inflation, confiscation, and war, #Bitcoin is the most powerful form of defense an individual can possess.

DO NOT SELL UR #BITCOIN .

Wealthy individuals understand their money isn't real, so they invest in scarce and desirable real assets like real estate, gold, art, and equity. Once they recognize Bitcoin as a finite, scarce monetary good, they'll buy in large amounts, driving its price so high that average people may not be able to afford a single Bitcoin.

3% of Bitcoin’s total supply is now managed by Bitcoin ETFs.

This is only the beginning.

我最近接受了台灣最具影響力的金融媒體《財訊》的採訪,討論了比特幣ETFs對比特幣以及財富管理的影響。

Recently featured in Wealth Magazine or 財訊, Taiwan's leading financial media, discussing the impact of Bitcoin ETFs on #Bitcoin and wealth management.

wealth.com.tw/articles/cac77…

Excluding GBTC, Bitcoin ETFs added approximately 68,933 BTC, creating a positive inflow of $2.8 billion in just about a week of trading days. This is equivalent to 36% of MicroStrategy's Bitcoin holdings, a number that took MicroStrategy about two quarters to achieve.

Saw this. I am here to spread the news.