As long as there is the option to do differently within the current system, or ways to improve that on a different layer, I don't understand why you'd classify this as a definitive failure.

You're still free to mine on the network, without having to ask for permission. You're still free to run your own node / set up a better solution.

And as for privacy.. Bitcoin never was intended as a solution for privacy issues.

What makes you say Bitcoin failed?

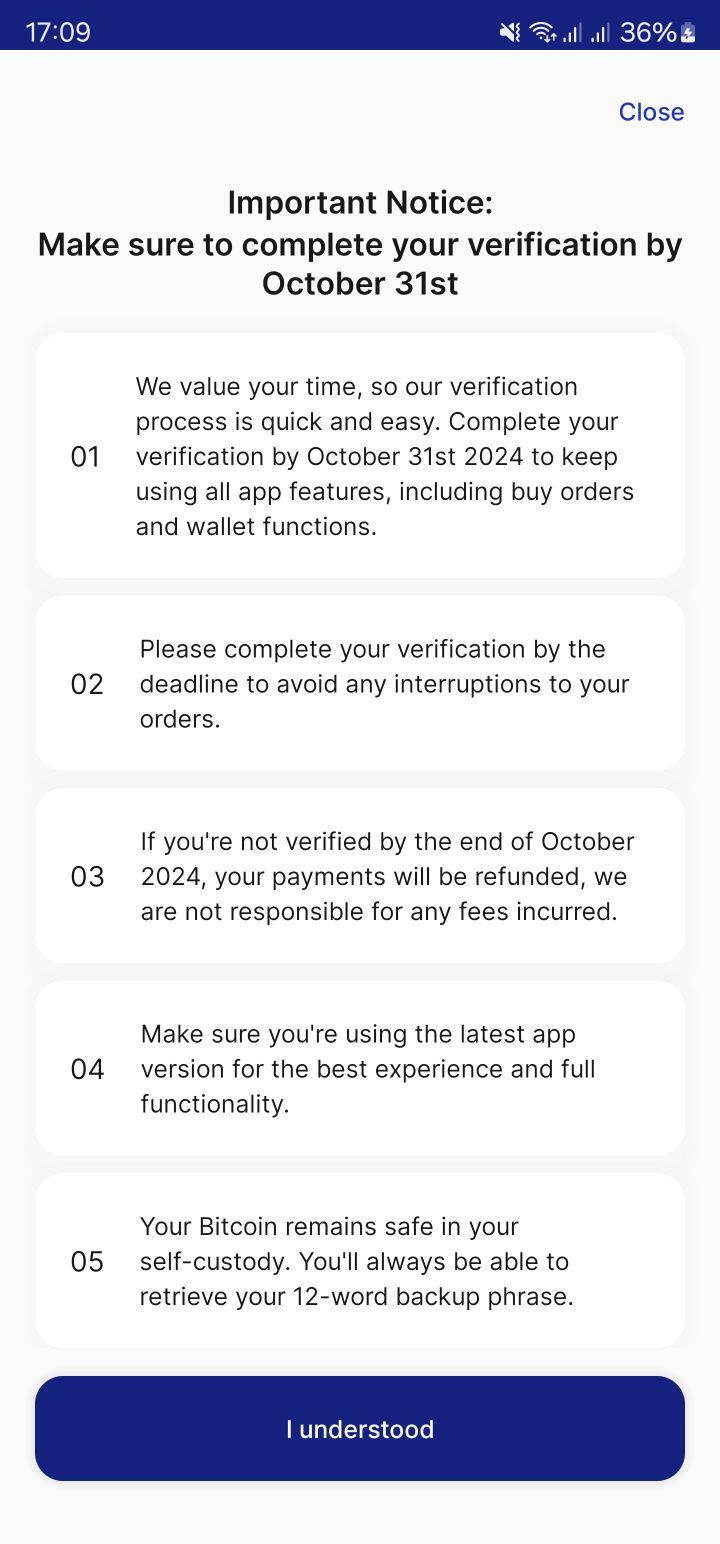

Any recommendations for doing so in Europe? I've been looking around a bit since Relai was forced to apply KYC to even the smallest purchases.

