Thanks for the info and the zapp! 🤩

It’s actually funny the way people support high energy demand for #AI and at the same time complaining about the energy demand for #Bitcoin.

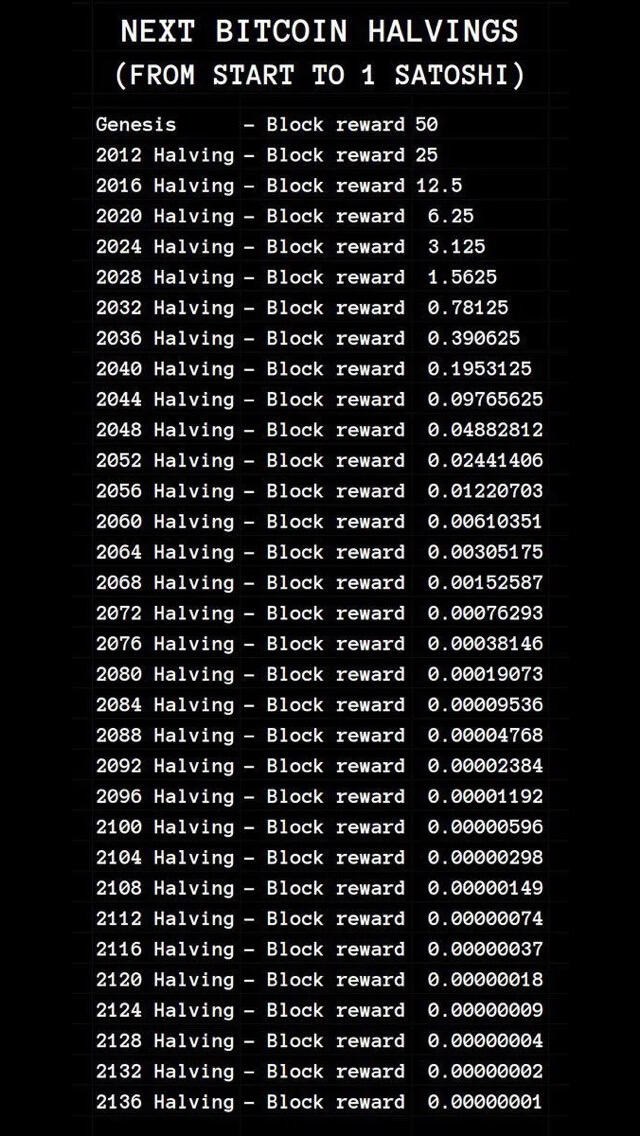

Keep #stackingsats

It’s inevitable. If not now it will be later. Better now while its cheap. In fact, if they were smart they should already be mining it.

What they do what that information after is up to them.

Every Bitcoiner has the duty to teach and inform other people who do not understand #Bitcoin.

I was whale zapped. My very first whale zap 🥹 Thank you, nostr:nprofile1qqsfrjd9ux5hgsg5cmlz6cdwfh5zv2024g8m2t6g9zqf83l8uqm0svspp4mhxue69uhkummn9ekx7mqpr3mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmqpzfmhxue69uhkummnw3ezu7nzvshxweczwanqt 🙏🏻 You rock! 🙌🏻

Wow

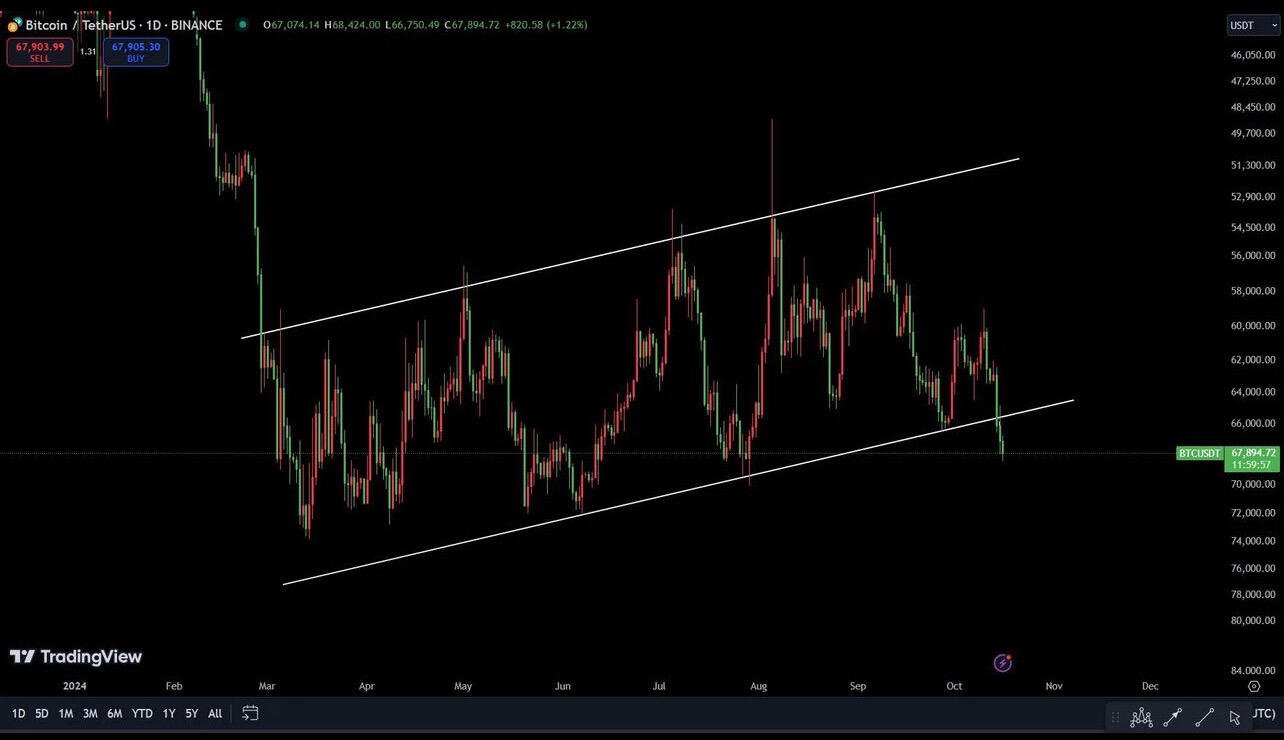

Its always a good time to accumulate bitcoin

Banks continue to rub in our faces easy credit, perpetuating the debt spiral of the world.

Opt out with #Bitcoin and be your own bank!

History repeats. It happened in the past but today people must be sleeping if they dont own any sats.

GM Wish you all a great day!

A good way to #stackingsats is to use the app #ember. We can stack daily and play games to increase your gains. AND, when stacking with friends the sats/h gets a boost.

Thank me later! 😉

Join Ember with my referral link and we'll both earn Bitcoin daily!

Referral Code: MNGXJYBWHLC

https://emberfund.onelink.me/ljTI/bce33290?mining_referrer_id=MNGXJYBWHLC

#Bitcoin #sats #stackingsats