Sorry to hear this. My best wishes to you and your family.

The hard truth: Americans don’t trust the news media, by Jeff Bezos

"Most people believe the media is biased. Anyone who doesn’t see this is paying scant attention to reality, and those who fight reality lose. Reality is an undefeated champion."

https://www.washingtonpost.com/opinions/2024/10/28/jeff-bezos-washington-post-trust/

Although the rest of the country the would likely find it hard to care less, Bezos’ decision that the Washington Post (a paper he owns) would not endorse a candidate for president has thrust the minions of the political class in the DC area into fits of apoplexy. Of course these minions who stand by their credo “Democracy Dies in Darkness” only when it suits their predilections assumed this endorsement would have safely gone to Harris.

I don’t share the view, as some have speculated, that Bezos’ decision to withhold a Harris endorsement - a decision he must have known would result in epic tantrums in the coddled spaces of the WaPo newsroom - amounts to an endorsement of Trump. Rather, I think it’s a recognition of the farce the DC political class has engaged in over the last nearly 4 years over who is actually running the country. Or maybe one of the richest and most successful men in the world just wasn’t up for bending to the whims of a cadre that exists and continues to be paid only by his good graces.

GM and happy Monday! #coffeestr

That seems to me the underlying meanings of the recent gems from the ECB and Minneapolis Fed as well. We’ve had no luck stopping it through our exhortations about its criminal nature or overall lack of value, so better tax or ban it.

I usually jot down a few notes to share with everyone. Maybe Friday is a good day to go a little deeper.

The next chapter of global politics is being written on the battlefields of Ukraine and the Middle East, trade politics between the US and China, AI, the debt in Washington, and probably another half dozen themes whose true impact we won’t truly feel before five to ten years from now. What isn’t yet clear is the title of this chapter, or at least the predominant theme or event that accelerates the world down a given path. Thinking about possible futures in this way predictably elicits another question; what was that theme or event that defined the ending chapter. There are a lot of candidates, but I believe that 9/11 was the event that led us to the world we inhabit today.

In the spirit of transparency, I feel obliged to acknowledge that 9/11 was an intensely personal event for me. I grew up on Long Island, and among the many acquaintances of mine murdered that day are three people I grew up with quite closely. My professional life in the years following 9/11 made the experience all the more visceral. Distance has allowed me to see things more clearly. My thoughts on the actions the US undertook in the years following the attack have evolved, in some cases significantly, but my thinking about these events will always be colored by the deaths of people I remember vividly to this day.

Endless States of Emergency

The Biden administration’s recent announcement, “Notice on the Continuation of the National Emergency With Respect to Persons Who Commit, Threaten to Commit, or Support Terrorism,” is emblematic of the erosion of governance that has plagued the years following 9/11. This order has roots in an executive order signed on 23 September 2001, just days after the attack. The continuation of this “national emergency” reveals how much the state has grown dependent on “emergency powers.” The nearly 1,000% increase in the use of sanctions by the Treasury Department since 9/11, an indulgence that laid the foundation for a slow but steady trend of de-dollarization, is but one consequence. And then there’s the Patriot Act….

Endless Wars and Regional Destabilization

The 1979 Camp David Accords brought a modicum of stability to the Middle East, or at least served as the foundation for a new balance of power. Despite war between Iran and Iraq, civil war in Lebanon, the region’s center held firm until post-9/11 events challenged that stability. The first sprout of that instability was the US invasion of Iraq, leaving a vacuum that provided actors opposed to the status quo a stage on which to act out that opposition. This also laid a firm foundation for instability to spread following an act of desperation by a young Tunisian in December 2010.

The Arab Spring and Civil Wars

I’m open to discussion, but I believe US policy directly contributed to the chaos of the Arab Spring, the subsequent civil wars, migrations, and shifts of balance of power that persist to this day. Among the corner stones of regional stability was the US-Egypt relationship. Obama’s decision to publicly support the removal of Husni Mubarak – and hence the entire military establishment – from power caused irreparable harm to the relationship, now with that government functionally back in power. The decision to intervene militarily in Libya in a civil war that persists to this day kicked off an immigration crisis that has destabilized European politics. The decision to intervene – but not decisively – in the Syrian civil war ignited by the Arab Spring only exacerbated the immigration crisis in Europe while allowing ISIS to take root and flourish.

Is That It?

Well no. The Syrian civil war allowed Russia to gain a foothold in the region, gaining combat experience that would embolden them to invade Ukraine. US support for protest movements destabilized relationship with traditional allies, especially in the Gulf region. On September 10, 2001, would any of you have envisioned a Chinese port in the UAE? All of these, and not to minimize the immense human suffering, the broken men and women, and trillions of dollars wasted are all legacies of our response to the tragedy of 9/11.

Lesson Learned?