How Nostr Devs see their app: https://video.nostr.build/6b7cbd657e5ea5492ce4d0a11f6f0f081ba5a1eb69fe874f18683309535215bf.mp4

Big oof..

Where is this from? Is this a TV show?

Saylor is probably right short term, but that's only because it is such a mental shift to move from a fiat standard to a bitcoin standard.

The more you move towards the latter, the more people will not accept a return unless it is in Bitcoin.

Just finished episode 239 of your podcast, the one with Michael Saylor. Interesting discussions.

Especially the discussion about Bitcoin, credit, lending/borrowing etc. I'd say both of you made valid points, although I tend to lean more towards your line of thinking there. What surprised me a tad bit is that Michael brought up the idea of getting a risk free return on your Bitcoin. I think what he discounts is that growing adoption of Bitcoin means a growing number of people will ascribe less and less value to fiat money; the whole system is based on trust after all. A 5% "risk-free" return in what? Fiat? That's not at all a good promise, since its worth will keep on declining. The more people want Bitcoin, the less value they'll ascribe to fiat. This is where I tend to follow your line of thinking: sure, fiat money will always pop up somewhere and it might even work for a while, but only so long as people believe in it. Under a hard money standard people it'll simply have a much shorter expiration date. It'll finally be seen for the ponzi it is.

I think pointing out that this is trust based and therefore increasingly fragile, even though I'm convinced Michael knows this, would drive home the point that risk is always involved here. The only way to generate a return, would be to go out and take risk to acquire more Bitcoin. This simply can _not_ be guaranteed on a Bitcoin standard.. which is where I think the difference in opinion stems from. Michael still reasons from a fiat standard perspective in some ways. I wonder what his take is on nostr:nprofile1qqsg86qcm7lve6jkkr64z4mt8lfe57jsu8vpty6r2qpk37sgtnxevjcpzpmhxue69uhkummnw3ezuamfdejsz9rhwden5te0wfjkccte9ejxzmt4wvhxjmcprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqgevlfj's thesis, laid out in The Price of Tomorrow.

Thanks for the excellent podcast 😃.

And not just the modern day peak fantasy, but also the historical ones! The further back the better 😃.

Having read a lot of Bitcoin books, each one giving a particular insight from each author

What I particularly liked about nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a Broken Money was the explanation of early forms of credit

Ie I give you something of value, if we were in a high trust tribe, then I would be happy noting down that you owe me something in the future, & storing that debt in my head. Ofc this doesn’t scale. But it pre-dates money in a sense.

Point being, I absolutely agree there will be a credit market on a bitcoin standard, it will however be radically different today, in large part due to the cost of capital being much higher, therefore debt risk much higher, so interest rates will have to reflect that

Fascinating one to watch play out

Which in turn means the debt won't be used to fuel non profitable nonsense, as that'd lead to default. Instead debt would be used to fuel the best, most profitable ideas only. The 10x, 100x or 1000x ideas.

Is that something new as a result of the TornadoCash case, or was this already in place?

The kind of mentality that should be applied to society more broadly.

No way you've got ankle mobility like that! 😱

I fully agree with you that it's important to communicate in a language that's understandable for newbies, but that's a different conversation 😃.

Okay, sure. I see your point. Leave out the word "is" to be factually correct.

Nonetheless I think you're generalizing a bit too much by stating that people are parroting something they do not understand, just because of this wording.

Next to being short for "cryptocurrency", the word "crypto" is also used to refer to the big pile of nonsensical cryptocurrencies outside of Bitcoin. I'm certain that you are well aware of this.

I'm sure there are plenty of individuals who say it without understanding it, but I'm also sure there are plenty of individuals who say it this way and know very well what they're talking about.

This is just you entirely misinterpreting the message. Purposely or not.

There is a difference between saying "Bitcoin not crypto" / "Bitcoin is not crypto" and saying "Bitcoin is not a cryptocurrency".

You're interpreting as if the latter is what people are saying here.

Does this mean no more purchases < 900 EUR without verification..?

Cool artwork. Did you make that? 😃