The majority of investors do not think Bitcoin can surpass Gold's market cap. They base their conventional thoughts on not making an effort to understand Bitcoin as a new standard for scarce desirable money.

The market always moves against lazy and conventional thinking. The price discovery will be so volatile and shock these people by surprise. And just like that Bitcoin has surpassed Gold and move on for the next battle.

If you own Bitcoin and are comfortable for self-custody, then there is no good reason to own ETFs.

If you want some upside for bitcoin denominated return, there is a good reason to buy $MSTR or Miners.

A 80/20, 80% spot and 20% $MSTR or Miners are good portfolio allocation imo.

Happy Chinese New Year! 龍年快樂!🐉

🤌

Getting ready for CNY.

If a Bitcoin L2 solution has a token attached to it, and the team is using it as a fundraising method along with some tokenomics, be careful; these are scams trying to profit from less knowledgeable people. The actual L2 solutions, like the Lightning Network, have no token; all you use is Bitcoin.

Bitcoin Layer 2 or Bitcoin off-chain scaling solutions are the next big technological developments that have the potential to unlock the utility of Bitcoin as a medium of exchange.

Satoshi created Bitcoin in 2009 and left shortly thereafter, when the price of Bitcoin was still less than a dollar.

Since then, his Bitcoin holdings have outperformed every other asset on the planet by simply doing nothing.

GM

The suffering comes from not knowing money is broken

The best approach is to ignore the Stock-to-Flow (S2F) or Power Law model. Instead, embrace the mentality that if Bitcoin is not going to zero, it's going to a million.

There is no other asset that can generate fiat cash as fast as Bitcoin. Few understand that hard money competes with weak money in a relationship where the weak invariably converts to the strong. This dynamic is fundamental to monetary economics; as confidence in hard money grows, the inclination to hold and transact in it increases, often at the expense of weaker currencies.

$Meta and $nvda continue to make ATH, which shows that investors are overweighting AI in the short term. These capital will flow as new narrative emerges.

My view is #Bitcoin becomes the next narrative that everyone trying to jump on.

Ark Invest increases its $ARKB position to 19% of its portfolio. At this point, why holding back? 50% or even 100% allocation is reasonable.

Cash flow is effective when money isn't devalued.

For instance, if the money supply doubles and a business generates a 10% cash flow, it's insufficient to offset the rate of money printing. In fact, in this scenario, the business effectively loses 90% against inflation.

Preach

The story of next decade is how Bitcoin overtook Gold, becoming the king of commodities. The rest is noise.

Stay focused and do not sell your Bitcoin.

Gold will be replaced by Bitcoin in this cycle. That means Bitcoin will reach 650K.

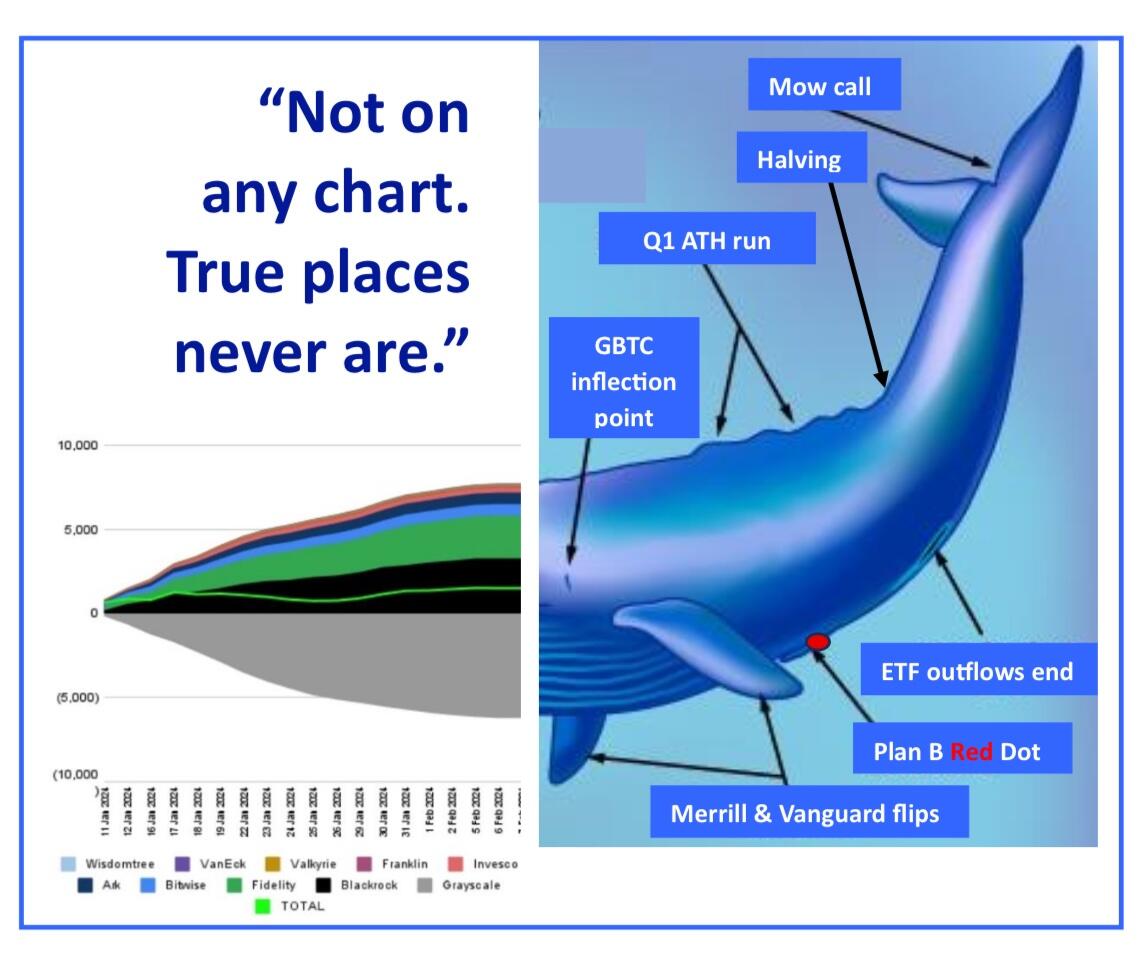

The New 9 added 6,399 BTC, bringing the total AUM to 140,178 BTC.