Not sure, but it was a tremendously costly chain of errors that we all need to consider as we decide how to address the challenges of this next chapter. But maybe a political consensus acknowledging that it was our own decisions that put us in the difficult position we find ourselves today would serve as the cathartic reset we need to thrive into the 21st century. Squishy thinking? Maybe, but when people ask me what bitcoin did for me, my response is always the same, “it cured my cynicism.” Really, it did.

nostr:npub1sk7mtp67zy7uex2f3dr5vdjynzpwu9dpc7q4f2c8cpjmguee6eeq56jraw nostr:npub1szn2v4mha08f7lvupml8rg4e4wcqdu5mqlc6nlspjlpj65m2jl3qq69297 nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a

GM! Is there a decentralized version of Substack running on Nostr? #asknostr

Encrypted channels using #meshtastic - slick! Very excited to get started!

CD142: BITCOIN AND SATOSHI WITH ADAM BACK

- nostr:npub1qg8j6gdwpxlntlxlkew7eu283wzx7hmj32esch42hntdpqdgrslqv024kw

https://cdn.satellite.earth/69c7a9b78cb71ca51958114961a034988c48c076eb00a3853cb72f3485557912.mp4

Excellent discussion!

My condolences and best wishes for your family.

This referenced paper from the Minneapolis Federal Reserve, along with the much discussed European Central Bank paper, has received an enormous amount of attention in Bitcoin circles – although I have yet to find any parallel attention being paid to it in tradfi media. That said, this paper was written for a reason, almost certainly a tasking received from Fed seniors to analyze the possible impact of bitcoin on Treasury markets. Anyone who has worked in government knows a lot of think pieces are written only to be shelved. But even those that are shelved represent some lines of thinking that motivated leadership to designate resources to a project.

I am not an economist, and thus am not in any position to refute the very serious looking formulas the authors use to support their conclusion that a “legal prohibition against bitcoin can restore unique implementation of permanent primary deficits, and so can a tax on bitcoin at the rate -(r - g) > 0.” What I am in a position to quibble with, however, are the normative assumptions that underline their entire thesis.

The foundation of the authors’ very scholarly sounding arguments are two assumptions; that bitcoin is “useless pieces of paper,” and that buyers of our debt, primarily among them foreign governments and financial institutions, won’t come to the same conclusion about this debt.

As for the “useless pieces of paper,” the phrase belies not only a profound misunderstanding of what bitcoin is and how it works, but also a deep well of contempt for those who see value in it. Regarding foreign buyers, it seems the authors are content to trap US citizens and financial entities in a debt cycle knowing full well that large foreign entities have been reducing their exposure to Treasuries for some years now. They can’t force China to buy our debt, but they certainly compel you to use your retirement savings to do so.

Strip away the fancy econometrics, and what you have is an apologetic piece of which the core intent is not ensuring Americans have the freedom and autonomy to choose their own paths to prosperity, but rather a blueprint for a subset of elites to keep all of us locked in a system that has made them wealthy at the expense of a large swath of our fellow citizens.

nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1sk7mtp67zy7uex2f3dr5vdjynzpwu9dpc7q4f2c8cpjmguee6eeq56jraw

I went down the #meshtastic rabbit hole last night. I might have found my next hobby.

Both this ECB paper and the recent one from the Minneapolis Federal Reserve Bank shine light on their barely concealed belief that people are here to serve the state. While the ECB paper drips with contempt, the Fed paper is blatant in its intent of keeping you trapped in the cycle of debt regardless of whether you want to be a part of it. Denying you a way out of the system is tantamount to making you a slave of it. The moral corruption underlying the motivation behind these papers is astonishing.

I have found that feeling older, the realization that the hard miles are starting to catch up, is more revelatory than gradual. You don’t feel it day to day, but rather the feeling reveals itself through little everyday things that a few years back would have passed unnoticed, unremarkable quotidian events. I just had that similar experience as it concerns my aging parents. My mother, a prodigious if very durable habitual tumbler, broke her hip last week. Coming along nicely after surgery, but the effect on both her and my father has been one of those revelatory moments. But as I said, her durability is helping her to recover nicely.

What I’m Watching

Middle East – I’m not surprised we’ve yet to see publicized direct Israeli action against Iran in retaliation for the 01 October ballistic missile attack. Rather, as a I previously speculated, Israel continues to focus on denigration of Hamas and Hizballah, up until now Iran’s preferred proxies for kinetic activities to impact Israeli decision making. I still maintain that Israel will prioritize the destruction of both Hamas and Hizballah’s ability to conduct substantial offensive actions against Israel. I also believe they will continue a parallel effort to create a new paradigm in which both these actors are unable to restore their offensive capabilities through a grip on political power.

Assuming Israel is able to achieve these goals, it raises important questions about how Iran might choose to protect its interests in a new such paradigm. Whereas the Huthis in Yemen can harass, they do not pose a significant military threat to Israel. So how will Iran react to losing its primary sources of leverage in the eastern Mediterranean? If under the previous paradigm Iran at least assessed it could limit direct Israeli threats to its security by building menacing proxies on Israel’s border, how will it respond to the loss of these proxies? Or the more fundamental question, how will it respond to a growing feeling of vulnerability? In my estimation, peace in Lebanon and Gaza might be the end of one chapter, but it presages a more threatening next chapter in which Iran feels compelled to accelerate its nuclear ambitions – with Israel coming that same conclusion.

In other news….

Charles Hoskinson says Cardano will flip Bitcoin.🤔

Am curious to see if Xi blinks and ultimately decides to get the printing press rolling. The messaging has been interesting…stimulus is coming.

When? How much?

Stimulus is coming…..

I tend to agree. Has Xi’s basic thinking evolved? Because if it has, why? Is the younger generation of CCP members becoming restless? Of course these are multi billion dollar questions…

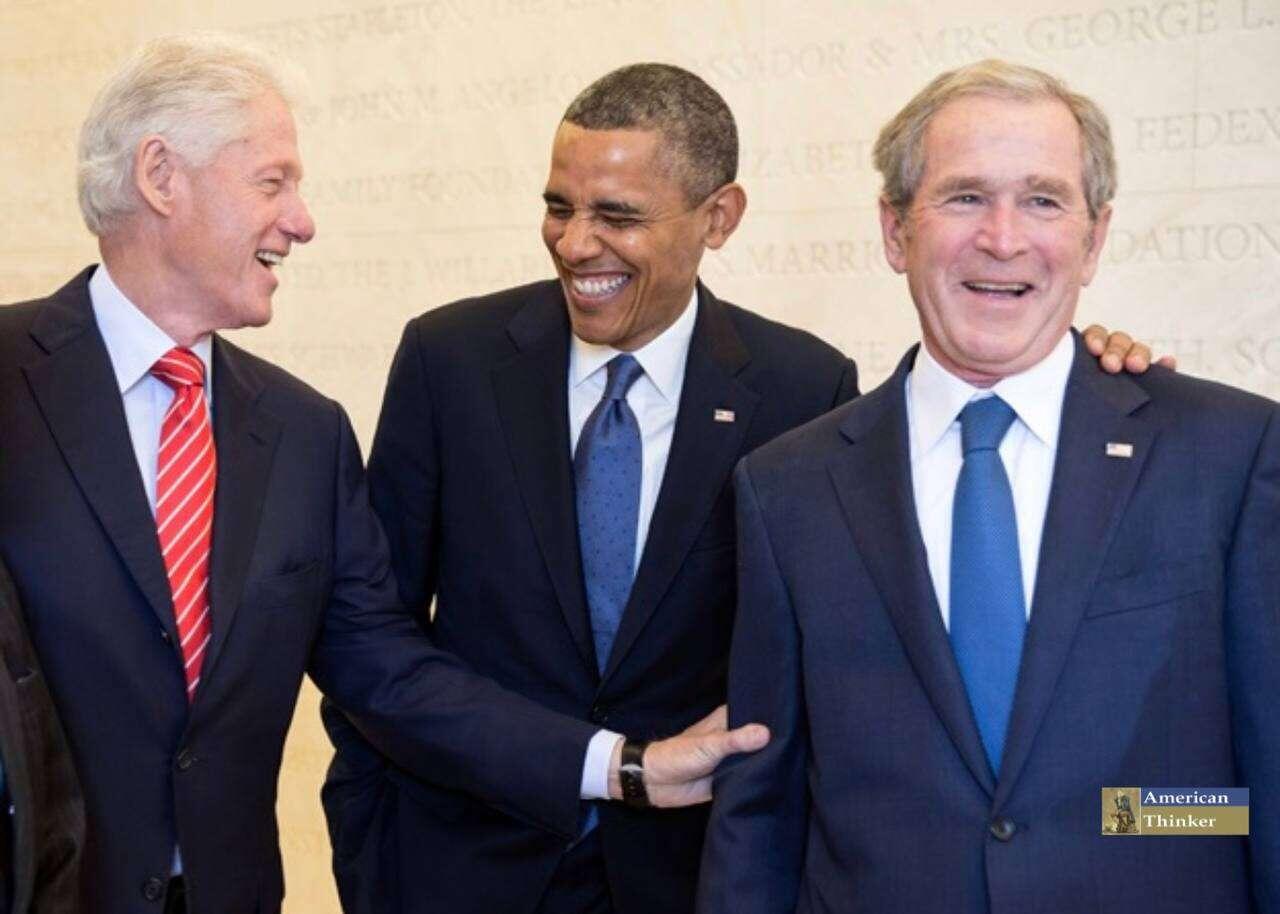

At face value this seems a bit…claustrophobic. But here’s the deal - regardless of who sits in the Oval, the same 1000 people or so in each party run things. Everyone knows the cabinet members, but it’s really the deputy secretaries, assistant secretaries, and the like who run things in DC. And that turnover between administrations, same for each party, is minimal.

I think people have a view of the deep state as shady natsec types running things with the help of strategic national programs. The reality is less interesting, more reflective of the banality of evil-people who have been in and out of government, who have relationships across industries, who actually might even believe they’re doing the right thing.

If you live in the WMA, you live outside the consequences of the decisions the WMA makes on behalf of the country. Someone recently described it as the “federally subsidized bourgeoisie of northern Virginia.”

This is the best description of the class that governs your lives. They don’t set out to harm - they just don’t really give a shit what you think or want - at all.

It ain’t a conspiracy. It’s far more banal.